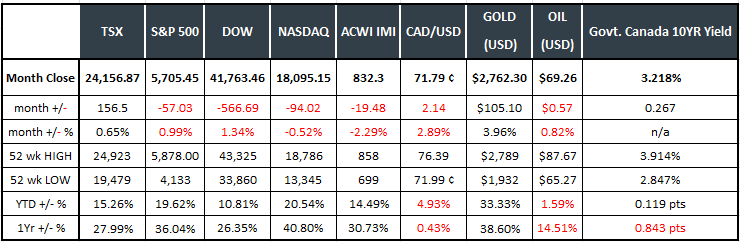

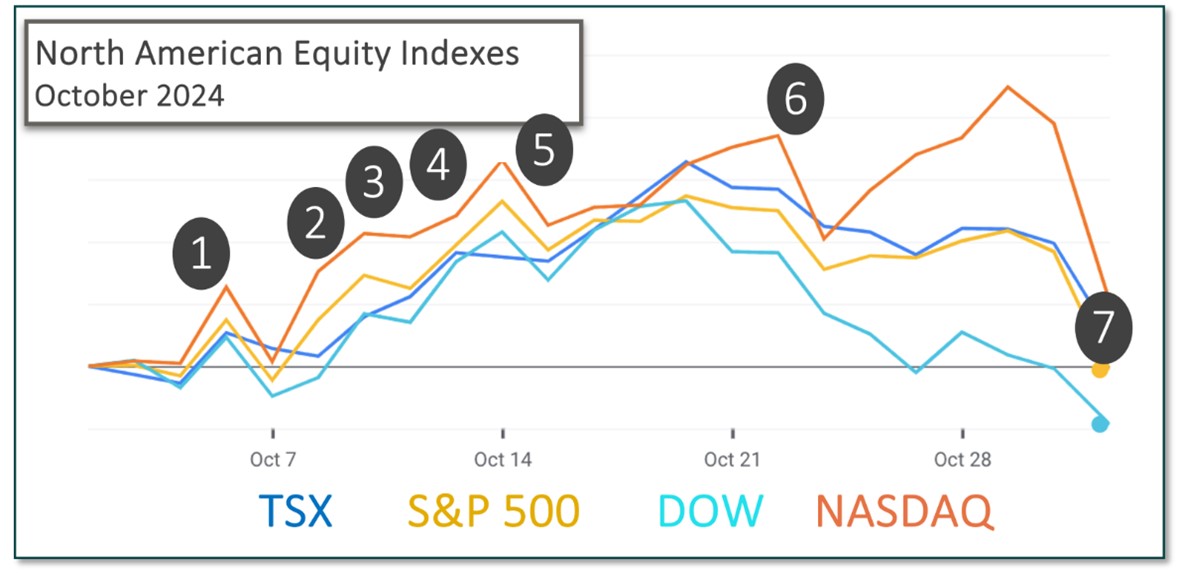

Last Month in the Markets: November 1-29, 2024

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in November?

The previous month concluded with the release of positive inflation news, setting the scene for positive equity results in November. On October 31, it was announced that the U.S. Personal Consumption Expenditures (PCE) price index for September had dropped 0.2 per cent to 2.1 per cent on a year-over-year basis. As the U.S. Federal Reserve’s (the Fed) preferred inflation indicator, lower interest rates are anticipated.

The first full week of November included the U.S. federal election that delivered a decisive Republican victory and a boost to most markets. BEA PCE release CNBC and PCE

(source: Bloomberg https://www.bloomberg.com/marketsand ARG Inc. analysis)

Other notable events and announcements included:

- November 1

U.S. employment (+12,000) came in lower than expected and unemployment at 4.1 per cent was unchanged in October according to the nonfarm payroll report. BLS Nonfarm Payrolls release

- November 5 to 8

A decisive election win was the best result for equity investors. A Republican-controlled Senate and House will facilitate the confirmation of federal appointees and the passing of laws. President-elect Donald Trump has promised an extension to his 2017 corporate tax reductions, reduced government spending and decreased regulation, which encourage positive corporate results and increased values. NBC News and markets Global and election results CNBC on elections and markets

- November 7

The Fed lowered its policy interest rate by 0.25 per cent (25 basis points). The release stated: “In support of its goals, the Committee decided to lower the target range for the federal funds rate by 0.25 percentage point to 4-1/2 to 4-3/4 percent. In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks.” Fed release

- November 8

Statistics Canada’s (StatsCan) Labour Force Survey for October reported that employment (+15,000) and unemployment (6.5 per cent) remained static. Despite the lack of job growth in October, employment was up 303,000 on a year-over-year basis. StatsCan release

- November 13

Markets settled downward after the large gains of the previous week that had been driven by a clear outcome in the U.S. elections. Once the election results were decided, investors refocused on corporate performance and overall economic conditions to drive markets. CNBC election and valuation

Before markets opened, the U.S. Consumer Price Index (CPI) for October was reported. For the fourth consecutive month, CPI increased 0.2 per cent on a monthly basis. On a year-over-year basis, consumer prices have increased 2.6 per cent. BLS CPI release

The inflation results suggest that central banks may slow the pace and size of rate cuts as inflation moved upward. Tariff promises made by Trump could further exacerbate inflation, which would delay rate cuts further into the future. CNBC and CPI (2)

- November 19

Canadian CPI rose 2.0 per cent on a year-over-year basis in October, up from the 1.6 per cent increase in September. This is the first increase in the rate of inflation since May. Although the rate of inflation has increased, it is at the goal rate set by the Bank of Canada (BoC). Over the past three years, prices for goods rose 10.2 per cent, while prices for services increased 14.2 per cent. StatsCan CPI release CBC and CPI

- November 22

Strong corporate results spurred equities along as earnings season drew to a close. After 95 per cent of the S&P 500 had reported their Q3 results, three-quarters of the companies reported a positive Earnings Per Share (EPS) surprise, and three-fifths reported a positive revenue surprise. FactSet Earnings Insight

- November 27

The U.S. PCE price index showed that prices rose 0.2 per cent in October and increased by 2.3 per cent on a year-over-year basis. For the month the price of services rose 0.4 per cent, while goods prices fell 0.1 per cent, food prices were little changed, while energy prices fell 0.1 per cent. The annualized inflation rate met expectations. BEA PCE release CNBC and PCE

- November 29

Canada’s economic growth has stalled. After remaining unchanged in August, Gross Domestic Product (GDP) edged up 0.1 per cent in September. Real GDP increased 0.3 per cent in the third quarter, after rising 0.5 per cent in both the first and second quarters of 2024. On a per capita basis, GDP fell 0.4 per cent in the third quarter, which was the sixth consecutive quarterly decline. On an annualized basis, the Canadian economy grew 1 per cent in the third quarter, down from 2.2 per cent in the second quarter. StatsCan Sept GDP StatsCan Q3 GDP CTV and GDP Wealth Professional

What’s ahead for December and beyond?

November was a successful month for equity investors as economic news and U.S. politics provided a positive push. Whether the economic indicators provide enough impetus for the BoC and the Fed to continue their rate-cutting cycle is not certain.

The first indication will occur on December 11, when the BoC delivers its next interest rate decision. The Fed Committee will meet one week later.

December has typically given investors an opportunity for tax-loss selling. However, in 2024 the North American equity indexes have risen between 19 and 28 per cent, which limits opportunities to consolidate positions for the current tax year.

Remember that deadlines are approaching for Registered Retirement Savings Plans, Tax-Free Savings Accounts, Registered Education Savings Plans and Registered Disability Savings Plans.