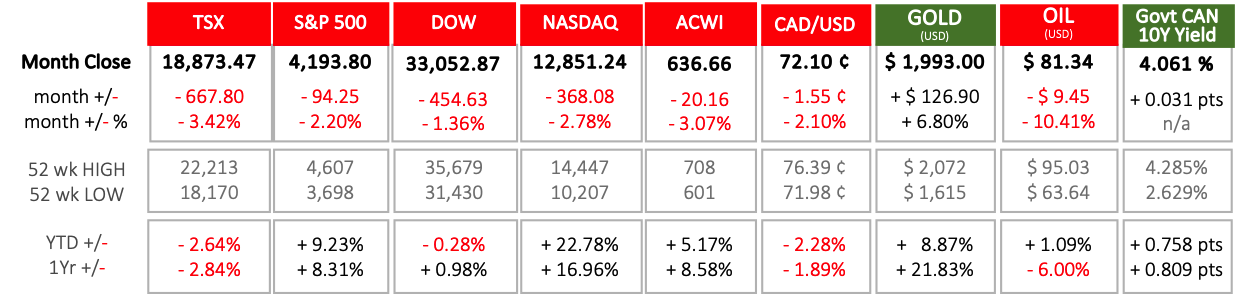

Last Month in the Markets: October 1st – 31st, 2023

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in October?

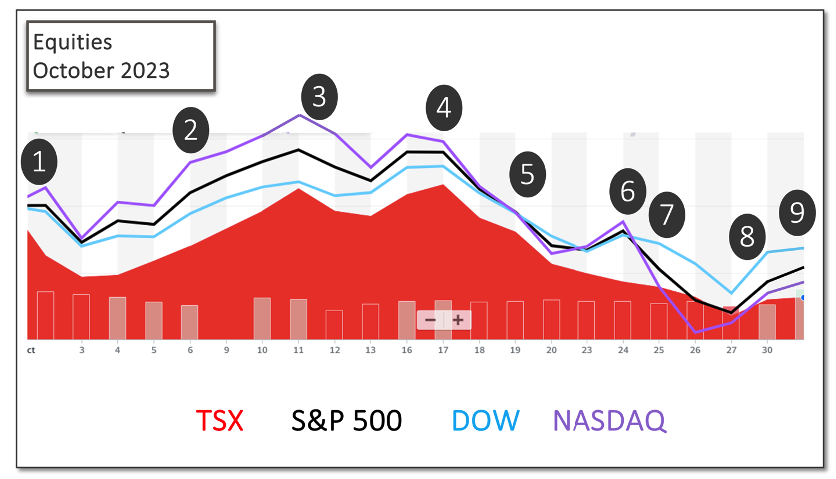

The 10th month of 2023 provided significant uncertainty and volatility.

(source: Bloomberg https://www.bloomberg.com/markets and ARG Inc. analysis)

Many events contributed to the bumpy ride for investors:

1. September 30th / October 1st

Just as the month was beginning, a stop-gap measure that extended spending for an additional 45 days was found to avoid a U.S. government shutdown. CNBC and “shutdown” CNN and “shutdown”

2. October 6th

“Total nonfarm payroll employment rose by 336,000 in September, and the unemployment rate was unchanged at 3.8 percent”, according to the U.S. Bureau of Labor Statistics. BLS release

3. October 11th and 12th

On two consecutive days U.S. producer and consumer inflation data was released. The Producer Price Index (PPI) increased 0.5% in September, down slightly from 0.7% in August. Year-over-year prices advanced 2.2%, which is the largest increase since April. Consumer prices rose 0.4% in September, down from 0.6% in August. Over the last 12 months the Consumer Price Index (CPI) has risen 3.7%, which is the same reading as in August. BLS PPI release BLS CPI release

4. October 17th

Canada’s CPI was lower than expected. On a year-over-year basis consumer prices rose 3.8% in September, slightly lower than the 4.0% gain measured in August. The slowing of price increases was led by travel, durable goods, and groceries. Gasoline rose 7.5% on an annualized basis, compared to August’s 0.8% increase. Excluding gasoline, the CPI rose 3.7% in September. CBC and CPI StatsCan CPI release

5. October 18th to 23rd

The U.S. corporate earnings season began as a mixed bag. The number of positive earnings surprises and the magnitude of the earnings surprises are slightly below the 10-year averages. The reaction of the markets suggests that investors were less than impressed. Factset and Q3 earnings

6. October 25th

The Bank of Canada made a monetary policy announcement that kept the policy interest rate unchanged. According to the press release, “Inflation has been easing in most economies, as supply bottlenecks resolve, and weaker demand relieves price pressures. However, with underlying inflation persisting, central banks continue to be vigilant.” This may provide insight into the U.S. Federal Reserve’s next announcement. BoC Press Release CBC and BoC

7. October 26th

U.S. GDP grew faster than expected during the third quarter. The annualized pace was 4.9%. The expanding economy, and inflation above goal, may serve as a rationale for the Federal Reserve to tighten monetary policy by raising interest rates, but traders see that as unlikely. CNBC and GDP BEA release

8. October 27th

The U.S. Bureau of Economic Analysis released the Personal Consumption and Expenditures (PCE) price index. In September, the most recent reporting period, personal income rose 0.3%, and the PCE price index rose 0.4%. Core PCE (excluding volatile food and energy) increased 3.7% on a year-over-year basis. Core PCE peaked at 5.6% in early 2022, and has fallen steadily, but remains well above the Fed’s target of 2%. The PCE is the Federal Reserve’s primary inflation indicator. It was reported a few days ahead of the next U.S. interest rate announcement. BEA and PCE CNBC and PCE

9. October 31st

According to StatsCan, “Real gross domestic product (GDP) was essentially unchanged for a second consecutive month in August as factors such as higher interest rates, inflation, forest fires and drought conditions continued to weigh on the economy.” StatsCan release

What’s ahead for November and beyond in 2023?

On November 1st, the Federal Reserve announced that it was holding interest rates unchanged. The Federal Funds rate will remain in the range of 5¼ to 5½%. Fed Chair, Jerome Powell, said that rate reductions have not been considered or discussed for the next interest-rate meeting in December. CNBC and Fed release Fed release and press conference

Regarding the conflict in the Middle East, the focus of our practice will continue to be the financial futures of our clients and their families. The situation will be continuously monitored for effects on local clients.

Wagner Investment Management Team contributors: Susyn Wagner & Karen Routledge & Patti Dolan