How is it already December? Family, friends and food are the highlights of the month for the Evans Crew. If you’re like us, you need the quiet time at the end of the month to recover! What does all this fun cost?

Turkey Costs Are Down

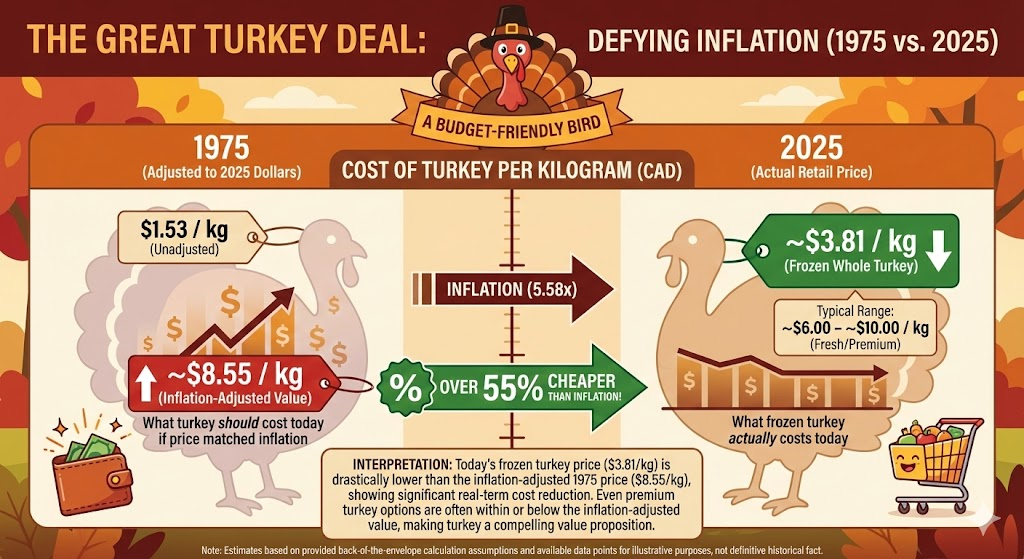

The good news is that your turkey dinner has gotten cheaper over time. In fact, had turkey followed inflation it would be over 50% more expensive than today. Alas, turkey is one of the few things that haven’t kept up with inflation.

Source: Gemini

What Has Changed: The Rising Cost of Raising a Family

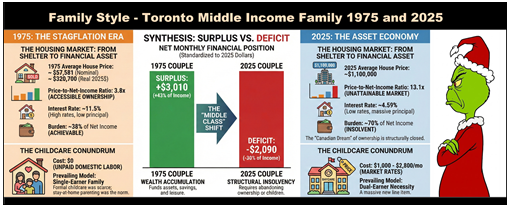

The money your kids and grandkids save on turkey is not sufficient to make up for other cost increases. Let’s extend the 1975 comparison to include the household costs of middle income families with kids.

The Housing Affordability Gap

The truth is that the 1970s were no picnic for young families. Many of you lived through that time. You’ll recall that inflation and high interest rates created lasting scars. The saving grace was that while mortgage rates were high, prices of assets compared to income was relatively low—so a home could be purchased for 3.8 times the average annual salary and childcare costs were low. Today, that home cost 13.1 times—unaffordable to the same family. Both buying and renting is nearly out of reach.

If they buy, servicing the mortgage ate up 38% of the baseline income in 1975 vs 70% today. What about renting? In 1975 it cost about 20% of income to rent versus over 42% today. Tax credits help today’s families but they are clawed back at relatively low incomes levels keeping families stuck. Here’s an illustration that compares the situation for a Toronto-based family in 1975 and in 2025. The setup is important to understand—we took the net after-tax median income in 1975 ($15,000) and increased it by CPI to stress-test how far it would go in 2025 ($83,550).

Source: Gemini

The Budget Reality: Surplus vs. Shortfall

The important comparison is in the middle of the illustration—notice that the 1975 couple had a monthly surplus of more than $3,000? Today’s couple has a shortfall of over $2,000. That’s a difference of $60,000 per year ($5,000 x 12). Add it up and today’s couple would need an income of approximately $140,000 just to be at parity with the family from 1975—still without being able to build wealth via real estate.

It’s Tough – But Not Hopeless

This is sobering, but it doesn’t need to be catastrophic. Even the Grinch couldn’t cancel the joy of the season. Every generation faces crises and they are defined by how they respond. Many parents (Anne and I included) worry about how our kids will fare in this new reality. Will housing prices revert enough to make home ownership viable? If not, how will they compound wealth?

We’re Here to Help Your Family Plan Ahead

We don’t pretend to have all the answers at Evans Family Wealth, but we have some of them. This December, we want to remind you that we’re here for you and your family. We’ve found that financial planning is a great tool, both for the next generation and for the current generation looking to help them. We’re here to help.

Warmly,

Glen