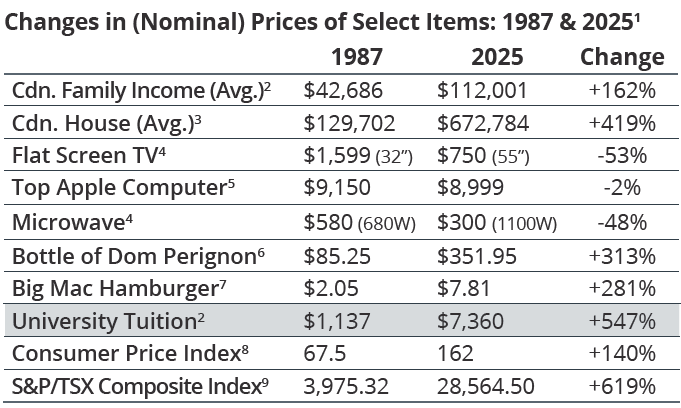

If you’ve eaten fast food recently, you may be surprised by the bill. Thirty years ago, a Big Mac hamburger cost around $2. Today, it is almost four times the price. Over the same period, average family income has risen by 162 percent, while the Consumer Price Index (CPI), the official measure of inflation, increased by 140 percent. Yet, among the items compared below (chart), one cost has far outpaced everything else: university tuition.

With the school year now underway, it is a timely reminder to consider education funding. Ensuring our families have the financial means to support higher education is more important than ever, given the rising costs. An investment program is also a great way for parents, grandparents and other family members to leave a legacy.

Registered Education Savings Plan (RESP) — The most common tool, the RESP offers tax-deferred investment growth, Canada Education Savings Grants (CESGs) of up to $7,200 per beneficiary and potential income-splitting when funds are withdrawn and taxed in a beneficiary’s hands.

Formal Trust — Unlike RESPs, there are no contribution limits (RESPs have a $50,000 per beneficiary limit), tax deferral or CESG benefits. However, earnings on trust assets may be taxed in the hands of the trust beneficiary if properly structured so attribution rules do not apply. Be aware that once funds are paid to the beneficiary, they can be used for any purpose, not just education.

Life Insurance — Participating whole life insurance can be structured to accumulate cash value to help cover future education costs. The cash value grows in a tax-advantaged way, and the policy also provides life insurance protection for the beneficiary.

Do You Have a Student in the Family?

If you have a student attending post-secondary school, keeping good records is important to take full advantage of tax benefits. Two tips:

- Tuition Tax Credit — This federal non-refundable credit has been reduced to 14 percent of eligible tuition fees (July 2025), with provincial credits available. After applying the tuition credit to their own taxes, any remaining credit can be transferred to one of the following individuals: spouse/partner, parent or grandparent to a maximum of $5,000 less the amount used by the student. Unused amounts can also be carried forward for use by the student in a future year.

- Moving Expenses — Certain moving costs may be deductible. For example, if a student attends a post-secondary program at least 40 km from home and returns in the summer for a job, these expenses may be deductible for the student on a tax return.

1. 1987 data is nominal data from: Report on Business Magazine, Apr. 2012, pg. 13; 2. https://publications.gc.ca/collections/collection_2018/statcan/13-208/CS13-208-1987.pdf; Stat Can T-1110019101 for 2025, with 3.6% (2024) & 3.8% (2025) wage growth assumptions; 3. Data from CREA; April 1987 and July 2025 data; 4. Average Sony HD TV price based on 32” and 55”, bestbuy.ca; 5. MacPro Tower, apple.ca; 6. LCBO Ontario pricing at July 1987 and July 2025; 7. Economist.com Big Mac Index raw data: https://github.com/TheEconomist/big-mac-data; 8. https://bankofcanada.ca/rates/related/inflation-calculator/ for June 1987 & 2025; 9. At close on 8/27/87 and 8/29/25.