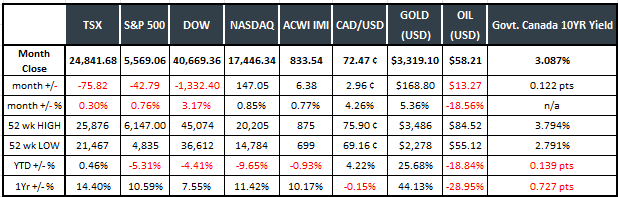

Last Month in the Markets: April 1 – 30, 2025

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in April?

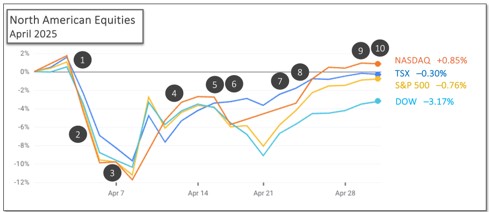

The difficult month for equities began with the announcement of tariffs by President Donald Trump on April 2. Considering economic theory and history, should the tariff scheme be implemented as proposed, the U.S., Canadian and global economy will likely fall into recession.

The potential for stagflation has also increased dramatically. The tools available to central banks to simultaneously battle rising inflation, high unemployment, and slow economic growth are limited. These sentiments have manifested themselves in equity values in the days and weeks following the announcement. BNN Bloomberg and JP Morgan Chase note

Further evidence of challenging times ahead is reflected in the price of gold, which has leapt over 25 per cent in 2025 and over 44 per cent over the past year. Gold has maintained its reputation as a safe-haven investment to protect against losses elsewhere, typically when uncertainty threatens equities.

Economic reports that influenced markets during April included:

- April 2 – Trump launches global trade war

At a mid-afternoon press conference from the White House Rose Garden, Donald Trump imposed tariffs on imports from 185 countries and territories. Watch CNBC

The calculation to determine the tariff rate is the trade deficit divided by the total imports from that country, and then halved. This method is not an accepted practice used by economists and assumes that a trade deficit represents the sum of all unfair practices by the foreign counterpart. Trump stated that the calculation included currency manipulation and other barriers, but these factors are not included in the mathematical formula. A report from the Cato Institute, which is based on 2023 World Trade Organization data, calculates China’s trade-weighted average tariffs at 3 per cent. Trump imposed a minimum tariff of 10 per cent, bypassing his own calculation, since it was applied on 115 countries with which the U.S. has a trade surplus.

- April 4 – Canadian employment falls in March, rises in U.S.

Employment data was released in Canada and the U.S. for March. StatsCan determined Canadian employment fell by 33,000, the first decline since January 2022, the employment rate declined 0.2 per cent and the unemployment rate rose 0.1 per cent to 6.7 per cent.

The total nonfarm payroll employment rose by 228,000 in March and the unemployment rate changed little according to the Employment Situation Summary from the U.S. Bureau of Labor Statistics. Job gains were made in health care, social assistance, transportation and warehousing, and retail trade. Federal government employment declined.

- April 7 – Bank of Canada releases its Business Outlook Survey

The Bank of Canada released its Business Outlook Survey (BOS) which does not include the latest tariff announcements since information was collected between February 6 and 26. One-third of businesses are including a recession in the next year as one of their planning assumptions. In the previous report, 45 per cent of companies expected to add employees and now only 32 per cent believe they will increase headcount. CBC and BOS

- April 10 – U.S. inflation falls slightly

In more encouraging news, the U.S. Bureau of Labor Statistics announced that the Consumer Price Index (CPI) rose 2.4 per cent in March on a year-over-year basis. The same measure one month ago was 2.8 per cent. Core CPI which excludes more volatile food and energy, was also 2.8 per cent, which is its lowest level in four years. BLS release

- April 15 – Canadian consumer inflation dips lower

StatsCan announced that the Consumer Price Index (CPI) for March was 2.3 per cent on a year-over-year basis, down from 2.6 per cent in February. The slowdown in price increases was driven by lower prices for travel and gasoline in March. Airfare costs fell by 12 per cent on a year-over-year basis as fewer Canadians travelled to the U.S. last month, when many families head south for March Break. Excluding gasoline, the CPI rose 2.5 per cent following a 2.6 per cent increase (excluding gasoline) in February. StatsCan CPI release CBC and CPI

- April 16 – Bank of Canada holds rates steady, and ECB drops 0.25 point

The Bank of Canada maintained its target for the overnight rate at 2.75 per cent and released its Monetary Policy Report (MPR). Tiff Macklem, Bank of Canada Governor, indicated that the “dramatic protectionist shift in US trade policy and the chaotic delivery have increased uncertainty, roiled financial markets, diminished global growth prospects and raised inflation expectations” in his opening statement to begin the press conference at 10:30 a.m. ET. Macklem outlined two of many scenarios; the first where the tariffs are negotiated away after an unpredictable process and households and businesses are cautious and the second scenario with a long-lasting global trade war. Neither of these, nor any combination of these extremes, provides a predictable and positive path.

The European Central Bank (ECB) released its Monetary Policy Statement (MPS) lowering its key lending rates by 0.25 per cent or 25 basis points. According to the ECB’s MPS “most measures of underlying inflation suggest that inflation will settle at around the Governing Council’s 2 per cent medium-term target on a sustained basis. ECB MPS explained

- April 24 – Interest rate speculation provides positivity

It appears that the U.S. Federal Reserve may be more inclined to lower interest rates sooner than previously communicated. Trump has expressed frustration with Fed Chair, Jerome Powell, and had previously hinted at terminating him. Last week, Trump reversed his early opinion. Coincidentally, Powell said that lower rates could arrive this summer, which pleased Trump. An independent central bank that is not beholden to election results is the accepted standard to protect markets and investors, but could still be at risk in the U.S. CNBC on Trump and Powell

- April 25 – Canadian retail trade declines

Retail sales decreased by 0.4 per cent to $69.3 billion in February, when four of nine subsectors and seven of ten provinces declined. The largest drops were seen at motor vehicle and parts dealers, and in Quebec and British Columbia. StatsCan and retail sales

- April 28 – Canada re-elects Liberals and Prime Minister Mark Carney

At the end of the five week campaign the Liberals won 169 seats, three short of the number needed to obtain a majority government. The official opposition will be the Conservatives with 144 seats. Elections Canada results

Early indications are that Prime Minister Mark Carney and President Donald Trump will meet in the near future to discuss trade arrangements between the two countries.

- April 30 – Gross Domestic Product (GDP) declines

Canadian real GDP was 0.2 per cent lower in February, following a 0.4 per cent increase in January. Goods producing industries fell 0.6 per cent, services-producing industries slipped 0.1 per cent in February. Mining, oil and gas extraction, construction, real estate, rental and leasing declined while durable goods, finance and insurance rose. StatsCan and GDP

American GDP decreased at an annual rate of 0.3 per cent in the first quarter of 2025, according to the advance estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2024, real GDP increased 2.4 per cent. BEA release

What’s ahead for May and beyond?

For the last five years the primary driver of markets has been the path of the pandemic, government responses to protect individuals, families and the economy, the path of inflation and central bank actions to temper its rise while avoiding recession. The concerns for economic growth, employment, inflation and rates continue, but the underlying source has changed from the pandemic to a global trade war.

Over the next weeks much of the uncertainty associated with the current situation should be reduced or eliminated if bilateral negotiations between the U.S. and Canada, China, Taiwan, U.K., Germany, France, Japan, and many others are successful. However, new rounds of presidential actions could reignite the type of market turmoil that has been observed since tariff-talk began in earnest in February.

The Bank of Canada and the U.S. Federal Reserve will deliver their next interest rate announcements on June 4 and May 6, respectively, which could provide a steadying counterbalance to trade uncertainties.