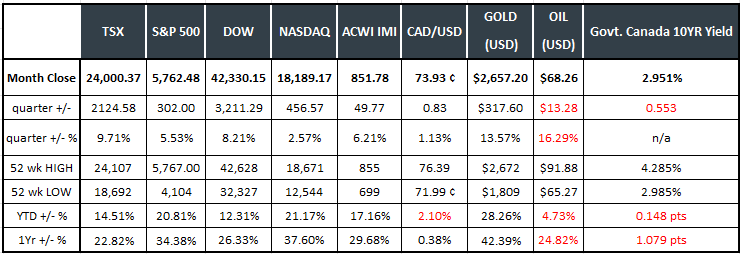

Last Quarter in the Markets: July 1 – September 30, 2024

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in the Third Quarter?

The biggest news directly affecting markets was the Bank of Canada (BoC) and the U.S. Federal Reserve (the Fed) executing rate reductions. The BoC has cut their policy rate by 0.25 per cent three times, totalling 0.75 per cent. Although the Fed has only made one rate cut, it slashed the federal funds rate by 0.5 per cent on September 18.

It has been a prolonged process, but inflation and employment both finally reached levels encouraging expansive monetary policy from their respective central banks. As outlined below, the Fed is poised to continue lowering rates should their dual mandates continue their trajectories. The BoC has made similar statements regarding their plans for rates. BoC press conference

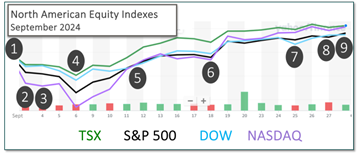

What happened in September?

For the second consecutive month, equity values ended much better than they began. North American equity indexes fell during September’s first week, reaching their lowest points for the month at the end of trading on Friday, September 6. Starting September 9, it was essentially an uninterrupted run of gains over the next three weeks.

(source: Bloomberg https://www.bloomberg.com/marketsand ARG Inc. analysis)

The notable events included:

- August 30

August concluded with less than positive news. U.S. inflation, as measured by the Core Personal Consumption and Expenditures price index (PCE), increased by 0.2 per cent in July and 2.5 per cent in the past year. This news contributed to a decline in equities for the first week of September based on the belief that the Fed might act conservatively with its rate reductions. BEA PCE release CNBC and PCE

- September 2

The first Monday of the month began with Canadian and American equity and bond markets closed for the observances of Labour and Labor Day, respectively.

- September 4

The BoC announced its third consecutive monetary policy update that reduced the overnight rate by 0.25 per cent (25 basis points). The target has been reduced from its July 2023 peak of 5 per cent to 4.25 per cent. BoC rate announcement CBC and BoC

- September 6

The NonFarm Payroll Report from the U.S. Bureau of Labor Statistics (BLS) showed employment increased by 142,000 in August, up from 89,000 in July, but below the consensus forecast of 161,000. The U.S. employment situation cleared the Fed to cut rates. BLS release CNBC and jobs CNN, jobs, rates, markets

- September 11 and 12

The BLS announced that the all-items Consumer Price Index (CPI) increased 2.5 per cent on a year-over-year basis. The increase was the smallest since February 2021, three and a half years ago. In August, the prices for shelter (+0.5 per cent) and food away from home (+0.3 per cent) increased, while the index for energy (-0.8 per cent) fell. BLS CPI release

The Producer Price Index (PPI) was released one day after the CPI. Wholesale prices rose 0.2 per cent in August, and 1.7 per cent on a year-over-year basis. BLS PPI release CNBC and PPI

- September 18

Following the BoC’s lead over the summer and on September 4, the Fed slashed the federal funds rate by 0.5 per cent to a range of 4.75 to 5 per cent. It was the first rate cut since March 2020. Fed release

The larger-than-expected rate cut of 50 bps follows substantial cooling in price pressures and labour markets, which suggests that the Fed has shifted their focus to avoiding a recession and ensuring economic activity doesn’t slow further. This implies more potential rate cuts on the horizon. CNBC and recession

As stated at the Fed’s press conference, it appears that rates may be reduced again before the end of 2024, and by another 1 per cent in 2025 based on the Fed’s Summary of Economic Projections. The long-term expectation is that the policy rate will settle at 2.75 to 3 per cent.

- September 25

Oil prices dropped as Saudi Arabia abandoned its $100 USD per barrel target. The Saudis will maintain production levels and seek to regain market share with lower prices, which is good news for consumers and companies relying on petroleum prices. A reduction in oil prices will also lower inflation globally, which should position central banks for more rate reductions. FT and oil

- September 27

Before North American markets opened, the U.S. Bureau of Economic Analysis (BEA) released the latest inflation data. The PCE price index rose 0.1 per cent in August, and 2.2 per cent on a year-over-year basis, down from 2.5 per cent in July. It is the lowest annualized inflation rate since February 2021. The PCE is the Fed’s preferred inflation measure and suggests that the Fed will focus on its other mandate to maximize employment. BEA PCE release CNBC and PCE

- September 30

The month ended with the National Day for Truth and Reconciliation.

What’s ahead for October and beyond?

The likelihood of an early federal election triggered by a non-confidence vote has risen dramatically. Once the New Democratic Party (NDP) left their alliance with the governing Liberal Party, the Conservative Party, Bloc Québécois and NDP have begun campaigning at Parliament’s Question Period. The political uncertainty could lead to additional market volatility for Canadian securities.

The scheduled U.S. elections may provide increased volatility for American equities. FT and election risk