Last Month in the Markets – August 1 – 31, 2023

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in August?

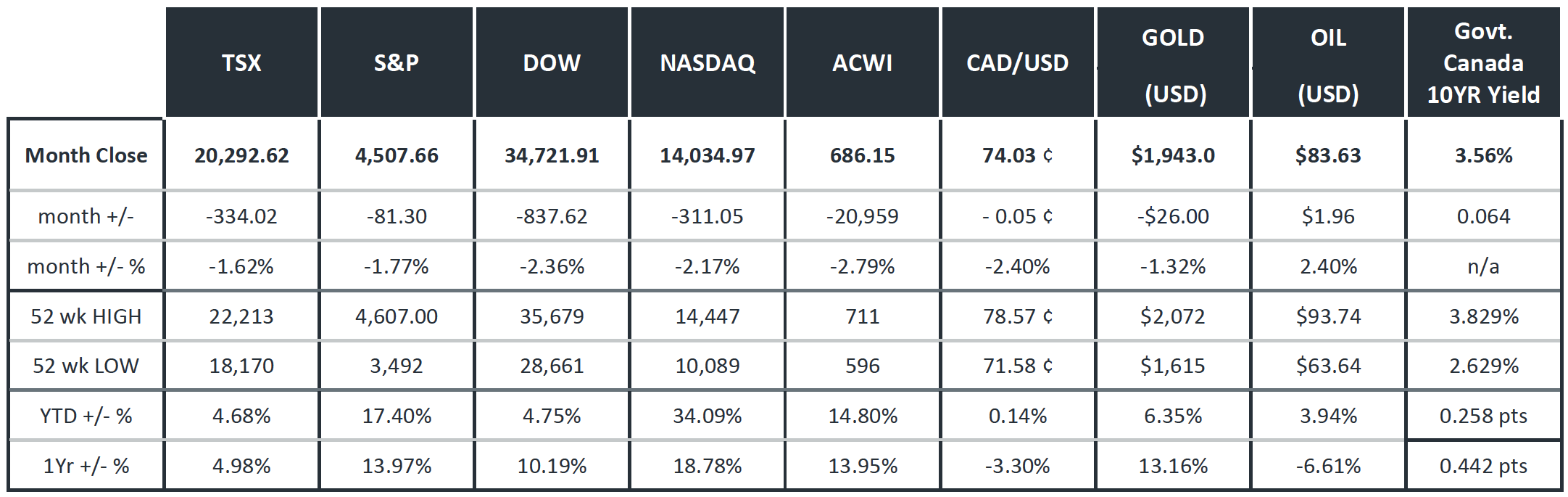

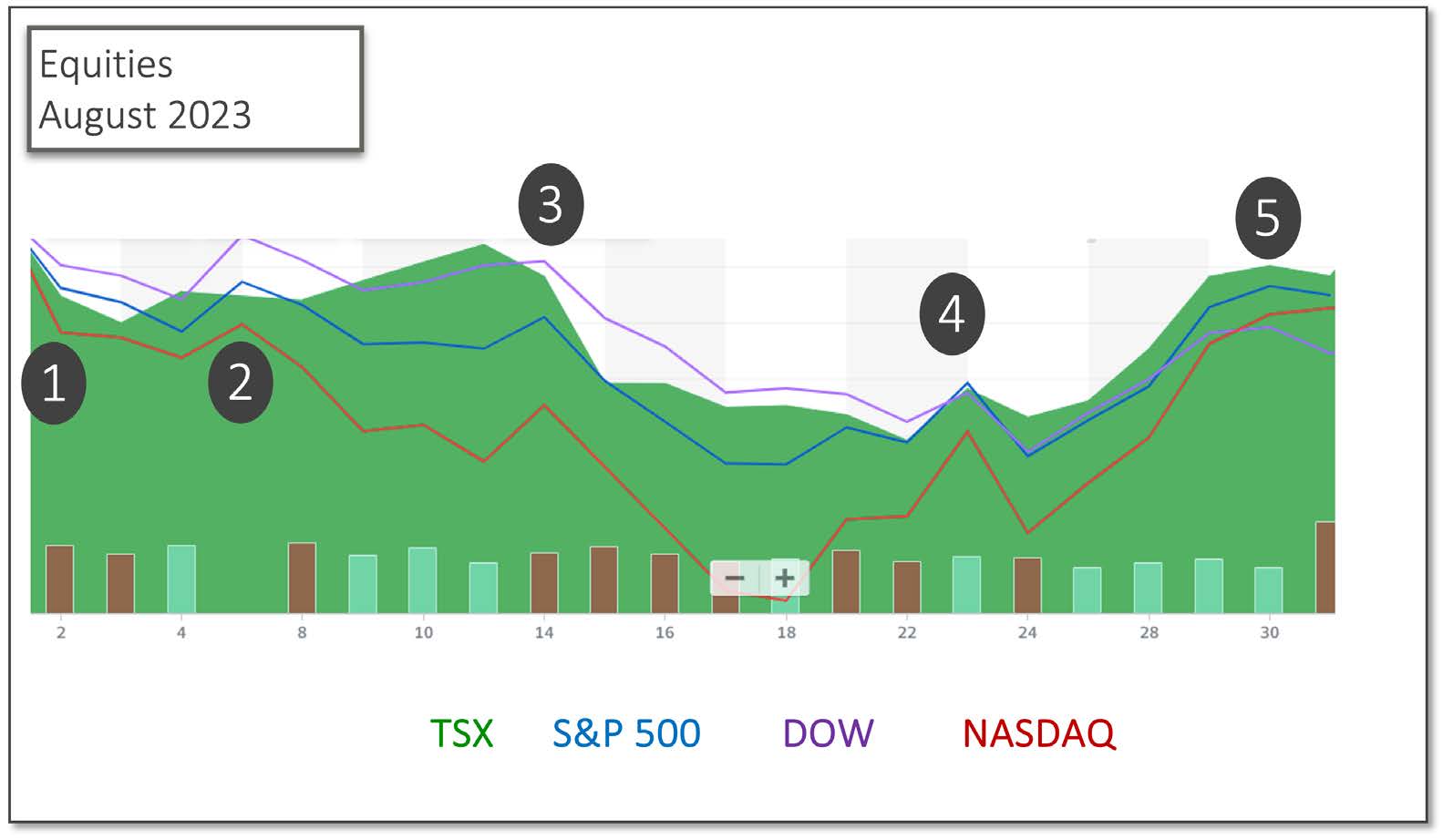

On a monthly basis North American equity indexes did not perform well, losing about 2%, and trimming year-to-date performance for the TSX Composite and Dow Jones to less than 5%. The Dow’s 1-year return at just over 10% has more than doubled the TSX, which sits below 5%. Year-to-date, the S&P 500 and NASDAQ have done well at 17.4% and 34.1%, respectively, and 14.0% and 18.8% year-over-year.

(source: Bloomberg https://www.bloomberg.com/marketsand ARG Inc. analysis)

(source: Bloomberg https://www.bloomberg.com/marketsand ARG Inc. analysis)

Like last month, August ended strongly, with a final week that delivered gains of 1.5% to 3.5% for the major indexes. However, the third week’s performance could not be reversed before September began.

- August 1st

Fitch Ratings downgraded the quality of U.S. sovereign debt from “AAA” to “AA+” reflecting “the expected fiscal deterioration over the next three years, a high and growing general government (GG) debt burden, and the erosion of governance relative to . . . peers . . . that has manifested in repeated debt limit standoffs and last-minute resolutions.

The government debt issue is driven by weaker federal government revenue, new spending initiatives and higher interest rates as the general government deficit is predicted to rise to 6.9% of gross domestic product in 2025 while the GG debt-to-GDP ratio is forecasted to rise to 118.4% by 2025. CBC and Fitch Press Release from Fitch

- August 4

U.S. Employment situation summary and the Canadian Labour Force Survey were both released. Markets treated this data with wariness since the continued resiliency of the American job market fed into growing concern that interest rates would remain at current levels. In the U.S., non-farm payroll employment rose by 187,000 jobs in July, and the unemployment rate was unchanged at 3.5% as 5.8 million Americans are unemployed. Employment in Canada was static in July with 6,000 less jobs, which represents a change of less than one-tenth of one percent. The unemployment rate rose 0.1% to 5.5%, the third consecutive monthly increase. StatsCan July Jobs BLS July Jobs NYTimes Jobs

- August 14 and 16

Economic indicators from China, the world’s second largest economy with significant international trade, began to turn downward. China’s economic recovery and growth are slowing. The economic integration by Canada and the

U.S. differs in magnitude and by overall trade balance, and “bad news from China” has affected different stocks and sectors differently in North America, but overall, both sides of the border have been impacted. China Trading Partners China’s economic woes

The U,S. Federal Reserve released its meeting minutes on the 16th from the July interest rate decision. The participants noted that “recent indicators suggest the economic activity has been expanding at a moderate pace. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated.” The committee voted unanimously to keep rates steady, while “prepared to adjust the stance of monetary policy as appropriate.” Fed Minutes

- August 25

On August 25th, Fed Chair, Jerome Powell, spoke about “Inflation and the Path Ahead.” According to Powell inflation is still running too high and further interest rate increases may be required. Over the past year, “restrictive monetary policy has tightened financial conditions, supporting the expectation of below-trend growth.” Despite these comments equity markets moved higher on the last day of the week, especially the Dow. Read Powell’s speech Watch Powell’s speech CNBC summary

- August 31

The month concluded on a highnote when Atlanta Federal Reserve Bank President Raphael Bostic indicated that “policy is appropriately restrictive” during a speech in Cape Town, South Africa. Although he did not indicate that it was time to ease monetary policy, he stated patience is needed to allow the current restrictive policy to influence the economy and not inflict unnecessary economic pain.” The Fed is expected to leave rates unchanged at its next meeting. CNBC and Bostic

What’s ahead for September and beyond in 2023?

The Federal Reserve’s next interest rate announcement is scheduled for September 20. Eight weeks will have passed since their last interest rate decision, in which time the U.S. will have released two rounds of consumer inflation and employment reports.

The deliberations at the Bank of Canada show that concern over raising rates too quickly and too far are important concerns for members of the rate-setting committee. https://www.cbc.ca/news/business/bank-of-canada-deliberations-1.6919589

Wagner Investment Management Team contributors: Susyn Wagner & Karen Routledge