Last Month in the Markets: February 1 – 29, 2024

What happened in February?

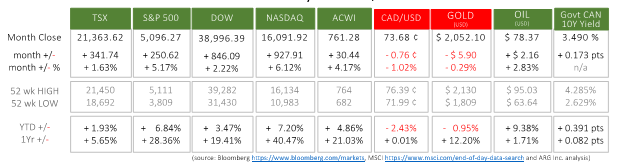

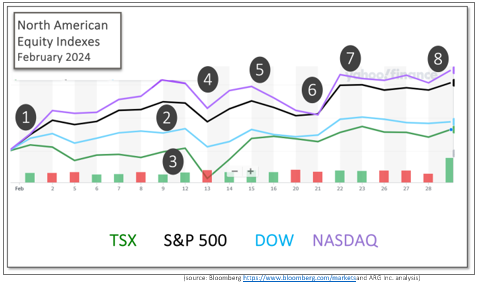

It was another strong month for equity investors focused on North America. Canada’s S&P/TSX Composite Index rose over 1.5%, the Dow Jones Industrial Average was up more than 2%, the S&P 500 ballooned by 5.2%, and the NASDAQ Composite jumped 6.1%. The S&P 500 reached new record high levels eight times in February.

Over the past year, U.S. indexes have grown roughly 20%, 30% and 40% for the Dow, S&P 500, and NASDAQ, respectively. The composition of the three indexes, 30 large corporations for the Dow, 500 diversified companies of the S&P 500, or more than 3,000 firms of the NASDAQ with a 55% concentration in technology, deliver different results. The 225 Canadian companies of the TSX have risen 5.7% since the end of February 2023.

In addition to company performance, several announcements and events contributed to the overall rise in equity values over the month:

1. January 31 – February 2

Events on the last day of January created a positive environment to begin February. The U.S. Federal Reserve held its benchmark interest rate, the federal funds rate, steady. At the press conference on January 31, Federal Reserve Chair Jerome Powell said, “I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting to identify March as the time to do that (lower rates).” Although this was not necessarily positive news, it was aligned with market expectations, and the neutral position set the foundation for February’s rise for equities. Fed release CNBC and rates

Additionally, Canadian Gross Domestic Product (GDP) grew by 0.2% in November after three months of static performance. Goods-producing industries grew faster than the services sectors as 13 of 20 industrial sectors increased in November. The slight expansion in economic growth was welcome news for investors because modest growth supports the economy and easing of monetary policy. StatsCan release StatsCan and GDP

The U.S. economy’s ability to add jobs has proven to be remarkably resilient. Total non-farm payroll employment rose by 353,000 in January, the largest monthly increase since January 2023. Lower job creation would support the Federal Reserve lowering interest rates, but on its own merits, the robust employment situation is positive for the economy. BLS release CNBC and jobs

2. February 9

The S&P 500 breached and closed over 5,000 points for the first time in its history. After closing over 4,000 points in April 2021, it took nearly three years to reach the next millennium. Much of the U.S. gains can be attributed to the growing sentiment that the Federal Reserve may have achieved a soft landing of slowing growth and inflation, but not placing the economy into a recession.

3. February 9

StatsCan released the latest data for the Canadian employment situation. January’s Labour Force Survey showed that employment increased by 37,000 after three months of little change. The unemployment rate fell 0.1% to 5.7%, the first decline in more than one year. The employment rate declined by 0.1% to 61.6% as population grew slightly faster than employment. A CIBC senior economist suggested that the Bank of Canada “won’t be in a rush to cut interest rates, and we maintain our expectation for a first [interest rate cut] in June”, which had been a growing expectation. StatsCan release CBC and LFS

4. February 13

According to the Bureau of Labor Statistics, U.S. inflation is more persistent than expected. Continuing inflation above target is lessening the likelihood of a Federal Reserve rate cut. Year-over-year inflation came in at 3.1%. On a monthly basis, prices rose 0.3% in January, higher than the 0.2% seen in December. BLS CPI release CNBC CPI and rates

5. February 16

The Producer Price Index tracks the prices domestic producers receive for their output from customers who are not end-consumers, and it provides a measure of insight into future consumer price levels as producer prices move through the supply chain toward end-buyers. The PPI rose 0.3% in January after declining 0.1% in December. The increase may have been small, but a price increase does not support falling interest rates. BLS PPI release CNBC and PPI

6. February 20

Inflation news dominated the economic releases in Canada. The Consumer Price Index (CPI) rose 2.9% on a year-over-year basis, down from 3.4% in December. Gasoline prices that fell 4% in January (year-over-year) led the slowing rate of annual inflation. Excluding gasoline, consumer prices rose 3.2% last month. Grocery prices remain above the aggregate rate of inflation at 3.4% but have lowered from December’s 4.7% level. Mortgage interest costs were the largest driver of inflation, increasing at an annual rate of 27.4%, while housing rental costs grew by 7.9% on a year-over-year basis. The cost of housing, both owned and rented, has been driven by previous interest rate increases. StatsCan CPI release CBC and inflation

7. February 21

The Federal Reserve released the minutes of its latest interest rate meeting. Although “participants judged that the policy rate was likely at its peak for this tightening cycle,” consumer spending was an area of concern, and some Fed members noted the risk that “progress toward price stability could stall.” The timing of interest rate reductions remains uncertain despite the progress against inflation that has been accomplished. FOMC Minutes CNBC and FOMC Minutes

8. February 22

The NASDAQ jumped 3%, largely driven by Nvidia, the U.S. computer chip manufacturer at the forefront of the artificial intelligence industry. Nvidia released an optimistic forecast of earnings that projected a threefold increase in quarterly revenue. Its 2023 fourth quarter revenue was $22.1 billion, a 265% increase from Q4 2022. Nvidia’s share price jumped 16% on the day, and its value breached $2 trillion and pulled the NASDAQ along with it. CNBC and Nvidia

9. February 29

Perhaps the most significant economic news, even for Canada, arrived from the U.S. Bureau of Economic Analysis. The Personal Consumption Expenditures (PCE) price index rose 2.4% in January, and core PCE (excluding food and energy) rose 2.8% on a year-over-year basis, and 0.4% in January. These levels were aligned with analyst expectations. Personal income grew 1.0%, which was well above the prediction of 0.3%. “Hot January inflation data adds to uncertainty and pushes back rate cut expectations” according to economic strategist, David Alcaly, at Lazards. PCE and CNBC BEA’s PCE

The U.S. Congress passed another budget bill extending the government’s ability to continue to operate. This was the latest round in a four-part series of short-term solutions that extends some government operations until March 8, and others until March 22, guaranteeing a fifth round of negotiations, grandstanding and infighting. The series of stop-gap measures is likely to continue since neither party seems willing to take the reputational damage of raising the debt ceiling permanently. CNN and spending bill CNBC and spending bill

What’s ahead for March and beyond?

Strong economic performance may delay interest rate cuts that could propel equities higher. However, the strong performance benefits companies, too. Dialing-in the correct proportions of influences to lower inflation, and not stalling the economy remains the overall goal. The Bank of Canada’s next interest rate announcements are scheduled for March 6, April 10, June 5, and July 24. The U.S. Federal Reserve’s scheduled monetary policy decisions occur on March 20, May 1, June 12, and July 31. According to expectations from CME’s FedWatch tool, interest rate reductions will not occur until June or July. The path of inflation has not slowed sufficiently, yet, to allow central bankers to lower rates. CME FedWatch tool CBC and BoC rates