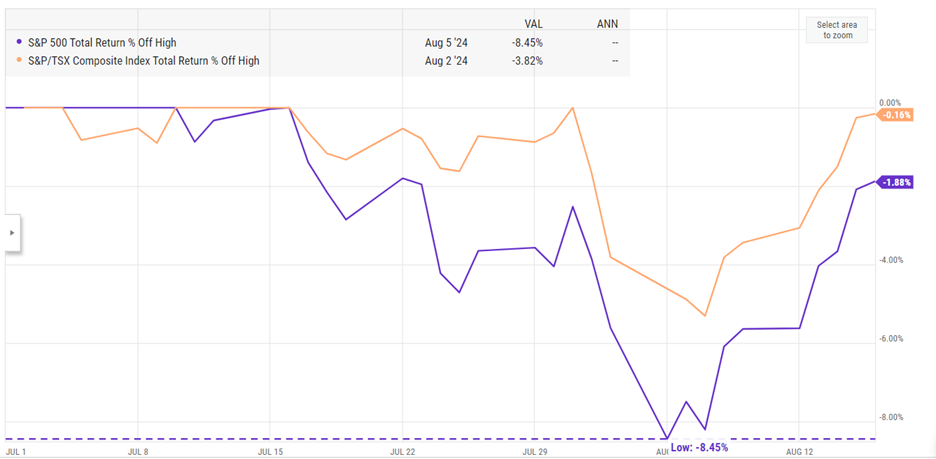

This summer’s market behaviour has been quite the ride. If you weren’t closely monitoring your portfolio, you might have missed some of the action. But for those of us paying attention, the global equity markets were anything but dull. By July 31, many of our clients’ equity holdings had hit their highest points of the year, only to sharply dip shortly afterward.

As shown in the S&P 500 (U.S. markets) and S&P/TSX Composite (Canadian markets) charts below, in just a few short days values fell by up to 8.45% and 5.31%, respectively, before swiftly recovering close to their peaks by mid-August.

Source: yCharts

Understanding Market Fluctuations

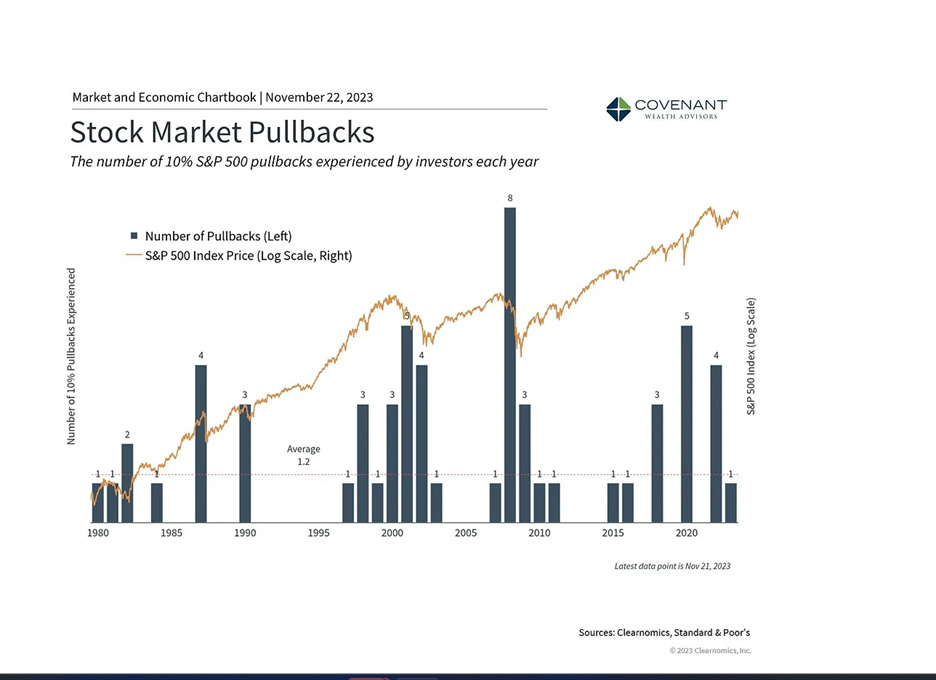

Did you know that over the 20 years from 2002 to 2021, the U.S. S&P 500 had dips of 10% or more in half of those years? That means market drops are pretty common. Understanding this doesn’t necessarily make anyone feel better, but it does help us see that market ups and downs are relatively normal.

Source: https://www.covenantwealthadvisors.com/post/understanding-stock-market-corrections-and-crashes

Personal Reflection and Lessons Learned

This last pullback got me thinking about my own time in the market—not just as an advisor, but as an investor. As many of you know, my biggest mentor in this business was my mom, who I worked with for many years until she retired in 2011. She had been in the markets since the mid-70s and taught me invaluable lessons about weathering market storms and staying the course during volatile times. She would frequently say to me, “Susyn, the market’s going to do what it does, but your job is to keep your clients focused on what they can control—their strategy.”

The 2008 market correction is a prime example of a downturn that felt very different from previous pullbacks—it was longer, deeper, and even experienced advisors like myself couldn’t help but wonder if this time … maybe it truly was different. I remember carefully going through the fundamentals of the investment strategies we had in place for our clients, reviewing the reasons behind each decision we made. Revisiting the “whys” behind our strategies reassured us that we had the right investments in place. And over time, the client portfolios we managed began to recover, and eventually grow.

Navigating Highs: What to Do If You Buy at the Peak

It’s happened to all of us—you invest just before the market peaks, and then your new holdings start losing value. I’ve been there, my clients have been there, and I understand how unnerving it can be. I remember a client who transferred their account to us in late 2007. This money was intended to support their eventual retirement. Naturally, they were quite upset when the market dropped sharply, with some of the holdings losing more than 20% of their value. We worked together to reassess their portfolio and made adjustments where necessary. But the most important action we took was actually doing nothing—despite the natural instinct to take immediate action, we resisted making drastic changes, understanding that time was the necessary medicine for this ailment because sometimes time is the only thing that can help.

But what if you bought at the peak and your investments haven’t bounced back right away? What do you do if recovery isn’t immediate?

- A Peak Isn’t Forever: What feels like a peak often isn’t. Markets have a way of bouncing back and growing over time. I’ve seen this countless times—don’t let short-term highs and lows throw you off course.

- Market History Matters: Markets are cyclical, and downturns are usually temporary. I often remind my clients that while it’s easy to worry about current conditions, the broader trends of economic recovery and growth tend to persist.

- Review the Why: Before making any changes, take a moment to review the fundamentals or the original reasons for your investment. If the underlying logic still holds, staying the course might be the best approach.

- Consider Dollar-Cost Averaging: By investing regularly, you reduce the risk of buying at the wrong time. Over time, this approach can lower your average cost per share and improve your overall returns when the market rebounds.

The Power of Time: Why Long-Term Investing Works

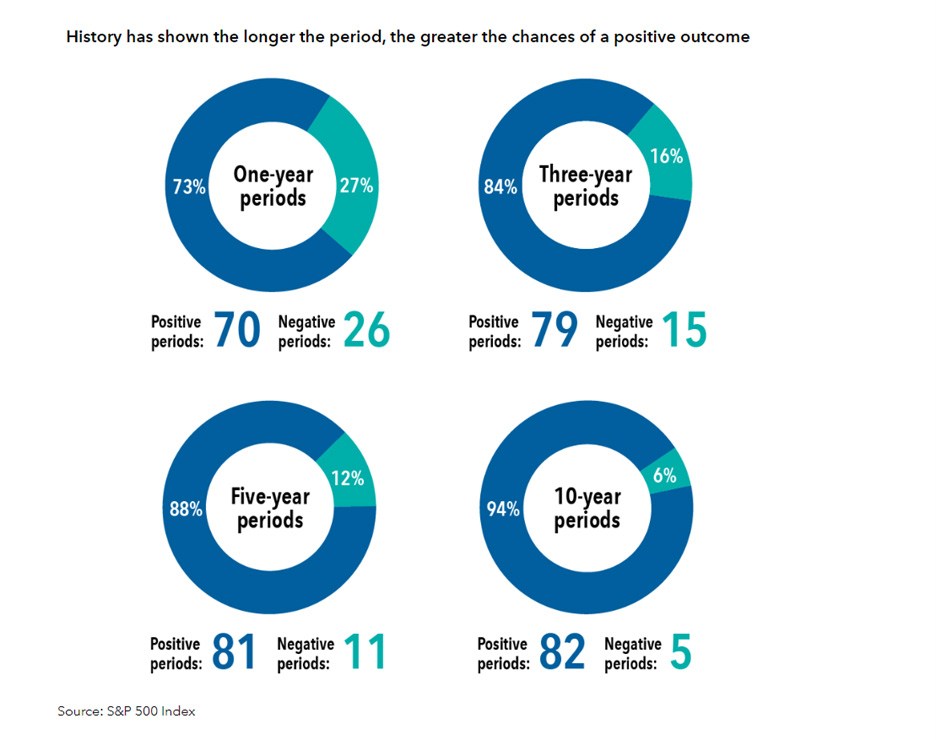

As you can see from the infographic below, history has shown that the longer you stay invested, the greater your chances of a positive outcome. Whether it’s a one-year period or a ten-year stretch, staying the course significantly increases the likelihood of seeing your portfolio grow.

Source: https://www.capitalgroup.com/individual/planning/investing-fundamentals/time-not-timing-is-what-matters.html

This data reinforces what I always tell my clients—time in the market beats timing the market. When you have a strong, diversified foundation, you’re better positioned to ride out the rough patches and come out ahead in the long run.

Conclusion

Building a strong, diversified investment foundation, understanding market history, and sticking to your plan—even when things get bumpy—are the key elements to successful investing.