Investing in a Corporation

For business owners or incorporated practitioners with surplus funds not required to meet lifestyle needs or for reinvestment in the business or practice, the question becomes how to maximize the value of these funds. Depending on personal marginal tax rates the tax cost to withdraw these funds can be significant. One method to defer personal income tax on surplus funds is to invest within the corporation.

(For the purposes of this article the term “corporation” is used to refer to a Canadian-controlled private corporation (CCPC)).

Passive Investment Income

Investment income earned within the corporation that is not directly related to active business operations is considered passive investment income.

Passive investment income can be grouped into the following categories:

- Income from property: foreign income, interests, other, rent and royalties

- Canadian dividends: eligible, non-eligible, and capital gains

- Taxable capital gains

Tax on Investment Income

Corporations do not benefit from graduated tax rates. Instead, income is taxed at a fixed rate depending on the type of income reported. All passive investment income, except for Canadian dividends, are subject to a federal tax rate of 38.67%. A portion of the federal tax (30.67%) is refundable and is added to the Corporation’s two respective Refundable Dividend Tax on Hand (RDTOH) accounts. A dividend refund is claimed, and the refundable tax “refunded” when taxable dividends are paid by the corporation to its shareholders.

Dividends received from Canadian corporations are subject to a 38.33% refundable tax. The entire amount is added to the corporation’s RDTOH accounts and refundable to the corporation when taxable dividends are paid to shareholders.

All passive investment income, except for Canadian dividends, are subject to a federal tax rate of 38.67%.

Concept of Integration

Perfect tax integration occurs when income is subject to the same or comparable overall tax rate, regardless if it is earned directly by an individual or first through a corporation, and the after-tax portion is then paid out to the individual.

The goal of integration is to remove any tax advantages or disadvantages associated with corporations and/or trusts first earning income and then paying it out to an individual.

To achieve integration, there are a number of accounts and/or tools in the Canadian income tax legislation, namely: Corporate RDTOH accounts and Capital Dividend Account (CDA) and for Individual taxpayers the gross-up and dividend tax credit on Canadian dividends received. Let’s focus on the two corporate accounts.

The goal of integration is to remove any tax advantages or disadvantages associated with corporations and/or trusts first earning income and then paying it out to an individual.

RDTOH Accounts

The refundable portion of tax paid on passive investment income is added to the Corporation’s two RDTOH accounts, namely Non-eligible RDTOH (NERDTOH) and Eligible RDTOH (ERDTOH).

NERDTOH tracks refundable taxes incurred on passive investment income earned. A dividend refund of the NERDTOH can be claimed upon payment of non-eligible dividends; and

ERDTOH tracks refundable taxes paid on eligible dividends received from corporations that are not connected (portfolio investments), as well as eligible dividends received from connected corporations to the extent these dividends triggered a dividend refund to the payor corporation. A dividend refund of the ERDTOH account can be claimed upon the payment of eligible dividends and non-eligible dividends (where NERDTOH balance is nil).

As indicated above, when a taxable dividend is paid to shareholders the corporation receives a dividend refund. The refund is 38.33% of the taxable dividend paid, provided there is a positive balance in the respective RDTOH account.

Capital Dividend Account (CDA)

Another corporate tax account that business owners should be acquainted with is the Capital Dividend Account (CDA). The CDA tracks non-taxable income, including the 50% portion of capital gains and capital losses, along with life insurance and capital dividends received. A positive CDA balance can be paid out to shareholders tax-free as a capital dividend. The CDA balance is then reduced by the capital dividend paid out.

Tax Implications by Investment Type

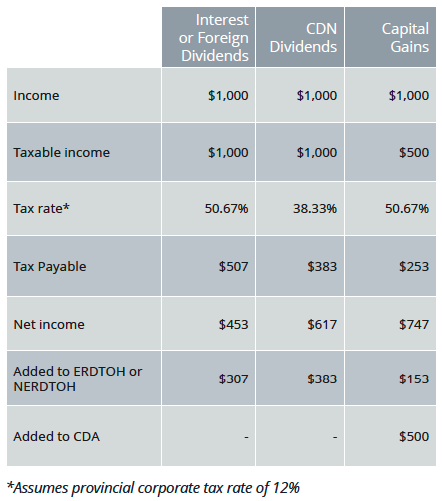

Similar to personal income tax, the tax treatment of investment income varies by type. The table below provides an example of how investment income is taxed in the corporation and recorded in the RDTOH and CDA accounts.

Table 1: Taxation of Investment Income with a Corporation

Small Business Deduction (SBD) Reduction

Active business income (ABI) earned within a corporation is subject to a federal tax of 15%. The small business deduction (SBD) reduces CCPCs’ federal corporate tax rate to 9% on the first $500,000 of ABI.

New rules on investment income earned in the corporation were introduced in 2019. These rules phase-out the small business deduction (SBD) for corporations that earn more than $50,000 of passive investment income in the preceding year. The SBD is reduced by $5 for every $1 of passive investment income and is fully eliminated where investment income earned in the preceding year exceeds $150,000.

Business owners who anticipate passive investment income in excess of $50,000 across their corporate structure should discuss strategies to preserve the SBD with their tax and wealth advisors.

Advantage or Disadvantage?

The taxation of investment income within the corporation is designed to eliminate any potential advantage over individual investors. This aligns with the goal of integration between the corporate and personal income tax regimes.

Integration, however, is rarely perfect. Whether investing in the corporation is advantageous (or disadvantageous) will depend upon several factors, including the personal marginal tax rate of the business owner, corporate tax rates, access to SBD, net income, etc.

To discuss whether to invest surplus funds within your corporation or withdraw and invest personally, it is recommended you consult with a qualified tax and wealth advisor.

Whether investing in the corporation is advantageous (or disadvantageous) will depend upon several factors, including the personal marginal tax rate of the business owner, corporate tax rates, access to SBD, net income, etc.