Last Month in the Markets: May 1 – 30, 2025

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG)

What happened in May?

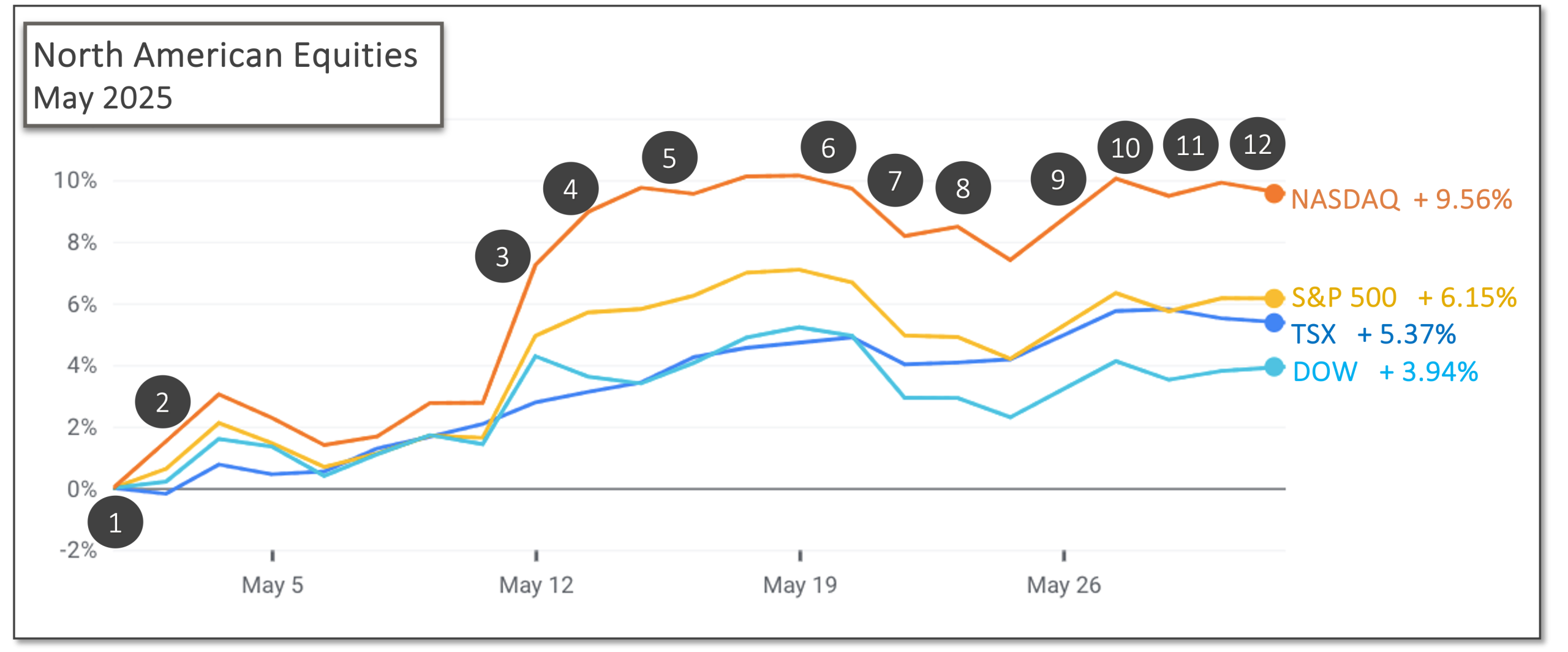

The month began positively, and somewhat quietly. Entering the month, the Canadian market was performing relatively well as the new government was preparing for the upcoming legislative session.

Just prior to the middle of May, the news that the U.S. and China had quickly arrived at a friendlier trade arrangement while continuing to negotiate a full tariff and trade treaty sent markets soaring. The gains of May 12 set the trajectory for the next week, which largely held until the U.S. House of Representatives passed a “big, beautiful bill” that increased federal deficits.

At the end of the month, judicial rulings stayed and then reinstated President Donald Trump’s tariff program. European Union tariff delays, and a renewal of 50% steel tariffs kept rhetoric high, and equities largely held their gains until the end of the month.

More uncertainty and volatility are predicted as trade negotiations and political whims continue.

Economic reports that influenced markets in May included:

(source: Bloomberg https://www.bloomberg.com/marketsand ARG Inc. analysis)

- April 30 – Canadian economic output declined

Canadian real Gross Domestic Product (GDP) was 0.2per cent lower in February, following a 0.4 per cent increase in January. Goods producing industries fell 0.6 per cent and services-producing industries slipped 0.1 per cent in February. Mining, oil and gas extraction, construction, real estate, rental and leasing declined while durable goods, finance and insurance rose. StatsCan and GDP

U.S. economy contracted in Q1, and job growth remained strong in April

American GDP decreased at an annual rate of 0.3 per cent in the first quarter of 2025 according to the advance estimate released by the Bureau of Economic Analysis. For reference, in the fourth quarter of 2024, real GDP increased 2.4 per cent. BEA release

- May 2 – S. nonfarm payroll employment increased by 177,000 in April and the unemployment rate was unchanged at 4.2 percent according to the Bureau of Labor Statistics’ press release.

- May 12 – Temporary truce between U.S. and China sent stocks soaring

U.S. tariffs on most Chinese goods were temporarily reduced to 30 per cent and China temporarily reduced its tariffs on most U.S. goods to 10 per cent. The size of the cuts to the proposed tariffs, on both sides, and the speed of the agreement contributed to the size of the surprise and the size of the increase for equity indexes. New deal for US and China

- May 13 and 14 – Positive inflation news contributed to equities rally

According to the Bureau of Labor Statistics, over the last 12 months, the all-items Consumer Price Index (CPI) increased 2.3 per cent before seasonal adjustment. BLS CPI release

U.S. Producer Price Index fell 0.5 per cent in April after being unchanged in March and increasing 0.2 per cent in February. On an unadjusted basis, the index for final demand rose 2.4 per cent for the 12 months ended in April. BLS PPI release

- May 16 – Moody’s downgraded U.S. government credit rating

The U.S. government had its creditworthiness rating downgraded by Moody’s, which followed the same conclusion reached previously by S&P Global ratings in 2011 and Fitch Ratings in 2023. Moody’s had held a perfect rating for the U.S. since 1917. The rating of the government’s ability to repay its debts is no longer at the highest level for all of the major ratings agencies. BBC and Moody’s

- May 20 – Canadian inflation slowed below Bank of Canada target

The Canadian CPI rose 1.7 per cent year-over-year in April, down from a 2.3 per cent increase in March. The lower inflation rate was led by energy prices that fell by 12.7 per cent in April, after a 0.3 per cent decline in March. However, inflation for food purchased in stores increased to 3.8 per cent in April, following a 3.2 per cent increase in March. The Bank of Canada attempts to limit the long-run average inflation rate to 2 per cent. StatsCan and CPI

- May 21 – Legislative progress drove markets downward

The U.S. House of Representatives passed a “big, beautiful bill” that the non-partisan Congressional Budget Office predicts will increase the federal deficit by $3.8 Trillion over the next decade. On Wednesday, after the House narrowly passed the bill that brings multitrillion dollar tax and spending cuts, U.S. equity markets fell.

The increasing deficit coupled with higher interest rates linked to the lower credit rating will bring higher borrowing costs and, ultimately, contribute further to the federal deficit. CNBC and big bill

- May 23 – Canadian retail sales continue to increase

Retail sales increased for the fourth consecutive quarter as six of nine subsectors saw increases. The largest increases were seen at motor vehicle and parts dealers, while sales at gasoline stations and fuel vendors fell in response to lower prices. StatsCan and retail sales

- May 26 – Tariff delay for EU moved markets higher

Equities jumped after President Trump announced two days after its introduction that a new 50 per cent tariff on European Union imports would be delayed until July 9. EU tariffs delayed

Expect more uncertainty with possible tit-for-tat countermeasures.

- May 27 – King Charles delivered throne speech to Parliament

King Charles delivered the speech from the throne to open Parliament for the newly elected Liberal government under Prime Minister Mark Carney. The priorities to eliminate interprovincial trade barriers, develop diverse international trading partners, deliver a middle class tax cut, increase housing, reduce tax on new homes, and manage immigration were reiterated. Throne speech

- May 28 and 29 – Uncertainty over U.S. tariffs continued

The U.S. Court of International Trade (USCIT) ruled that Trump did not have the authority to impose the program of tariffs, which sent stocks upward. After a prompt appeal by the administration, a federal appeals court placed a temporary hold on the USCIT ruling. Stocks declined in response to the continuation of restrictive trade tactics. NBC News and rulings

- May 29 and 30 – Canadian employment fell while GDP maintained its pace

Canadian payroll employment decreased by 54,000 in March following a decline of 40,200 in February. On a year-over-year basis, payroll employment was up 32,800 despite the last two months of decline. StatsCan and employment

Canadian GDP increased 0.5 per cent in the first quarter of 2025, the same pace as the fourth quarter of 2024. Increased exports of passenger vehicles (+16.7 per cent), industrial machinery, equipment and parts (+12.0 per cent) were driven by the looming threat of U.S. tariffs. StatsCan Q1 GDP

On balance, the economic and political news of May provided positive movement for equities. The lowering of tariff rates and the delay of tariff introductions pushed stocks higher. The uncertainty, to this point, has been unhelpful for equity indexes.

What’s ahead for June and beyond?

The negotiations between the U.S. and multiple countries will dominate economic news for the foreseeable future. Prime Minister Mark Carney described the situation and Canada’s planned response in a speech in early April. While the actions of the U.S. president may not be predictable, the direction that the Canadian government will take is clear.

In more practical and mundane matters, the Bank of Canada and Federal Reserve will deliver their next interest rate announcements on June 4 and June 18, respectively. Central banks are attempting to protect domestic economies while facing significant uncertainty regarding trade restrictions and tariffs imposed by the U.S. President.