The headline that stopped Canadians in the bread aisle

Last week Canada’s Competition Bureau announced a proposed $550 million settlement with grocers and bread producers who admitted to coordinating wholesale price increases for roughly 14 years. Investigators estimate that Canadians paid $4 to $5 billion more for everyday bread than they otherwise would have. No executive faces criminal sentencing; the companies will simply write a check and move on.

For consumers, that outcome feels unfair. For investors, it is a stark reminder of how lucrative market concentration can be.

What Is a Canadian Oligopoly and Why Does It Matter?

An oligopoly is a market dominated by a handful of players who enjoy high barriers to entry, pricing power, and lobbying muscle. When competition is muted, margins and returns on capital tend to stay elevated for years.

Canada is fertile ground for these structures:

Add a regulatory framework that sets a high bar to block mergers, and the moat deepens.

Oligopoly Outperformance: The Data Speaks

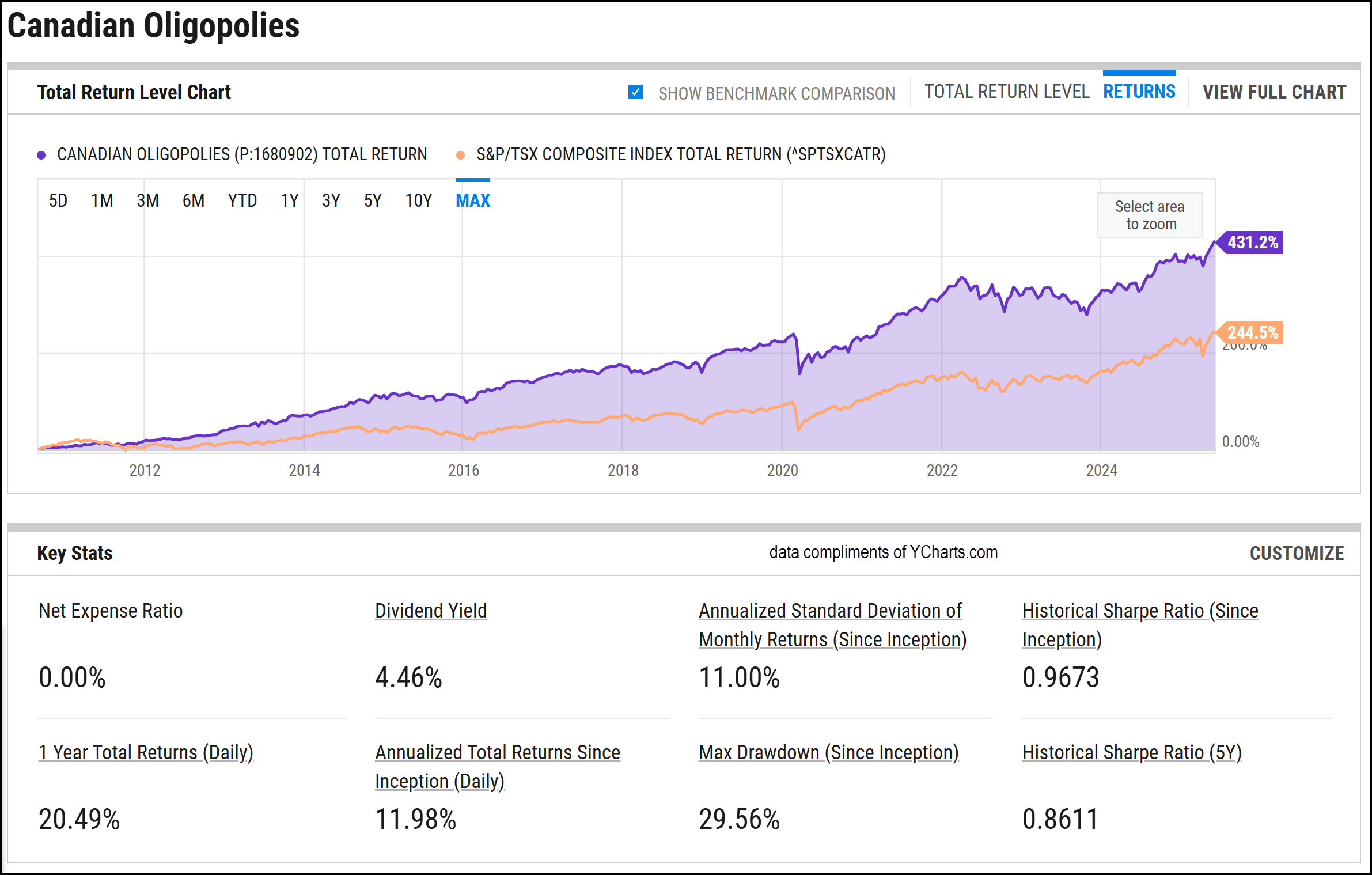

Since 2010 an equal-weight basket of 16 large-cap Canadian oligopoly names has delivered a total return of 431%, handily beating the 245% return of the S&P/TSX Composite. Even I was surprised by this outperformance. Here’s the bottom line: Concentration has paid shareholders—even as consumers complain about prices.

Past performance, of course, is not predictive. Regulatory backlash, political pressure, or technological disruption can erode moats faster than history implies. Still, the long run of out-performance highlights why global allocators routinely overweight Canadian incumbents.

YCharts.com © 2025 YCharts, Inc. All rights reserved

How Evans Family Wealth Positions Client Portfolios

As an Ottawa Wealth Management leader, at Evans Family Wealth we take markets as they are, not as we wish them to be. Our Canadian equity sleeve purposefully tilts toward entrenched champions in banking, telecom, and energy infrastructure—but we balance that exposure with diversified global and international exposure and thematic exposure to dominant leaders in growth industries. We overlay a tactical asset allocation strategy to de risk portfolios when necessary. This pragmatic mix has worked well for the families we’ve helped guide through multiple market cycles.

Should You Invest in Canadian Oligopolies?

If you live in Canada you already pay oligopoly prices for food, data plans, and bank fees. Owning a slice of the profits can help offset that cost. The key is sizing positions properly and understanding the policy risks. As an Ottawa Investment Advisor committed to evidence-based decision-making, we can show you exactly how much of your portfolio, if any, belongs in these high-moat names and how to integrate them with your broader goals.

Next Steps: Turn Market Reality Into Portfolio Results

Reserve a 30 minute strategy call with our team and discover how our disciplined wealth-management process converts Canada’s oligopoly profits into long-term, tax-efficient compounding for your family; there’s no cost or obligation.

Watch the Video: Artificial Intelligence and Canada’s Oil and Gas

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen