Night Sky in Wyoming (Credit: Arthur Cauty)

Navigating by the Stars on a Cloudy Night

The combination of clear mountain air and expansive night skies in Wyoming’s Jackson Hole may be responsible for the clearest account of Central Banking in recent memory. Chairman Powell was unusually forthright when he admitted that the Federal Reserve was, “navigating by the stars on a cloudy night”. Talk about saying the “quiet-part” out loud!

Rare candour indeed from a technocrat that, along with our political leadership has created an inflation crisis unseen in almost 50 years. Appointed in Feb 2018, US CPI has rocketed over 22% higher during his tenure. No need to applaud.

CPI has increased 22% since Jerome Powell was appointed

source: Stockcharts.com

Tiff Macklem at the Bank of Canada started two years after Powell but has overseen an increase in inflation of almost 16% in just a little over 3 years. This isn’t a Powell bashing piece. Powell’s mea culpa is our own – we are all navigating by the stars on a cloudy night!

Smokescreens, Not Just Clouds

Clouds aren’t the only thing that make it hard for investors to navigate – smokescreens were used in naval battles to mask ship’s whereabouts, confounding the enemy and allowing tactical retreats. Nowadays, it’s harder to distinguish who is blowing smoke and why.

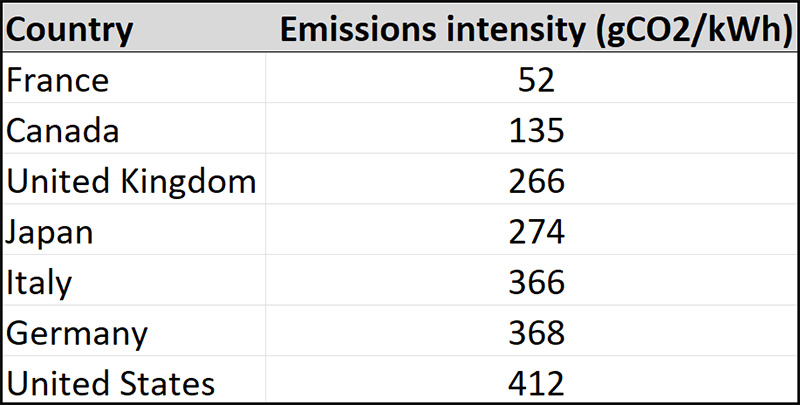

Take for instance the recently announced Clean Electricity Regulations (CER) proposed by the Federal Government in Canada. As I understand it, the intent is to drive Canada’s grid toward “net zero” carbon emission by 2035. Who would argue with that? But consider this – owing to abundant hydro and nuclear power generation, Canada’s grid is already a model of low carbon emission now – ranking second lowest in emissions among the G7:

source: Google Bard

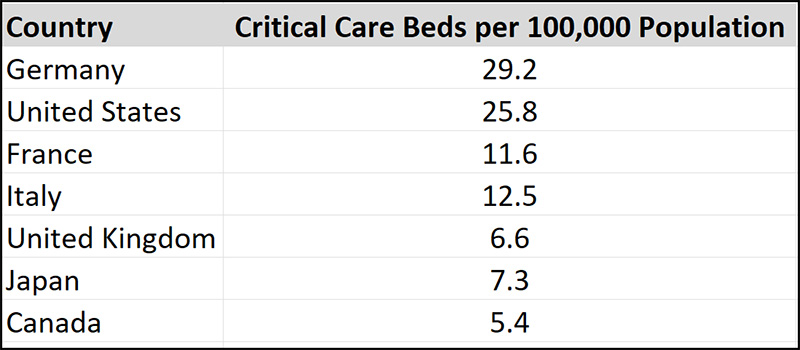

Canada’s grid emits just half as much carbon as the average G7 country! What’s that saying – “if it ain’t broke….”? If governing is the allocation of scarce resources (tax dollars) against competing interests than investing in an area of leadership means starving other initiatives of investment. What could be more important than climate change? Healthcare. The chart below shows we rank dead last in G7 Critical Care Beds per capita.

source: Canadian Medical Association Journal titled “Critical care capacity in Canada: How are we doing?”

According to data provided by the CMA, Canada has the lowest number of Critical Care Beds per 100,000 people than any other G7 country. This number will fall even further when Stats Canada acknowledges that they failed to count approximately one million students still in the country. Like many of you, I’ve seen loved ones struggle to get the care they deserve. Or take productivity – Canada ranks worst among the OECD countries for real productivity per capita. Surely, this crisis also needs solving. To say nothing of the housing crisis!

As laudable as climate initiatives may be, prioritizing them over addressing more existential crises seems like blowing smoke. How can we be confident that a government that can’t count its population or provide adequate healthcare to its citizens can be trusted to solve climate change?

Investors need to see through this smokescreen.

Investors Need Night Vision

There is an enduring lesson here for investors. Unlike our central bankers, who ran the economy onto the rocks of inflation by keeping the throttles wide open (and interest rates at 0%) in shallow rocky water. Or our governments that seem more concerned with virtue signaling than solving the everyday crises they have helped create, we need to develop night vision to help us navigate these times.

For me that means two things:

- Being humble.

- Making small mistakes.

1. Practice Humility in Position Sizing

In investing, humility can be expressed in position sizing. You’ve heard that diversification is critical for long term success – that’s not because diversification maximizes returns. Diversification minimizes the risk of catastrophic losses (see Powell’s track record).

Today’s AI enthusiasts are probably getting ahead of themselves. As powerful as this technology is, betting more than a manageable amount can lead to losses. There is a conceit that today’s leaders will be tomorrows as well, and that justifies ever higher prices. (Today, market darling Nvidia is trading at 116 times earnings!) What could possibly go wrong?

Competition may be closer than we think. China’s Huawei shocked the world this week with a new cell phone that used a Chinese chip that features 7 nanometer construction. US sanctions on China were thought to have made this kind of advance impossible. Previously, only Taiwan Semiconductor had shown the capacity to fabricate such specialized chips at scale. Make no mistake, competition will come! – https://www.reuters.com/technology/teardown-huaweis-new-phone-shows-chinas-chip-breakthrough-2023-09-04/

2. Make Small Mistakes, Not Big Ones

I know I’m going to make mistakes – so I focus on trying to make my mistakes small. That generally means not adding to losing positions and sometimes it means cutting losses on positions that have gone against me.

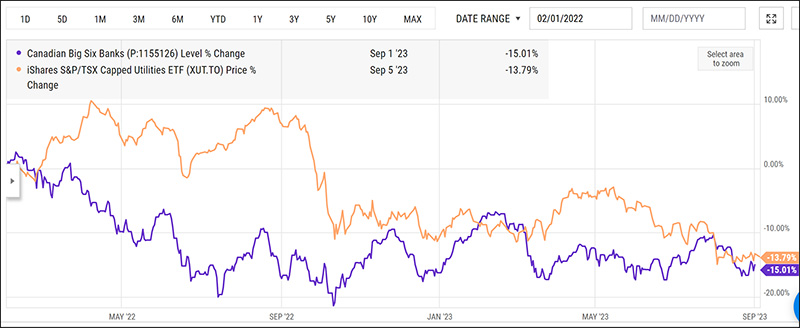

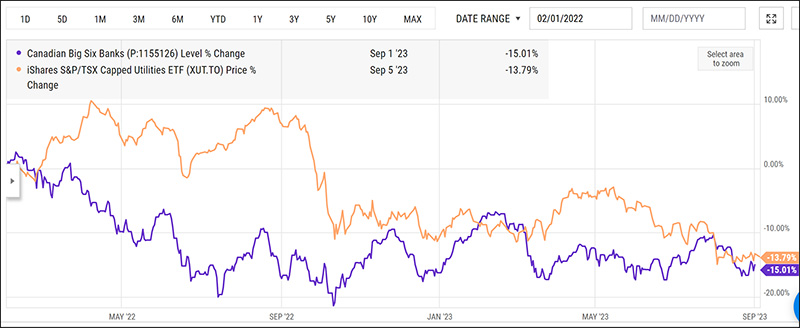

It also means sticking to a discipline. The simple fact is that no investment strategy outperforms at all times. Consider the financial stocks and the utility stocks in Canada. These high dividend paying sectors are the bedrock of the Canadian stock market – and yet they have struggled as interest rates have spiked:

source: YCharts

Several Canadian Banks are down almost double the average performance of the Big Six Bank shown above!

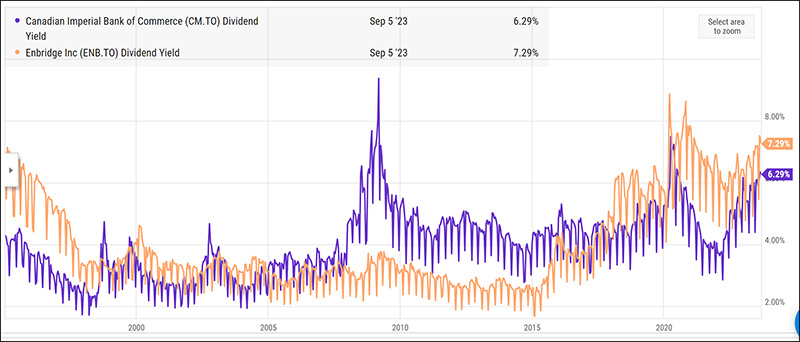

Making small mistakes in the context of market setbacks means recognizing that one sure way to make a problem worse is to extrapolate short term performance into the future. Sure the Big Six Banks and Canadian Utilities are struggling this year – but that probably represents a better opportunity than a risk! Take a look at the Dividend Yield of Enbridge and CIBC:

Investors buying these securities today are getting a dividend yield close to the all-time highest of the past 25 years (no this isn’t a recommendation). If history is any guide, these out of favour bulwarks of the Canadian investment landscape will return to favour once the interest rates cycle is complete. Investors are being paid handsomely as we wait for these sectors to recover.

Fog Is the Norm, Not the Exception

Powell is right to observe that the Fed is “navigating by the stars on a cloudy night”. His mistake (and potentially ours too) is to have not realized that those sailing conditions are the norm.

A big benefit that smaller retail investors like you and me have over the big shots – we’re unlikely to believe in our own infallibility!

Safe travels!