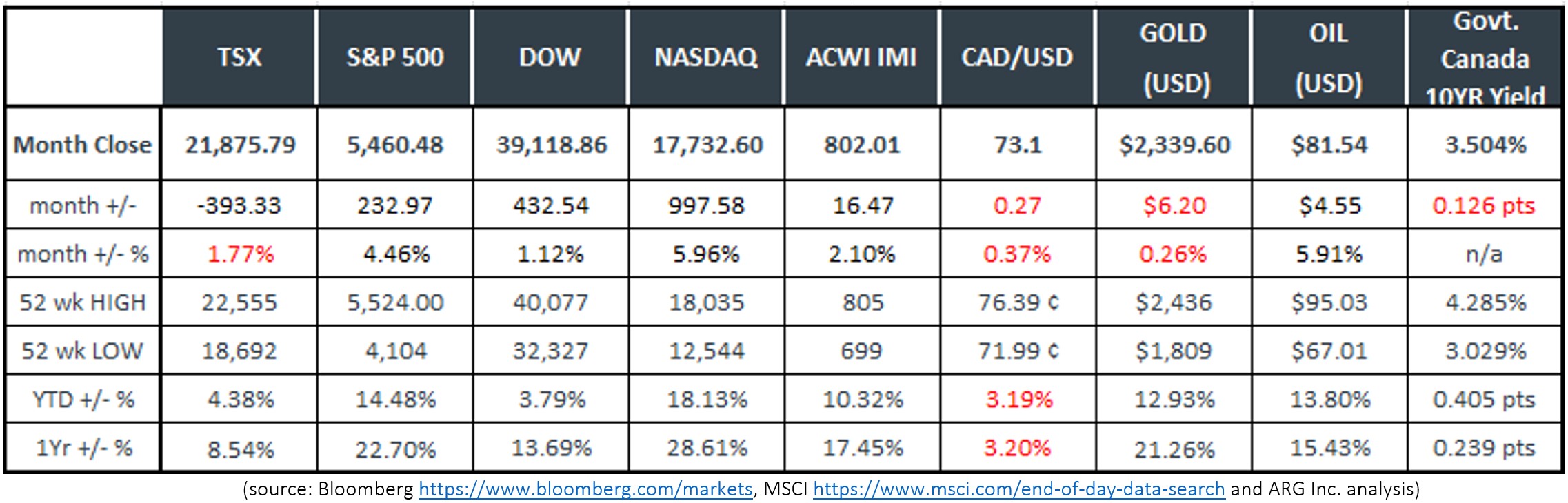

Last Month in the Markets: June 3 – 28, 2024

What happened in June?

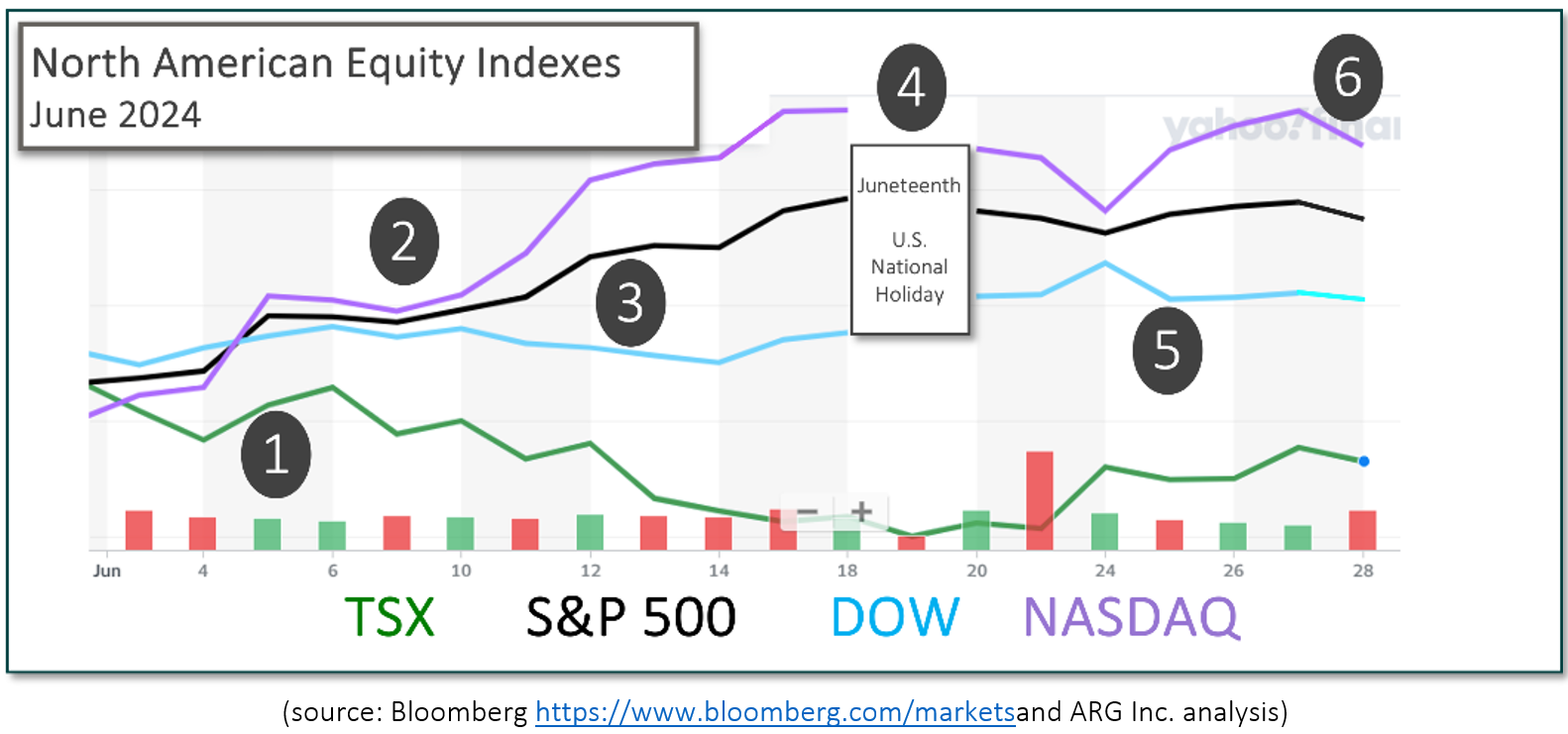

Markets were mixed over the course of last month: the S&P/TSX Composite was the only major North American equity index to lose value, while the U.S. indexes climbed. The NASDAQ leapt approximately 6%, the S&P 500 rose approximately 4% and the Dow Jones Industrial Average brought a 1% positive gain.

The latest earnings season and forward guidance provided much of the impetus for the rise of U.S. stocks during the first half of June. Inflation and interest rate expectations continued to influence values, while geopolitical events in the Middle East and Ukraine have fallen from focus in the popular press.

Events and announcements triggered positive and negative reactions from equity indexes:

- June 5

The Bank of Canada reduced its policy interest rate, the overnight rate, by 25 basis points to 4.75%. The rate had been at 5% since July 2023, and this was the first reduction since March 2022 as our central bank fought against domestic consumer inflation. According to the announced press release “The Bank’s preferred measures of core inflation also slowed and three-month measures suggest continued downward momentum.” It also included, “With continued evidence that underlying inflation is easing, the Governing Council agreed that monetary policy no longer needs to be as restrictive.” CBC News and BoC

- June 7

U.S equities performed well for the week despite Friday’s labour news. In May, the total non-farm payroll employment increased by 272,000 according to the Bureau of Labor Statistics.

The strong jobs market with rising wages, which is a driver of services inflation, is delaying interest rate cuts by the Federal Reserve. After the announcement, the likelihood of a rate-cut in September fell about 12 percentage points to 56% according to CME’s FedWatch tool. BLS release CNBC and jobs CME FedWatch tool

- June 12

At 8:30 am Eastern time, the Bureau of Labor Statistics reported that the Consumer Price Index (CPI) was unchanged for the month of May after rising 0.3% in April. Over the past 12 months, the all-items index increased 3.3%. Core CPI, which excludes food and energy, rose 3.4% on a year-over-year basis, which was lower than expectations. CNBC and CPI

At 2 pm, the Federal Reserve delivered its interest rate announcement that maintained the federal funds rate at a range of 5% to 5.5%. According to the press release, “Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.” The underlying indicators for economic activity, jobs and inflation, made the decision to hold interest rates steady. CNBC and Fed rates

- June 19

U.S. markets were closed for the Juneteenth national holiday. NY Times and Juneteenth

- June 25

StatsCan reported that Canadian CPI rose 0.6% in May and 2.9% on a year-over-year basis, up from 2.7% in April. Higher prices for services (+4.6%) provided fuel for the increase in the overall rate of inflation. Although goods inflation tempered, grocery prices rose 1.1% in May, and 1.5% on an annual basis in May. The price increase for groceries is seasonal, but it was the first acceleration since June 2023 in the year-over-year inflation for food purchased in stores, which is an unwanted result as is the uptick in the overall rate of inflation. StatsCan release CBC and CPI

- June 28

Before markets opened, the U.S. Bureau of Economic Analysis delivered the PCE release. On a year-over-year basis, the Personal Consumption Expenditures (PCE) price index decreased 0.1%. Excluding food and energy, the core PCE increased 0.2% in May from April on a year-over-year basis. Core PCE achieved its lowest reading since March 2021, which matched expectations and could lead to future interest rate reductions PCE March 2021

What’s ahead for July and beyond?

Interest rates will continue to heavily influence markets as inflation continues to cool, economies slow and jobs growth declines. The Bank of Canada will release interest rate updates on July 24 and September 4. The Federal Reserve’s next scheduled opportunities to adjust interest rates are July 31 and September 18.

The Federal Reserve tracks PCE more closely than CPI, and Core PCE is the most important inflation measure for the U.S. central bank. CPI computes the increase in the price of a basket of goods and services using a weighted average method, while the PCE utilizes total spending data, which accounts for changes in consumer behaviour.

Based on previous Fed statements, the recent drop in the PCE could facilitate an interest rate cut, but consistency and predictability are the next, necessary conditions. CNBC and PCE CPI definition PCE definition