Last Month in the Markets – February 1st -28th, 2023

What happened in February?

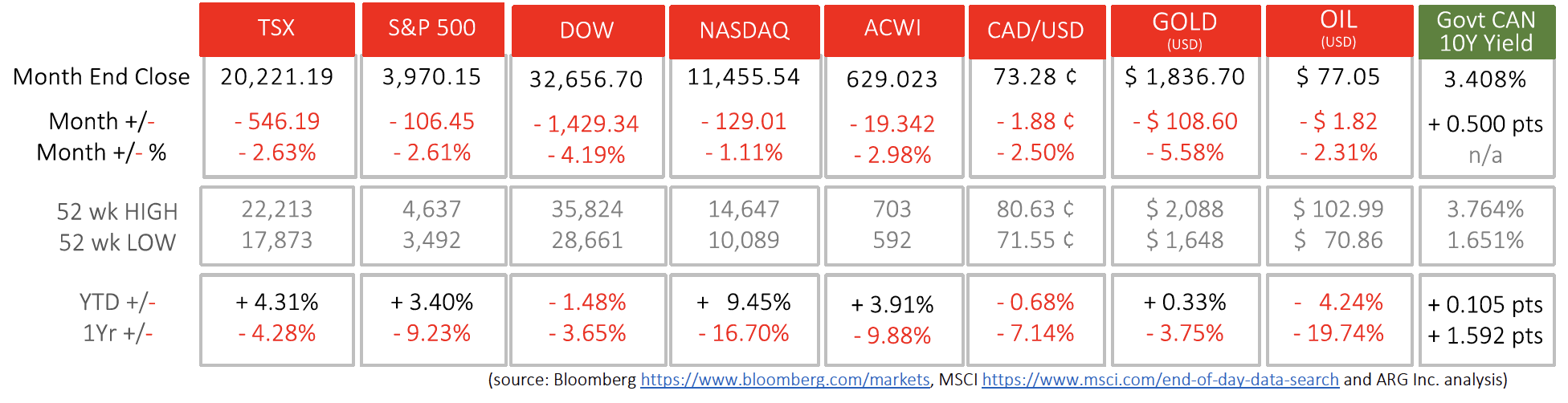

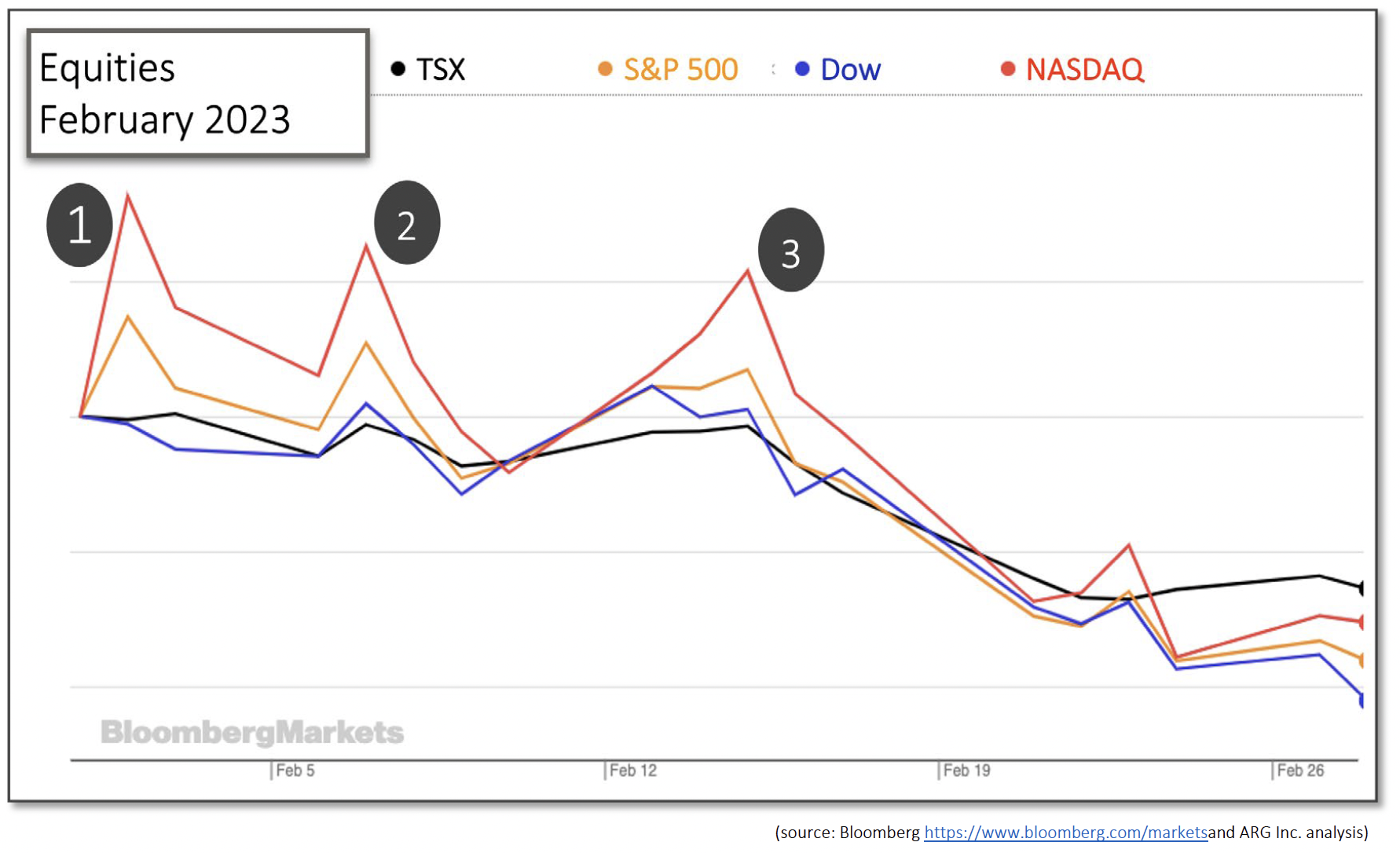

With the exception of a few peaks, last month delivered mostly negative results for investors concentrated in equities. Canada’s TSX and the U.S. S&P 500 fell by almost the exact percentages of 2.63% and 2.61%, respectively, in February. The Dow dropped an additional point-and-a-half finishing the month 4.19% below January’s close. In a relatively benign result, the NASDAQ leaked a little more than 1% of its overall value. The All-Country World Index (ACWI), which is comprised of 23 Developed Markets and 24 Emerging Markets and 2,882 constituents, lost 3% of its value last month. The Canadian dollar continued its slide against the American counterpart, and the commodities, gold, and oil, followed downward. Bond yields, represented by the Bank of Canada 10-year note, rose again.

Each time equity values made significant gains, those higher levels created a peak when negative news caused indexes to retreat immediately afterward:

- The Federal Reserve raised its benchmark “federal funds” rate by 25 basis points to a range of 4½ to 4¾ percent. The optimism for slowing interest rate increases was short-lived when the announcement did not support a gentle path for rates. The U.S. Non-farm Payroll Report showed that employment rose 517,000 in January with widespread gains and the unemployment rate was unchanged at 3.4%, and steady since early last year. The strong jobs market suggests that interest rates have not sufficiently slowed the economy and further action from the Federal Reserve is required.

- The jobs market weighed-down markets again when Fed Chair, Jerome Powell, stated, “The reality is if we continue to get strong labor market reports or higher inflation reports, it might be the case that we have to raise rates more”. Regarding the reduction of inflation with recession, he said, “There’s been an expectation that it’ll go away quickly and painlessly. I don’t think that is at all guaranteed.” These statements reiterated existing policy, but their stark frankness confirmed the Fed’s prioritization of inflation reduction over recession avoidance.

- Consumer inflation reversed its recent path by increasing in January more than it had in December, and year-over-year prices increased 6.4% according to the Bureau of Labor Statistics press release. a. On February 16th, Bank of Canada Deputy Governor, Paul Beaudry, reconfirmed the importance and commitment to the 2% inflation target. Despite the pain inflicted by higher interest rates, stable and predictable prices facilitate better spending and investing decisions.

The remainder of February was negatively influenced by Canadian inflation running at 5.9%, and increasing Gross Domestic Product for the U.S. fourth quarter. Both situations support more hawkish monetary policy.

What’s ahead for March and beyond in 2023?

The key influence on markets will continue to be the performance of the world’s largest economy, the United States, and its effect on American and global monetary policy. The European Union and the European Central Bank (ECB) will also exert some influence, too.

The ECB and the U.S. Federal Reserve will announce their latest monetary policy statements, which include interest rate decisions, on March 16th and 22nd, respectively. The Bank of Canada will precede both of those organizations with an announcement on March 8th.

Watching the results of monetary policy announcements, rate forecasts prior to announcements, and missed expectations, will provide insight into market moves.

Currently, the guidance from the ECB and Federal Reserve continues to indicate rate rises for the next round and beyond, if necessary. The Bank of Canada’s pause in rate hikes is in jeopardy based on recent commentary. Inflation continues to run far above its target, and the interest rate increases to-date may have tempered inflation’s climb but have not brought price increases back into the target range of 2%.

Barring any unexpected economic shocks, like an escalation by Russia, monetary policy driven by inflation will continue its control of markets.

BoC monetary policy Fed monetary policy ECB monetary policy

Wagner Investment Management Team contributors: Susyn Wagner & Karen Routledge

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPW assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

© 2022, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION.