If you’d like to add friends or family to this email list, please sign up here.

Our Growth and Income model portfolios continued to reach new highs in October, building on recent gains.

As we approach the U.S. election, we see a favourable market outlook regardless of the result. Volatility hedges have recently spiked, similar to levels seen near previous market bottoms in September 2022, February 2022, June 2019, and January 2015. These levels suggest the potential for a rally into year-end as election-related hedges unwind.

Further bolstering our optimism, economic indicators show solid growth momentum. The U.S. labour market remains resilient, even amid challenges like hurricane season and the Boeing strike. Incomes continue to rise, particularly in Canada, where lower-income households have enjoyed a 14 per cent wage increase year-over-year—more than offsetting higher interest expenses. With sustained income growth on both sides of the border, consumer spending appears poised to drive economic expansion. This growth is supported in two scenarios: either interest rates remain steady, encouraging spending, or they decrease, lowering debt service burdens—both of which boost economic momentum.

Government spending is further fueling growth. Although recent campaign promises mention deficit reduction, meaningful cuts are unlikely, especially given the limited authority of the executive branch and mid-term considerations for Congress. We expect spending will continue to flow into the economy, stabilizing inflation around the average government debt coupon rate.

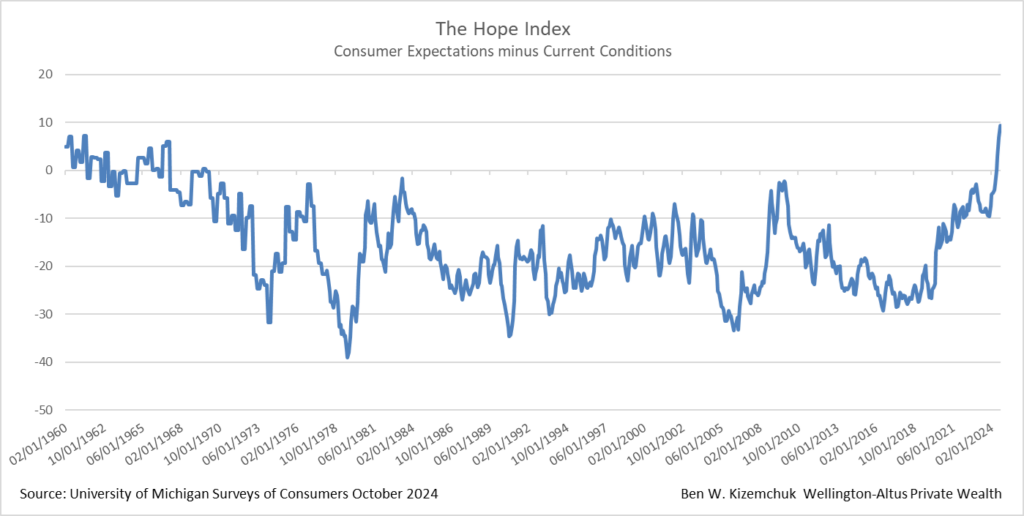

In line with this, our proprietary “Hope Index”—which measures optimism in consumer expectations—has hit an all-time high. This surge points to a generational shift from pessimism, driven by rising incomes among Millennials and Gen Z and wealth gains for Boomers. This dynamic is setting the stage for potential substantial gains in equities as sentiment improves.

As we look ahead, we continue to emphasize high-quality stocks that are well-positioned to benefit from ongoing government outlays, credit expansion, and increased optimism in the market.

In closing, we thank our clients for the trust and capital inflows received recently. We believe this favorable environment presents substantial growth opportunities, and we invite you to share in this success by introducing friends and family to our portfolios. We are committed to helping all clients achieve their financial goals.

Model Portfolio Highlights

Growth Portfolio No changes in October.

American Growth Portfolio No changes in October.

Income Portfolio No changes; we continue to hold a diversified basket of U.S. and global high-quality stocks.

Our approach targets opportunities with a significant margin of safety with minimal risk of permanent loss. Patience remains essential in realizing long-term gains.

For questions about your portfolio or to schedule a meeting, please contact us. Thank you.

Yours,

Ben

Ben W. Kizemchuk

Portfolio Manager & Investment Advisor

Wellington-Altus Private Wealth

Office: 416.369.3024

Email: bwk@wellington-altus.ca

Book a meeting

Ben Kizemchuk offers full-service wealth management for high-net-worth Canadians including families, business owners, and successful professionals. Ben and his team provide investment advice, financial planning, tax minimization strategies, and retirement planning.

Performance reporting disclaimer: Performance results reflect the returns of each representative model portfolio. Returns are calculated using each model portfolio’s monthly performance, including changes in securities values, and accrued income (i.e., dividend and interest), against its market value at the closing of the last business day of the previous month. Performance results are expressed in the stated strategy’s base currency and are calculated on a net of fees basis. Individual account performance may materially differ from the representative performance history set out in this document, due to factors such as an account’s size, the length of time the strategy has been held, the timing and amount of deposits and withdrawals, the timing and amount of dividends and other income, and fees and other costs. Investors should seek professional financial advice regarding the appropriateness of investing in any investment strategy or security and no financial decisions should be made solely on the basis of the information provided in this document. This is not an official statement from WAPW. Please refer to your official WAPW statement for your specific performance numbers.

Market Commentary

November 2024 Update

If you’d like to add friends or family to this email list, please sign up here.

Our Growth and Income model portfolios continued to reach new highs in October, building on recent gains.

As we approach the U.S. election, we see a favourable market outlook regardless of the result. Volatility hedges have recently spiked, similar to levels seen near previous market bottoms in September 2022, February 2022, June 2019, and January 2015. These levels suggest the potential for a rally into year-end as election-related hedges unwind.

Further bolstering our optimism, economic indicators show solid growth momentum. The U.S. labour market remains resilient, even amid challenges like hurricane season and the Boeing strike. Incomes continue to rise, particularly in Canada, where lower-income households have enjoyed a 14 per cent wage increase year-over-year—more than offsetting higher interest expenses. With sustained income growth on both sides of the border, consumer spending appears poised to drive economic expansion. This growth is supported in two scenarios: either interest rates remain steady, encouraging spending, or they decrease, lowering debt service burdens—both of which boost economic momentum.

Government spending is further fueling growth. Although recent campaign promises mention deficit reduction, meaningful cuts are unlikely, especially given the limited authority of the executive branch and mid-term considerations for Congress. We expect spending will continue to flow into the economy, stabilizing inflation around the average government debt coupon rate.

In line with this, our proprietary “Hope Index”—which measures optimism in consumer expectations—has hit an all-time high. This surge points to a generational shift from pessimism, driven by rising incomes among Millennials and Gen Z and wealth gains for Boomers. This dynamic is setting the stage for potential substantial gains in equities as sentiment improves.

As we look ahead, we continue to emphasize high-quality stocks that are well-positioned to benefit from ongoing government outlays, credit expansion, and increased optimism in the market.

In closing, we thank our clients for the trust and capital inflows received recently. We believe this favorable environment presents substantial growth opportunities, and we invite you to share in this success by introducing friends and family to our portfolios. We are committed to helping all clients achieve their financial goals.

Model Portfolio Highlights

Growth Portfolio No changes in October.

American Growth Portfolio No changes in October.

Income Portfolio No changes; we continue to hold a diversified basket of U.S. and global high-quality stocks.

Our approach targets opportunities with a significant margin of safety with minimal risk of permanent loss. Patience remains essential in realizing long-term gains.

For questions about your portfolio or to schedule a meeting, please contact us. Thank you.

Yours,

Ben

Ben W. Kizemchuk

Portfolio Manager & Investment Advisor

Wellington-Altus Private Wealth

Office: 416.369.3024

Email: bwk@wellington-altus.ca

Book a meeting

Ben Kizemchuk offers full-service wealth management for high-net-worth Canadians including families, business owners, and successful professionals. Ben and his team provide investment advice, financial planning, tax minimization strategies, and retirement planning.

Performance reporting disclaimer: Performance results reflect the returns of each representative model portfolio. Returns are calculated using each model portfolio’s monthly performance, including changes in securities values, and accrued income (i.e., dividend and interest), against its market value at the closing of the last business day of the previous month. Performance results are expressed in the stated strategy’s base currency and are calculated on a net of fees basis. Individual account performance may materially differ from the representative performance history set out in this document, due to factors such as an account’s size, the length of time the strategy has been held, the timing and amount of deposits and withdrawals, the timing and amount of dividends and other income, and fees and other costs. Investors should seek professional financial advice regarding the appropriateness of investing in any investment strategy or security and no financial decisions should be made solely on the basis of the information provided in this document. This is not an official statement from WAPW. Please refer to your official WAPW statement for your specific performance numbers.

Recent Posts

February 2026 Update

If you’d like to add friends or family to this email list, please sign up

January 2026 Update

If you’d like to add friends or family to this email list, please sign up

December 2025 Update

If you’d like to add friends or family to this email list, please sign up

November 2025 Update

If you’d like to add friends or family to this email list, please sign up

October 2025 Update

If you’d like to add friends or family to this email list, please sign up

The opinions contained herein are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Wellington-Altus Private Wealth. Assumptions, opinions and information constitute the author’s judgement as of the date this material and subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. All third party products and services referred to or advertised in this presentation are sold by the company or organization named. While these products or services may serve as valuable aids to the independent investor, WAPW does not specifically endorse any of these products or services. The third party products and services referred to, or advertised in this presentation, are available as a convenience to its customers only, and WAPW is not liable for any claims, losses or damages however arising out of any purchase or use of third party products or services. All insurance products and services are offered by life licensed advisors of Wellington-Altus. Wellington-Altus Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. All trademarks are the property of their respective owners.