Click here to download this article as PDF.

Most people, investors or not, tend to base their current views on what is most recent in memory. In good times, we may expect them to continue for the foreseeable future; in bad times, we often underestimate our ability to move forward. We all tend to “drive by the rearview mirror” to some extent, basing our decision making on what has just happened.

In investing, this may be amplified. We can see significant market movements based on the prevailing sentiment. It has been said that “In the short run, the market is a voting machine. But in the long run, it is a weighing machine.” Prices can overshoot underlying “fair values” in both directions during the course of a cycle. While it is never easy to see asset prices under pressure, 2022 saw a return to more reasonable fair values and perhaps more thoughtful ways of deploying capital, which can be viewed as healthy.

One of the challenges of investing is that building wealth doesn’t always follow a steady course. We may forget that the investing road can be a long one — depending on our objectives, sometimes as long as our lifetimes — and what happens from year to year often has less significance down the road.

Though not to overlook the challenges of today, it is important to keep perspective. Many of the same issues we faced in 2022 persist: geopolitical conflict, sustained inflation and high interest rates — and now, the expectation of slower economic growth with the central banks’ continued attempts to reel in inflation. Yet, we may be well positioned to endure these times. Our financial system continues to be strong; most companies and individuals are not heavily indebted, a previous driver of serious downturns. While stronger labour markets continue to complicate central bank efforts, they may lessen the impact of any slowdown. And while there will always be short-term setbacks, corporate profits and economies have grown over time. This isn’t likely to change.

It is instructive that throughout the turbulence of 2022, renowned investor Warren Buffett added to his portfolio; in fact, a record amount of purchases.1 Buffett uses the inevitable down periods to continue building wealth for the future, strong in his conviction that brighter days lie ahead. While Buffett has outperformed the markets over time, consider also that he has underperformed the S&P 500 more than 40 percent of the time on an annual basis.2 It is a reminder that even for the most respected investors, investing is never a smooth road.

The road ahead can be a long one — be guided accordingly. As Buffett’s actions remind us, it is important not to let the short-term outlook obstruct our view as we continue planning for the future. The rear-view mirror is great for perspective on where we’ve just been, but don’t necessarily let what you’ve seen dominate your drive to the future.

After a challenging year, we remain grateful for your continued confidence in our services. May the year ahead be filled with brighter days and stronger markets.

1. https://markets.businessinsider.com/news/stocks/warren-buffettberkshire-hathaway-60-billion-record-stock-purchases-portfolio-2022-8;

2. BRK-A vs. S&P 500 Index annual returns, 1965 to 2021.

RRSP SEASON IS HERE AGAIN

The RRSP & RRIF: Be Aware of Taxable Withdrawals

The market volatility in 2022 put many asset values under pressure. Yet, markets are cyclical and we expect prices to eventually resume their climb in the same way as the cycle swings back to more optimism. As such, consider the implications of making taxable withdrawals from either the Registered Retirement Savings Plan (RRSP) or Registered Retirement Income Fund (RRIF). In both cases, allowing funds to remain within the plan can be beneficial to allow asset prices to recover. Here are some other considerations:

The RRSP: Implications of Taxable Withdrawals

For those still saving for retirement, when looking to pay down short-term debt, some may consider withdrawing funds from the RRSP . However, consider the implications of making taxable withdrawals. They will be subject to a withholding tax and must be reported as income on a tax return. You may end up paying more tax on the withdrawal than you’ll save in interest costs on debt. If your current income is higher than it will be in future years, you may be paying higher taxes today than in the future. You will also forego the opportunity for continued tax-deferred compounding, perhaps the most beneficial aspect of the RRSP. In addition, once you make a withdrawal, you won’t be able to get back the valuable contribution room.

RRIF Withdrawals: Are There Ways to Minimize the Impact?

For those who have entered retirement, allowing funds to remain in the RRIF may be challenging given the minimum withdrawal requirement, which is considered taxable income. However, there may be ways to potentially minimize the impact and here are some ideas:

Make withdrawals at the end of the year — By taking your withdrawal at the end of the year, it may allow greater time for asset values to potentially recover. Consider also that making withdrawals at the end of each year, instead of the beginning, allows for a longer time period for potential growth within the plan.

Make an “in-kind” withdrawal — If you aren’t in need of funds from the RRIF minimum withdrawal, consider making an “in-kind” withdrawal. While the fair market value at the time of withdrawal will be considered income on a tax return, you will continue to own the security. If you transfer this to a TFSA , subject to available contribution room, future gains will not be subject to tax.

Split RRIF income with a spouse — Don’t overlook the opportunity to split income and save taxes on mandatory withdrawals. RRIF income qualifies as eligible pension income for pension income splitting. If you have a lower-income spouse and you’re 65 or older, you can split up to 50 percent of your RRIF income to reduce your combined tax bill.

If you are turning age 71 in 2023, here are additional options…

Make the first withdrawal next year — You aren’t required to make a withdrawal in the year that the RRIF is opened. You can wait until the end of the year in which you turn 72 to make the first withdrawal. Base withdrawals on a younger spouse’s age — If you have a younger spouse, you can use their age to result in a lower minimium withdrawal rate, helping to keep more assets to grow within the plan. This can only be done when first setting up the RRIF, so plan ahead.

RRSP & RRIF Reminders

• RRSP Deadline: March 1, 2023 (for the 2022 tax year). Don’t overlook the opportunity for tax-deferred growth.

• Turning 71 in 2023? You must collapse your RRSP. Please call the office to discuss options.

Macroeconomic perspectives

Rising Interest Rates: What to Expect in 2023

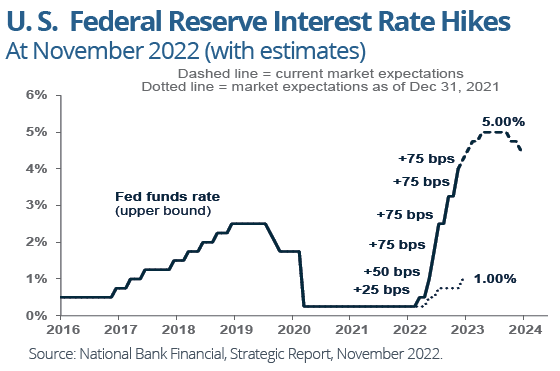

2022 will go down in the record books as an abnormal year for the financial markets. As inflation reached 40-year highs, it caught he central banks by surprise and led to a rapid tightening of monetary policy through interest rate increases. What has made this tightening cycle unique is the speed and magnitude at which rates increased (chart).1 Many argue that these actions have been necessary because the central banks acted too late to control inflation. However, this created significant volatility in 2022, with declines to both fixed income and equity markets. The declines may have felt particularly significant because form much of 2020/2021, asset values increased with little interruption, supported by the availability of low-cost capital and use of leverage, an increased money supply due to pandemic stimulus and excessive exuberance.

What Can We Expect in 2023?

The central banks have been focused on achieving “price stability” to prevent inflation from becoming entrenched. The good news is that we are seeing the effects of the rate hikes take place (they often lag), such as with the cooling of rate-sensitive areas of the economy like the housing market. Yet, it will take time for inflation to substantially ease. As such, if inflation persists, the central banks are likely to continue raising rates, with the intent of slowing economies, and this may lead to market volatility.

More recently, there has been a growing belief that the tightening policies may be

slowing. In December, the Bank of Canada said it would be “considering whether the policy interest rate needs to rise further.”2 This may be positive news because rising rates have put downward pressure on the financial markets. For fixed income, investors will recall that bonds have an inverse relationship to interest rates: when rates rise, bond prices generally fall. For equities, higher rates mean valuations generally go down because the future value of cashflows is lower when a higher discount rate is used — this is especially true for the way in which growth stocks are valued. If a significant slowdown in inflation does become apparent in 2023, it will then allow for a return to less restrictive monetary policy.

1. www.forbes.com/advisor/investing/fed-funds-rate-history/; 2. www.bankofcanada. ca/2022/12/fad-press-release-2022-12-07/

Estate Planning , IN BRIEF

When Was the Last Time You Reviewed Your Will?

Over the years, the statistics haven’t changed much: the majority of people still do not have a Will and, for those who do, it may be outdated. When was the last time you read through your Will? Why not make your Will a priority in 2023. If you haven’t yet drafted a Will or need to make updates, in brief, here are some considerations:

Think carefully about how the Will is structured for your children. Estate lawyers suggest that many people often fail to properly plan for children. Sometimes, assets are passed in the Will to children at the age of majority without any conditions. Yet, transferring a significant amount of money at this age can lead to problems. Setting up a trust may be one way to help younger beneficiaries better manage funds. Others may neglect to appoint guardians or trustees over assets for minors. The terms and conditions for how funds are distributed to, and by guardians can also be specified in the Will to help protect beneficiaries.

Remember which assets your Will distributes (and how). Don’t forget that a Will may not include all of the assets that you hold at death. Assets held in registered accounts (TFSAs, RRSPs, RRIFs*), as well as certain pension plans or insurance policies, may have named beneficiaries which means these assets will pass outside of thee state. In most cases, joint assets will also pass outside of the estate. This is often overlooked when equalizing an estate between multiple beneficiaries. As well, don’t forget the potential effect of taxes on these accounts in reducing the final distribution of assets passing through a Will.

Pre-plan for cash flow issues. Will there be enough cash or liquidity to pay estate taxes, funeral costs or probate (in provinces where applicable)? There may be a significant tax liability for a family property or business, especially if the value has increased over time. Planning, using tools such as life insurance, can avoid future surprises.

Update as things change. Regular updates to Wills are often overlooked, such as due to changes in marital/family status, when a new beneficiary is identified, a change in jurisdiction occurs or when the status of assets changes. Administrative updates may also be needed, such as when a person named in the Will has a name change due to marriage or divorce. These updates can help to make future estate settlement easier.

Tell someone! Make sure to tell a trusted friend or loved one, as well a s the estate’s executor/liquidator, of the location of your Will.While this may sound obvious, there have been instances in which estates were settled through the provincial courts because the Will could not be located.

*Not applicable in Quebec.

Investing perspectives

Three Reminders to Start Another Year

After a difficult year, and as we look to the year ahead, here are three reminders to help keep perspective.

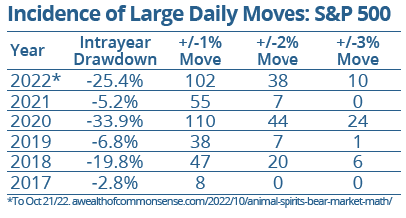

Volatility: Likely to persist — Periods of greater volatility tend to coincide with market drawdowns and 2022 was no exception (chart).* In 2023, we expect ongoing volatility as the central banks continue their tightening practices to rein in inflation.R ate hikes are intended to slow the economy, which may put downward pressure on earnings and lead to volatility. Downward volatility can be difficult, even for the best of us. Modern behavioural scientists suggest that we feel the pain of loss about twice as much as the pleasure of a similar sized gain. It can cause undue stress or prompt poor investing decision making. During these times, consider focusing less on the financial news or checking in on portfolios. Leave the day-to-day focus on your investments to those who are here to manage them.

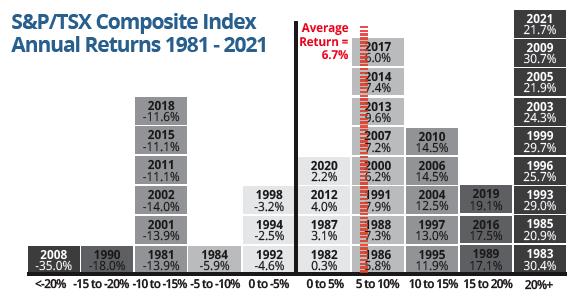

Markets will go down; This is normal — Part of investing involves accepting that the markets will go down from time to time. The good news is that, over longer periods, compounding average returns can lead to significant wealth. We often talk about average returns and it’s worth repeating that annual returns often do not fall close to this average. Consider the visual (top right) that shows the wide dispersion of annual returns of the S&P/TSX Composite Index since 1981. Annual returns are less than the long-term average of 6.7 percent (red line) in 19 out of 41 years. That’s almost one-half of the time. And, 29 percent of the time, annual returns were negative. In the short term, we can expect a wide range of outcomes, including negative performance.

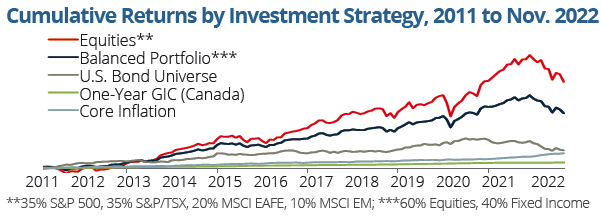

Equities continue to be one of the best asset classes to generate wealth — With increased market volatility and interest rates at levels not seen in decades, products like low-risk, guaranteed investment certificates may look appealing. While this may be a good opportunity for cash on the sidelines, if you’re investing for the long term, consider that equities continue to be one of the best asset classes in which to generate wealth and beat inflation over time, even in spite of the down years.

New Year’s Advice for the Younger Generation: It Starts With Saving!

At one time in the not-so-distant past, our society was tuned into saving. We wouldn’t think of buying something until we saved enough cash to pay for it, whether for a car or other consumer goods. Only for the rare, big-ticket item, such as a home, would we go into debt.

Today, this quaint notion has largely gone by the wayside. Younger generations appear more impulsive, often choosing to ignore the admonishments to “wait” before spending. Our increasingly on demand and cashless society, with easy access to credit cards and lines of credit, can land many in difficulty with debt. Often missing has been the discipline of the past: “Can we afford this?” The lack of a saving strategy has implications for investing: Without saving, there is no accumulation of capital; Without capital, there can be no investment.

It’s Hard to Save!

Often, those who profess to want to save will protest that it is impossible to do today. Yes, the cost of living is high and inflation is creating further pressures, with many people having a tough time making ends meet. Yet, there may be certain ideas that can help improve our personal fiscal habits, and here are some tips:

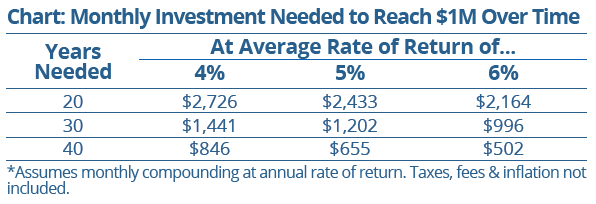

Pay ourselves first — It is interesting how the shift to spending from saving has occurred during a time in which the general wealth of Canadians continues to grow. Sometimes, the problem with saving is a lack of will. One easy way to make saving a regular habit is to “pay yourself first.” This involves having a portion of each paycheque automatically set aside in a separate account: via a payroll deduction at work, an automatic bank account debit, a dollar-cost-averaging investment plan or similar program. The theory: What you don’t see, you won’t miss — and otherwise spend. How much you allocate is up to you, but almost any amount sent to savings can create a sizeable amount over the years. And this can translate to even more if invested over time. It may surprise many young people, but the ability to become a millionaire is well within reach if you start early (see chart).

Consider a budget — This is not to admonish anyone about their spending habits. Yet, just the effort of sitting down and mapping out the family income and expenses each month, without doing anything else, can be revealing. It will pinpoint where your money is going — in debt repayment, entertainment costs, daily expenses, commuting costs or others. As a result, you may be able to determine areas on which to focus in order to bring spending into better balance.

Cut consumption — Minor reductions in consumption can lead to meaningful savings that can be put towards building an investment portfolio or other worthwhile cause. Some ideas? Consider that skipping the $5 coffee each workday for a year could achieve annual savings of $1,250. Or carpooling to work could save on gas and parking. There may be an opportunity to prioritize and cancel memberships or subscriptions. Or, avoiding lifestyle creep to “keep up with the Joneses” — the pressure to buy certain things because others around you have them.

With some forethought, you can build your own list of possible savings that fits your lifestyle and circumstances. You may surprise yourself with what you can achieve. These tips may not seem significant at first glance, but consider that finding just $3,000 in savings each year can accumulate to over $100,000 in just 20 years if invested at a five percent rate of return. Not a bad basis for a real investment program!

Don’t overlook the “gift” of time — One of the greatest gifts that most young people have is time. A good rule of thumb that may encourage saving is the “Rule of 72,” a simplified formula that estimates how long it takes for an investment to double in value based on a rate of return by dividing 72 by the rate of return. Here’s a thought: An investment with an annual rate of return of five percent will double in approximately 14 years (72÷5=14.4), so a 25-year-old could potentially see their savings double four times within their lifetime (assuming average life expectancy).

The bottom line? Success in building wealth is often within reach for many of us…and it can all start with saving!