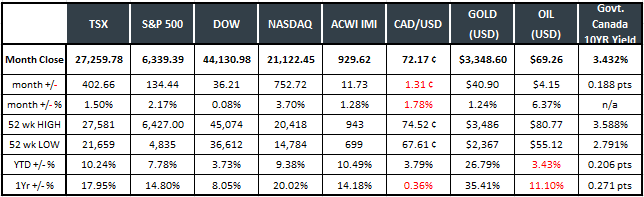

Last Month in the Markets: July 1-31, 2025

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in July?

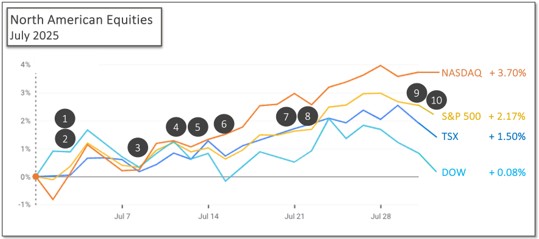

Equity indexes had a productive month. New all-time highs were reached several times by the TSX, S&P 500 and the NASDAQ. The Dow nearly achieved the same feat. The effects of President Donald Trump’s global trade war have not had significant effects on nations, yet. For major economies the negotiated or imposed tariffs have not been implemented, or have not been in-place long enough, for inflationary, employment and output effects to have materialized.

(source: Bloomberg https://www.bloomberg.com/markets and ARG Inc. analysis)

Economic reports and geopolitics that influenced markets in July included:

- July 3 – Trade balances narrow and widen

May’s import, export and trade balance data was released by StatsCan. Canada’s merchandise trade deficit with the world narrowed from a record $7.6 billion in April to $5.9 billion in May. Exports to the U.S. (down 0.9 per cent) were down for a fourth consecutive month. Exports to countries other than the U.S. rose 5.7 per cent in May to reach a record high of $47.6 billion, the third consecutive monthly high. CBC and trade

The U.S. trade balance increased more than 18 per cent to $71.5 billion in May (up from $60.3 billion in April) as exports fell according to the Bureau of Economic Analysis release. Imports also fell, but by a smaller percentage than exports. In May, the largest trade deficits in billions were with Mexico ($17.1), Vietnam ($14.9) and China ($14.0). Reuters and trade balance

- July 3 – U.S. job growth in June hits the average

The U.S. Bureau of Labor Statistics reported that total nonfarm payroll employment increased by 147,000 in June, higher than expectations and just below the 12-month average of 146,000. BLS release CNBC and jobs data

- July 8 – “Big Beautiful Bill” moves markets lower as debt grows higher

Some of the downturn can be attributed to the approval and signing into law Trump’s “big, beautiful budget bill”. Projections from the Congressional Budget Office have deficits increasing by $3.3 trillion over the next decade.

- July 10 – Trade war continues with new letters from the American president

Tariff letters were sent by Trump to major trading partners. “The resulting uncertainty is preventing companies and countries from making plans as the rule so global commerce give way to a state of chaos” according to a NY Times article. Canada and the U.S. had been negotiating toward an agreement before a deadline on July 21 until Trump sent a letter with a 35 per cent tariff and a new deadline of August 1.

- July 11 – Canadian jobs growth surprises

StatsCan released employment data for June. Expectations were for little change, however the Canadian economy surprised analysts by adding 83,000 jobs and unemployment fell 0.1 per cent to 6.9 per cent. This was the first increase in employment since January. The unemployment rate had increased for three consecutive months before the decrease in June. StatsCan release CBC and jobs

- July 15 – Inflation data from Canada and the U.S.

Canada’s Consumer Price Index (CPI) rose 1.9 per cent on a year-over-year basis in June, up from a 1.7 per cent increase in May. On a monthly basis, prices rose 0.1 per cent in June. StatsCan release

The Bureau of Labor Statistics (BLS) reported that consumer price increases have accelerated in response to President Trump’s trade war and tariffs. In June, prices have risen 2.7 per cent on a year-over-year basis, the same measure in May was 2.4 per cent. Over the course of the month of June, prices rose 0.3 per cent, a significant increase from May’s monthly inflation of 0.1 per cent.

The initial impact of the global trade war is reflected in these figures. Economists predict prices to rise further if threatened tariffs are imposed on August 1. Despite already increasing inflation, Trump is calling for the U.S. Federal Reserve to lower interest rates at their next announcement on July 30. BLS CPI release CNBC and CPI NYTimes and CPI

- July 21 – Bank of Canada’s analysis shows companies expect more tariffs impacts

The Bank of Canada released its Business Outlook Survey for the second quarter of 2025, which was conducted in May. “Uncertainty continues to drive cautiousness in outlooks for hiring and investment.” Although some tariff effects have arrived, fewer firms expect future adverse impact. As of May, one-third of firms believe their costs will rise as a result of the trade war. BoC BOS

- July 22 – Magnificent Seven performance moves indexes higher

The TSX, S&P 500 and NASDAQ reached new all-time highs, and the Dow sat just 0.2 per cent or just 112 points below its closing record of 45,014 reached back in December. The TSX and S&P 500 have risen seven and nine per cent, respectively, since mid-June. Some instability may present itself this week as large trade deadlines loom, interest rate announcements await and corporate earnings from the Magnificent Seven arrive. Factset’s analysis.

- July 30 – Bank of Canada and Federal Reserve hold rates steady

The Bank of Canada held its policy interest rate unchanged on Wednesday morning. It was the third consecutive interest rate decision that held rates firm at 2.75 per cent. The Canadian economy has shown resilience despite the threats of American tariffs. Inflation has not responded as favourably. Since it appears that the U.S. president will not return to more open trade conditions, and will impose tariffs and other restrictions, the Bank of Canada has not, yet taken steps to stimulate the economy. The Bank made projections based three scenarios: tariffs in-place as of July 27, an escalation in tariffs, and a de-escalation in tariffs. CBC and interest rates BoC release

The U.S. Federal Reserve held their federal funds rate unchanged at a range of 4.25 to 4.5 per cent. The announcement included, “…recent indicators suggest that growth of economic activity moderated in the first half of the year. The unemployment rate remains low, and labor market conditions remain solid. Inflation remains somewhat elevated.” All but two of the Governors voted in-favour of maintaining rates at the current level. Fed release

- July 31 – Canadian employment and economic growth move in different directions

On Thursday, StatsCan released jobs data for May showing that “payroll employment” increased by 15,300 in May, a slight increase from April’s 14,600. Over the past year payroll employment has increased 43,300 as of May. StatsCan and payroll employment

Canadian gross domestic product edged downward by 0.1 per cent in May, the second consecutive month of decline. Goods producing industries like mining, quarrying, and oil and gas extraction, while manufacturing expanded. Services sectors were unchanged overall. StatsCan and GDP

What’s ahead for August and beyond?

Trump implemented 35 per cent tariffs against Canadian imports that are non-compliant with the Canada U.S. Mexico Agreement (CUSMA) on August 1. Prime Minister Mark Carney released a statement outlining the Canadian government’s disappointment and continued commitment to CUSMA. Canadian trade officials travelled to meet with Mexico’s President and trade team to begin the month. Canada/Mexico cooperation

Also, before markets opened on August 1, the U.S. Bureau of Labor Statistics (BLS) signalled that tariffs had already affected the American economy when it reported that just 73,000 jobs were added in July. This is half the number averaged over the last twelve months. The uncertainty of tariff amounts and timing that will increase inflation and decrease economic activity had hiring deferred or avoided. Trump’s immediate response was to fire the leader of the BLS. BLS release Trump fires BLS leader

Additionally, Trump has been calling for the U.S. Federal Reserve to lower interest rates, and has threatened the tenure of Fed Chair, Jerome Powell. On the same day that he fired the BLS leader, a Federal Reserve Governor resigned. The replacements at the Fed and BLS could provide some insight into the path of monetary policy and economic reporting for the balance of his presidency. CNBC and Fed and BLS

Canadian monetary policy leaders operate independently of political pressure and will announce their next interest rate decisions on September 19 and October 29, as will the U.S. Federal Reserve.

The path of trade negotiations and monetary policy will provide significant influence over markets in Canada, the United States and globally.