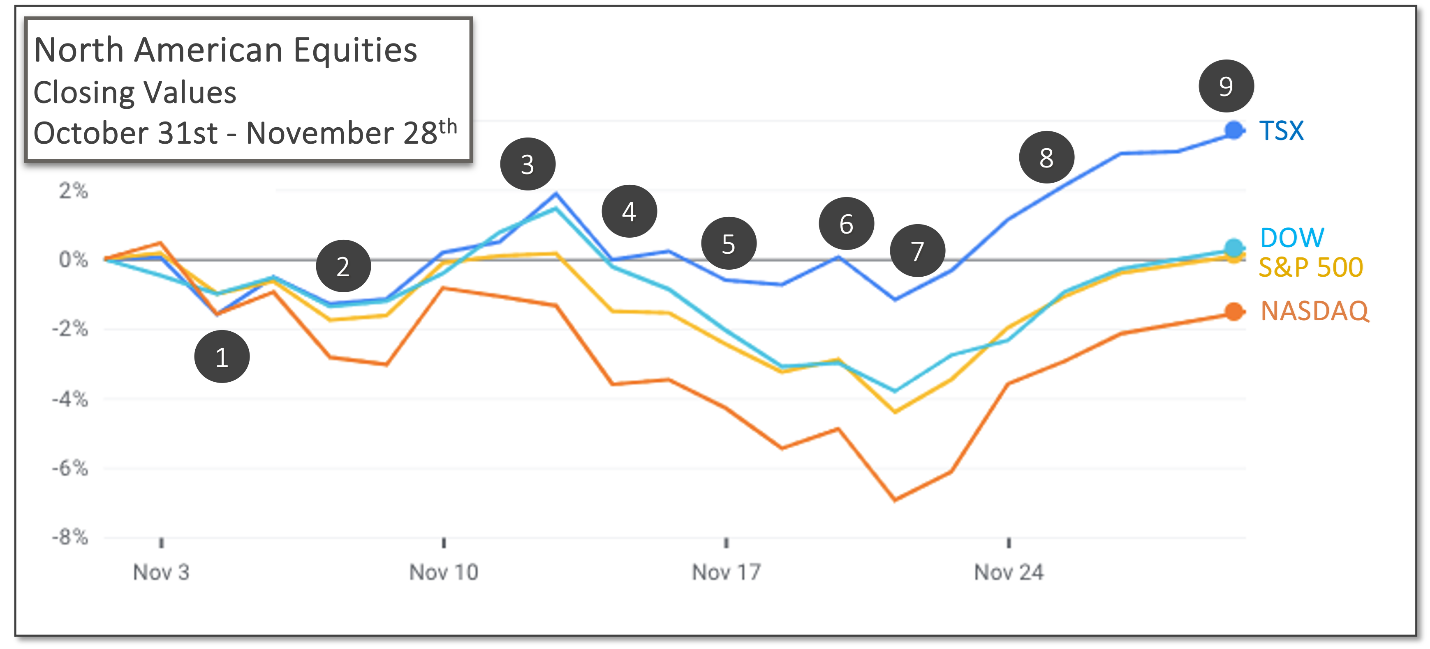

Last Month in the Markets: November 3 – 28, 2025

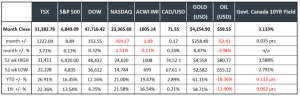

Index returns based on index value (source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in November?

The final, and Thanksgiving shortened, week of the month salvaged what had been a dismal period for North American equity indexes. The S&P 500 and Dow eked out small gains but gains nonetheless after rising more than 3 percent last week. The TSX rose 4 percent in the last week and achieved another all-time high. In the four trading days last week, NASDAQ jumped nearly 5 percent but remained 1½ percent below its level from the end of October.

Gold continued to hold much of its gains, up about 60 percent from one year ago. Oil continues to slip toward its 52-week low as supply outpaces demand.

(source: Bloomberg https://www.bloomberg.com/marketsand ARG Inc. analysis)

Events that influenced markets in November included:

1. November 4– Federal Liberals tabled their budget in the House of Commons

Prime Minister Mark Carney introduced the first Canadian federal budget in 18 months. The promised 25% reduction in minimum RRIF withdrawals was not included. Some businesses will be able to immediately expense investment in new facilities, some small corporations’ shares will be RDSP eligible in 2027 and bare trust reporting will finally begin in 2027 for year-ends of December 31, 2026, and later.

2. November 7 – Canadian employment bounced-back

The Labour Force Survey from StatsCan reported that employment increased by 67,000 in October and the unemployment rate declined by 0.2% to 6.9%. Wages have increased 3.5% (+ $1.27 to $37.06) on a year-over-year basis in October, following growth of 3.3% in September. StatsCan release

Shutdown scuttled U.S. air travel

The U.S. government shutdown and subsequent legal battles created confusion for travellers. The immediate effect was the cancellation of 1,400 flights and the delay of 6,000 more were delayed at the 40 largest airports for safety reasons. BBC and flights

3. November 12 – Government shutdown ended

The longest government shutdown in U.S. history finally ended, and the reopening will take several weeks, if not months, to achieve.

4. November 14 – Effects of shutdown reduced likelihood of Fed rate cut

Unfortunately, the positive effect of reopening was tempered for investors. During the shutdown the Bureau of Labor Statistics missed reporting several key economic indicators, and it appears that several may never be reported. Missed reports in 2025 will prevent the interpretation of annualized trends in 2026 when year-over-year comparisons are impossible. Doubt has begun to rise whether the Federal Reserve has sufficient evidence to reduce interest rates. As of November 14 CME’s FedWatch tool indicated that the likelihood of a ¼ point rate cut was slightly less than rates remaining unchanged. NYTimes, data and rate cuts CNBC and data

5. November 17– Canadian consumer inflation edged upward

StatsCan reported that the Consumer Price Index (CPI) rose 2.2% on a year-over-year basis in October, slightly lower than the 2.4% increase in September. CPI fell due to lower gasoline prices and a slowing of price increases for groceries. StatsCan CPI release

Canadian budget bill passes House vote

The House of Commons approved the 2025 budget bill, which was enabled by four abstentions and the support of Green Party MP, Elizabeth May, the vote passed 170-168. Watch highlights here

6. November 20– U.S. jobs added and returned to April levels

The U.S. Employment Situation Summary revealed that “total nonfarm payroll employment edged up by 119,000 in September but has seen little change since April.” Employment rose in health care, food services and social assistance and job losses occurred in transportation and warehousing and in the federal government. The unemployment rate changed little in September at 4.4 percent. BEA current release

7. November 21– Fed released its meeting minutes and rate cuts have become less certain

The U.S. Federal Reserve released the minutes from its interest rate meeting of October 28-29 when the federal funds rate was reduced by ¼ percent. Some committee members stated that lowering the rate could entrench inflation above the 2% goal and signal a reduced commitment to achieving price stability. CME’s FedWatch tool predicted a 60% chance that rates would be held steady on December 10th, up from about 50% one week earlier. Reuters and Fed minutes

8. November 25 – More economic releases cancelled by U.S. administration

Three import indicators, jobs, inflation and GDP, have been delayed or cancelled with the now-ended government shutdown as the excuse for withholding data. The tariff scheme and mass deportations has reduced U.S. GDP by 7 percent according to one source, and consensus is growing that bad news is being withheld. MSN Yahoo

9. November 28– Canadian GDP rebounds in Q3

“Real gross domestic product (GDP) rose 0.6% in the third quarter of 2025, after falling 0.5% in the second quarter” according to the StatsCan release on November 28. During the quarter, imports dropped 2.2% and exports edged upward 0.2%, strengthening the trade balance. Contributing to the GDP rise was increasing crude oil and bitumen exports, government capital investments in weapons systems and hospitals. The annualized GDP growth rate in the quarter was 2.6%. CBC and GDP

December rate cut by fed grew more likely

The positive Canadian and scarce U.S. economic news does not account for the recent upswing in equity values. A noteworthy release, the Federal Reserve’s Beige Book summary of economic conditions, has CME’s FedWatch tool predicting an interest rate cut in December. The decline in overall employment, among other statements and conclusions, was interpreted as leading to a rate cut. Lower rates are, generally, a boost to business and personal spending, and push economic expansion and equities higher.

What’s ahead for December and beyond?

The upcoming Bank of Canada and Federal Reserve interest rate decisions, both on December 10, will provide influence over capital markets as the date and announcements approach. The analysis and negotiations associated with USMCA, tariff discussions, and geopolitical events in the Middle East and in Europe with Russia will not go unnoticed. As always, surprises will have the most impact, and typically negatively.