Principal At Risk (PAR) structured notes are the most complicated instruments we recommend to clients. We are breaking them down for you this month and giving you a couple of examples of ones that some of you have owned.

Structured notes can work in a portfolio as an alternative to fixed income. You get a good-sized coupon contingent on the value of underlying assets, and you also have some protection of principal. There are no guarantees, but there is more protection than you have with an equity. They can therefore be a nice complement to other holdings. Having said that, you lose the protection if you sell them before they mature or are called, so we would consider them to be more illiquid; you don’t want too much of your portfolio in them.

The Mechanics

- There is an issue date and a maturity date, like a GIC. Therefore, a specific issue is not available to purchase all the time. New issues come out weekly.

- There is an underlying asset to the note. We choose notes that use large, high-quality holdings: banks, utilities, or even the entire index (like the S&P 500).

- There is a barrier; we typically choose a -30% barrier. As long as the price of the asset does not fall below the barrier, a coupon is paid. Hence, it is called a contingent coupon and the coupon is typically paid monthly or semi-annually.

- There is an autocall level; if the price of the assets rises above the autocall (typically 105% or 110% of the value on the issue date), the note is called back. You receive your pri ncipal back, as well as the interest owning up to that date. This is how the vast majority of notes finish. The bank will assess the auto call level on each payment date. If the underlying asset is not above the autocall level on that date, the note is not called and you receive your coupon payment.

- There is typically an initial hold period where, regardless of how the underlying asset performs the note cannot be called. This initial period varies by note but is usually around 6 months from the issue date.

- If the note does not rise above the autocall level before maturity (usually at seven years), you receive your principal back if the underlying asset is above the barrier. If it is below the barrier, you would receive the value of the underlying asset. In all our experience with notes, we have never had a note mature to seven years. They have always been called.

- Between the close date (the last day you can purchase) and the issue date (a couple of days later), the issuer (read manufacturer) initiates the options on the underlying assets to pay for future payment dates.

- The price of the underlying asset varies as it trades on the market. As the markets move up or down, the value of the structured note also changes, just as the value of the underlying stocks varies. Therefore, in a down market, your structured note also shows as being down. However, keep in mind you are still getting paid the coupon as long as the assets are above the barrier.

- What happens if you choose to sell your note before maturity? The bank allows you to sell the notes back to them, but it is not at an advantageous price to you. You would typically only be selling if the underlying asset was down (as otherwise it would be called shortly) so the price you receive would reflect that decline in the underlying asset. As such we strongly recommend clients look at these notes as a holding for the full term. You do not get any principal protection or advantages by selling early.

Real Examples

BMO is the issuer of the note for both.

BMO European Banks PAR Note, Series 2797 (JHN15070)

Underlying Assets: EUROSTOXX Bank index

Issue Date: December 6, 2021

Maturity Date: December 6, 2028

Pay: Monthly

Contingent Coupon: 8.58%

Autocall Level: 105%

Barrier Protection: -40%

www.bmonotes.com/Note/jhn15070

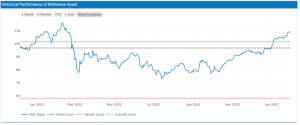

As the price of the index stayed above the red line (barrier), this note paid all the coupons. After the initial holding period of six months, where the note was above the green line (autocall), but the note was not yet callable, the note once again rose above the autocall in January of this year and was called. The annualized return was 8.5%.

BMO Canadian Insurance PAR Note, Series 1116 (JHN12747)

Underlying Assets: Great West Life, Manulife, Power Financial, Sun Life (i.e. Stocks of Canadian Insurance Companies)

Issue Date: November 18, 2019

Maturity Date: November 18, 2026

Pay: Semi-Annual

Contingent Coupon: 7.75%

Autocall Level: 110%

Barrier Protection: -30%

www.bmonotes.com/Note/JHN12747

www.bmonotes.com/Note/JHN12747

This time, the price of the underlying asset in this example fell below the red line (barrier) and the note missed a payment. You can see from the timeline this note was purchased just before the pandemic – that was the reason for the drop in price in March of 2020. The underlying assets (insurance companies), like everything else, recovered over time and then passed the autocall level. It only gets called on a pay date, which for this note was semi-annual, reached in November 2021. The annualized return on this note, with the missed payment and a short lifespan, was still 5.65%.

Let us know if the visuals help – we know this holding is a complicated one. But we feel it’s worth putting in the effort and gaining a level of comfort with how they work. Structured notes can be a welcome addition to many portfolios.

As always, happy to discuss further.