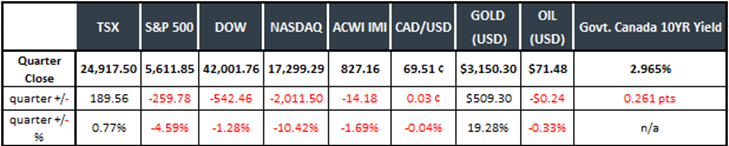

Last Quarter in the Markets: January 2 – March 31, 2025

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in the first quarter of 2025?

The most influential event affecting markets was the inauguration of President Donald Trump and his introduction of tariffs on imports into the U.S. Initially described as measures to protect American jobs and security, these tariffs have caused equity markets to reverse their recent success.

Additionally, the downward trend for inflation has slowed, and in the U.S., it has begun to rise again. With the inflationary effects of tariffs still to be felt, rising prices will likely delay interest rate reductions by both the Bank of Canada and the U.S. Federal Reserve.

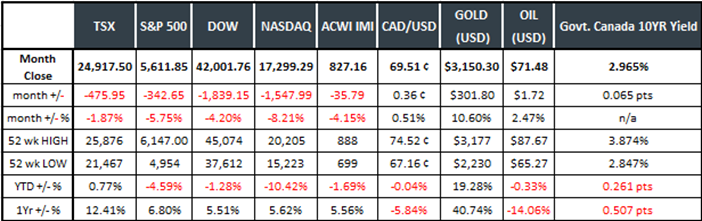

Last Month in the Markets: March 3 – 31, 2025

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in March?

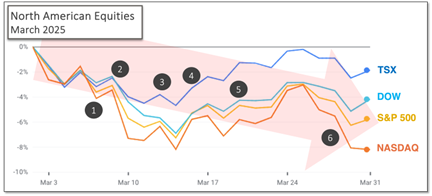

Equities experienced a very difficult month with the Dow losing 4.2 per cent, the S&P 500 dropping 5.8 per cent, and the NASDAQ plummeting 8.2 per cent. Canada’s TSX fell by only 1.9 per cent, making it the top performer among major indexes. A 1.9 per cent drop typically does not count as a success, but in March, the TSX fared much better than American indexes. The allure of the formerly high-flying S&P 500 has lessened as it experienced its worst month since 2022. The much more temperate TSX now leads the U.S. indexes year-to-date and over the past year by remaining in positive territory and returning more than 12 per cent.

The conditions for this decline after two stellar years for equity index performance are attributed to, and admitted by, Trump. The effects of his proposed and implemented tariffs on imports to the U.S. are well understood by the markets. The cost of tariffs will either be absorbed by firms (lowering their profitability), passed on to purchasers (increasing inflation), or a combination of the two. If lower-cost alternatives existed prior to tariffs, U.S. firms would have utilized those methods. Under a tariff regime, a change in production location will increase costs for a firm. NYT article

The price of gold has leapt nearly 20 per cent in 2025 and over 40 per cent over the past year. It continued its reputation as a safe-haven investment to protect against losses elsewhere, typically when uncertainty threatens equities.

(source: Bloomberg https://www.bloomberg.com/marketsand ARG Inc. analysis)

Additional economic reports influenced markets during March:

1. March 6: Interest rate announcement

The European Central Bank (ECB) cut its interest rates by 0.25 per cent (25 basis points), which set its interest rates on the deposit facility, the main refinancing operations and the marginal lending facility at 2.50 per cent, 2.65 per cent and 2.90 per cent, respectively. ECB release

2. March 7: Canada and the U.S. released employment data for February

In Canada, employment was virtually unchanged (+1,000), and the unemployment rate held steady at 6.6 per cent. The gains found in wholesale and retail trade (+51,000) and finance, insurance, real estate and leasing (+16,000) were offset by declines in professional, scientific and technical services (-33,000) and transportation and warehousing (-23,000). Hourly wages have risen 3.8 per cent on a year-over-year basis. StatsCan release

According to the Bureau of Labor Statistics (BLS), U.S. jobs rose by 151,000 in February, which was higher than expected, while the unemployment rate was unchanged at 4.1 per cent. Wages have risen 4.0 per cent over the last year. The latest U.S. jobs data suggests that the next U.S. Federal Reserve rate cut will occur in the second half of 2025. BLS release CNBC and jobs CME FedWatch

3. March 12: Interest rates and inflation

The Bank of Canada reduced its target for the overnight rate again. The announcement included, “the pervasive uncertainty created by continuously changing US tariff threats is restraining consumers’ spending intentions and businesses’ plans to hire and invest. Against this background, and with inflation close to the 2% target, Governing Council decided to reduce the policy rate by a further 25 basis points to 2.75%.”

U.S. consumer prices increased 0.2 per cent in February, and on a year-over-year basis, the all-items index increased 2.8 per cent before seasonal adjustment. In January, the monthly inflation increase was 0.5 per cent, and the annualized inflation rate was 3.0 per cent. BLS release

4. March 14: New Prime Minister of Canada

On Friday, Mark Carney, a former central banker, replaced Justin Trudeau as Prime Minister. Unrelated to this change, North American equity indexes rose for the second consecutive Friday.

5. March 19: Federal Reserve interest rate announcement

The U.S. Federal Reserve kept interest rates steady. The statement included, “In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.” The U.S. Federal Reserve is watching the effects of the Trump administration’s actions to impose tariffs and trade restrictions, and the resulting responses from sovereign nations affected by the trade war. The U.S. Federal Reserve will continue to maximize employment and return inflation to its long-run target of 2 per cent even as “uncertainty around the economic outlook has increased.”

6. March 28: U.S. inflation rises, Canadian GDP rises, and leaders talk

Equities initially moved lower again with the U.S. Bureau of Economic Analysis’ release of the Personal Consumption Expenditures price index (PCE), which is the U.S. Federal Reserve’s preferred inflation measure. Inflation for February was 2.5 per cent, and Core PCE, excluding food and energy, ticked higher than expected to 2.8 per cent from one year ago. The uncertainty surrounding inflation and tariffs continues to linger and delay CME’s FedWatch prediction of lower rates in June and July. CNBC and PCE

Canadian Gross Domestic Product (GDP) rose 0.4 per cent in January, a slight increase over the 0.3 per cent increase in December. 13 of 20 sectors rose, with goods-producing sectors delivering the largest increase at 1.1 per cent for the first month of 2025. Mining, quarrying, and oil and gas extraction provided the largest increase in January. The largest drag on growth occurred in the retail trade sector, which contracted 0.9 per cent. Tariffs are affecting February growth, when GDP is estimated to be unchanged. StatsCan release CBC and GDP

Upcoming tariff announcements, in addition to last week’s confirmation that imported vehicles would be subject to a 25 per cent tariff, have been hanging over the markets. In the first telephone call between Prime Minister Carney and Trump, they discussed economic and security matters as the Canadian federal election looms. Both sides indicated that the call was substantive and constructive, which is welcome news for Canadians and Americans who are directly affected by the trade war. CBC recap of call

What’s ahead for April and beyond?

The path of tariff threats and introductions will continue to drive markets. By the end of March, a number of tariff and trade actions had been taken:

- Feb 1: Announcement of 25 per cent tariff on all imports from Canada, 10 per cent on energy

- Feb 2: Canada retaliates with tariffs on $30 billion of imports from U.S.

- Feb 3: Tariffs by U.S. suspended for 30 days

- Feb 13: Trump announces 25 per cent tariffs on foreign steel and aluminum on top of tariffs that were suspended on Feb 3, effective March 12

- Feb 13: Trump signs a memorandum to impose reciprocal tariffs on all foreign imports starting April 2

- Feb 21: Trump signs a memorandum to impose tariffs on countries that levy digital service taxes on U.S. technology

- March 5: Trump exempts Big Three automakers until April 2

- March 6: Trump amends orders to exempt United States-Mexico-Canada-Agreement (USMCA) compliant trade until April 2

- March 7: Trump promises new tariffs on dairy and lumber from Canada

- March 9: Trump declines to assure Americans that tariffs will not create U.S. recession

- March 10: Ontario starts charging 25 per cent export surcharge on electricity

- March 11: Trump threatens to increase Canadian steel and aluminum tariffs to 50 per cent

- March 11: Electricity export tax and threatened increase to 50 per cent tariffs on steel and aluminum withdrawn

- March 12: Steel and aluminum tariffs begin

- March 26: Trump announces 25 per cent tariff on foreign-made consumer vehicles and components Trump Tariff Timeline

On April 2 at 4 p.m. Trump announced additional details of his global tariff plan during a press conference from the White House Rose Garden. During his speech, Trump presented a table with “U.S.A. Discounted Reciprocal Tariffs” to be charged on goods from 60 countries, including China (34 per cent), European Union (20 per cent), Taiwan (32 per cent), Japan (24 per cent), India (26 per cent), and the United Kingdom (10 per cent), which are approximately half the rate of “Tariffs Charged to the U.S.A.”

Canada and Mexico were not on the list of countries contained in the table shared at the press conference. Immediately afterward, American officials stated that goods that are compliant with the USMCA Agreement are exempt from additional tariffs. The 25 Per cent tariff introduced in February and March on steel, aluminum, consumer vehicles and auto components imported from Canada, and Canada’s tariffs on $30 billion of U.S. goods will remain in place. The tariff effect on individual products requires additional details. For example, only the non-U.S. portion of a foreign vehicle is subject to the 25 per cent tariff. Trump tariffs April 2nd List by Country

Lastly, the next round of interest rate decisions by the Bank of Canada and the U.S. Federal Reserve will occur on April 16 and May 7, respectively, and will rely on their existing mandates of price stability and employment to guide their actions as tariffs and reciprocity is revealed.