Exciting news, Briana is taking on a larger role at Evans Family Wealth. Don’t worry—I’m not going anywhere—I’m just taking advantage of her studies to help us all improve our investment returns! Before I get into the details, let me tell you a basketball story…

From Point Guard to Portfolio Management: Briana’s Journey

Briana played point guard on her highschool girls’ basketball team. The coach was impressed with Briana’s dribbling, ball control and passing. Her shooting? Not so much! Early in her ‘career’, her first bucket eluded her for several games. That might explain why when she recovered a rebound under the net and scored she shot both hands in the air and screamed “Yayyy!” as though she had scored the winning goal in extra-time on the soccer pitch. I remember this because I was screaming in the bleachers as well. We celebrate our wins in the Evans house!

Briana Evans to Lead Mutual Fund Strategy at Evans Family Wealth

Today I’m having Briana “take point” on our mutual fund business. Having successfully passed all three levels of the CFA program, she is highly qualified to analyze this important part of the business and implement improvements. While she continues to work toward earning her charter, I’m tasking her not just with analyzing performance but also with assessing costs. Where possible, we’re going to recommend lower-cost ETFs as replacements.

Enhancing Our Mutual Fund Trading System for Better Performance

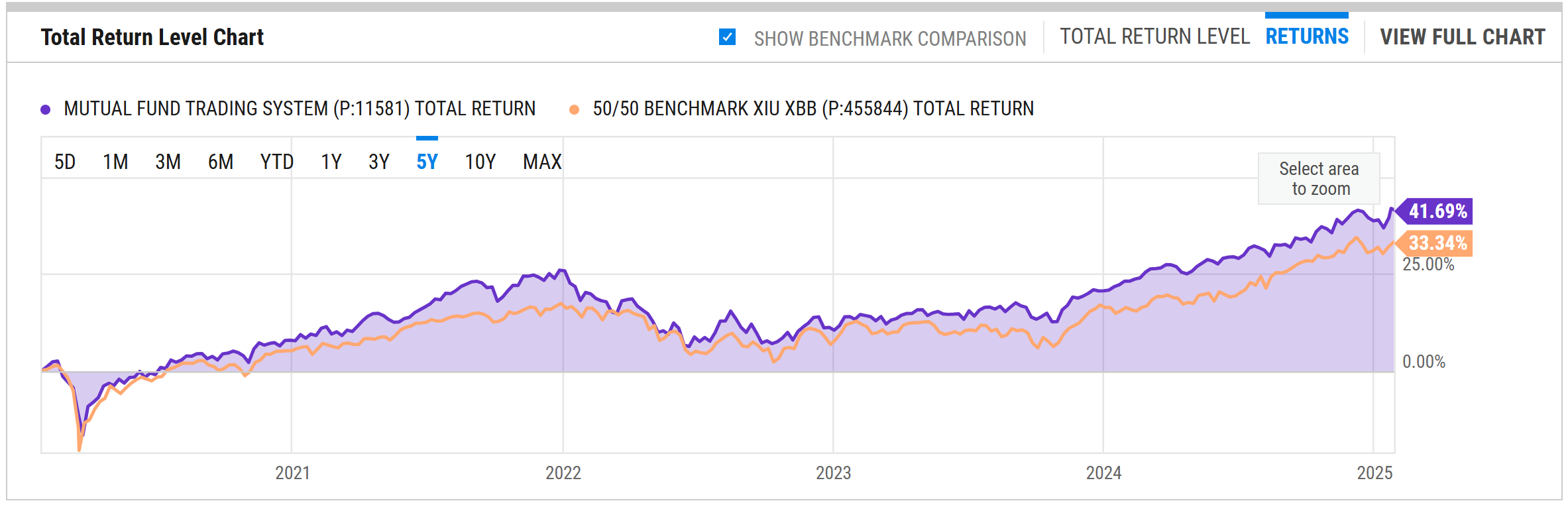

While the Mutual Fund Trading System has performed well, it is due for a refresh. Our goal has always been for our model portfolio to outperform the 50/50 stock and bond portfolio in Canada. We’ve achieved that goal, but we think we can do even better.

YCharts.com © 2025 YCharts, Inc. All rights reserved

This work will take time and will be ongoing. Our aim is simple, to make sure that you are getting the best value for your investment dollars. Briana will do the research and due diligence, then together we will decide on changes and she will reach out directly to you as needed to make improvements.

6+ Years of Experience: Briana’s Growing Role in Wealth Management

Briana has worked with me for over 6 years, completing the CFA exams (and others) along the way. You’ve come to know her as a skilled and conscientious assistant (I get many compliments on her efficiency) now you’ll get to see her ability in portfolio management.

Please join me in congratulating Briana on this next step in her investment career. Let’s cheer her on from the bleachers! After all, her success will be your success!

Glen