A Global Order Breaks at Davos

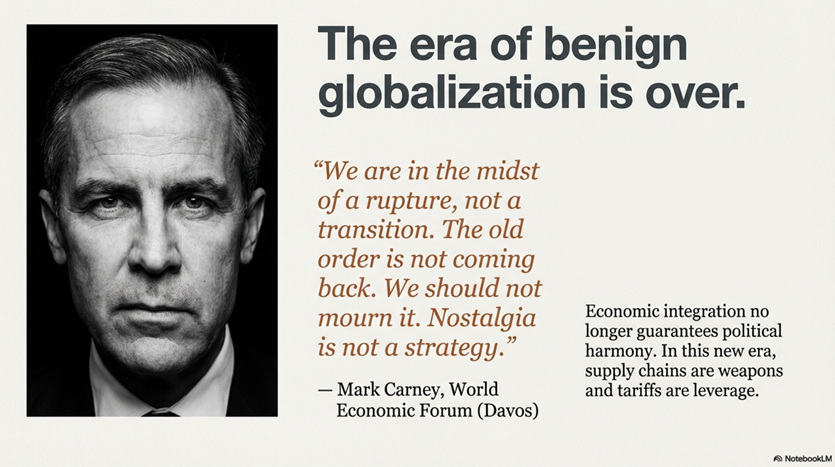

In Davos, Switzerland this week, Prime Minister Mark Carney did something remarkable. He told the truth—by admitting a lie.

“We are in the midst of a rupture, not a transition,” Carney declared to the World Economic Forum. “The old order is not coming back. We should not mourn it. Nostalgia is not a strategy.” Then, stopping short of an apology, he acknowledged the fiction at the center of the globalist dream: “We knew the story of the international rules-based order was partially false.”

From Globalization to Strategic Fragmentation

Coming from anyone else, this might sound like pessimism. Coming from Carney—the former central banker who spent decades architecting the very rules-based order he was eulogizing—it lands differently. Here’s what investors like you and I need to understand: the era of benign globalization, where economic integration would inevitably produce political harmony, is over. Supply chains are now weapons. Tariffs are leverage. The pleasant fiction has ended.

And the opportunity for investors has never been greater.

The Pivot From Bits to Atoms

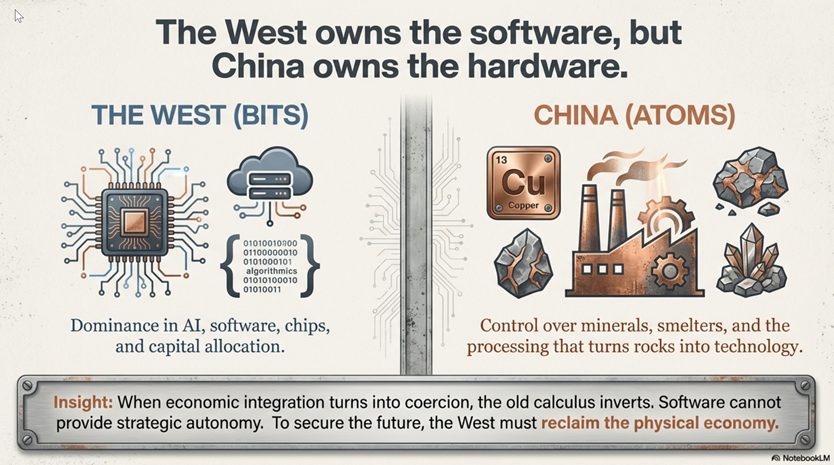

As we wrote in our Cold War 2.0 missive (read it here), for twenty years, the West outsourced the physical economy while retaining dominance in the digital. America built the software; China built everything else. The United States leads in Bits—AI, chips, capital. China controls the Atoms—the minerals, the smelters, the processing that turns rocks into technology.

According to Carney this era is over.

Why Canada’s Resources Suddenly Matter

When great powers begin using economic integration as coercion, the old calculus inverts. Suddenly, the countries with the rocks—the actual physical materials that power electrification, that build defense systems, that enable the AI revolution—possess something that software alone cannot provide: strategic autonomy.

And Canada? Canada has the rocks.

The Copper Thesis: Why Investors Should Care

Consider copper—the metal of electrification. Every EV requires 53 kilograms of copper versus 23 kg in a conventional car. Every data center powering AI, every grid upgrade enabling renewables, every defense system runs on copper wire. Demand is projected to rise from 27 million tons today toward 33 million tons annually as electrification accelerates.

Yet supply cannot keep pace. Major mine disruptions—Grasberg in Indonesia, El Teniente in Chile—tightened markets sharply in 2025. Copper finished the year up nearly 40%, its best performance since 2009. J.P. Morgan forecasts prices reaching $12,500 per metric ton by mid-2026. Goldman Sachs sees structural deficits emerging by 2029, with prices potentially reaching $15,000 per ton by 2035. BloombergNEF warns the shortfall could reach 19 million tons over the next 25 years without massive new investment.

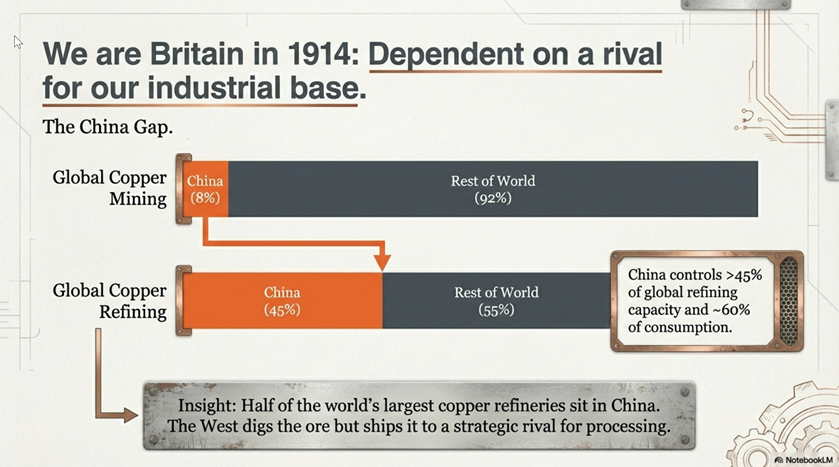

China’s Refining Chokehold

Here’s the chokehold that creates Canada’s opportunity: China mines only about 8% of global copper but controls over 45% of global refining capacity—and nearly 60% of consumption. Half of the world’s largest copper refineries sit in China. The West digs the ore but ships it to a strategic rival for processing. We are Britain in 1914, dependent on foreign smelters for the materials of our own industrial base.

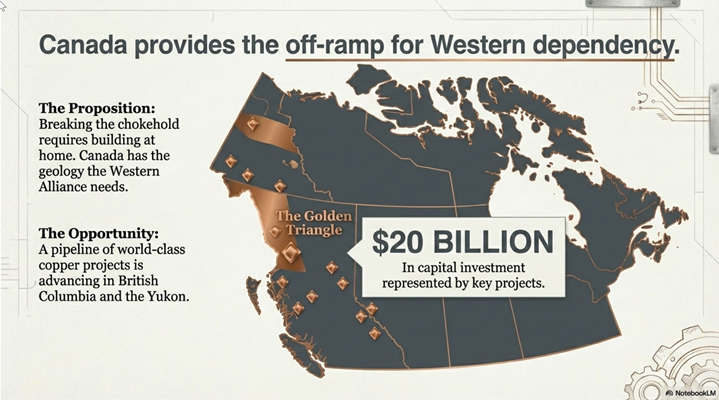

Canada’s Copper Project Pipeline

Breaking China’s chokehold requires building at home. The good news: we are finally building.

In British Columbia’s Golden Triangle and the Yukon, a pipeline of world-class copper projects is advancing that represents over $20 billion in capital investment:

KSM (Seabridge Gold) is now “substantially started”—securing its environmental permits indefinitely. With 7.3 billion pounds of copper and a 33-year mine life, it anchors the next generation of Canadian mining.

Casino (Western Copper & Gold) has attracted investment from Rio Tinto and Mitsubishi—Japanese capital explicitly seeking supply outside Chinese control.

Galore Creek (Teck/Newmont) pairs two of the world’s largest mining companies with resources exceeding 12 billion pounds of copper.

Yellowhead (Taseko Mines) offers a near-term production path with federal clean technology tax credits accelerating the build.

This is not theoretical. Shovels in the ground, capital deployed. Phase One—the iron and concrete stimulus—is underway.

The Missing Link: Smelting Capacity

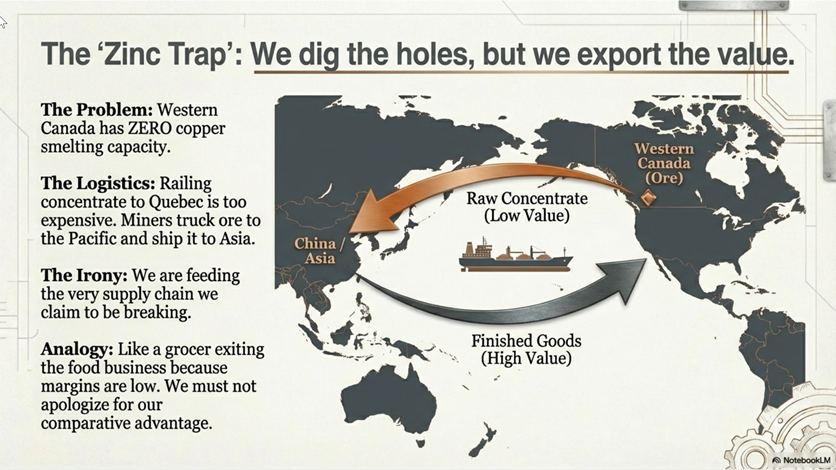

But here’s the uncomfortable truth: we dig the holes, then export the value.

Western Canada has no copper smelting capacity. Zero. The economics of railing concentrate across the continent to Quebec are prohibitive, so miners truck their ore to Pacific ports and ship it to Asia. We feed the very supply chain we claim to be breaking—what I’ve called the “Zinc Trap.”

Those who think Canada shouldn’t embrace its resource extraction expertise are like the new CEO of grocery store announcing he’d like to exit the grocery business because margins are low. Our comparative advantage is literally in the ground beneath our feet. The question is whether we’ll develop it or apologize for it.

Green Copper and Canada’s Competitive Advantage

The federal and provincial governments have finally recognized this. In December, Ottawa and Victoria launched a Request for Information for a Western Canadian copper smelter—a $2.5 to $3.5 billion facility that would close the supply chain loop. Better still, Canada possesses a unique competitive advantage: BC’s grid is 98% hydroelectric. A Canadian smelter would produce “Green Copper”—verified low-carbon metal commanding premium pricing as manufacturers race to meet emissions targets. Clean and secure. That’s the Canadian value proposition.

From Political Words to Industrial Work

Carney gets this. “Canada has what the world wants,” he told Davos. “We are an energy superpower. We have the most educated population in the world. We have capital, talent, and a government with the immense fiscal capacity to act decisively.”

These are the right words. Electrifying words.

But words don’t smelt copper. Words don’t build mines.

Why the Reindustrialization of Canada is Inevitable

Here’s what Carney knows: America cannot decarbonize or rearm without Canadian materials. And Canada has treaty obligations with the US (USMCA and Defense Production Sharing Act) that limit us in ways and require us to attend to the needs of the continent we share with the hegemon. We shouldn’t pretend otherwise. The Western Alliance needs a secure supply node outside Beijing’s leverage. We can be that node—the keystone connecting American technological demand with the atoms that make technology physical.

What we need now are premiers, advocates, and investors who understand that the “Re-Industrialization of Canada” is not a slogan but a strategic imperative backed by trillions in forced demand.

Briana and I are absolutely convinced that Canada’s brightest days are ahead of it—powered by electricity conducted by Canadian-smelted copper and generated by Canadian nuclear, renewable and oil gas production. In the world of atoms, Canada will lead, and investors who step up and participate will prosper.

Glen