Election Season and Investment Strategy

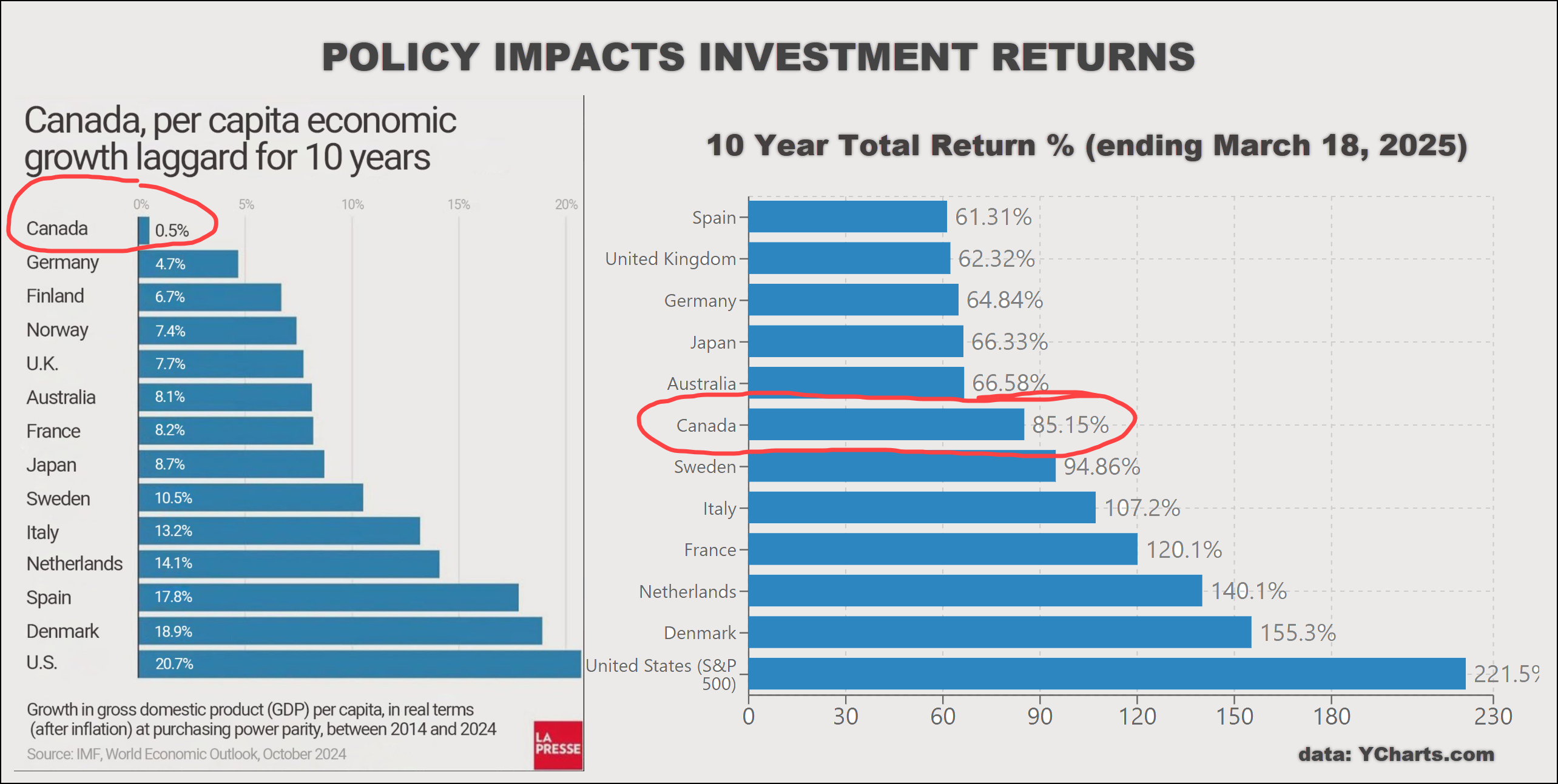

Buckle up, election time is on us! Happily, I’m not in the political commentary business. Who you vote for is entirely your business. My job is to help you make sense of the investment world and to allocate your hard earned savings to the most prospective areas. Election results and economic policy are best measured over time. Sadly, for the past 10 years, Canadian economic policy has led to the absolute worst per capita economic growth among our peers and consequently poor investment returns.

Canada’s Economic Growth Falls Behind

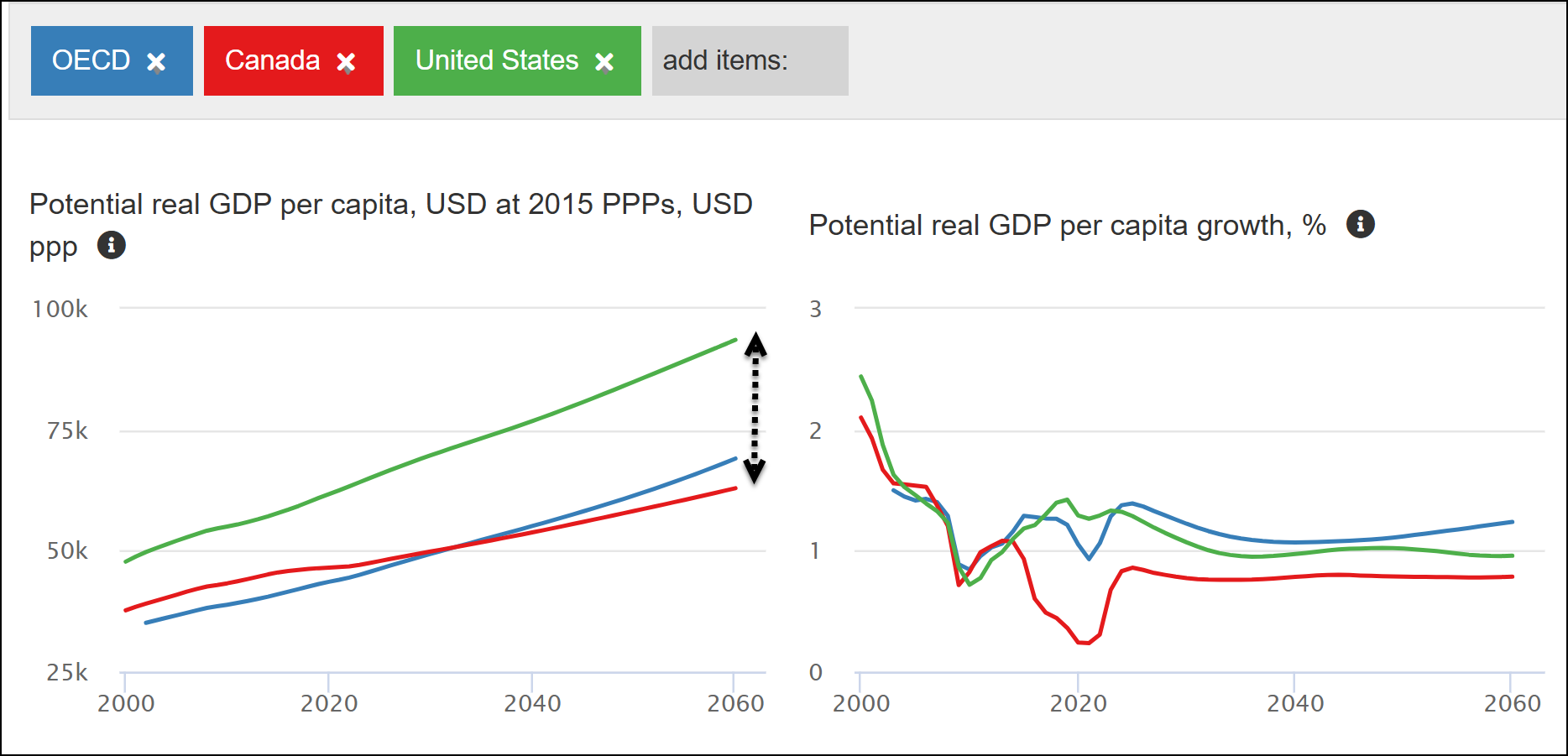

More troubling still, the Organization of Economic Cooperation and Development expects Canada to continue to trail the average of its peers. The gap between real GDP per capita in Canada and the U.S. (and OECD average) will continue to grow beyond 2060. That’s a lifetime folks. A full generation of economic malaise. Canadians aren’t victims of despotic rulers—we voted for the policies and leaders that delivered these outcomes.

The Hidden Costs of Policy Decisions

These are the macro economic facts which explain the disappointing relative performance of the Canadian stock market against its peers. The story gets worse when you look behind the numbers.

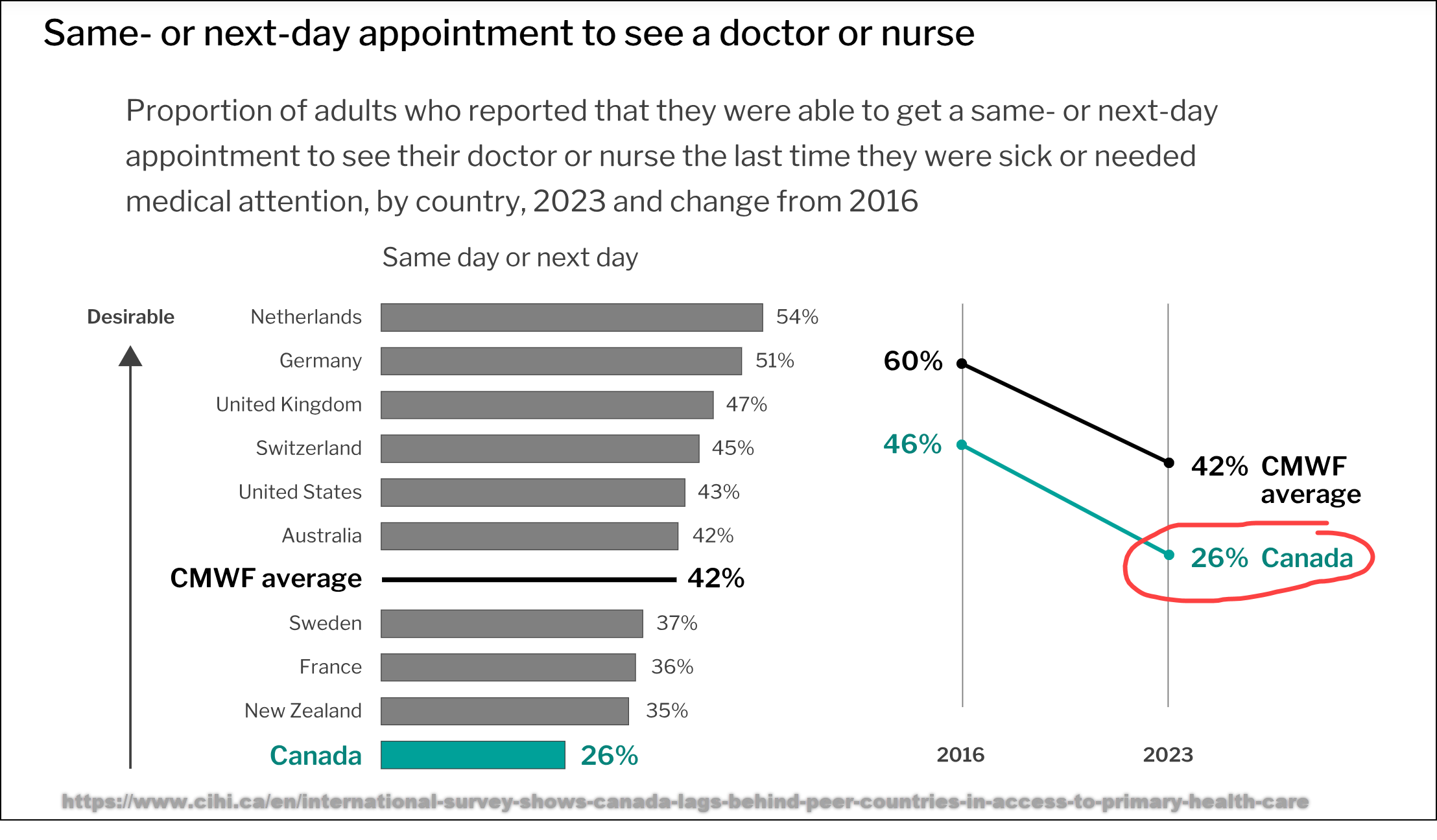

Once the source of national pride, Canada’s Universal Healthcare system is straining under the weight of unrestrained population growth. More than 1 in 5 Canadians are without a family doctor. The stress shows up in the ability to access healthcare—only 26% of Canadians report they were able to see a doctor or nurse in a timely way (down from 46% in 2016).

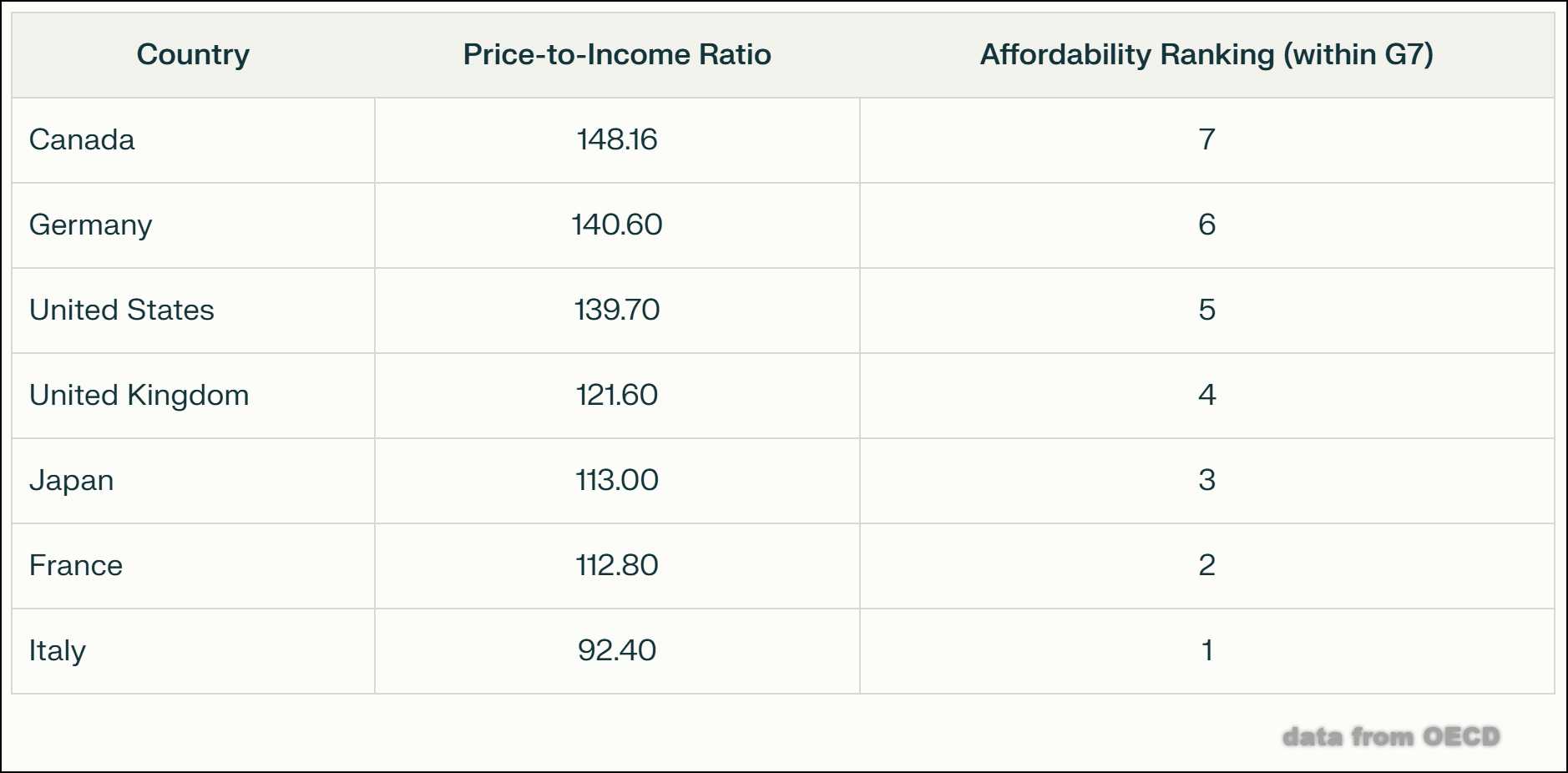

The Canada dream of home ownership, integral to family formation has become a nightmare. Canada is the least affordable country in the G7 by a wide margin. The dream that you and I enjoy is unlikely to be realized by the next generation.

Looking Ahead: The Next Generation’s Burden

Let’s be honest, none of this is news. We’ve just become comfortable with it—or resigned to it. I’m a proud Canadian and father of 3 awesome 20-something year old kids. Just like your kids, grandkids, nieces and nephews—they’ll bear the brunt of the impact of the policies you and I have endorsed for the past 10 years. To imagine that trend continuing to beyond 2060 is heartbreaking to me.

Those of us with financial assets have options the young do not. How we allocate those assets becomes increasingly important. As your investment advisor, I’ll continue to look for the best investment opportunities for your hard-earned savings (and theirs). Sadly, that may mean further decreasing our allocation to Canada.

Where Are the Big Investors Putting Their Money?

For context, Canadian pension plans currently have less than 4% invested in Canada—source. The Canadian Pension Plan has approximately 11% of its capital invested in Canada—source. Unless there is an about face on economic policy, global options may continue to be preferable to Canada.

Should Investors Reduce U.S. Exposure?

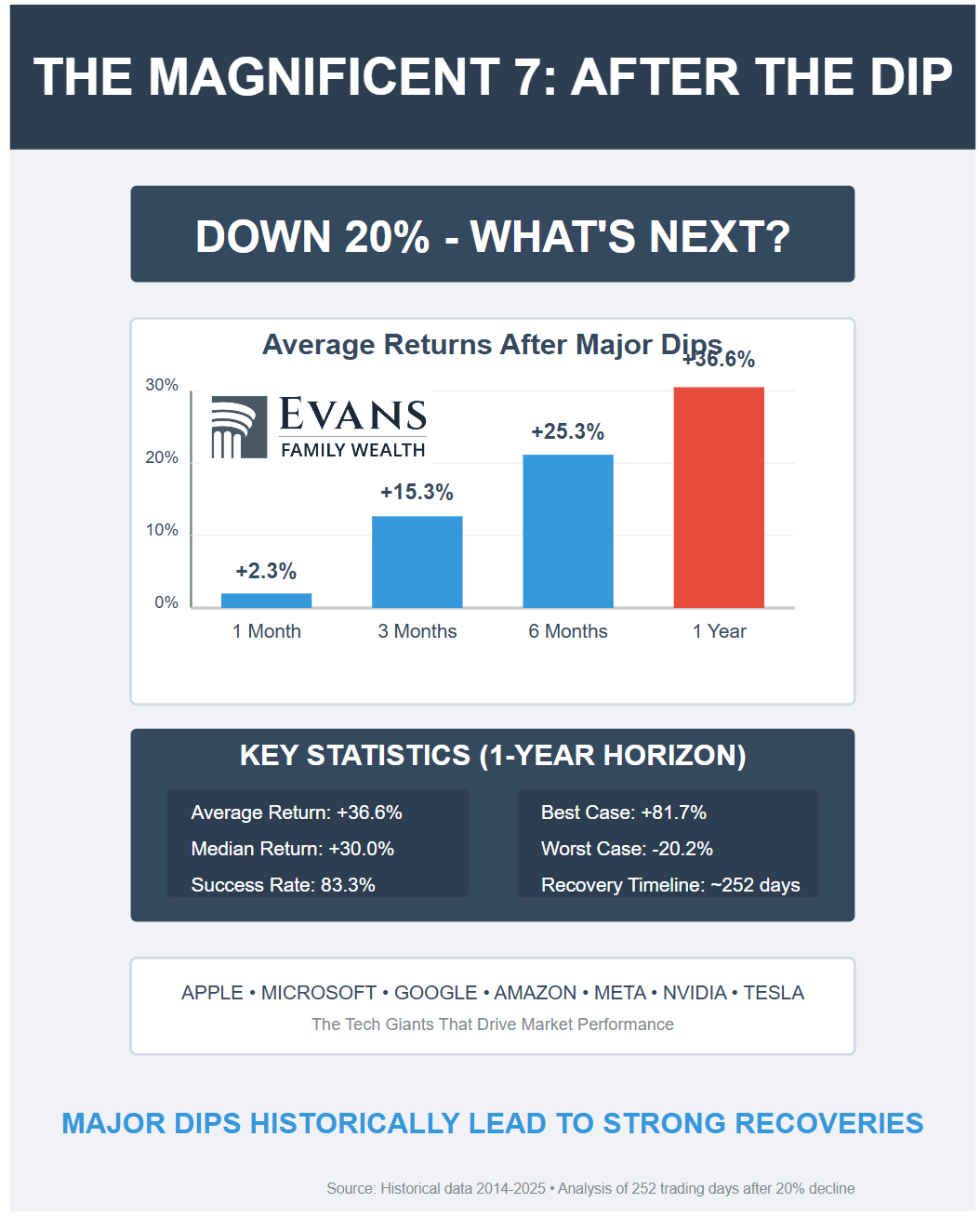

We’ve had a few calls from clients wanting to reduce U.S. exposure lately. I can’t predict the future, but Canadian investors have been very well served by holding U.S. securities over the past decade and these depressing economic trends don’t suggest that increasing Canadian exposure will be a winning strategy. Ironically, after the recent sharp correction in U.S. stocks (particularly the Magnificent 7) future returns look very good if historical precedents hold:

What’s Next for Investors?

Canadians will choose a new prime minister soon. For investors, voting is only half the job. We will then have to decide whether Canada is a good place for our capital to call home—I’m on it.

Watch the Video: Canada’s Economic Wake-Up Call

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen