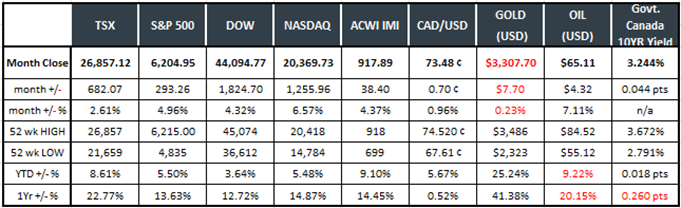

Last Month in the Markets: June 2-30, 2025

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in the first half of 2025?

The turmoil and deep drop of April caused by President Donald Trump’s global trade war seems like a distant memory now that a recovery has occurred. Overall, the TSX is leading the North American equity indexes with a solid gain greater than 8.5 per cent this year.

(source: Bloomberg https://www.bloomberg.com/markets and ARG Inc. analysis)

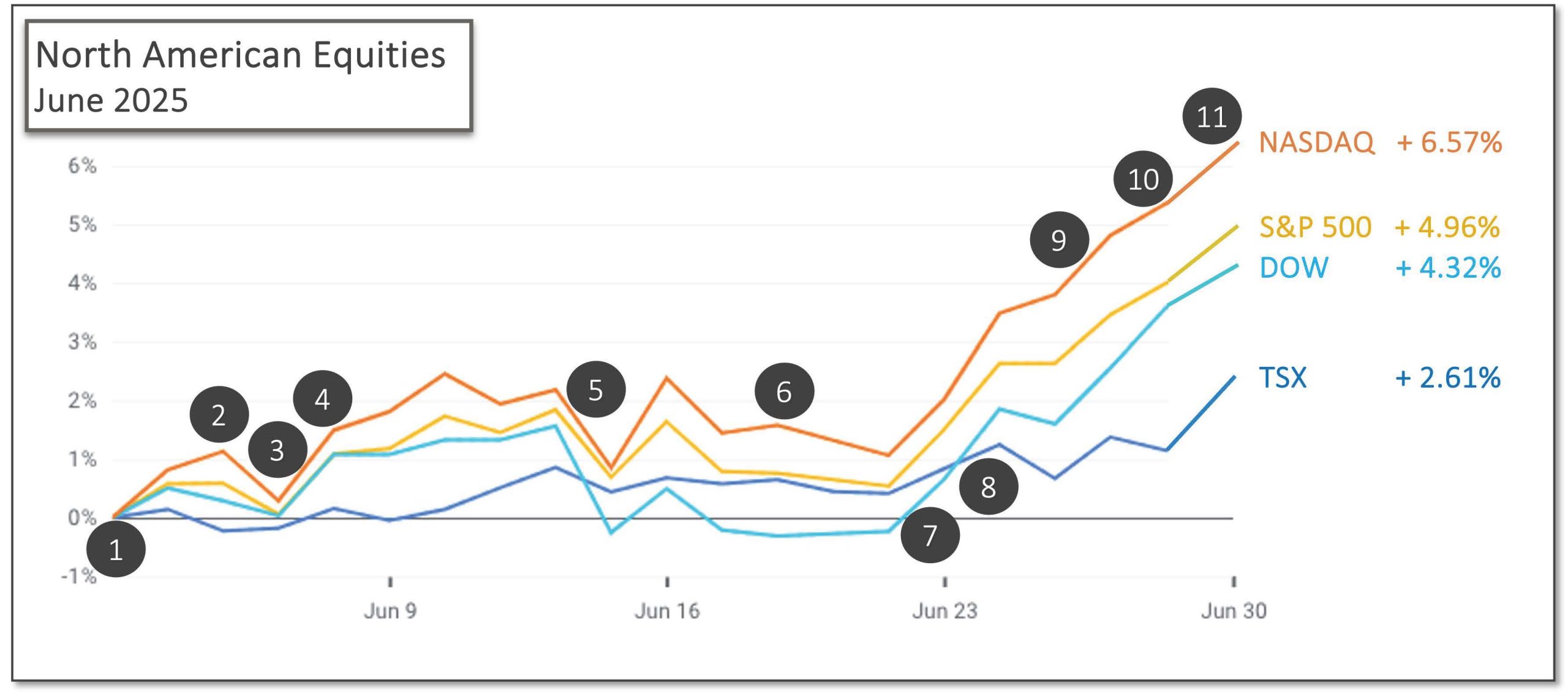

What happened in June?

Equity markets started June on a positive note, though the first half of the month was marked by volatility as economic data sent mixed signals. Geopolitical tensions escalated when Israel launched an attack on Iran on June 12, introducing a wave of uncertainty that weighed on investor sentiment. Markets drifted lower in the days that followed, but a strong rebound in the final week of trading helped U.S. indexes finish the month with solid gains. Canada’s TSX followed a similar trajectory, though with less volatility, ultimately posting a steady 2.6 per cent gain for the month.

Economic reports and geopolitics that influenced markets in June included:

- May 29 and 30 – Canadian employment fell while GDP maintained its pace

As the previous month concluded, jobs and GDP news was mixed and may have influenced June’s overall performance for the TSX. Canadian payroll employment decreased by 54,000 in March following a decline of 40,200 in February. StatsCan and employment

Canadian GDP increased 0.5 percent in the first quarter of 2025, the same pace as the fourth quarter of 2024. Total exports rose, led by of passenger vehicles (16.7 per cent increase), industrial machinery, equipment and parts (12.0 per cent increase) under the looming threat of U.S. tariffs. StatsCan Q1 GDP

- June 4 – Bank of Canada maintained interest rates

The Bank of Canada (BoC) held interest rates unchanged for the second consecutive decision. The policy interest rate, the Canadian overnight rate, was kept at 2.75 per cent. The BoC announcement included, “With uncertainty about US tariffs still high, the Canadian economy softer but not sharply weaker, and some unexpected firmness in recent inflation data, Governing Council decided to hold the policy rate.” CBC, tariffs and rates

- June 5 – European Central Bank lowered rates

In contrast to the BoC, the European Central Bank lowered its interest rates by 0.25 per cent as inflation hovers around the Governing Council’s 2 per cent medium-term target. ECB rate announcement

- June 6 – Jobs reports from U.S. and Canada shows employment waning

The Bureau of Labor Statistics reported its Employment Situation Summary, showing nonfarm payroll employment increased by 139,000 in May, and the unemployment rate was unchanged at 4.2 per cent. The average monthly gain over the last 12 months has been 149,000, slightly more than the U.S. job growth in May. BLS release

StatsCan announced that employment was little changed in May (+8,800). The employment rate held steady at 60.8 per cent, and the unemployment rate rose 0.1 percentage points to 7.0 per cent. From October 2024 to January 2025 Canadian employment increased by 211,000, but there has been virtually no additional employment in the last four months. StatsCan release

- June 12 – Rising tensions in the Middle East affected market performance

Israel’s attack on Iran’s nuclear installations and military leadership, and Iran’s predictable response caused stocks, oil and gold to react. Stocks were down sharply the next day, except for energy stocks as oil jumped, as did gold.

- June 18 – Federal Reserve continued its wait-and-see approach

The U.S. Federal Reserve chose to maintain interest rates at their current levels. The statement included, “The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty about the economic outlook has diminished but remains elevated. The Committee is attentive to the risks to both sides of its dual mandate. In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4.25 to 4.5 percent.” Fed announcement and press conference

- June 22 – U.S. bombed Iran

Over the weekend, as tensions continued to rise, Trump executed a three-site bombing raid on Iran. The destruction of Iran’s nuclear capabilities was the goal. Oil prices have risen about 10 per cent recently due to the conflict with Iran. A reduction in Iran’s oil exports or production in the Middle East caused by U.S. actions will harm China directly, and further strain relations with the U.S. NYT and US raid

Two days later Trump announced a ceasefire between Israel and Iran.

- June 24 – Canadian inflation stayed below Bank of Canada goal

The Consumer Price Index (CPI) rose 1.7 per cent on a year-over-year basis in May, matching April’s rate. On a monthly basis, the CPI rose 0.6 per cent in May. A smaller price increase for rent and a decline in travel tours put downward pressure on the CPI in May. Excluding energy, the CPI rose 2.7 per cent in May, compared with 2.9 per cent in April. StatsCan and CPI

- June 26 and 27 – U.S. and Canadian Gross Domestic Product fell

American GDP decreased at an annual rate of 0.5 per cent in the first quarter of 2025. In the fourth quarter of 2024, before Trump began to implement his tariff policy, GDP increased at an annual rate of 2.4 per cent. BEA GDP release

Canadian GDP edged down 0.1 per cent in April, following a 0.2 per cent increase in March. Goods producing industries were down 0.6 per cent in April, with the manufacturing sector accounting for nearly all the decline. Services-producing industries were up 0.1 per cent in April. StatsCan and GDP

- June 27 – U.S. inflation rose slightly above the U.S. Federal Reserve’s goal

Personal income fell $109.6 billion and disposable personal income decreased $125.0 billion in May. The Personal Consumption Expenditures (PCE) price index, the U.S. Federal Reserve’s primary inflation indicator, for May increased 2.3 per cent on an annualized basis. Excluding food and energy, Core PCE, increased 2.7 per cent from one year ago. PCE release

- June 27 and 30 – Tariff and trade negotiations between Canada and the U.S. continued

On Friday, Trump suspended all trade and tariff negotiations with Canada in retaliation to Canada’s Digital Services Tax, which was cancelled on Monday, restarting trade talks.

What’s ahead for July and beyond?

July 21 is the next major deadline for tariff negotiations between Canada and the U.S. The progress of trade talks, inflation, employment and interest rates will guide the path of the markets in the second half of 2025.

The uncertainty of existing trade talks has been augmented by the situation in the Middle East. The debates about Iran’s nuclear capabilities continue as their response has been mild. More volatility from the region could affect financial markets.

The slowdown in GDP growth, spurring employment growth declines, could spur interest rate reductions by the Bank of Canada and the U.S. Federal Reserve on July 30 that would be viewed positively for equities.

Reuters and trade talks CNN and rates Money Week and Middle East oil