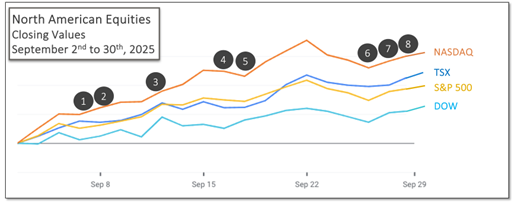

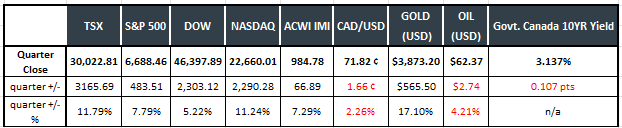

Last Month in the Markets: September 2 – 30, 2025

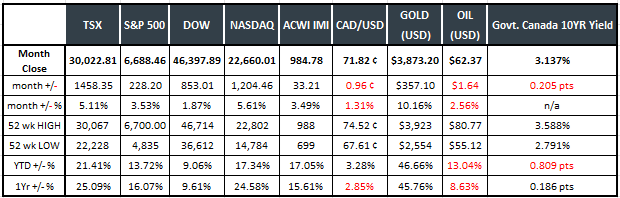

Index returns based on index value (source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

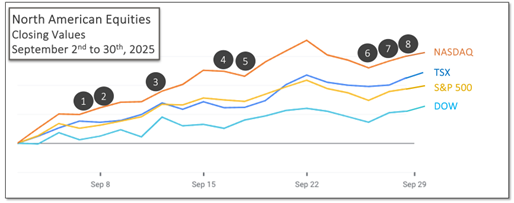

Last Quarter in the Markets: July 1 – September 30, 2025

Index returns based on index value (source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in Q3 and September?

Investors focused on equities and enjoyed spectacular performance over the last three months, including last month. From an economic news perspective, it was a relatively calm month. Conditions that had been in place continued their paths as indicators held their trajectory. Employment remained soft, inflation ticked upward, and central banks cut rates as a result.

The lack of overtly negative news provided a positive upward push. Continuing geopolitical turmoil did not worsen, but did allow gold to jump 10 per cent in September and 17 per cent in the last quarter as oil dropped 4 per cent off its price in the last three months. Bond yields continued to falter as interest rates were lowered.

(source: Bloomberg https://www.bloomberg.com/markets and ARG Inc. analysis)

Events that influenced markets in September included:

1. September 5 – Canadian and U.S. employment reports disappoint

Canada’s Labour Force Survey showed that employment dropped by 66,000 in August after falling by 41,000 in July. The employment decline in August was mostly part-time work (-60,000), and full-time employment was stable following a decline in July (-51,000). StatsCan LFS release

“Total nonfarm payroll employment changed little in August (+22,000) and has shown little change since April,” according to the U.S. Bureau of Labor Statistics’ Employment Situation Summary (ESS) release for August. During the first five months of 2025, U.S. employment grew by an average of 168,000 per month, which included 228,000 in March, which was prior to the announcement of tariffs on April 2. BLS ESS archive

2.September 5 – Prime Minister Mark Carney announced an economic recovery plan

Prime Minister Mark Carney announced actions to strengthen the Canadian economy, reduce reliance on the U.S., and promote trade on a broader scale. CBC and Carney’s plan

3.September 11 – U.S. CPI remained above goal

The Consumer Price Index (CPI) crept upward in August. The year-over-year consumer inflation rate was 2.9 per cent, and the month-to-month increase was 0.4 per cent. In July, the annual rate was 2.7 per cent. Core CPI, which excludes more volatile food and energy, climbed at an annual rate of 3.1 per cent, and 0.3 per cent for the month. BEA CPI 250911 CNBC and CPI

4.September 16 – Canadian CPI edged up in August, remained at goal

According to the StatsCan release, the year-over-year Consumer Price Index (CPI) increased 1.9 per cent in August, up from a 1.7 per cent increase in July. The CPI decreased 0.1 per cent over the month of August. StatsCan CPI release CBC and CPI

5.September 17 – The Bank of Canada and the U.S. Federal Reserve lowered policy interest rates

Theoretically, inflation at current levels does not pose a risk, and with economic growth and employment waning, the Bank of Canada lowered its policy interest rate on Wednesday morning. The interest rate charged between financial institutions and the bank, the overnight rate, was lowered by 0.25 per cent (25 basis points). The Bank of Canada had last adjusted rates on March 12, 2025. The Bank’s statement indicated that “Canada’s GDP declined by about 1.25 per cent in the second quarter, as expected, with tariffs and trade uncertainty weighing heavily on economic activity.” Bank of Canada release CBC and interest rates

The U.S. Federal Reserve (the Fed) took similar action to lower the federal funds rate to a range of 4 to 4.25 per cent. The Fed’s statement began, “Recent indicators suggest that growth of economic activity moderated in the first half of the year. Job gains have slowed, and the unemployment rate has edged up but remains low. Inflation has moved up and remains somewhat elevated.” Federal Reserve release CNBC and Fed rates

6.September 26 – U.S. PCE confirmed inflation above goal rate

The Bureau of Economic Activity (BEA) reported that the Personal Consumption Expenditures price index (PCE), the U.S. Federal Reserve’s preferred inflation indicator, rose in August at 2.7 per cent on a year-over-year basis. In July, prices rose 2.6 per cent. The slight uptick in consumer inflation is unlikely to change the course of the Feds interest rate policy. On September 17, the Fed indicated that two additional rate cuts were possible in 2025. BEA PCE release CNBC and PCE

7. September 26 – GDP rebounds in Canada and the U.S. Gross

Domestic Product (GDP) has been more resilient than expected in both the U.S. and Canada according to the latest announcements. Canada’s GDP grew 0.2 per cent in July, the first increase in four months. U.S. GDP grew at an annual rate of 3.8 per cent in the second quarter according to the BEA’s “third estimate”. BEA GDP release StatsCan GDP release

8.September 30 – U.S. government shut down by budget battle

At midnight the U.S. federal government did not have funds to operate as the latest budget bill ended without a replacement. Despite the turmoil the S&P 500 reached a new record as equity markets believe the shutdown will be short-lived. CNBC live updates

What’s ahead for October and beyond?

The U.S. government shutdown and interest rate policy could likely influence markets for the balance of this year. The political wrangling in the U.S. could have implications beyond the passage of stop-gap or longer term spending bills, if the threats to permanently shutter offices and departments are enacted.

It appears that the Democrats’ objections represent their overall displeasure with many actions of the President Donald Trump administration. Also, the Republican-controlled House of Representatives and Senate were unable to pass spending bills to keep the government operating, including votes shortly before and after the shutdown began. On October 1, the consensus prediction was for a two-week long shutdown, which is the average length of a government closure since 1990. Closure predictions

The Bank of Canada and the U.S. Federal Reserve have two interest rate announcements scheduled before the end of the year, on October 29 and December 10. Markets believe that rates will continue to fall to the end of the year. Lower interest rates, generally, support equities as the economy responds with increased activity. On the afternoon of October 1, CME’s FedWatch tool has the likelihood of a rate cut on October 30 at 100 per cent.

The trade war initiated by Trump will continue for the foreseeable future and will dovetail with Canada-US-Mexico (CUSMA) treaty renegotiations in early 2026. CUSMA arose from Trump’s update of NAFTA during his first presidency, and a scheduled update was contained in the update. Meetings between Canada and Mexico suggest that they may cooperate together to bolster their position with the United States. Canadians are encouraged to submit their thoughts via email to Global Affairs Canada at https://international.canada.ca/en/global-affairs/consultations/trade/2025-09-19-cusma.