Last Month in the Markets: December 1 – 31, 2025

Last Year in the Markets: January 2 – December 31, 2025

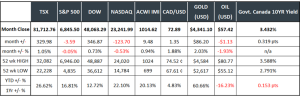

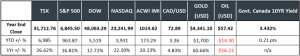

Index returns based on index value (source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

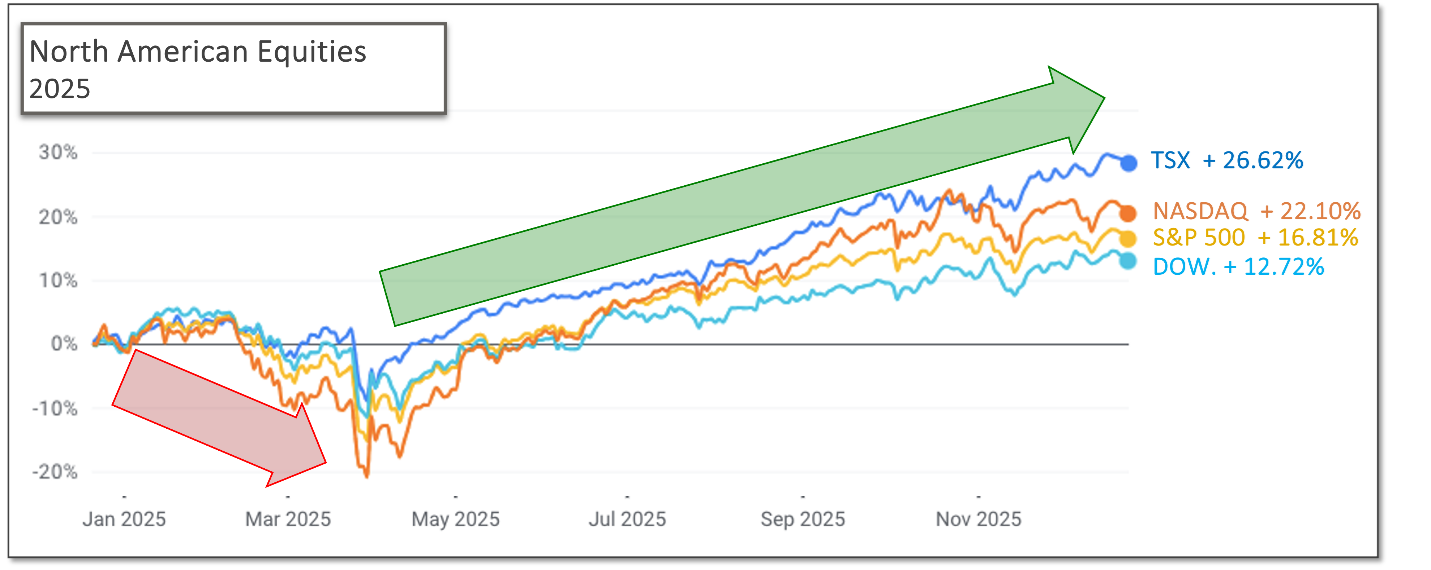

What happened in 2025?

Last year was productive for equity investors, with Canadian and American indexes delivering strong returns for the third consecutive year. However, it wasn’t without turbulence. The first quarter saw modest gains until a major policy announcement in early April introduced a new round of trade tariffs, sparking a global trade conflict.

By Friday, April 4, the North American equity indexes had plunged between 6.32 per cent and 10.02 per cent for the week. The MSCI All Country World Index fell 7.91 per cent over the same period, signifying the depth and breadth of the negative effects of tariffs on equity values around the world. Fortunately, by mid-May the TSX, S&P 500, Dow and NASDAQ had recovered these early losses.

(source: Bloomberg https://www.bloomberg.com/marketsand ARG Inc. analysis)

Delays in the implementation of tariffs on U.S. imports were followed by periods of market stabilization and deferred financial effects. In some cases, announced tariffs were later modified, postponed, or withdrawn in conjunction with developments in international trade negotiations and policy announcements by other nations.

Volatility spiked in early April, as measured by the VIX Index. It reached its third-highest level on record, behind only October 2008 (during the global financial crisis) and March 2020 (at the onset of the global pandemic). Since that peak, the VIX has returned to more moderate levels, and equity markets advanced to set new all-time highs by the end of 2025.

Geopolitical uncertainty during the year drove some investors toward gold, contributing to a significant increase in its value. Gold prices rose over 60 per cent and reached new highs. At the same time, perceived and actual slowdowns in global economic growth reduced demand for oil, resulting in a notable price decline of more than 16 per cent.

What’s ahead in 2026?

The volatility experienced in 2025 may continue into the new year, although it is unlikely that a single event will replicate the widespread and lasting market impact seen last April. Regardless of individual political views, it’s important to interpret economic and policy developments through the lens of personal financial goals, a central principle in sound investment management.

Monetary policy will continue to play a critical role in shaping capital markets, with decisions guided by inflation and employment data. Both the Bank of Canada and the U.S. Federal Reserve are set to make interest rate announcements on January 28, March 18, April 29, October 28, and December 9. The Bank of Canada will also announce rates on June 10, July 15, and September 2, dates that precede corresponding announcements from the Federal Reserve by one or two weeks.

As each decision approaches, markets will factor in expectations. While anticipated moves tend to have limited immediate impact, unexpected decisions can introduce significant volatility.

Looking ahead, global and domestic GDP data may influence commodity prices, particularly oil, while ongoing geopolitical developments could affect the price of gold. These relationships generally hold, though exceptions can and do occur. Additional uncertainty may also stem from the actions of the U.S. Supreme Court, legislative bodies, and the executive branch.

Staying Invested Through Uncertainty

While no investment strategy can eliminate uncertainty, remaining invested with a disciplined approach is essential to achieving long-term financial goals. Managing risk in a way that reflects your individual circumstances remains a guiding principle of effective financial planning and investment decision-making.

If you would like to discuss how current conditions may affect your portfolio or financial goals, we are here to help.