We have always been taught that diversification is good, as is being defensive in a difficult equity market. In past, this has been mostly true but in the last few years that didn’t really help and here’s why.

Bonds

Bonds have been an integral part of a diversified investment portfolio – think about the 60/40 portfolio, made of 60% equities, 40% bonds.

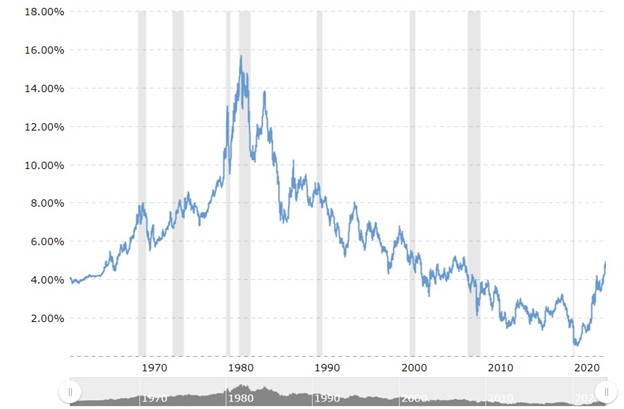

In fact, since the early ‘80s, we saw interest rates go from a high of almost 16% in September of 1981 down to a low point of 0.64% in August of 2020. When interest rates go down, bonds go up. That worked like a charm for almost 40 years. Bonds always seemed like the safe place to be.

Then, interest rates turned around in 2020 and started heading up. Now we see the reverse is also true. When interest rates go up, the underlying prices of the bonds go down. That’s why this year, 2023 will see the third consecutive negative year in bonds. Fortunately, over the past three years we moved primarily out of bonds and more toward structured notes and GICs. Imagine if you had the standard 60/40 portfolio of stocks and bonds over the last three years. Double whammy.

10 U.S. Year Treasury Rate – 54 year Historical Chart

Enough of the Doom and Gloom

We seem to have seen the peak in central bankers raising interest rates and inflation now appears under control and trending downward. Ahh, a good thing you say, and yes, it is. For us, what that means is that bonds (and therefore the bond proxies, like utility, pipeline and telecom stocks) will also be on the rise in the coming year. We will therefore be re-allocating back into bonds to a certain degree as we expect them to regain their favour in the light of falling interest rates.

What Does this Mean for You?

For you, it means two things to consider. Do I go with bonds for a potentially higher gain or a straight 1 or 2-year GIC for now? There are cases for both. With falling interest rates there is reason to believe the bond fund will outperform the GICs, BUT, there is no guarantee. Currently, as an example, the PIMCO Monthly Income fund, an established classic bond fund, has an expected yield of 7.5%. A 2-year GIC right now pays as much as 5.75%.

It’s a question of preference for you and your need for a guaranteed return. We will be talking to you about this in the coming weeks.

We believe that the worst is over for interest rates and a bond rally is in the works. For now, if you have questions or would like to learn more, let us know, we’re here to help.