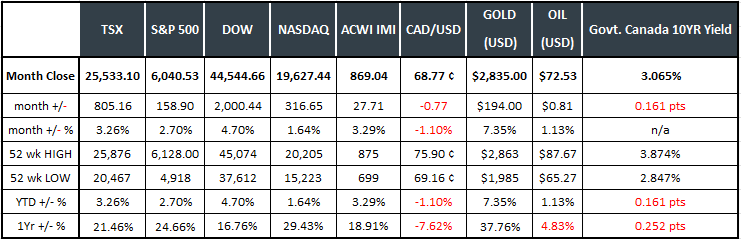

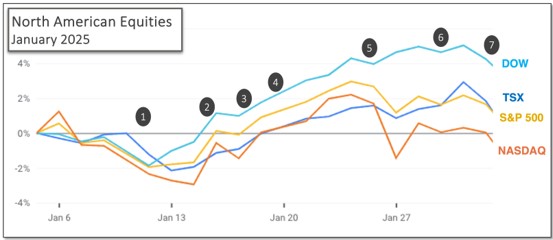

Last Month in the Markets: January 2-31, 2025

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in January?

Equity performance for the first month of 2025 was strong. If, over the next 11 months, the indexes continue to rise at the same pace that they rose in January, their 2025 returns could potentially outperform their 2024 returns.

The month included the inauguration of the 47th U.S. President, interest rate announcements, inflation and gross domestic product (GDP) data.

The most significant action affecting investors will be the threatened tariffs that were introduced on February 1 by President Donald Trump. The effects of tariffs will be felt in future periods.

In January, the events and announcements included:

- January 10

StatsCan’s Labour Force Survey reported that Canadian employment rose by 91,000 in December. The unemployment rate declined slightly by 0.1 percentage points to 6.7 per cent. StatsCan release CBC and LFS

U.S. employment increased by 256,000 in December. The unemployment rate remained constant at 4.1 per cent, and the number of unemployed people did not change in December and sat at 6.9 million. BLS release

- January 15

Consumer prices rose 0.4 per cent in December, and the all-items index increased by 2.9 per cent over the last year according to the U.S. Bureau of Labor Statistics. Over 40 per cent of the month’s increase was attributed to energy prices. Gasoline rose 4.4 per cent in December. The annual rate for Core CPI, which excludes more volatile food and energy, was 3.2 per cent and slightly better than expectations of 3.3 per cent. BLS CPI release CNBC and December 2024 CPI

- January 17

Although only 9 per cent of S&P 500 companies have reported, earnings, earnings per share and revenue growth are above 10-year averages. If the results continue, it will be the seventeenth consecutive quarter with revenue growth. The Financials sector was the largest contributor to the overall earnings growth rate. FactSet release

China’s economy expanded by 5.4 per cent in the fourth quarter, exceeding expectations. Their full year GDP growth reached 5 per cent as stimulus measures delivered results aligned with overall goals. Future GDP growth may be hampered by tariffs imposed by President Trump, and the effects would likely be felt after the first quarter and beginning in the second half of the year. CNBC and China GDP

- January 20

Trump was inaugurated as the 47th President of the U.S. in a ceremony on the Rotunda of the Capitol Building. Within the first days of his presidency, over 100 executive orders were signed to further his agenda. The Republican party controls the Executive and Legislative branches of government, and the conservative Supreme Court provides a strong mandate enabled by limited resistance.

- January 24

As of his first Friday after returning to office, Trump’s threatened tariffs had not materialized. A February 1 implementation date for 25 per cent tariffs against Canada and Mexico imports had been repeatedly mentioned. In some statements, Trump has implied that tariffs are designed to facilitate the tightening of borders that permit drugs and illegal immigrants to enter the U.S.

President Trump has suggested that firms could relocate production to the U.S. to avoid paying tariffs and that tariffs would generate revenue for the U.S. government. CNN and tariffs CBC and tariffs The Guardian and tariffs Global and threats

Fourth quarter earnings for U.S. corporations continued their positive results. After about 80 firms of the S&P 500 had reported, seven of the eleven sectors reported year-over-year earnings growth for Q4, and six of the seven reported double-digit growth. FactSet Insights 250124

- January 29

The Bank of Canada lowered its policy interest rate by 25 basis points, the U.S. Federal Reserve held rates steady and the European Central Bank took the same decision as Canada. Progress against inflation was the main justification for continuing to reduce rates, along with the desire to stimulate economic activity. Tariffs have the capability of sparking inflation and reducing economic output, which will likely induce additional monetary policy changes.

- January 31

The U.S. Bureau of Economic Analysis released the Personal Consumption and Expenditures (PCE) price index, the U.S. Federal Reserve’s preferred inflation indicator. On a monthly basis headline PCE rose 0.3 per cent and 2.6 per cent on a year-over-year basis for December. Both figures were aligned with expectations and are above the Fed’s targets. CNBC and PCE BEA release

What’s ahead for February and beyond?

On Saturday, February 1, President Trump signed an executive order that imposed tariffs of 25 per cent on imports from Mexico and Canada. China and Canadian energy will be subject to a 10 per cent import tariff.

This order appears to be in violation of the United States-Mexico-Canada Agreement, which was signed into law by Donald Trump in 2020 during his first presidency. The near universally held opinion at the time was that open trade between the three countries through the modernization of the North American Free Trade Agreement (NAFTA) was positive for each national partner. USMCA explainer

On the morning of February 3, a one-month pause was negotiated by Mexico after committing to deploy troops along its northern border to slow illegal immigration and drug shipments.

The specifics of China’s response, other than a challenge at the World Trade Organization (WTO), has not been communicated.

Canada introduced a retaliatory schedule of 25 per cent tariffs on American imports. After two telephone calls between Trudeau and Trump on the eve of bilateral tariffs, a postponement for 30 days was agreed. Prime Minister Trudeau will implement a $1.3 Billion border security plan, appoint a fentanyl “czar” and designate Mexican drug cartels as terrorist organizations. Approximately 10,000 additional personnel will be deployed to the border. However, in 2024, less than 20 kg of fentanyl was seized entering the U.S. from Canada, while 9,570 kg was seized from Mexico.

During the 30 day pause, President Trump may impose additional demands on Canada and Mexico. Investors, governments and businesses have another few weeks to prepare for tariffs or negotiate terms to avoid their implementation. Tariff postponement Trump tariffs Canadian response Chinese response NYT summary

Lastly, for Canadian taxpayers looking to reduce their 2024 taxable income, the deadline for Registered Retirement Savings Plan contributions is March 3.