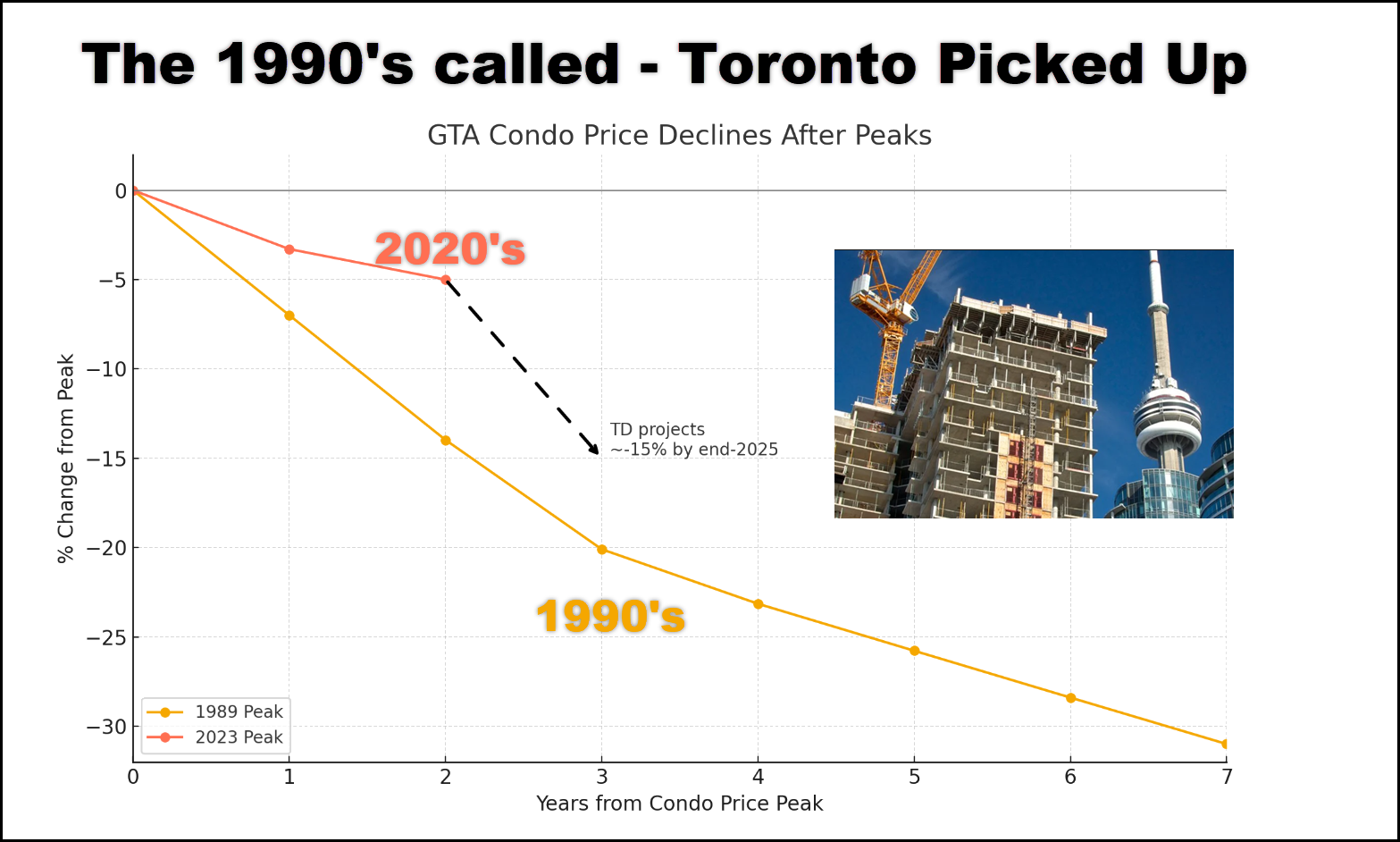

The 1990s Called: Are We Repeating the Condo Crash?

The 1990s called—Toronto picked up. Back then condo owners learned that prices could fall for 7 years in a row. The new cycle looks eerily familiar:

“By the end of this year, GTA condo prices will likely have dropped 15‑20 % from their 2023 Q3 peak, with about 10 percentage points of that decline happening in 2025. A glut of supply, slowing population growth and tariff‑driven economic uncertainty are all weighing on demand.” TD Economics, GTA Condo Market Outlook

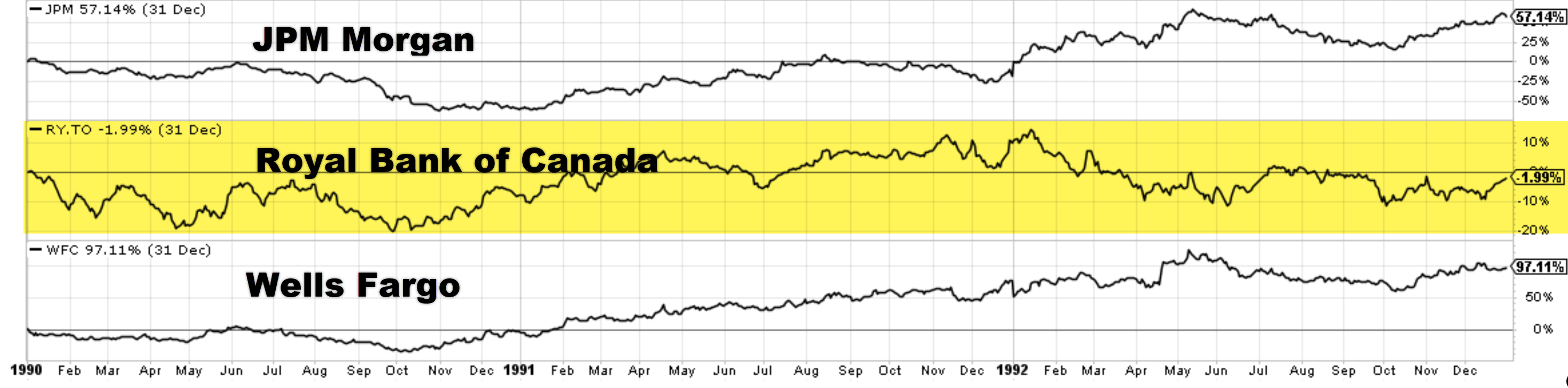

What the Condo Crash Means for the Big 6 Banks

Canada’s Big Banks have feasted on mortgages and are now dealing with indigestion. Provisions for loan losses have increased, but declining interest rates have cushioned the blow. Flashback to 1990‑93. During the last condo crack‑up, Canadian bank shares went nowhere for three years, while U.S. leaders like JPMorgan gained 50% and Wells Fargo nearly doubled.

Charts courtesy of StockCharts.com

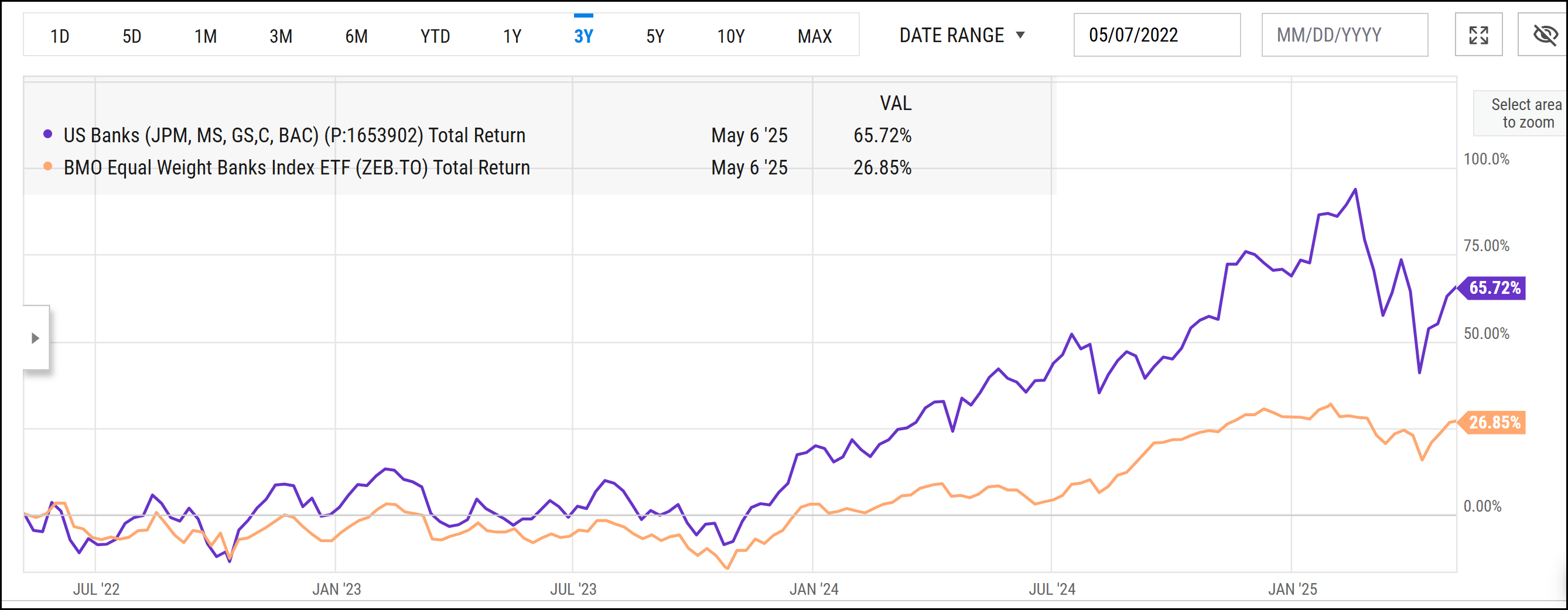

Might History Repeat? A Tale of Two Housing Markets

Might history repeat? I can’t say, Ontario and BC’s housing markets are retrenching. The rest of the country seems to be doing relatively well. Still, I’m intrigued by the promises to deregulate the U.S. banking sector.

The Cross-Border Scorecard: Canada vs. U.S. Banks

Compared to Canada’s Big 6 Banks, the U.S. Big banks have handily outperformed in recent years and over the longer term too:

YCharts.com © 2025 YCharts, Inc. All rights reserved

Our Take: Income, Growth, and Tactical Positioning

- Income seekers: Canada’s oligopoly banks still pay 4–5 % dividends, fully eligible for the dividend‑tax credit. Keep collecting.

- Growth hunters: U.S. banks offer better ROE upside if deregulatory talk in Washington turns into lighter capital rules. Valuations remain reasonable at ~10 × forward EPS.

- Tactical shift: We will remain under‑weight Canadian banks versus our benchmark until credit‑cost trends stabilize and condo inventories stabilize.

What do you think? If you’d like to discuss how this view fits your portfolio, contact us today.

Watch the Video: Canada’s condo Carnage and the Big Six Banks

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Cheers,

Glen