The Zimmermann Telegram, published on March 1, 1917, transformed America’s war stance overnight. This shocking revelation—Germany’s secret proposal to ally with Mexico and reclaim Texas, Arizona, and New Mexico—galvanized the nation. By April 6, 1917, the United States was at war. The nation just couldn’t “unsee” the telegram.

Turning points like these remind us that pivotal moments often reveal truths we can no longer ignore. Recently, I came across a visual that hit me with similar force. Warning: you won’t be able to “unsee” this either.

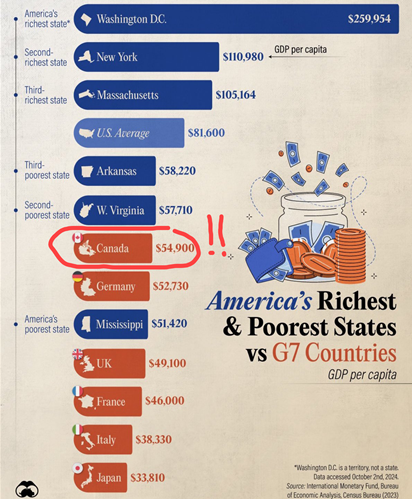

Canada’s Economic Wake-Up Call

Canada ranks just below West Virginia, the second poorest U.S. state, in GDP per capita. These numbers worsen when considering Real GDP per Capita, which has collapsed against the U.S. since 2015. Seeing this representation of Canada’s economic challenges, I was struck again by how urgently we need change.

Another chart I can’t “unsee” is just as jarring. According to J.P. Morgan, individual investors in the U.S. have returned less than 4% while the S&P 500 is up over 20%. I suspect Canadian numbers are no different.

Why Investors Underperform

What does this tell us? Many people are trying to improve their financial circumstances but are being thwarted by poor advice, emotional decision-making, or both. This isn’t just unfortunate—it’s heartbreaking.

The Need for Advisors Who Think Differently

At times like this, people need better tools and guidance. Unfortunately, the big banks aren’t helping. A recent article from Forbes highlights how advisors at major institutions in the U.S. (and similarly in Canada) are often restricted in what they can discuss with clients, especially on emerging topics like Bitcoin.

“There is a frustration that advisors typically cannot discuss [Bitcoin] with clients. They can’t bring it up, and they’re admonished not to say anything at all. It just makes them look silly.” – source.

One of the reasons I moved to Wellington-Altus is that we have the freedom to provide clients with broader, more meaningful advice. Whether or not Bitcoin is right for you, you deserve an advisor who can discuss it openly—especially with Bitcoin nearing $100,000 per coin and dominating financial headlines.

YCharts.com © 2024 YCharts, Inc. All rights reserved

Building a Stronger Financial Future

This isn’t just about Bitcoin. It’s about the tools and strategies our children and grandchildren will need to overcome the disadvantages of starting from a lower economic base. The data is clear: the current meme of “do-it-yourself” investing isn’t yielding results. Individual investors are consistently underperforming, and the stakes for future generations couldn’t be higher.

At Evans Family Wealth, we believe disciplined, informed investing can make all the difference. Briana and I are here to help you, your family, or anyone in your circle take charge of their financial future. If we can be of service, we’d be honoured to assist.

Let’s give the next generation the tools they need to succeed.

Glen