Markets have been heavy in 2018 despite tax reform and a solid earnings season.

The economy is terrific, we are at full employment, and company balance sheets are the best they have ever been…yet the market sucks in 2018.

It can be difficult to find a single reason for why markets struggle.

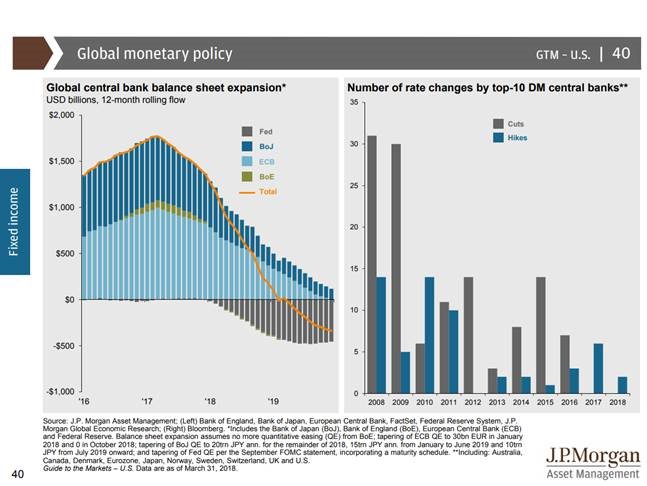

This chart from J.P Morgan illustrates a good picture as to why the market is struggling. Basically, from the moment central banks began quantitative easing, they were forcing money into the system- trying to create inflation. As money goes into the system all assets appreciate, some more than others (Vancouver, Toronto Real Estate). As the picture below shows, we are now starting to see the US exit quantitative easing, meaning money is leaving the system.

Usually when money leaves the system, asset prices should go down, it is deflationary. Now some assets will go down more, and in many cases assets will go up. With this backdrop, we need to ensure our assets are protected as best we can, one way is to ensure they can grow out of this potential issue. Therefore, our primary solution is to remain overweight equity assets, as companies themselves have earnings growth that can help lift us out if this turns into a potential challenge.

This is certainly a cloud on the horizon, but we remain optimistic with our portfolio structure. We should be able to weather a storm better than other layouts.

The Stuchberry Group