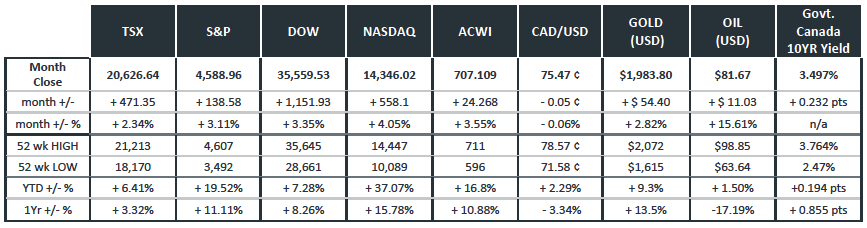

Last Month in the Markets – July 3–31, 2023

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in July?

North American equity indexes added another 2 to 4 percent to their year-to-date advances on positive news on the inflation, jobs, and monetary policy fronts. Gold, oil, and Canadian government bonds also increased as the Canadian dollar nearly broke-even after losing just five one-hundredths of a cent by month’s end.

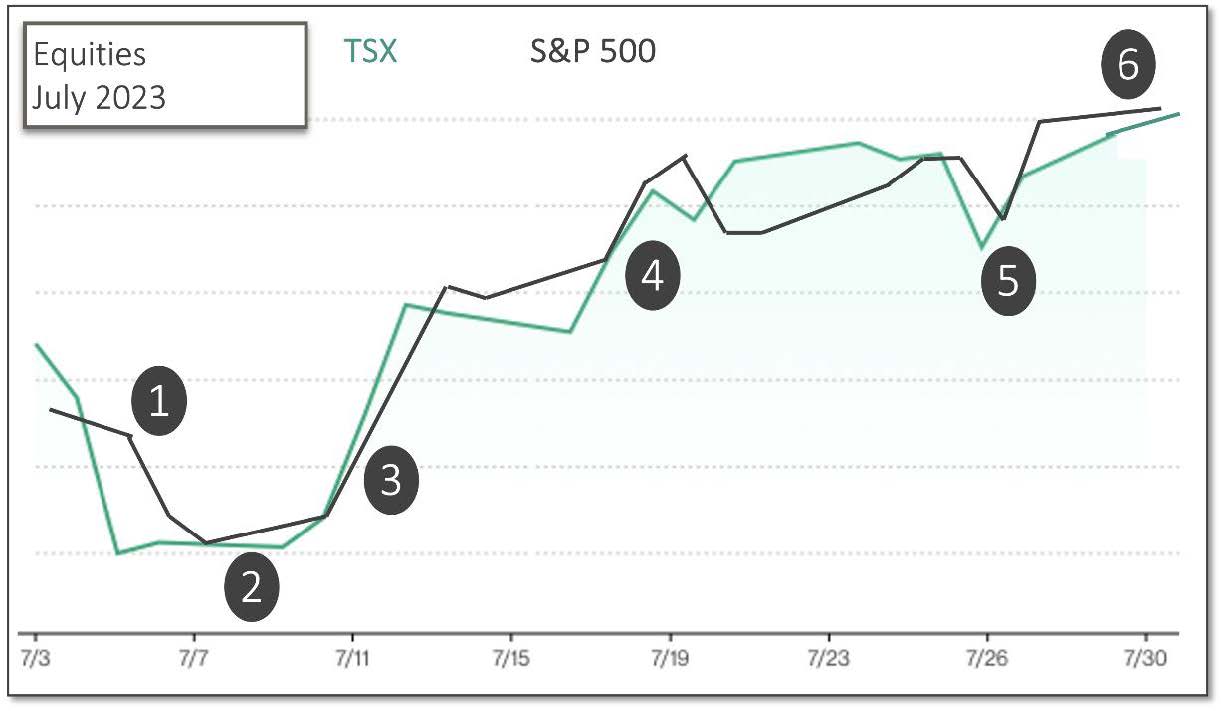

(source: Bloomberg https://www.bloomberg.com/markets and ARG Inc. analysis)

Like last month, July ended strongly. June 30 achieved an exceptional day of gains for equity indexes, while July earned its positive returns over the last two-thirds of the month.

1. July 5

The month began slowly with markets closed for the official observance on July 3 of Canada Day and Independence Day on July 4. Following the two holidays the Federal Reserve released the meeting minutes from its previous Federal Open Market Committee that included interest rate deliberations and opinions of its committee members. The belief that the federal funds rate must be raised to 5.6% (up from their March 2023 projection of 5.1%) sent equity markets lower. FOMC Meeting Minutes Summary of Econ Projections

2. July 7

Continued strength in employment for June held markets steady. The increase of 60,000 and 209,000 additional jobs in Canada and the U.S., respectively, represented a situation where “good news” might actually be “bad news.” A robust labour market that is able to fuel consumer demand and inflation might require more severe monetary policy from the Bank of Canada and the Federal Reserve. Markets were wary, and held their ground, and did not rise on this news that might otherwise be interpreted positively. StatsCan June Jobs BLS U.S. June Jobs

3. July 12

The U.S. Bureau of Labor Statistics reported that the Consumer Price Index had risen 0.2% in June, and the all-items index had risen 3.0% over the last 12 months. Shelter continued as the largest contributor to price increases, along with groceries and food away from home. Energy prices fell, especially gasoline, heating oil and natural gas, while electricity prices rose. BLS. U.S. June CPI

The Bank of Canada increased its benchmark interest rate by a quarter percent (25 basis points to 5%. The small increase was aligned with expectations and was driven by easing inflation and lower energy prices and a decline in goods price inflation.

“However, robust demand and tight labour markets are causing persistent inflationary pressures in services,” according to the Bank’s press release and in its Monetary Policy Report.

The lowering inflation and tempered policy by the Bank of Canada were viewed positively and markets turned upward in response.

4. July 18

Actual good news was announced by StatsCan as consumer inflation rose on a year-over-year basis by 2.8%, which was down from the previous month’s annual inflation of 3.4%. The devil-is-in-the-details since much of the decline could be attributed to falling gasoline prices in June.

“Excluding gasoline, headline inflation would have been 4.0% in June, following a 4.4% increase in May. Canadians

continued to see elevated grocery prices (+9.1%) and mortgage interest costs (+30.1%)” based on StatsCan analysis. StatsCan CPI Release

5. July 26

The Federal Reserve increased its interest rates, again by 25 basis points (a quarter percent). There may have been some hope that a pause in rate increases might be permitted by slowing inflation, but once the news was received it was digested well, and markets rose again. Fed Press Conf

6. July 28

The Fed’s primary inflation indicator, the Personal Consumption Expenditures price index showed an increase of 3.0% over the past year and 0.2% for June, which is a very positive indicator. PCE Release

What’s ahead for August and beyond in 2023?

The continuous flow of news on the battle against inflation and interest rates is wearying. Although, the conditions persist to ensure that monetary policy will be closely followed, the next Bank of Canada and Federal Reserve announcements will occur on September 7 and 20, respectively. A brief reprieve from the bombardment of speculation and news from central banks could lead to lower volatility in the markets for the balance of summer.

Wagner Investment Management Team contributors: Susyn Wagner & Karen Routledge