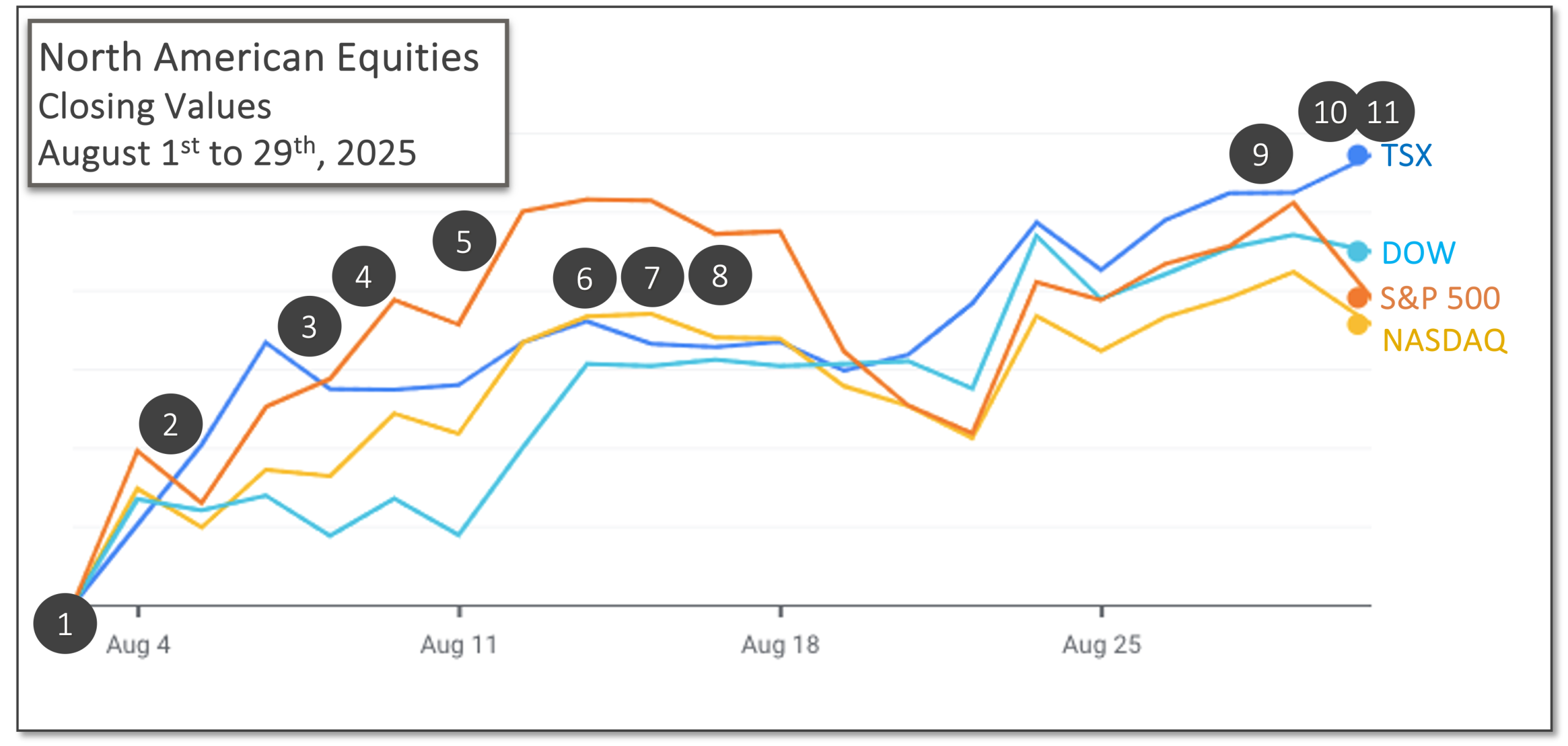

Last Month in the Markets: August 1-29, 2025

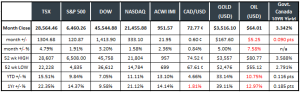

Index returns based on index value (source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in August?

The TSX was the clear star among North American equity indexes last month, moving nearly 5 per cent above its closing value at the end of July. Not only did it best the S&P 500, Dow and NASDAQ in August, it leads all of them in year-to-date and one-year performance. This has occurred despite the threats and imposition of tariffs from the U.S. President Donald Trump and his administration, and the recently muted response from the Canadian government.

(source: Bloomberg https://www.bloomberg.com/markets and ARG Inc. analysis)

Economic reports and geopolitics that influenced markets in August included:

1. August 1 – Trump’s tariffs arrived

To begin the month, 35 per cent tariffs were imposed on Canadian imports to the U.S. as negotiations continue. Talks or communication were not ongoing at the highest level between Prime Minister Carney and President Trump when the tariffs came into force. Prime Minister Carney has indicated that negotiations with the U.S. president will resume when appropriate. CBC and Tariffs

The month began with a disappointing Employment Situation Summary that caused President Trump to fire the chief statistician at the Bureau of Labor Statistics. Trump has been calling for an interest rate reduction, and the economy’s poor job performance could trigger a rate drop.

2. August 5 – trade deficits affected by threatened and enacted tariffs

Canada’s trade deficit continued to widen and reached its second highest monthly level at $5.9 billion. Imports grew faster than exports as inbound shipments of high value oil equipment arrived in June. Exports to the U.S. have fallen to 70 per cent of total exports, compared with 83 per cent in June 2024. Reuters and Can trade balance

The Bureau of Economic Analysis announced that June’s U.S. trade deficit shrank 16 per cent to $60.2 billion as exports eased 0.5 per cent (down $1.3 billion) and imports fell 3.7 per cent (down $12.8 billion) compared to May. The trade deficit reached its lowest level in two years as the trade gap with China and imports of consumer goods dropped sharply. BEA release Reuters and US trade balance

3. August 7 – China’s exports surged to skirt U.S. tariffs

China’s exports increased more than expected in July. Shipments sent to other countries that often forward Chinese goods on to the U.S. jumped. Shipments directly to the U.S. fell more than 20 per cent and overall, China’s exports grew by 7.2 per cent compared with July 2024. NYT and China’s trade

4. August 8 – Canadian employment fell dramatically and U.S. CPI rose

Canadian employment declined by 41,000 jobs in July according to StatsCan’s Labour Force Survey after an increase of 83,000 in June. The employment rate fell 0.2 per cent to 60.7 per cent and the unemployment rate was unchanged at 6.9 per cent. Analysts expected employment to increase by 13,500 and unemployment to tick up to 7.0 per cent. The employment decline was concentrated among youth aged 15 to 24 (-34,000). The industries that lost the most jobs were information, culture and recreation (-29,000) and construction (-22,000). CBC and Labour Force Survey

5. August 11 – China’s tariffs given 90-day reprieve

President Trump signed a 90-day extension delaying the introduction of 145 per cent tariffs on Chinese imports, and China delayed its retaliatory tariffs of 125 per cent on U.S. imports. The existing tariffs on imports from and exports to China are 30 per cent and 10 per cent, respectively. CNBC and China tariffs

6. August 12 – U.S. inflation may not delay Fed rate cuts

The CPI increased 0.2 per cent for the month and 2.7 per cent on a year-over-year basis. Core CPI, which excludes more volatile food and energy price changes, increased 0.3 per cent for the month and 3.1 per cent compared to last year. Core inflation rose more rapidly in July than it has in the past five months. With delays and renegotiations, July prices do not yet reflect all the effects of threatened and implemented tariffs, suggesting that inflation could continue to increase in the coming months. CNBC and CPI BLS CPI release NYTimes and CPI

Many analysts believe the weakness in the employment situation will encourage the U.S. Federal Reserve to cut interest rates despite rising inflation in July. On the morning of the CPI announcement, CME’s FedWatch tool listed the probability of a rate cut on September 17 at 94 per cent.

7. August 14 – Producer inflation soared

The Bureau of Labor Statistics released the Producer Price Index (PPI) showing that wholesale prices jumped 0.9 per cent in July, after holding steady in June and rising 0.4 per cent in May. The year-over-year rate of producer inflation grew to 3.3 per cent for July, the highest rate in five months when February’s PPI was 3.4 per cent. BLS PPI release

8. August 15 – Trump and Putin met in Alaska

U.S. President Donald Trump met with Russian President Vladimir Putin in Alaska to discuss his war with Ukraine. The President of Ukraine, Volodymyr Zelenskyy, was not invited to the summit meeting, whose exclusion drew the ire of NATO and the European Union leaders. The progress, if any, achieved from the summit has not materialized in a meaningful manner, yet. CBC and Alaska Summit

9. August 28 – U.S. Gross Domestic Product revised upward

During the period of April through June, the U.S. economy grew by 3.3 per cent, better than the 3.0 per cent estimated initially. Imports subtract from GDP total in the calculation, and after stockpiling before tariffs were introduced, imports in the latter stages of the quarter fell by nearly 30 per cent, which propped up GDP numbers. CNBC and GDP

10. August 29 – Canadian economy shrank

StatsCan reported that gross domestic product declined by 0.4 per cent in the second quarter after rising 0.5 per cent in the first quarter. The decline was driven by substantial reductions in exports (down 7.5 per cent in Q2) and business investments in machinery and equipment. U.S. initiated tariffs and Canada’s response, and the underlying uncertainty caused by the trade conflict, created the environment for an economic slowdown. StatsCan release

11. August 29 – PCE inflation remained above goal, tariffs deemed illegal, and rates could fall

The U.S. Federal Reserve’s (the Fed) preferred inflation indicator, the Personal Consumption Expenditures (PCE) price index rose 2.6 per cent over the past year, and core inflation that excludes food and gasoline rose 2.9 per cent. Both are above the Fed’s goal of 2 per cent, showing tariffs imposed by Trump have raised prices. Inflation has returned to February’s level, which had been falling until tariffs were announced. BEA PCE release CNBC and PCE

A federal appeals court has declared that Trump’s tariffs are illegal after upholding a May ruling by the Court of International Trade. The tariffs will remain in-place temporarily to allow a further appeal to the U.S. Supreme Court. BBC and tariff ruling

Also, despite the mixed economic news CME’s FedWatch tool has increased the likelihood of a cut to the federal funds rate by the U.S. Federal Reserve on September 17.

What’s ahead for September and beyond?

Important news will arrive on September 17 when the Bank of Canada and the U.S. Federal Reserve announce their interest rate decisions. Canadian inflation is in-range of the 2 per cent goal, and job growth has ended. The prediction as of Labour Day has the likelihood of a Fed rate cut at about 90 per cent, as U.S. inflation is above goal, which could delay rate cuts, but jobs growth is slowing, which encourages a rate cut.

The imposition of tariffs and retaliatory trade maneuvers suggest that inflation will continue to rise, and jobs growth will continue to fall. With a potential Supreme Court ruling on the legality of President Trump’s tariffs in October, uncertainty will continue until at least the autumn, if not longer.

Trade and tariff negotiations between Canadian and American leaders continue in the shadow of a looming Supreme Court appeal and the scheduled Canada-United States-Mexico Agreement review in July 2026. CBC and CUSMA review

The trade and interest rate situation will heavily influence market performance for some time.