Gold Shines as Markets Focus on Tariffs

While tariffs dominate the headlines, gold continues to shine brilliantly in the wings. Cruising to new all-time highs, gold’s luster serves as a reminder of the need for two things: humility and diversification. In this business, it’s easy to have the former and mandatory to have the latter. Let’s dig in.

YCharts.com © 2025 YCharts, Inc. All rights reserved

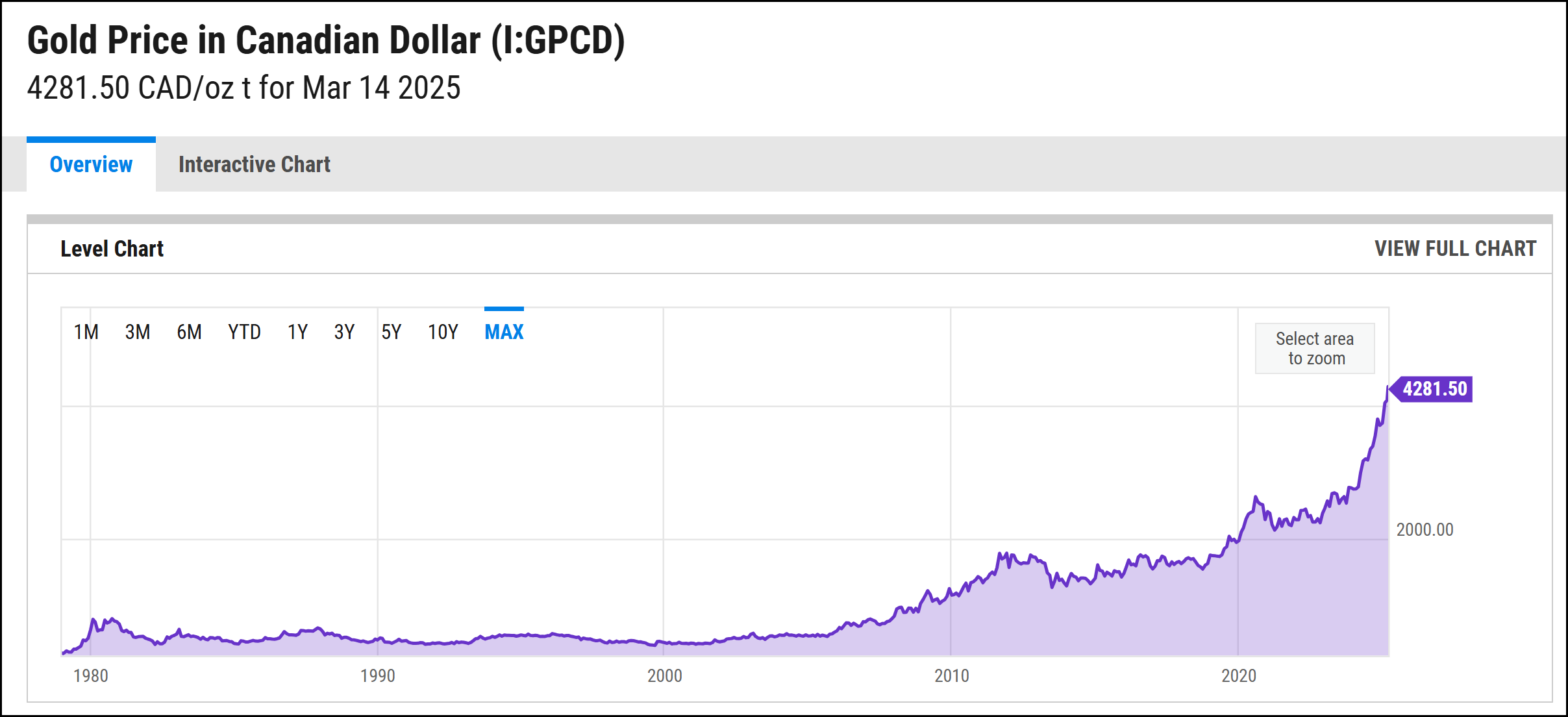

Gold: The Ultimate Judge and Jury

Think of a bar of gold as a mirror—reflecting the debauchery of the currency in which it is priced. Notice how the price of gold in Canadian dollars looks like a parabolic chart—that’s less about gold than it is about the management of Canada’s currency and inflation. The verdict is in, gold is the ultimate judge and jury. Our government and central bank have collapsed the value of your currency by embracing inflation.

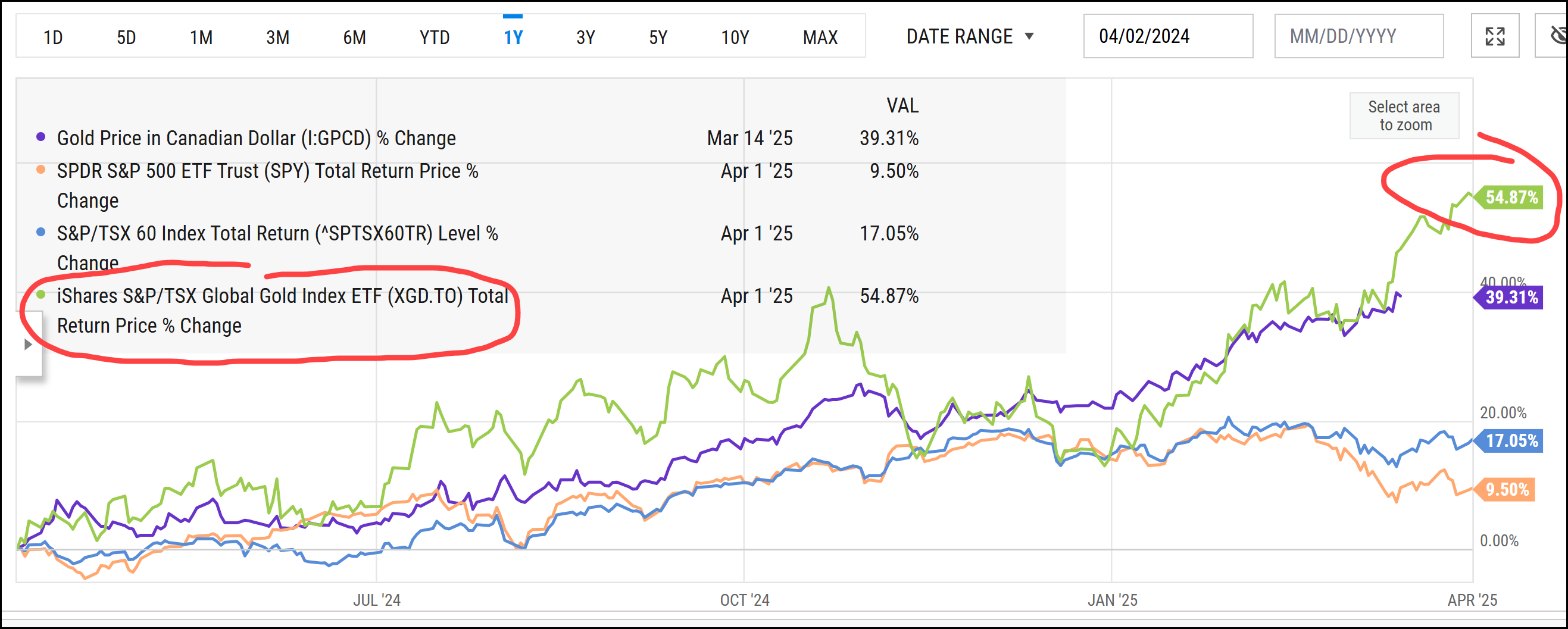

Gold The Undisputed Champion

YCharts.com © 2025 YCharts, Inc. All rights reserved

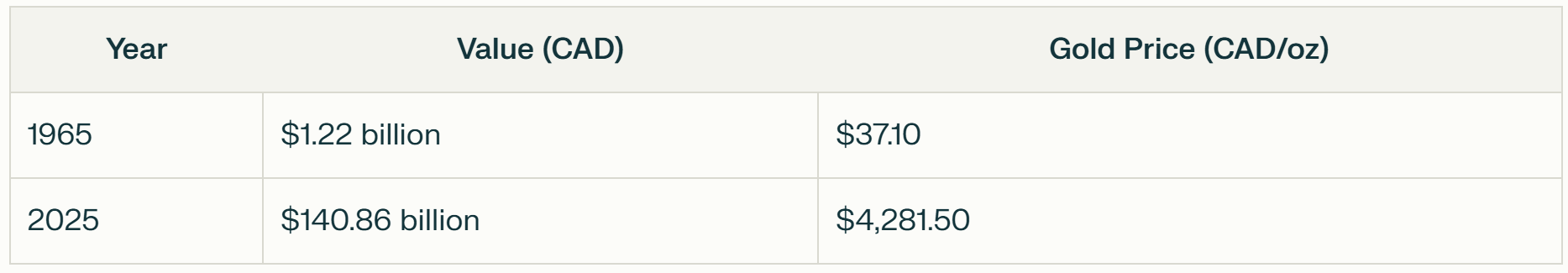

Gold’s Performance Compared to Stocks

Gold has nearly doubled the performance of both the S&P 500 and the TSX 60 since 2000. It’s a litmus test for central bankers and investors. Historically, both have failed the test. In my opinion, central bankers are completely without excuse.

The Bank of Canada’s Costly Mistake

At the direction of Prime Minister Trudeau, Governor Polloz of the Bank of Canada sold the last meager 77,000 ounces of its gold reserves in 2016. They effectively hold none now. You read that right—the Bank of Canada has divested of the one asset that would protect Canadians against the very inflation it systematically creates. In 1965, the Bank of Canada held over 32 million ounces. Had they just held onto it, the value would have increased 115 times.

source: Perplexity.ai

The Bank of Canada’s 1965 gold holdings would be worth $140 billion today, exceeding its current total reserves of $124 billion! This may rank among the worst trades in central banking history—and that’s saying something. Consider the irony: an institution whose mandate is to maintain 2% inflation (yet whose policies triggered Canada’s worst inflation in five decades) sold off its inflation hedge (gold) only to replace it with more devaluing currencies.

The Bigger Picture: Central Bankers and Inflation

Canada is not an outlier in this regard. Central bankers are a bit like lemmings and most jumped off the same cliff in the past 50 years despite literally knowing that their playbook is currency devaluation.

The public infatuation with central bankers remains a complete mystery to me. Never have so few, inflicted so much economic damage with complete impunity and received so much applause in return. Despite being the ultimate insiders they missed the lay-up trade of the century. Investors (and taxpayers) need to have greater humility than our “betters” in the hallowed halls of the Bank of Canada!

Diversification: The Free Lunch for Investors

For investors the answer is shiny and bright—own gold (at least a little). Historically, gold producers have been a poor substitute for gold. Happily that hasn’t been the case recently. The Canadian gold miners have increased almost 55% in the past year—eclipsing the TSX 60 and the S&P 500.

YCharts.com © 2025 YCharts, Inc. All rights reserved

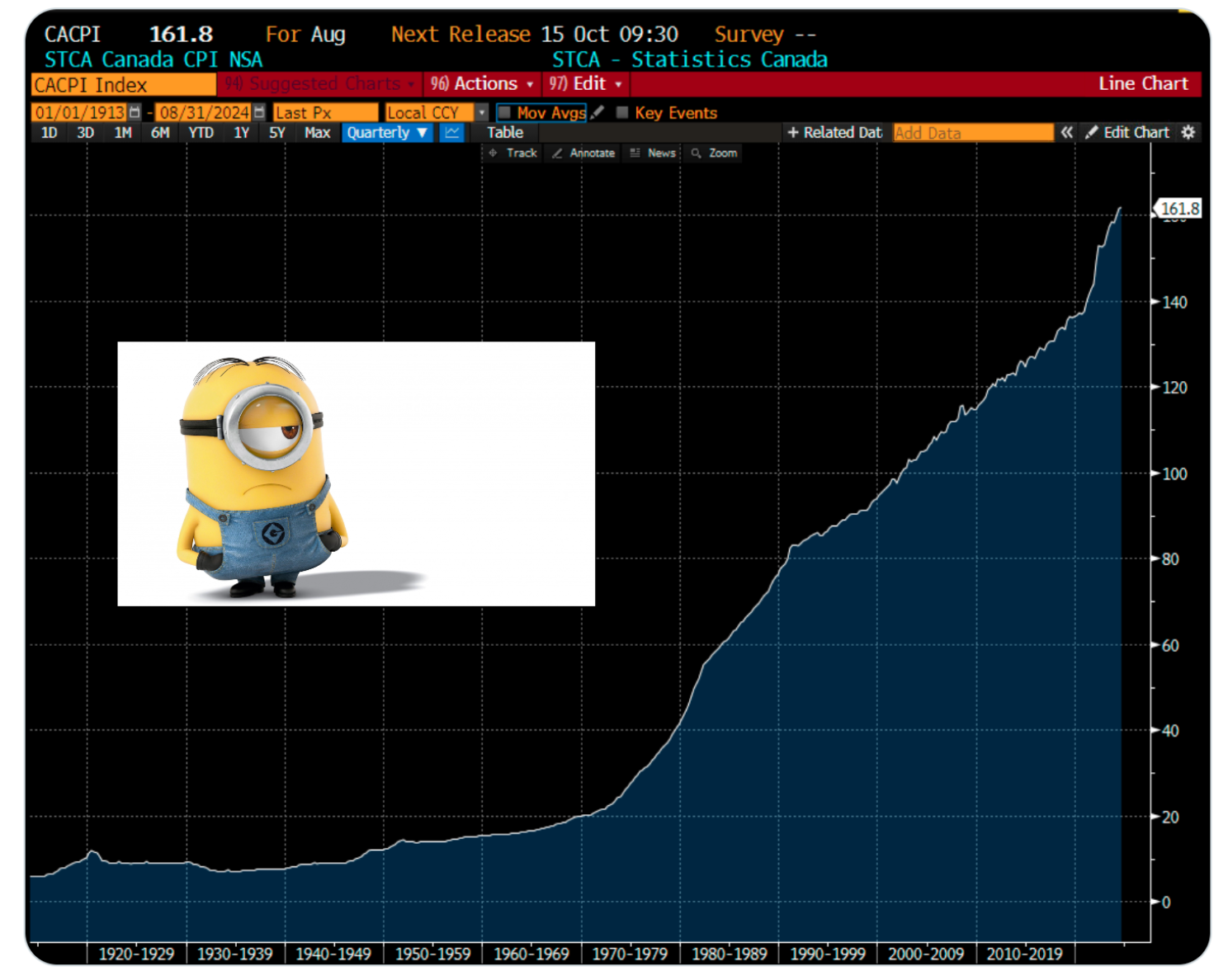

Inflation: The Engine That Keeps Running

Central bankers create inflation—it is their mandate. Everything is downstream of this inflation. As investors we always have to remember that rising prices do not signify increasing value. Inflation inexorably rises pushing prices higher. What about value?

source: Bloomberg

Has Your Home Really Increased in Value?

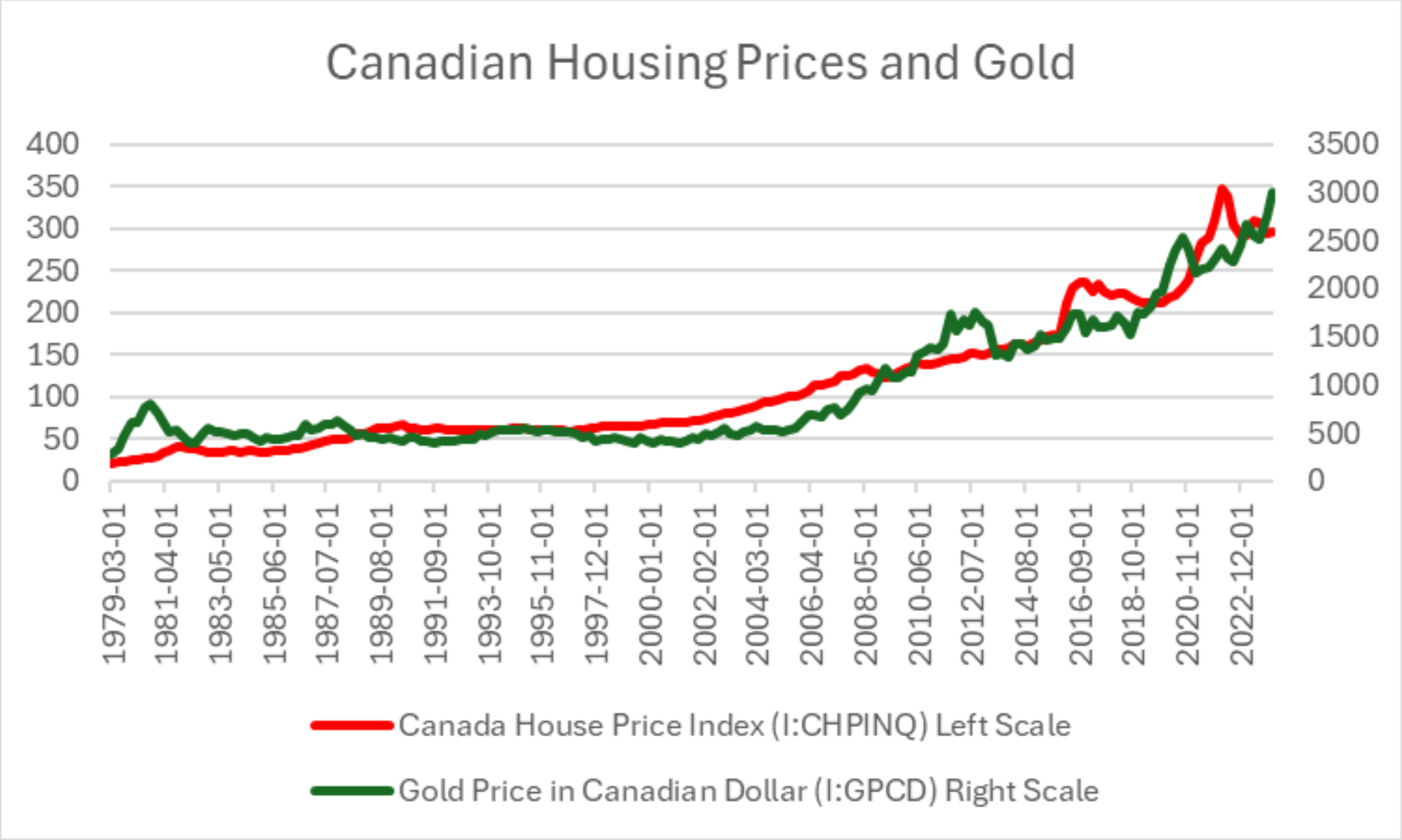

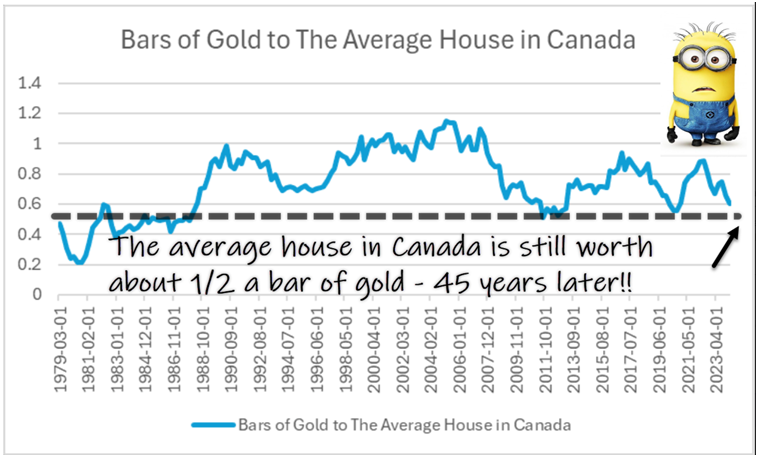

Let’s consider Canadian’s second love (after hockey), homes. Canadians know that homes have increased in price- but have they increased in value? This question can be answered if we compare the price of homes and gold—pretty close match, right?

However, if we divide the average Canadian House Price (red line) by the Price of Gold in Canadian dollars (green line) we find that remarkably, homes have barely moved. Which raises the uncomfortable question—”has the value of your home increased”?

Gold and Bitcoin: The Investor’s Cure for Inflation

If you read my reports you know that I have long been both a gold and a Bitcoin bull. My bullishness stems less from my belief in gold and Bitcoin than my iron-clad belief in central bankers! Central Bankers create inflation, always have, always will. That means that investors should always have a hedge.

Watch the Video: The Golden Rule: Own What They Don’t, Protect What They Won’t

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

We’re on it.

Glen