In 1853, while tens of thousands of fortune-seekers rushed to California’s gold fields, a quiet Bavarian immigrant took a different path. He must have chuckled watching city-folk arrive poorly outfitted for mining. Instead of staking a claim, he bought bolts of sturdy tent canvas and thread. While others were ripping their pants trying to strike it rich, he sold them rugged work pants. When the gold rush ended, and most prospectors were broke, this immigrant who’d never swung a pick had minted a business estimated to be worth about $855 million in today’s money. His name? Levi Straus.

Levi Strauss – photo Wikipedia

Strauss’s success is the classic “picks-and-shovels” lesson: supply the boom-time tools instead of chasing the boom itself. In the modern artificial intelligence (AI) rush, Nvidia is the obvious pick-supplier, but another unsung tool is reliable power. Training large AI models now consumes more electricity than some entire countries, and the fastest way to generate those electrons is still North American natural gas. Canadian energy firms may end up “covering the seats” of U.S. tech giants by fueling their data-center ambitions.

The Modern Gold Rush: Why Canadian Energy Is This Cycle’s Levi Strauss

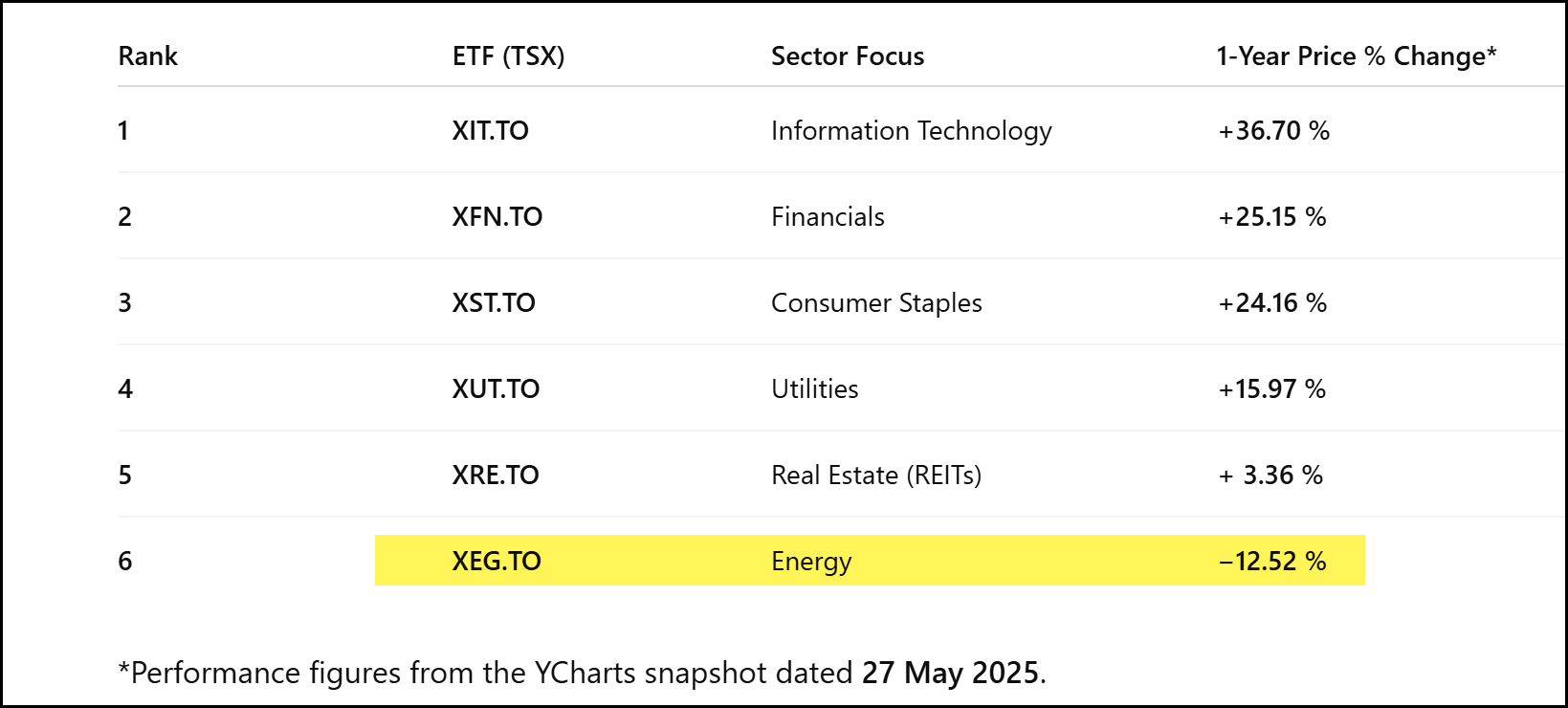

Last week’s Throne Speech staked Canada’s claim to become an energy superpower. At the same time, OPEC’s recent supply boost and tariff jitters have knocked crude below US $70, idling U.S. drilling rigs and setting up a future supply squeeze. Drill, Baby, Drill has fizzled and Canadian Energy now sits at the bottom of the TSX sector performance table.

Chart 1: TSX 1-Year Sector Performance—Energy trails the pack (YCharts, 27 May 2025)

Oil Slumps, But Gas Surges: What That Means for Canadian Producers

Crude has fallen more than 35% from its 2022 peak, yet natural-gas prices have almost doubled since last winter on LNG demand and new co-fired plants for AI campuses. The widening oil-to-gas spread means gas-levered producers already enjoy rising cash-flows, while oil-centric names are set up for a classic mean-reversion rally.

YCharts.com © 2025 YCharts, Inc. All rights reserved

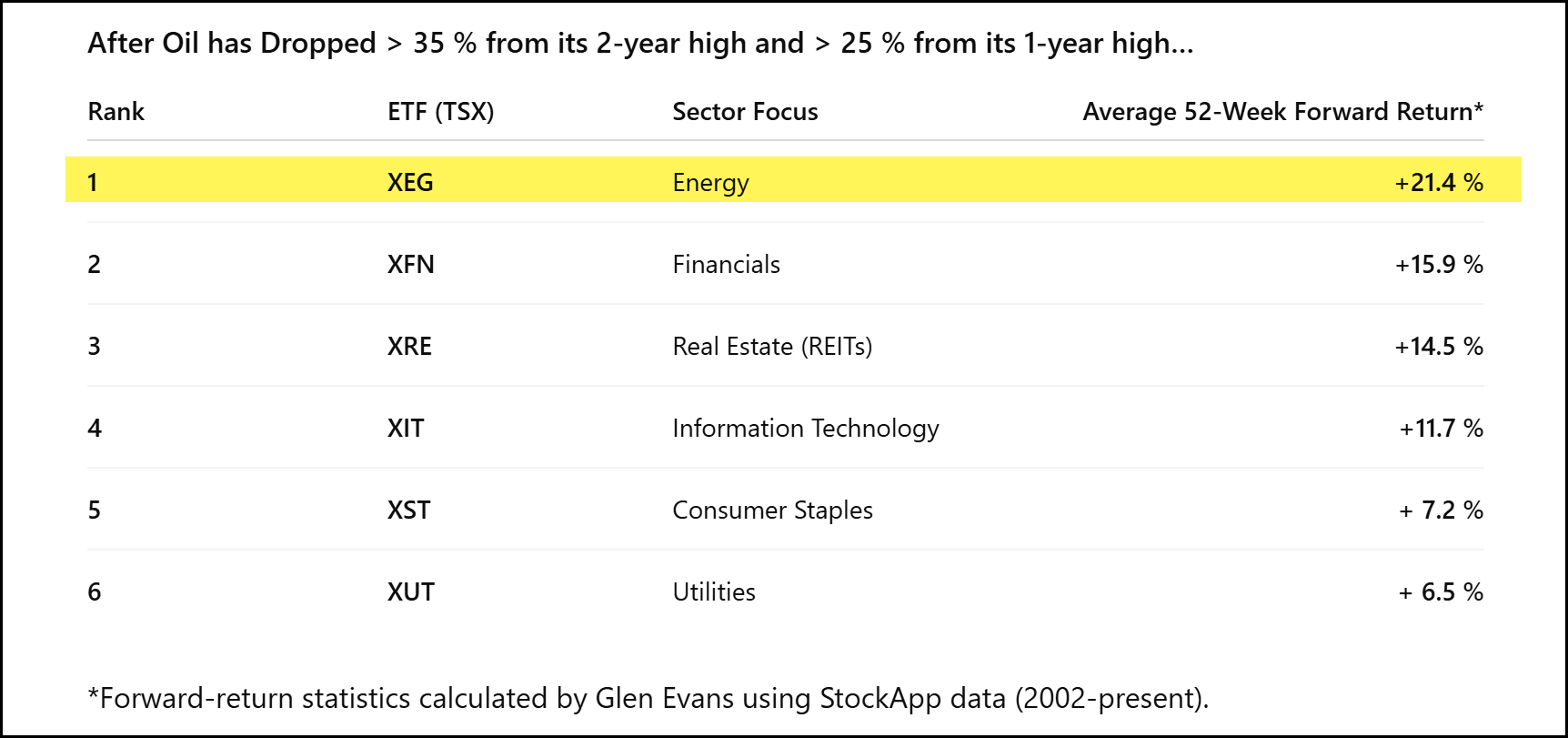

History Suggests a Strong Comeback for Canadian Energy Stocks

Across the past two decades, whenever oil has dropped > 35% from its two-year high and > 25% from its one-year high, Canadian Energy has delivered the strongest average 52-week rebound among major TSX sectors:

Chart 3: Average 52-Week Forward Returns after Large Oil Drops (2002-2025)

AI Needs Power—And Canadian Natural Gas Is Poised to Deliver

Training the next wave of AI models will require more electricity than a midsize country. Those electrons will be generated primarily by North-American natural gas and Canada owns some of the lowest-cost supply on the planet. In other words, while the world chases the glamour of AI, Canadian producers may again be the Levi Strausses of this boom.

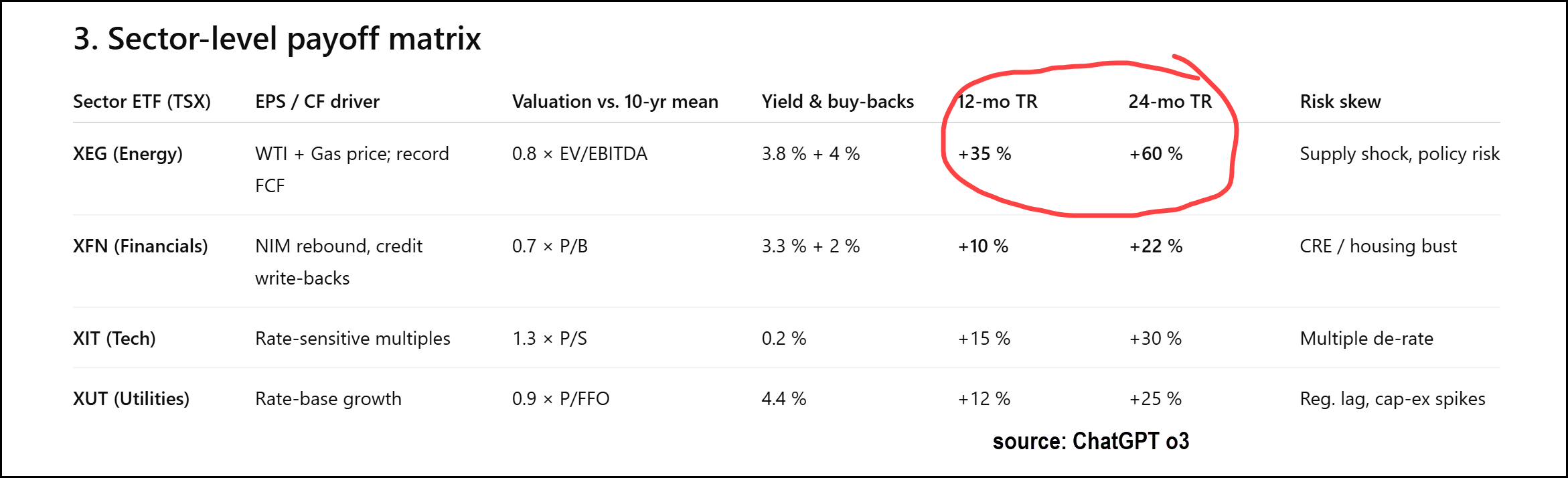

AI Confirms the Setup: Models Forecast Energy Sector Rebound

We pressure-tested the setup with an external AI research engine that digested 20+ years of commodity data and macro variables. Even after conservative assumptions—no new OPEC cuts and only moderate AI-power growth—the model still projects above average one and two-year gains for Canada’s beaten-down energy names.

Chart 4: AI-Adjusted Supply-Demand Model—WTI Path to US $85-95 by 2027

Balancing Growth and Stability: How We’re Investing in the AI Era

You know I’m an AI, nuclear, and technology bull—but Strauss reminds us that supplying the rush can be safer than joining it. That’s why we invest in both Growth and Stability:

- Growth arm: Nvidia, Microsoft, Celestica, Google and other AI-enablers.

- Stability arm: Canadian Natural Resources, Tourmaline, Enbridge, Cameco and other names that power the future.

Watch the Video: Artificial Intelligence and Canada’s Oil and Gas

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Want to see how this impacts your plans? Reach out today.

Glen