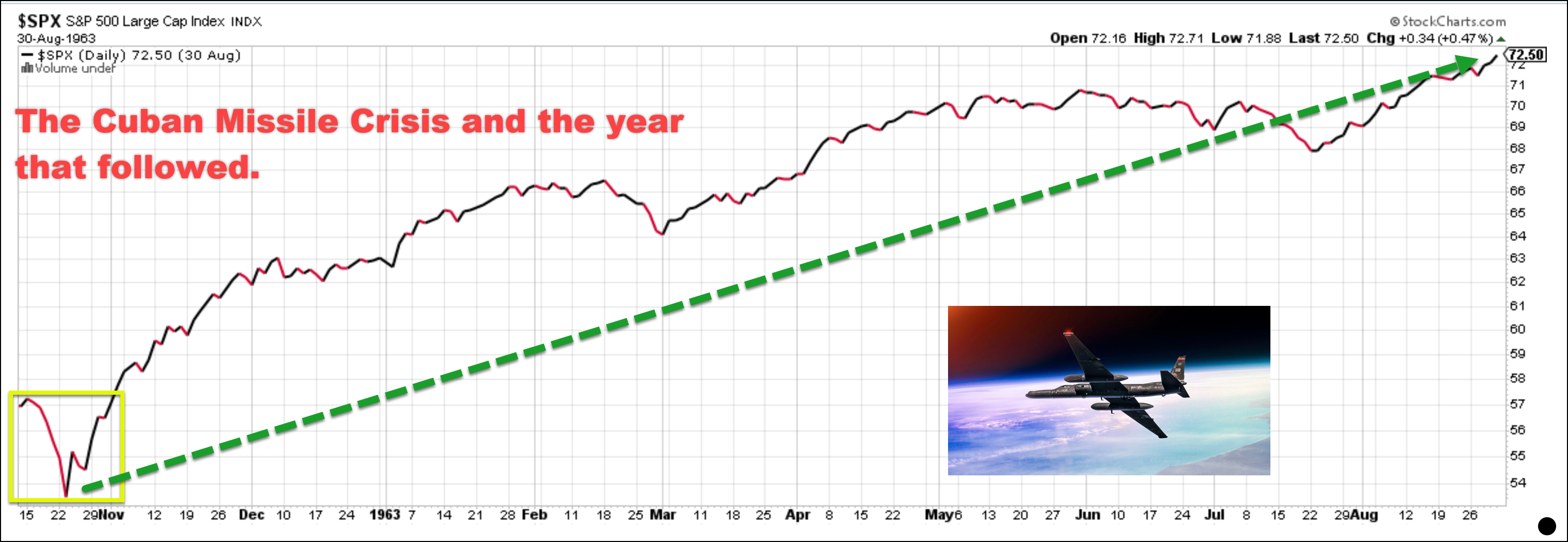

Lessons from the Cuban Missile Crisis and Market Resilience

The Dragon Lady overflew the objective for just 7 minutes—plenty of time to start World War III. At the controls of the U2 spy plane, Major Richard Heyser had no idea that his reconnaissance photos would wind up on President Kennedy’s desk the next day precipitating the October 16-28, 1962 Cuban Missile Crisis—a 13 day standoff between nuclear superpowers that brought the world to the edge of oblivion.

How Did the Stock Market React to the Cuban Missile Crisis?

How did the stock market react to the risk of Armageddon? Predictably enough, the market dropped about 10% in the immediate days of the crisis, but managed to recover almost all of the losses by the end of the month—going on to rally almost 35% in the following year.

The Market’s Ability to Withstand Crises and Poor Leadership

Surprised? We probably shouldn’t be—financial markets are incredibly resilient to crises and even poor leadership. For long term investors like you and I, that is an important lesson to keep in mind as we grapple with President Donald Trump’s tariffs.

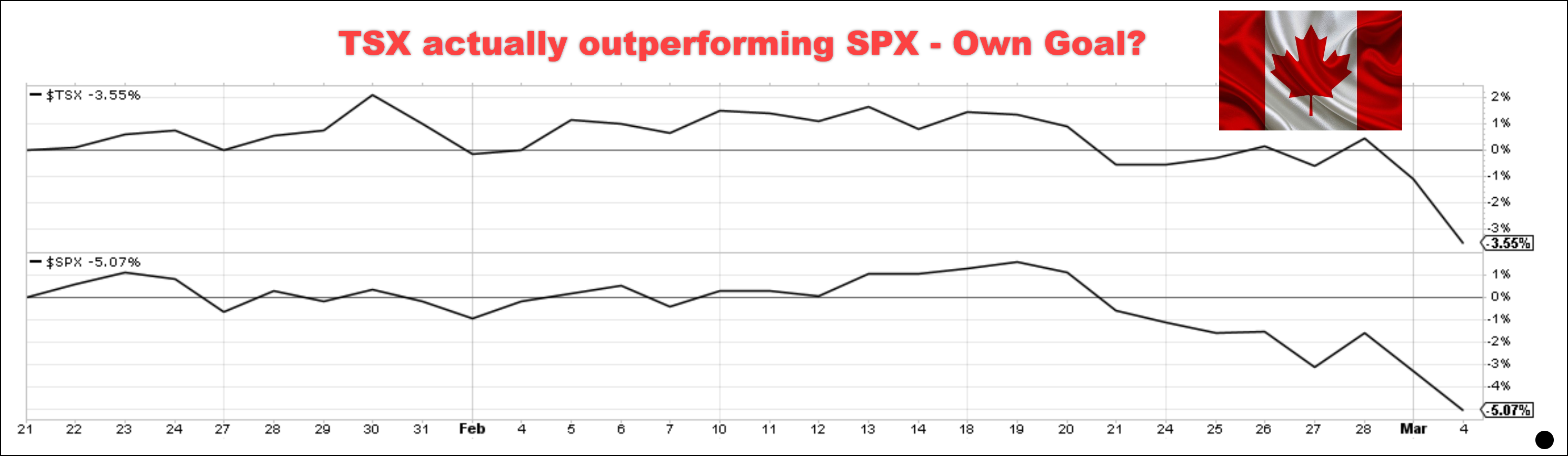

Tariffs and Their Impact on Canadian and Global Markets

A couple of charts show just how much of an “own-goal” tariffs represent. Since Trump’s inauguration, Canada has actually fared better than the U.S. stock market.

source: StockCharts.com

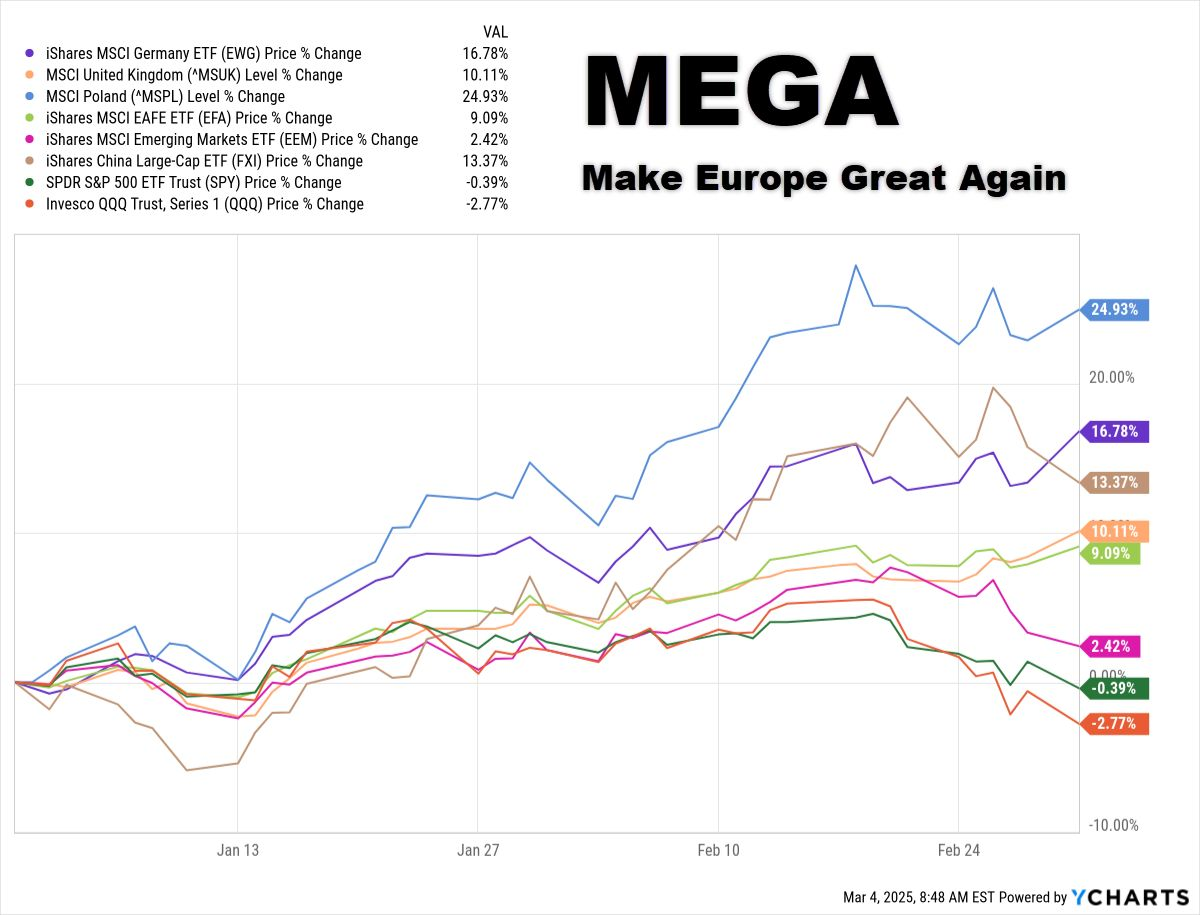

Global Markets Outperforming the U.S. – A Surprising Trend

Looking at the performance of markets globally, you could be forgiven to think that Trump’s agenda was to Make Europe Great Again (MEGA). Notice how the U.S. Markets (SPY and QQQ) are underperforming European, Chinese and Emerging Markets. I wouldn’t count on this divergence continuing for long.

YCharts.com © 2025 YCharts, Inc. All rights reserved

The Short-Term Risks for Canada and How to Respond

None of this is to diminish the short-term risk to Canada. I say short-term because the expectation continues to be that the enormous upheaval caused by these tariffs will hurt Trump’s base, slow the economy and raise inflation at an inauspicious time for him consequently, most think he will declare victory and move on in weeks rather than months. While that is the current consensus view, readers should be cautioned that the prior consensus was that he would either not implement tariffs at all or would do so at substantially lower levels.

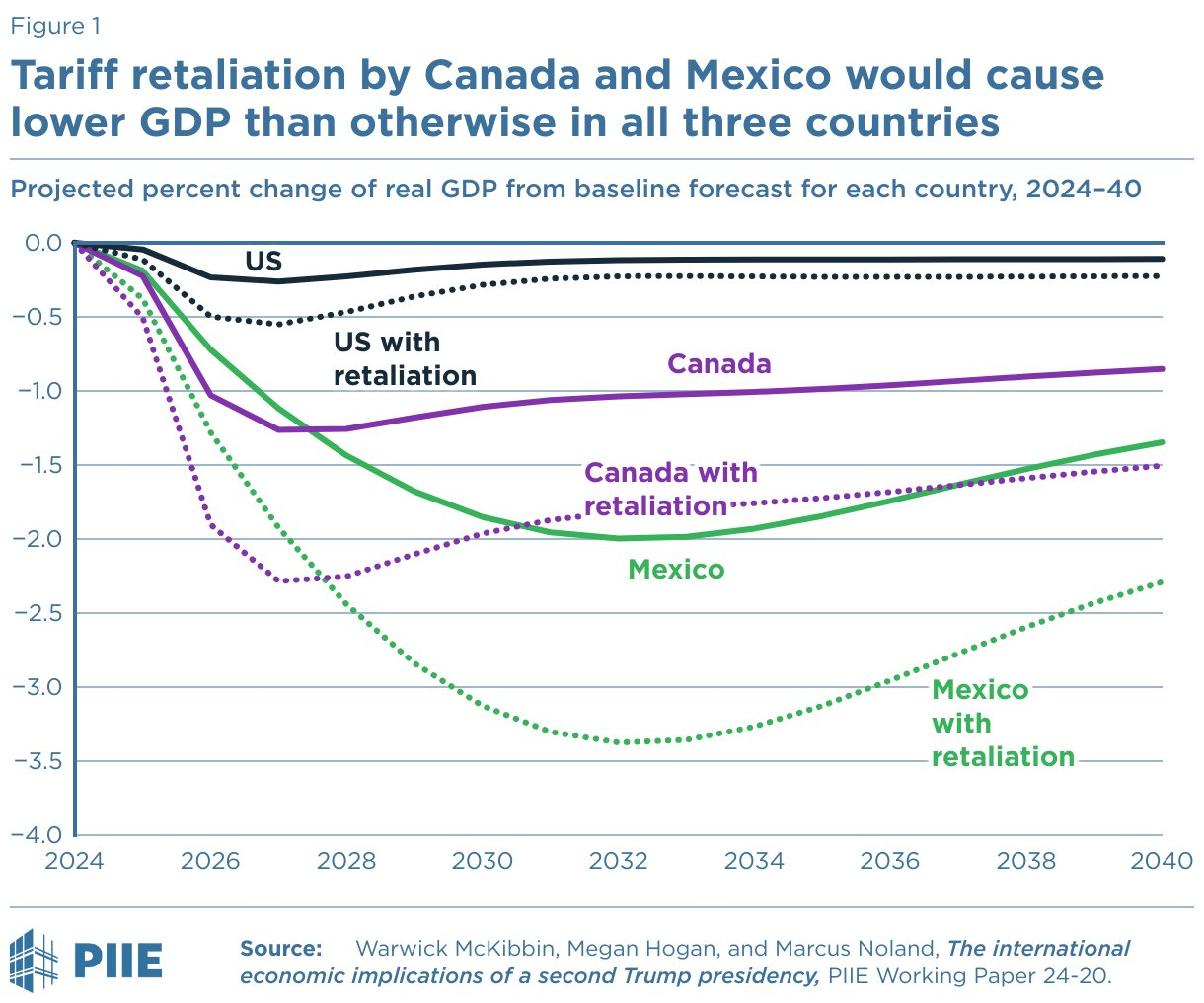

Why Retaliation Isn’t Always the Right Move

Let’s not get cocky though. Threats to shut off the power to our U.S. neighbours will not create many friends (even if it makes us feel good). Similarly, ratcheting up counter-tariffs when economists agree that will cause monumentally more pain for Canadians than the U.S. is a risk. The lesson here should be: “let’s not make a bad situation worse”.

source: Peterson Institute for International Economics

A Realistic and Hopeful Outlook for Canada’s Economy

My message continues to be one of hope. Not in the star-eyed naive sense—hope in the realist, number crunching, self-interested sense. Canada is a fantastic trading partner and our relationship with the U.S. is mutually beneficial. What we are not able to sell to the U.S. we can find markets for abroad. We’re not a global street corner with our hand outstretched, we’re offering the commodities and skills the world needs. Trump’s slap in the face will snap us out of the dream-like state we’ve been led into by a decade of anti-growth policies that pretended that building and shipping wasn’t fundamental to this country’s success.

Canada’s Natural Advantages in a Shifting Global Economy

Canada’s best days are ahead. You don’t need to be flying the Dragon Lady at 70,000 feet to see that with access to three oceans, having the third largest oil supplies, the fourth largest natural gas reserves Canada is a waking juggernaut. Markets are reacting as they should and I expect this crisis to be short-lived. When the threat passes, we should see broad based recovery.

Watch the Video: Tariff Wars & Market Resilience: Investing Through Global Crises

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen