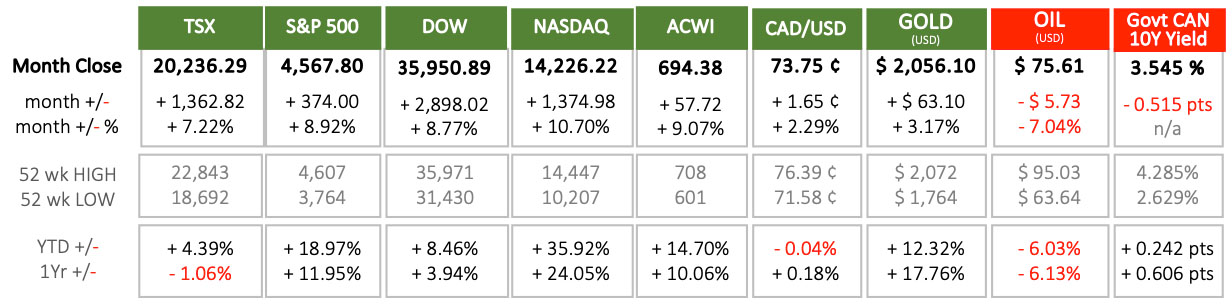

Last Month in the Markets: November 1st – 30th, 2023

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in November?

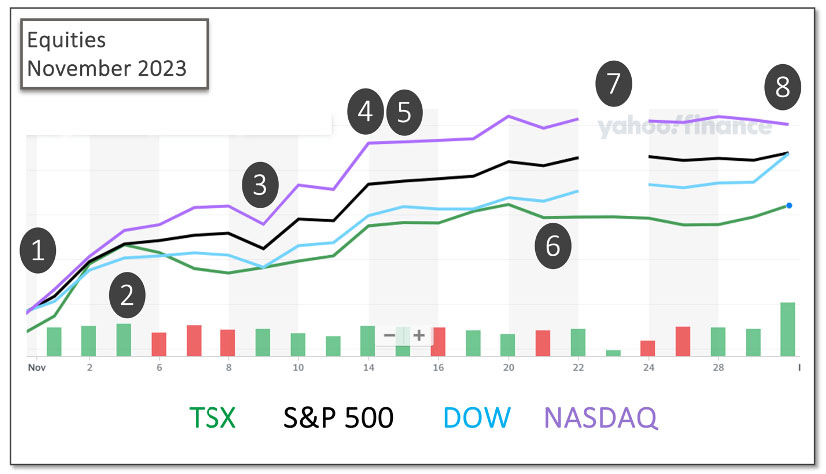

The major North American indexes were led by the NASDAQ with a 10½ percent increase, the Dow and S&P 500 at nearly 9 percent, and the TSX delivered a very healthy gain of more than 7 percent.

Gold continued to perform well despite a calming, or at least the sense of calming, in political and geopolitical uncertainty. President Biden and Chinese President Xi met in San Francisco ahead of the Asia Pacific Economic Cooperation summit to thaw relations between the two countries. A U.S. government shutdown was averted mid-month after passing a bipartisan spending and debt bill. The war between Hamas and Israel paused to allow humanitarian aid into Gaza, and a hostage/prisoner exchange.

The month concluded with positive inflation news from the U.S., and growing analyst expectations that the Federal Reserve and other central banks, like the Bank of Canada, could begin cutting rates in 2024.

(source: Bloomberg https://www.bloomberg.com/markets and ARG Inc. analysis)

Many events contributed to the up-and-up-and-up month for investors:

- November 1st

The U.S. Federal Reserve held the federal funds rate unchanged, and within a range of 5¼ to 5½ percent. Although, no promises of rate reductions were offered, the continuation in the pause of rate increases caused a positive reaction in equity markets. North America stocks rose on the news after several weeks of poor performance. Fed release CNBC equities and Fed

- November 3rd

The Canadian economy added 18,000 jobs last month, after adding 64,000 jobs in September and 40,000 in August. October’s performance represents a slowing of the Canadian economy. The unemployment rate rose to 5.7%, the fourth consecutive monthly increase. StatsCan release

The U.S. Bureau of Labor Statistics reported that nonfarm payroll had risen by 150,000 in October, and the unemployment rate rose 0.1% to 3.9%. Each of the major worker categories saw minor change sin unemployment rates, as a total of 6.5 million Americans were unemployed. BLS release

- November 9th

Federal Reserve Chair, Jerome Powell, stated at an International Monetary Fund meeting that interest rates may not be high enough, yet, to bring inflation back to the 2% target, again demonstrating the sensitivity of markets to interest rate speculation. AP and Powell

- November 14th

The U.S. annualized Consumer Price Index increased 3.2%, down from September’s year-over-year inflation of 3.7%. The rise in the price of shelter was offset by the decline in the price of gasoline. The Federal Reserve’s pause on interest rate increases appears to be well reasoned at this time. U.S. equity indexes rose 1½ to 2½ percent and the TSX jumped 1.6% for the day. BLS release CNBC and CPI More CNBC and CPI

- November 15th

After the U.S. House of Representatives passed another spending bill the day before, the Senate voted 87-11 to end the third and latest fiscal standoff ahead of a deadline. CNN and US Govt

- November 21st

The Canadian Consumer Price Index (CPI), rose 3.1% on a year-over-year basis for October, down from 3.8% in September. Gasoline prices fell by 7.8% in October and was the primary driver of lower overall inflation for Canadian households. StatsCan CPI release

- November 23rd

U.S. Thanksgiving closed markets there all-day Thursday and at 1 pm on Friday, November 24th.

- November 30th

Canadian GDP dropped 0.3% in the third quarter after rising by the same amount in the second quarter. Less exports, slower inventory accumulation, lower non-residential construction, greater household savings contributed to the decline. StatsCan GDP release

Also, on the 30th, the U.S. Bureau of Economic Analysis released its Personal Consumption and Expenditures (PCE) price index, the Federal Reserve’s primary inflation indicator. For the most recent period, October, the PCE rose 0.1%, and 3% from a year ago, matching analyst expectations. CNBC and PCE BEA PCE release NYTimes and PCE

What’s ahead for December?

The next two interest rate announcements from the Bank of Canada and the Federal Reserve are scheduled for December 6th and 13th, respectively. The recent inflation news, along with employment levels, will guide the monetary policy of these two bodies.

The most recent news from the Bureau of Economic Analysis regarding the PCE has some believing that rate cuts are more likely next year than previously thought. An easing of interest rates would promote consumer and corporate spending, which could lead to additional corporate profits.

Wagner Investment Management Team contributors: Susyn Wagner & Karen Routledge & Patti Dolan