AI Hallucinations and Fiscal Hallucinations

Anyone who’s used ChatGPT knows the feeling: it speaks with absolute confidence even when it’s completely wrong—that’s called a hallucination. Recent research found something interesting though. When you penalize AI models for wrong answers and reward them for saying “I don’t know,” the hallucinations drop dramatically. Turns out humility beats confident misinformation.

I’ve worked with Large Language Models enough to develop an “ear” for hallucinations. Now I’m hearing echoes of hallucinations in the reporting about the list of 32 Infrastructure Projects leaked to the Globe and Mail. As a saver and investor, you’ve probably developed a similar ear. When you hear someone in authority invent new phrases and categories, you should be alert to hallucinations.

Canadians have recently heard newly coined terms like “decarbonized oil” and “global climate competitiveness” in describing these major projects. Beware—those investment categories don’t exist, they’re hallucinations, dressed up as an investment thesis.

These spending decisions aren’t just policy questions. They’re market factors that affect every Canadian investor. Fortunately, we don’t have to look far to see the consequences of making poor bets with taxpayer funds.

Northvolt’s Collapse: A $7 Billion Lesson for Investors

In 2023, Ottawa and Quebec announced their $7 billion EV battery plant deal with Sweden’s Northvolt. Politicians lined up for the photo ops, calling it nation-building infrastructure.

From an investment perspective, the numbers should have raised red flags immediately:

Quebec committed up to $2.9 billion. Ottawa pledged $4.4 billion. Here’s what actually happened:

- Quebec advanced $510 million upfront

- $270 million went to equity (total loss)

- $240 million was a land loan (likely impaired)

- Northvolt built nothing and declared bankruptcy in 2025

- Ottawa never disbursed funds, but only because the project collapsed first

Northvolt: The Numbers

- Total commitments: $7.4 billion

- Taxpayer exposure: $510 million

- Return on investment: -100%

- Assets created: Zero

Venture capital is difficult and the risks are high. This is exactly why I don’t put client savings into venture capital, new issues, or private equity deals. I manage your money as if it were my own family’s retirement fund. The Northvolt outcome illustrates why governments make poor venture capitalists: they lack the due diligence discipline that comes from risking your own capital. Humility keeps you solvent.

Fiscal Policy as a Market Risk

The broader concern isn’t political but fiscal. Canada’s debt-to-GDP ratio continues climbing, and projects like these add pressure to our currency and bond markets at a time of rising interest rates.

Carbon Capture and Climate Projects: Costly Misfires

Consider the Pathways Alliance carbon capture project: $16.5 billion in proposed spending for technology that has consistently underperformed globally. Previous Canadian attempts tell the story:

- Genesee (Alberta): $2.4 billion project canceled as economically unviable

- Boundary Dam 3 (Saskatchewan): $1 billion spent, captures 57% vs. promised 90%

- Alberta Carbon Trunk Line: Heavily subsidized, consistently behind targets

Market Reality Check

- Government success rate on large tech bets: Poor

- Private capital discipline: Avoids unproven technologies

- Portfolio impact: Currency and bond exposure to fiscal outcomes

Each failed project represents capital that could have reduced debt, lowered taxes, or improved infrastructure that actually generates economic returns.

Churchill LNG Port: subsidies on Thin Ice

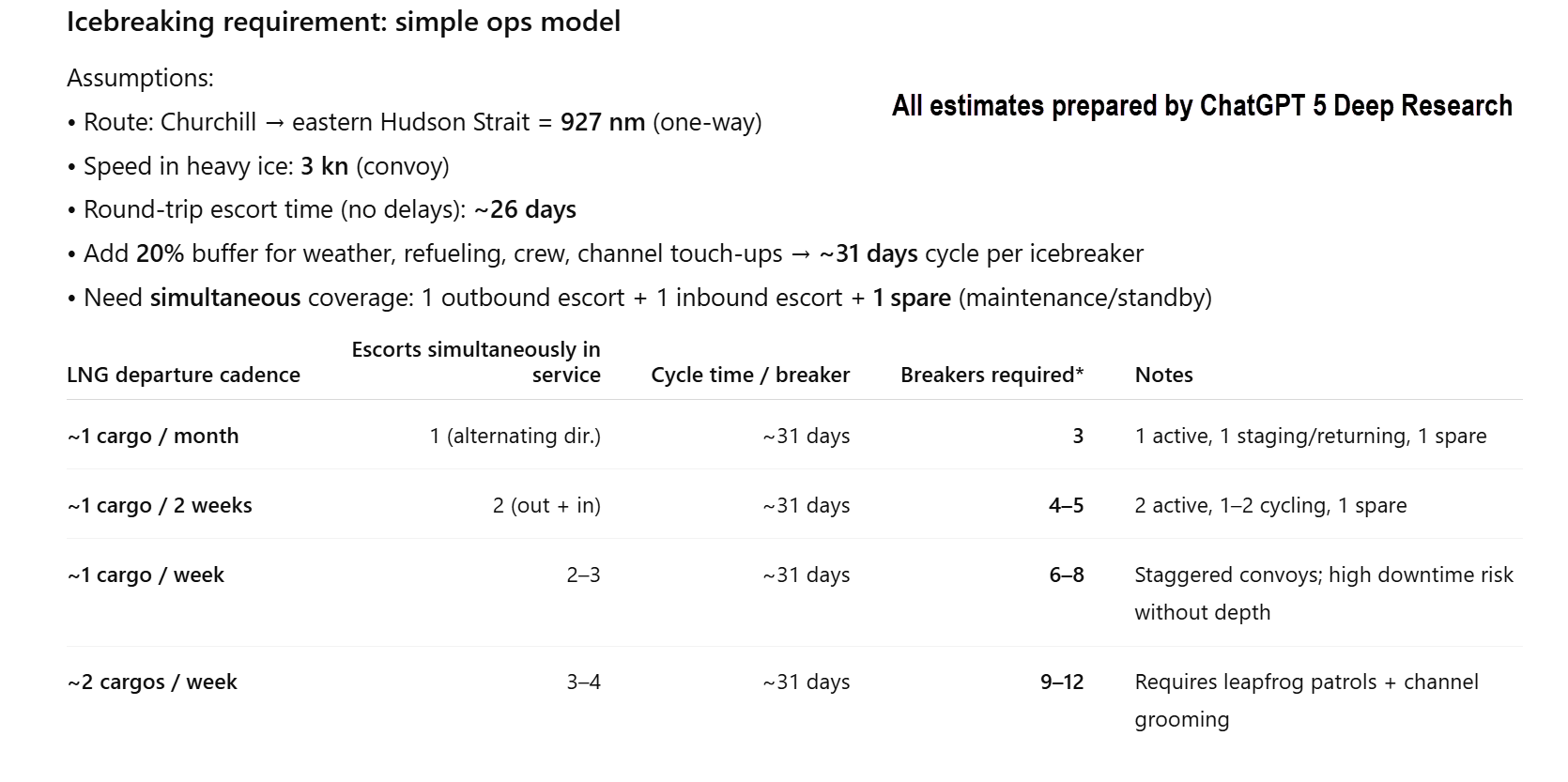

The Churchill LNG proposal illustrates how fiscal hallucinations compound into real market risk. Politicians can call Arctic shipping “strategic infrastructure,” but the economics remain unchanged: shipping just one LNG cargo biweekly, through 927 nautical miles of thick ice would require 4-5 icebreakers and take 31 days, pushing transport costs from the normal $8-12 million per cargo up to $70 million. The seasonal shipping window makes utilization rates economically impossible without massive ongoing subsidies.

For Canadian investors, the question to be asked is who pays the subsidies?

Canada Polar Icebreaker

For those of you interested, here are the details, feel free to jump ahead if the details don’t interest you:

For bond investors, these commitments represent future obligations. For currency holders, they signal fiscal discipline concerns. The Loonie’s performance often reflects international confidence in our fiscal management.

Investment Discipline: Protecting Your Portfolio

My approach to your portfolio reflects the same discipline that makes successful private investors avoid government venture plays:

- Focus on proven business models. Companies that generate cash flow without subsidies tend to survive market cycles and government policy changes.

- Avoid speculative ventures. Whether it’s carbon capture technology or Arctic shipping routes, unproven concepts carry venture capital risk levels that don’t belong in retirement portfolios.

- Value preservation first. I treat your savings as I would my own family’s money, which means avoiding the kind of over-confident bets that led to Northvolt’s collapse.

Canada’s Deficit and Market Positioning

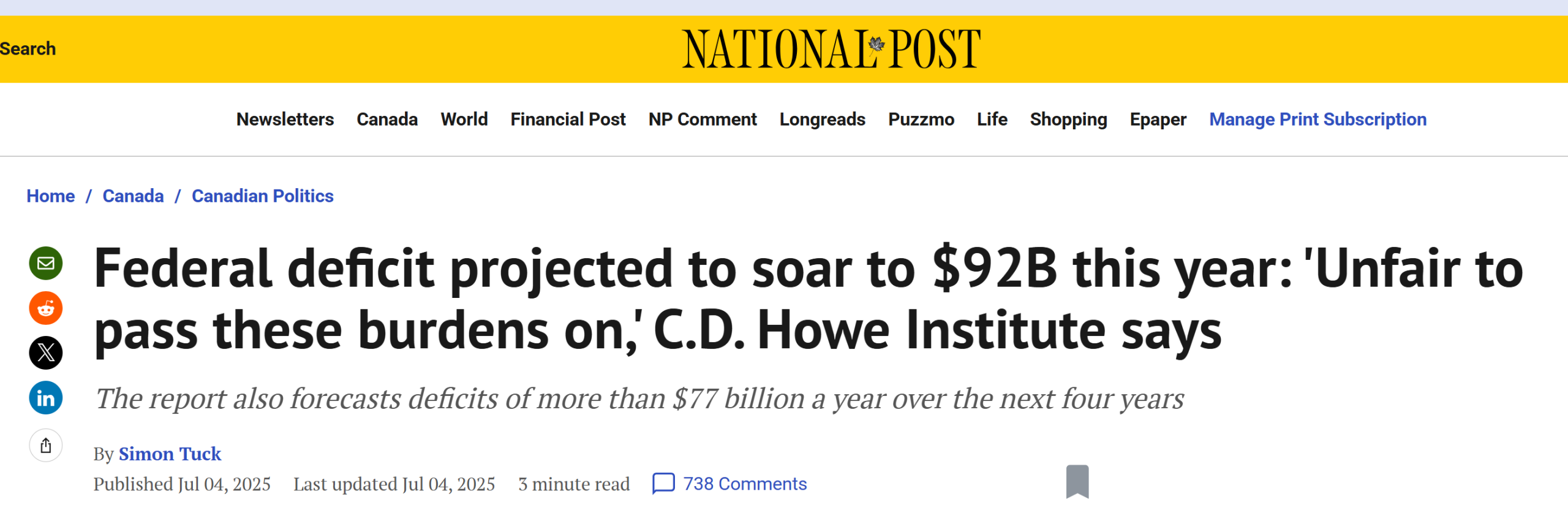

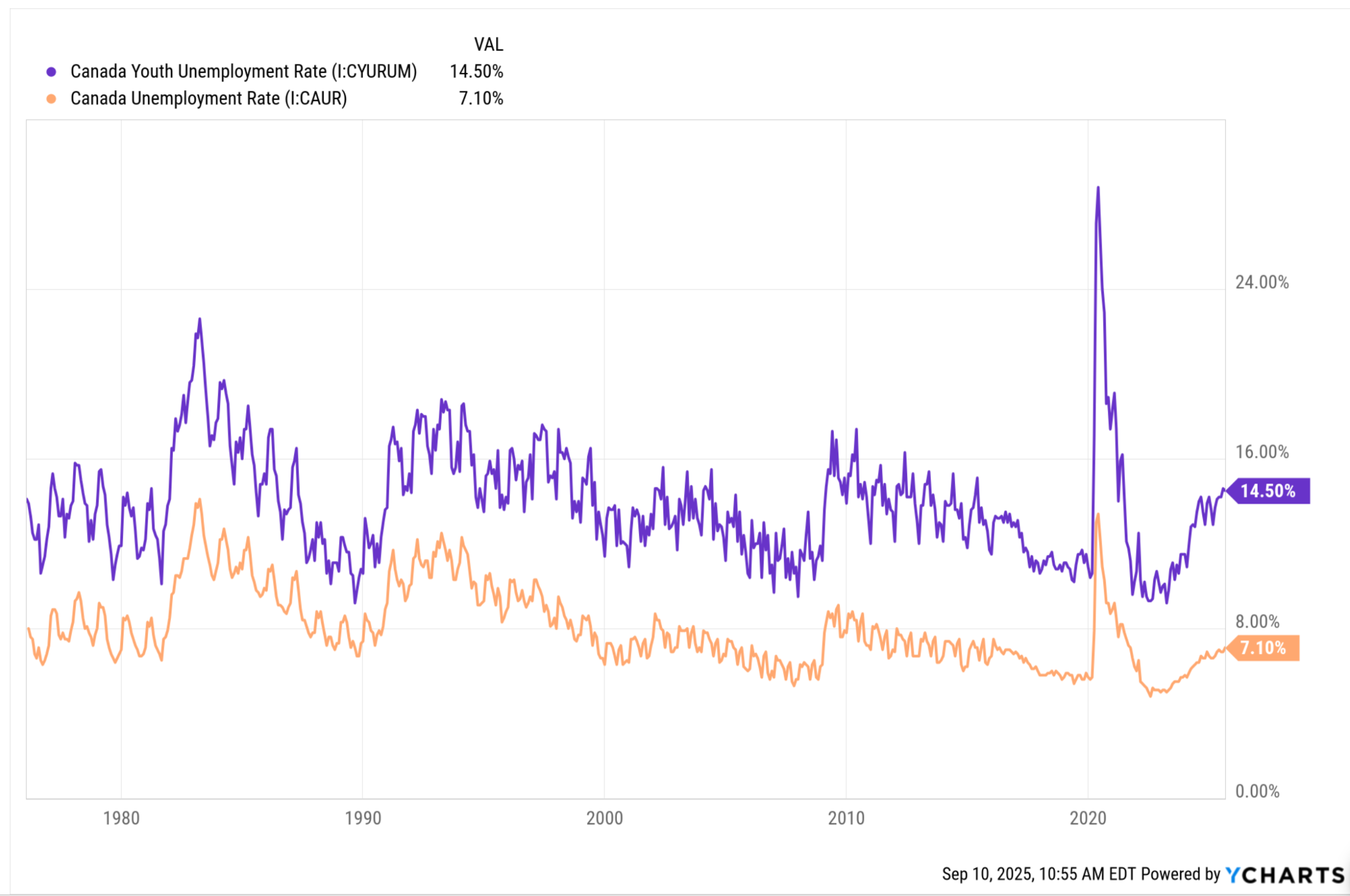

With deficit projections approaching $100 billion (see headline below), Canadian investors face renewed currency and bond market pressures. The Northvolt loss represents just one data point in a larger trend of spending commitments that are unlikely to generate the promised returns at a time of increasing unemployment (see chart below).

Huge spending plans are meeting a rapidly decelerating economy with unemployment spiking. This is a toxic mix for the government’s books—outlays for social support are increasing while tax revenue is decreasing making the deficit larger.

YCharts.com © 2025 YCharts, Inc. All rights reserved

Professional money management means being honest about uncertainty while protecting what’s certain. Your savings represent years of hard work. They deserve the same careful discipline you used to earn them, not speculative bets on government venture projects.

That means avoiding venture-stage bets, whether they come from government or private markets, and focusing on businesses with proven track records, sustainable competitive advantages, and cash flows that don’t depend on subsidy renewals.

Bottom Line: Avoid Over-Confident Bets

AI researchers are solving the hallucination problem by teaching models to say “I don’t know.” Portfolio management has always worked the same way: when you’re not sure, don’t bet the ranch.

Government venture capital experiments like Northvolt remind us why professional money managers stick to proven investment principles. It should remind taxpayers why governments might be better at removing regulations that inhibit investment and discourage the private sector from risking their own venture capital. Your retirement savings and tax dollars deserve better than over-confident guesses.

Watch the Video: Hallucinations in AI and Ottawa’s $100B Spending Plans

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen