Why Carney’s Portfolio Matters More Than His Speeches

Prime Minister Mark Carney’s book, Value(s) argues that how we invest our capital is the clearest expression of the values we actually hold. In his recent ethics disclosure, Canadians got a rare glimpse into both his investment acumen and his values.

The biggest bombshell? It’s not the cheap “gotcha” that he owns fossil fuel and mining companies like Canadian Natural Resources and Teck. The real shocker is that the man who once helped safeguard Canada’s Big Six Banks now has zero personal investment exposure to them.

In structuring his “blind trust,” Carney reportedly transferred his assets rather than liquidating them. The non-partisan group Democracy Watch reports that he instructed the trustee to freeze the portfolio rather than allow the trustee to make changes. If true, that makes the disclosure even more significant—because it reflects conviction, not convenience.

We’ll leave the political commentary to the pundits. For Canadian investors, here are three practical lessons we can take from the portfolio of the country’s most famous central banker and investor:

-

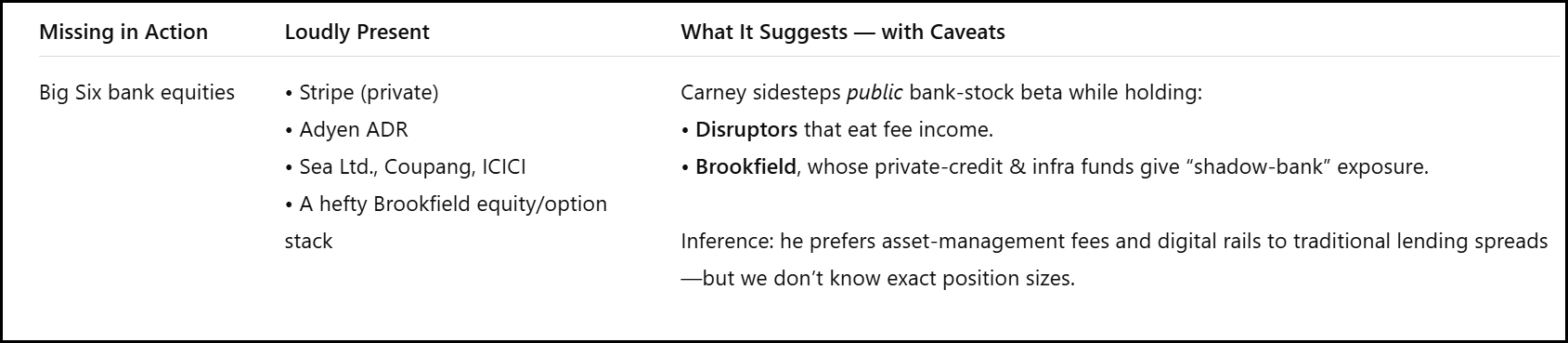

Why Carney Favours Fintech Over Canadian Banks

Carney appears tactically bearish on the Canadian banking sector. Remember, financials make up nearly 30% of the TSX. He owns none of BMO, TD, Scotiabank, CIBC, Royal Bank, or National Bank.

Instead, his portfolio includes meaningful exposure to fintech disruptors like Stripe, Adyen and others that directly target bank fee structures and consumer finance margins.

-

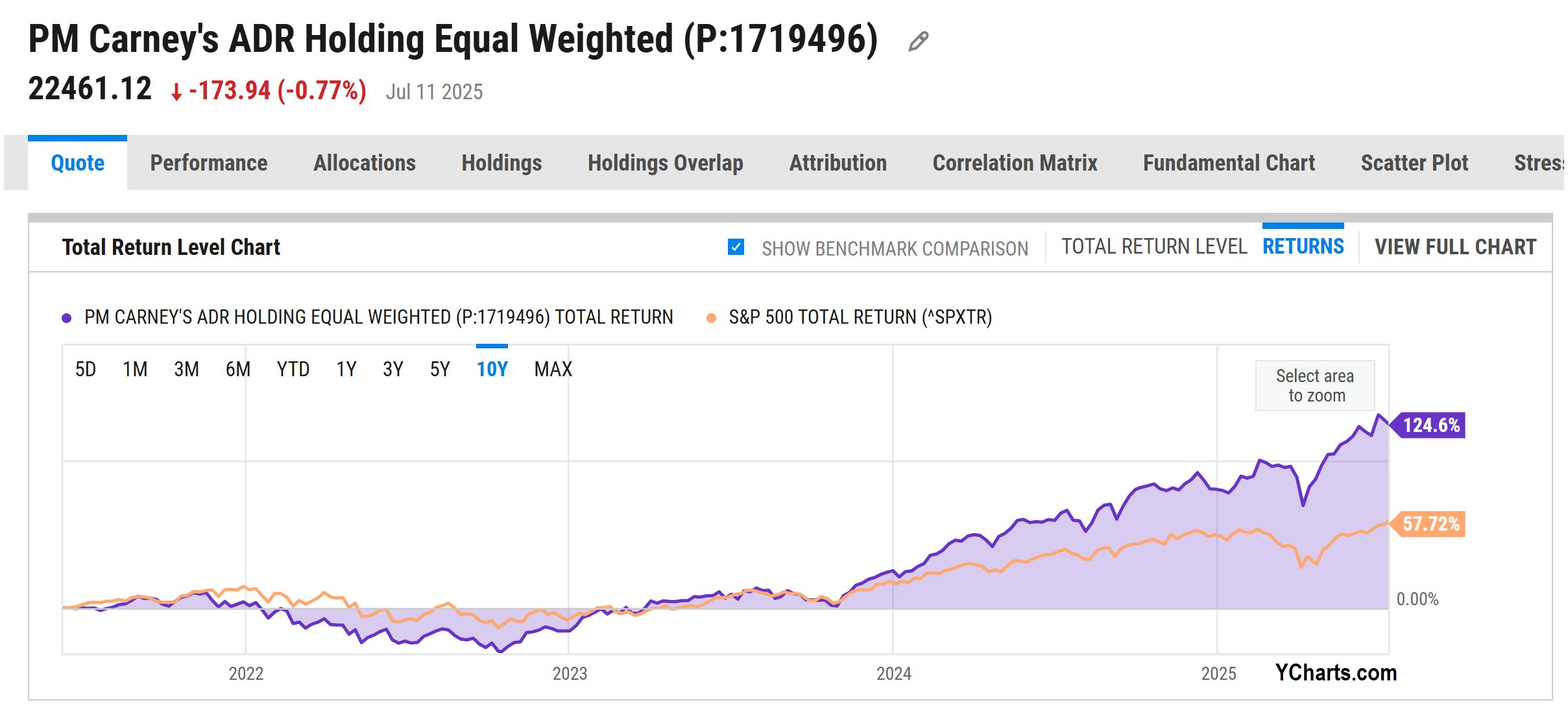

A Masterclass in Avoiding Home Country Bias

Carney’s elbows are down. While we don’t know his position sizes, we do know he owns only 20 Canadian-listed companies out of 566 securities disclosed—just 3.5% of his equity book. That’s a reminder to all of us: being Canadian doesn’t mean your portfolio has to be. His foreign equity selection skews toward innovation, scalability and diversification.

YCharts.com © 2025 YCharts, Inc. All rights reserved

-

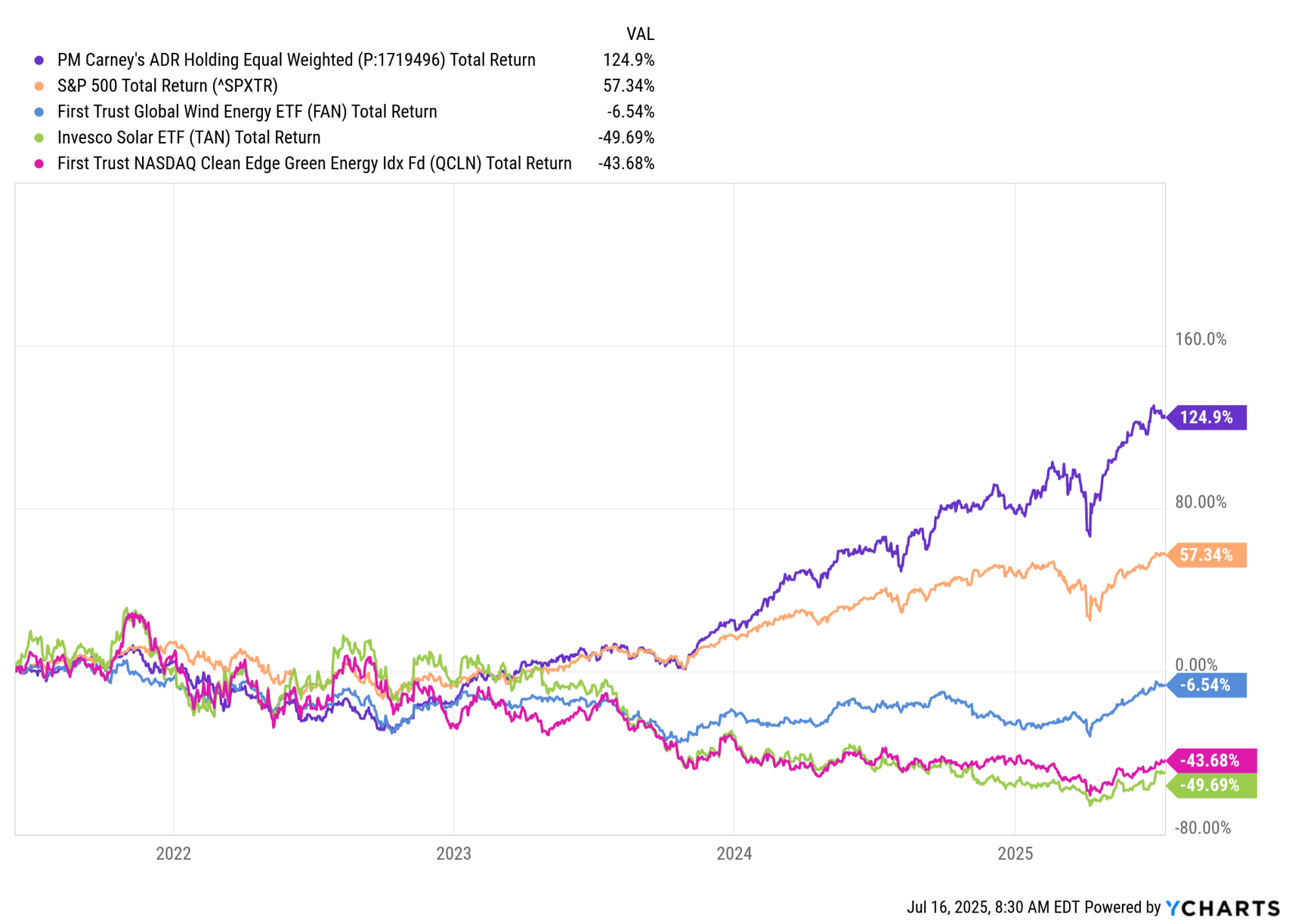

The Picks-and-Shovels Approach to the Energy Transition

Carney’s approach to ESG isn’t just about optics—it’s strategic. Yes, he owns traditional energy names like CNQ and Teck (which only recently divested of coal), but you won’t find solar panel makers (TAN) or wind turbine stocks (FAN) here. Greentech (QCLN) is largely absent as well. What you will find are:

- Schneider Electric – the largest copper cable company in the world

- Eaton – the global leader in switchgear and electrification

- And miners that provide the materials for the transition, not just the PR for it. He’s betting on the picks and shovels of the energy transition—not the slogans.

YCharts.com © 2025 YCharts, Inc. All rights reserved

What Canadian Investors Can Learn from a Central Banker’s Portfolio

I’m a big fan of Carney’s approach. Long-time readers know I’ve questioned the wisdom of blindly overweighting Canadian bank stocks. Even so, I wouldn’t personally recommend a 0% allocation. In fairness, Carney may already have significant exposure to Canadian financials through Brookfield Asset Management, which he once ran. Without greater transparency, we can’t say for sure. The inclusion of private fintech disruptors like Stripe and Adyen certainly suggests a deliberate posture—less a bet on Canada’s past and more a portfolio aimed at its future.

Whatever your politics, Mark Carney’s credentials are hard to ignore: former central banker, Goldman Sachs alum, and CEO of Brookfield.

That makes his investment disclosure all the more revealing, not for its politics, but for what it quietly says about risk, opportunity, and conviction.

This isn’t a placeholder portfolio. It’s a globally diversified bet on disruption, decarbonization, and the future—not the past.

For Canadian investors nearing or in retirement, the lesson is clear: don’t confuse patriotism with portfolio strategy. Or values with conviction. The world is bigger than the TSX and the future won’t look like the past.

It’ll be better.

Watch the Video: Mark Carney’s Portfolio Shock

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen Evans