The Year Without a Summer: When Volcanoes Changed the Climate

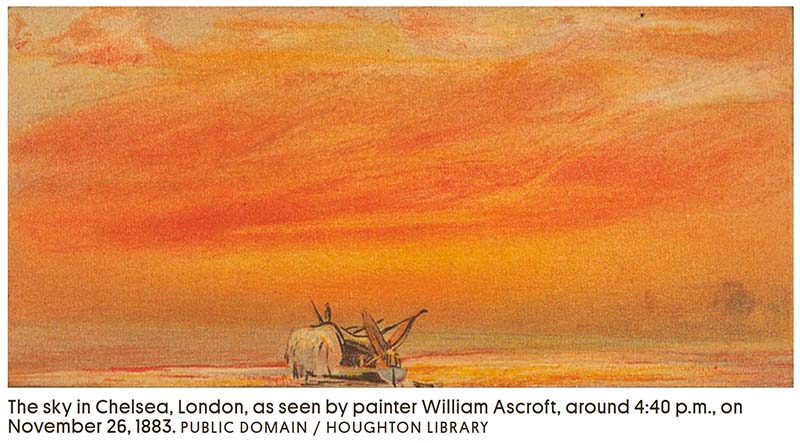

In 1815, Mount Tambora, in modern day Indonesia, erupted spectacularly, sending about 10 cubic miles of rock and dust into the atmosphere. Heard from over 2,600 miles away, the largest ever volcanic eruption in the past 13,000 years spewed ash and sulfur dioxide into the stratosphere blocking the sun and causing the global temperature to drop. This cooling caused global crop failures in 1816. Mount Krakatoa’s 1883 eruption similarly dropped US temperatures by nearly 1.2 degrees celsius. The ash cloud from Krakatoa cooled the globe and created beautiful sunsets like this one in London.

Shipping Emissions: The Surprising Role of Sulfur Dioxide

More recently, changes to shipping fuel regulations have resulted in less sulfur dioxide being released by the global shipping industry. Sounds good right? Actually, it’s a mixed bag – the reduction in sulfur dioxide is thought to be responsible for increased ocean surface temperatures! This has prompted researchers to wonder if the sulfur dioxide emitted in shipping has been masking some of the global warming – source.

source: https://www.carbonbrief.org/analysis-how-low-sulphur-shipping-rules-are-affecting-global-warming/

Can We Engineer Cooling Without Eruptions?

The reduction in sulphur dioxide in the atmosphere causing warming is likely to be studied closely by geo-engineering scientists who have been interested in seeding the stratosphere with sulphur dioxide to scatter sunlight and make clouds more reflective. If you’re like me, you shudder at the idea of large scale geo-engineering projects like this. source https://www.technologyreview.com/2019/08/09/615/what-is-geoengineering-and-why-should-you-care-climate-change-harvard/

The Carbon Problem: Flow vs. Stock

You might be wondering why we’d even be considering this. The depressing answer is that all our efforts to reduce emissions are unlikely to be sufficient to reduce the amount of greenhouse gases sufficiently to ameliorate warming. Simply put – our well-intentioned efforts to reduce emissions will be insufficient to achieve what climate scientists claim is required. These efforts only reduce the annual “flow” (or increase) in CO2 emissions. They do nothing to reduce the “stock” (the aggregate amount of carbon in the atmosphere). In truth the problem continues to worsen – albeit at a slower pace.

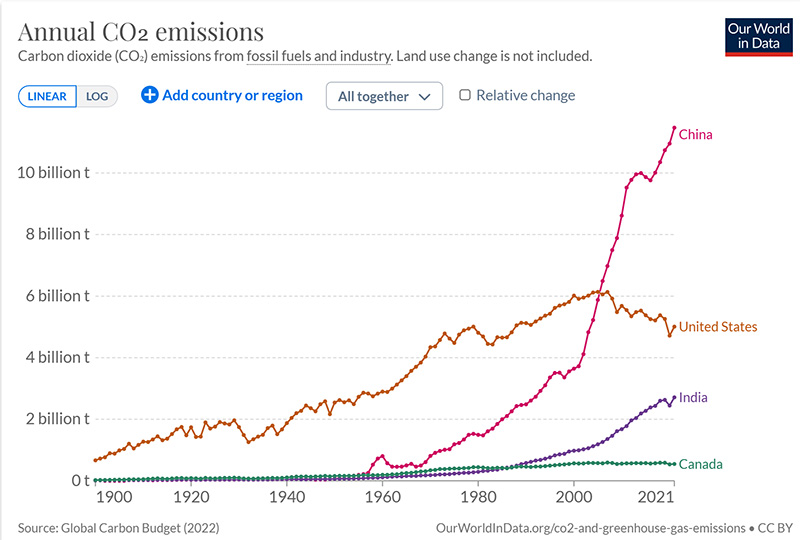

Annual CO2 emissions continue to grow. You can see that the United States has substantially reduced annual emissions and Canada has been able to cap emissions, but the developing world is sharply increasing emissions – more than offsetting the cut backs elsewhere. SImply put, China and India are not onboard. Do any of us really think these trends are going to change? To me, the idea that the developing world is going to abandon energy-dense hydrocarbons in time to achieve the net zero 2050 commitments is delusional.

Reducing emissions will not solve climate change. This annual output can be thought of as the “flow” of carbon emissions. That’s what climate activists and our government leaders are chiefly focused on – reducing emissions by taxing carbon and punishing emitters. If China, India and the developing world don’t play ball – this will never be achieved at a global scale.

Of more concern to me is the “stock” of carbon emissions (really of greenhouse gases of which CO2 is a small fraction). This is the aggregate amount of carbon that has already been emitted into the atmosphere and that continues to increase regardless of our willingness to sacrifice our economies on the altar of climate change. Wouldn’t it be nice if we could just remove the carbon from the air?

Canada’s Direct Air Capture Tech: A Global Solution?

A client recently recommended a new book on the subject called Scrubbing the Sky, by Paul McKendrick. It admirably distinguishes between the stock and flow problem of climate change, building the case that we should be focusing more effort on removing the stock of C02 in the atmosphere. Turns out that Canada features in the story.

Canada’s own Carbon Engineering technology is featured in the book. Coincidentally, Carbon Engineering was recently acquired by Occidental Petroleum and is set to showcase the first commercial Direct Air Carbon Capture installation in 2025 in Texas. source: https://leaderpost.com/commodities/energy/oil-gas/warren-buffett-backed-occidental-buy-carbon-engineering Notice the buyer was an oil company? Who better knows how to engineer complex systems and scale innovative technologies?

Carbon Engineering is also an advisor to the XPrize. Recently, the XPrize announced a $100 million dollar prize (funded by Elon Musk) to bring the cost of Direct Air Capture down below $100/ton. Fifteen milestone winners out of 287 applicants have received funds to further their research.

Climate Tech Investing: Risk, Reward, and Irony

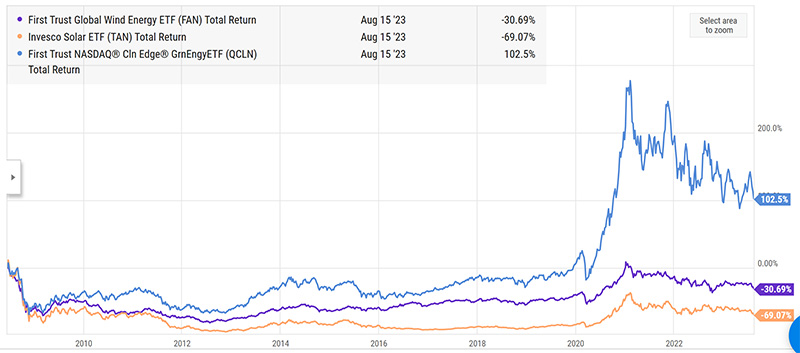

I continue to puzzle over the best way for investors to participate in the decarbonizing trend. Despite the promise of massive government largesse, Wind and Solar ETFs have historically struggled compared to the Green Technology ETF but the very high volatility remains a major concern. And despite a sharp rise in 2021 they have been unable to find traction even with the Biden Inflation Reduction Act. This area is increasingly difficult for individual investors.

source: YCharts

Will Oil Companies Lead the Carbon Capture Revolution?

I ran the numbers on direct air carbon capture technology using current cost estimates of $200/ton. A little back of the envelope math (actually using ClaudeAI) revealed that the “flow” of carbon emissions is an increase of about 2.2 billion tons per year. If Occidental Petroleum is able to demonstrate that Carbon Engineering plants can remove 1 million tons/year we’d need 2,200 units to remove the “flow” of global carbon emissions. Building these plants would cost somewhere around $440 billion. That’s a pittance – a mere 0.47% of global GDP! Less than the current global subsidies for oil and gas companies.

If history is a guide, the XPrize will spur development in this nascent field and bring costs substantially lower. Then scales of economy will further reduce costs as manufacturing processes improve. As this technology advances we will be able to also reduce the “stock” of CO2 in the atmosphere.

Sunrise or Sunset? The Future of Climate Solutions

What should investors do? Good question! While many assume the oil and gas industry is now in its sunset years – how ironic would it be if the best investment for environmentally conscious investors was Occidental Petroleum! If the Carbon Engineering acquisition pays out like Warren Buffett thinks it will, that strikes me as a real possibility.

You know that I’m a techno-optimist. While I’m dubious that we will solve our carbon crisis solely by focusing on cutting emissions — adding a technology that solves the problem strikes me as highly plausible and more consistent with our innovative nature. In the end I believe we will solve our problems – with or without assistance from volcanoes.

Glen