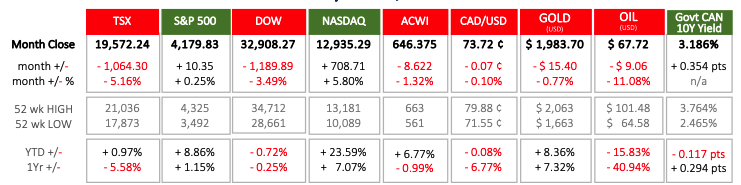

Last Month in the Markets – May 1-31, 2023

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in May?

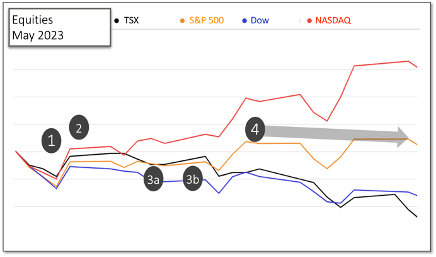

Last month saw divergence among major North American equity indexes, with two increasing and two decreasing in value. The NASDAQ gained more than Canada’s TSX lost – plus almost 6% against minus 5%. The S&P 500 and the Dow delivered performance with a gap of nearly 4% – plus 0.25% versus minus 3.5%, respectively. The risk of a negative economic shock from the U.S. debt ceiling situation played against increasing optimism for technology stocks concentrated in the NASDAQ with the growth of Artificial Intelligence (AI).

(source: Bloomberg https://www.bloomberg.com/markets and ARG Inc. analysis)

May concluded with the passage of the debt ceiling bill in the U.S. House of Representatives that will keep the government operating and allow the U.S. Treasury to meet its obligations if or when it is passed by the Senate and signed into law by President Biden. Prior to the deal that was negotiated by President Biden and House Speaker McCarthy, several other influential events occurred.

- May 3 – The U.S. Federal Reserve increased its federal funds rate by 25 basis points. Predictions that the Fed would not raise rates were proved wrong, but the meeting minutes of the Federal Open Market Committee indicated that the decision was not unanimous. Equities dipped temporarily on recession fears. https://www.federalreserve.gov/monetarypolicy/fomcpresconf20230503.htm

- May 5 – Equities recovered quickly from the Fed’s rate increase when Canadian and U.S. jobs data was released. Employment rose by 41,000 and 253,000 in April, respectively, and unemployment remained unchanged in both countries at 5% and 3.4%. The strength of the jobs market showed that a recession was not immediately on the horizon. https://www150.statcan.gc.ca/n1/daily-quotidien/230505/dq230505a-eng.htm?HPA=1&indid=3587-2&indgeo=0 https://www.bls.gov/news.release/empsit.nr0.htm

- May 10 – Inflation has not responded to interest rate increases as much as needed, but has not grown much worse, and had markets holding steady. Inflation news was neutral, and it was not apparent if the U.S. central bank, the Federal Reserve, would stop interest rate rises.

- U.S. consumer inflation rose 0.4% in April and 4.9% on a year-over-year basis. Shelter was the largestcontributor to the monthly increase, followed by vehicle and gasoline prices. https://www.bls.gov/news.release/cpi.nr0.htm

- May 16th – Canadian inflation rose more in April at 0.7% for the month and 4.4% for the year. https://www150.statcan.gc.ca/n1/daily-quotidien/230516/dq230516a-eng.htm?indid=3665-1&indgeo=0

4. May 28 – U.S. debt ceiling arguments and negotiations continued throughout the month and became increasingly concerning for markets during the second half as the deadline to avert a crisis approaching. Over the last weekend of May, a deal was agreed to by Biden and McCarthy. Over the next three days of May the legislation, The Fiscal Responsibility Act, was debated and passed in the House. It is being fast-tracked through the Senate. The goal is to enact this new law before the deadline of June 5, set by Treasury Secretary Yellen when U.S. government debt obligations would go unmet. https://www.cnbc.com/2023/06/01/debt-ceiling-bill-updates.html

During the first half-day of trading since the House passed the debt bill equity indexes rose 0.5% to 1% indicating that an important hurdle had been cleared.

What’s ahead for June and beyond in 2023?

Now that the U.S. debt ceiling crisis seems to have been avoided, pending passage in the U.S. Senate markets will return

to their usual priorities: inflation, interest rates, economic growth, and the linkages between them.

Inflation has stopped growing but is remaining much higher than the 2% annual rate targeted by Canadian and American central banks. Further interest rate increases aimed at lowering demand, particularly consumer demand and consumer spending, increase the threat of a recession. Traditionally a recession was defined as two or more quarters of negative economic growth. The updated definition of a recession is “a significant, widespread, and prolonged downturn in economic activity.”

The goal for Fed Chair, Jerome Powell, and Bank of Canada Governor, Tiff Macklem, is to raise rates just high enough to curb inflation and not induce a recession. The next two opportunities to adjust interest rates are June 7 in Canada and June 14 in the U.S. Whether the interest rate pause continues in Canada or begins in the U.S. will provide insight into the

path of the economy, and markets, in the near term.

Wagner Investment Management Team contributors: Susyn Wagner & Karen Routledge