The New Zinc Trap

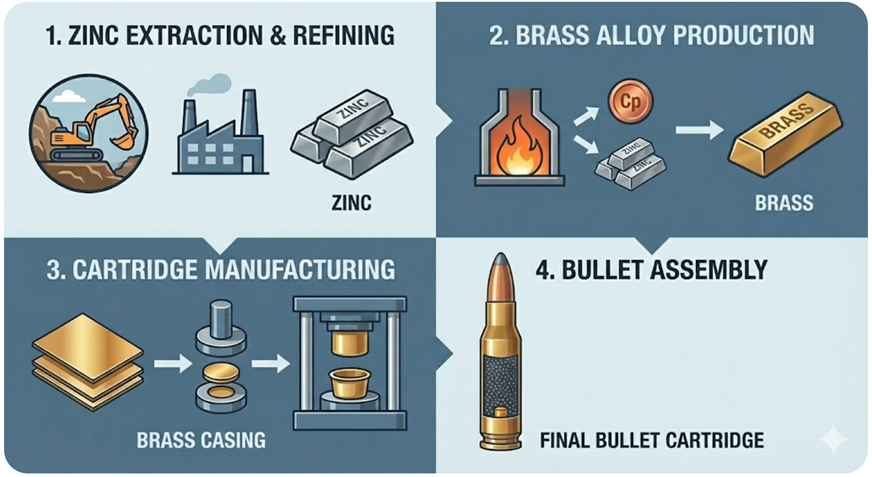

The assassination of Archduke Ferdinand in 1914 dragged major powers into First World War. Britain, in particular, had reason for foot-dragging. It had allowed a German consortium to acquire Australian zinc smelters, the very smelters it depended on for its supply of refined zinc. No zinc, no brass. No brass, no bullets. Britain walked right into the Zinc Trap.

A century later, the West is repeating the mistake.

Only this time, the smelters aren’t in Australia. They’re in China. And it’s not just zinc. It’s lithium, cobalt, graphite, rare earths, and virtually every material required to build an AI chip, an electric vehicle, or a missile guidance system.

Cold War 2.0 Is No Longer a Metaphor

For years, analysts debated whether U.S.-China tensions constituted a “new Cold War.” That debate is over. The latest U.S. National Security Strategy makes it explicit: industrial capacity, secure supply chains, and control over critical materials are no longer economic preferences—they stated national security imperatives.

Bits vs. Atoms: The New Global Divide

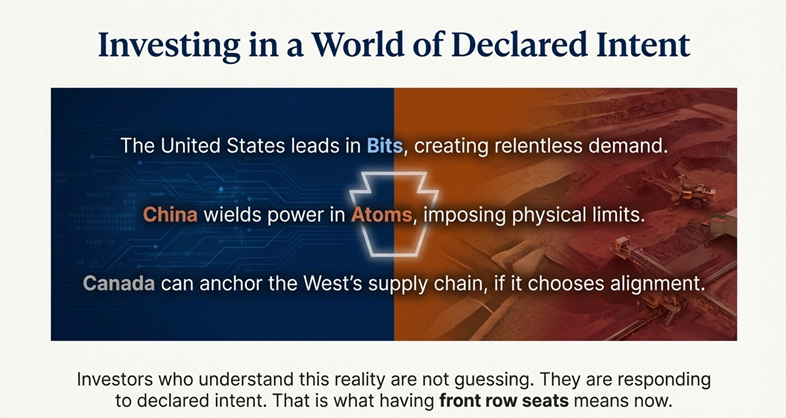

The battlefield is defined. America leads in Bits—AI, chips, software, capital. China controls the Atoms—the minerals, the smelters, the processing capacity that turns rocks into technology. Beijing has already weaponized this leverage through export controls. Washington has noticed.

Investors too are waking up to the reality—it’s Cold War 2.0 and at least two opportunities present themselves.

The Zinc Trap 2.0: Silver

This is no longer hypothetical. On January 1, China’s silver export restrictions went into effect and silver is just the start. Tungsten, antimony, rare earths: Beijing is systematically tightening control over the materials the West needs. China controls 60-70% of global refined silver supply, and silver is essential for solar panels, AI hardware, and weapons systems. This isn’t a commodity squeeze. It’s an energy embargo by another name.

Canada supplies the base metals from which silver is derived. China controls the processing. The Zinc Trap has returned—and this time, both the clean energy transition and the AI buildout hang in the balance.

The West must respond—and Canada could lead.

Why This is Profoundly Inflationary

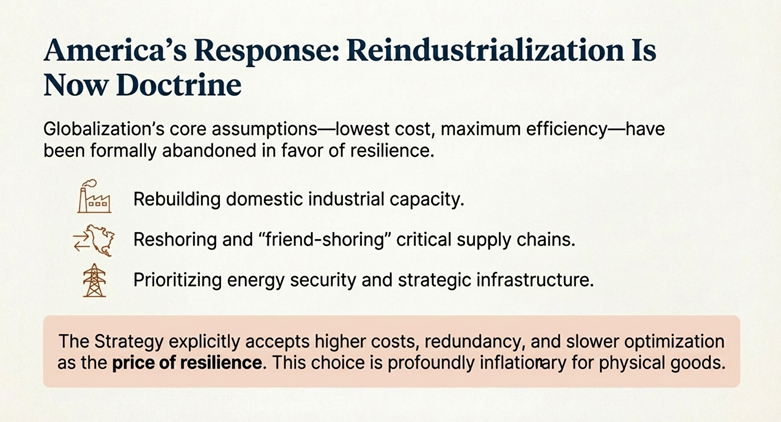

Just like Britain in 1914, the West will respond by rebuilding domestic industrial capacity, reshoring and “friend-shoring” critical supply chains and prioritizing energy security and strategic infrastructure.

The strategy explicitly accepts higher costs, redundancy, and slower optimization as the price of resilience. This choice is profoundly inflationary for physical goods. It also creates policy-mandated demand—not a cyclical upswing, but a structural shift locked in by national security imperatives. Cold War 2.0 is underway.

Canada: The Keystone of the Western Alliance

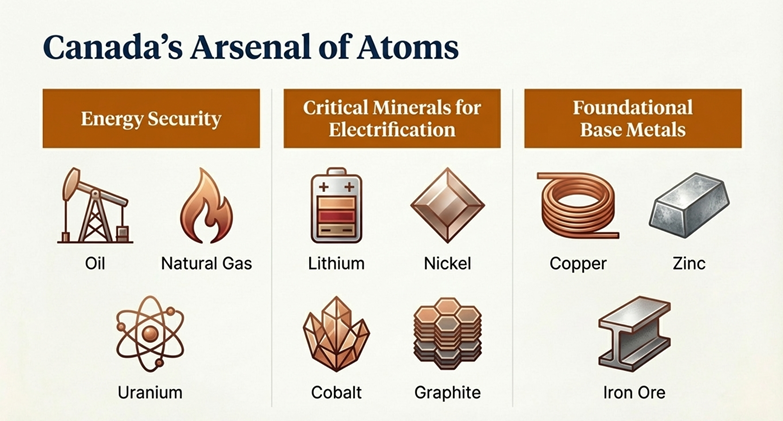

In a world where trust matters as much as price, Canada occupies a unique and underappreciated position. Consider what Canada brings to the table:

- Abundant critical minerals and secure energy: oil, natural gas, uranium, lithium, nickel, cobalt, graphite, copper, zinc, and iron ore.

- Stable rule of law and geographic proximity: no supply chain runs through contested waters or adversarial territory.

- Alignment with Western security interests: a NATO ally sharing the world’s longest undefended border with the primary consumer of these materials.

Canada can serve as the keystone connecting U.S. technological demand (Bits) with secure raw material supply (Atoms), anchoring a resilient North American supply chain.

But this role is not automatic. It is conditional on strategic choices. Will Canada and the U.S. build closer ties or will Canada fall into the orbit of Chinese influence?

The Supercycle Lock-In

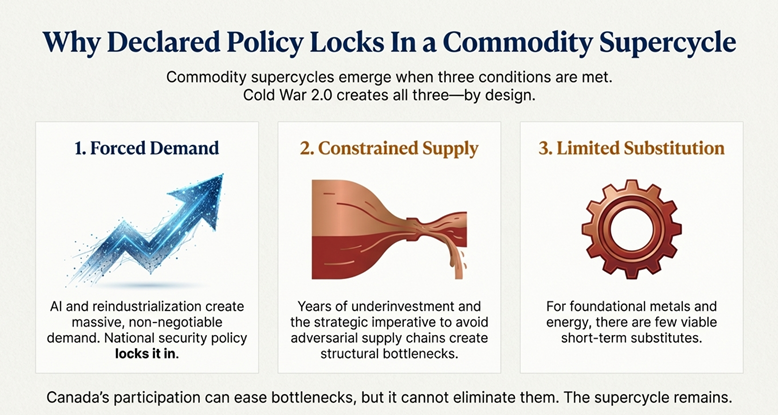

Commodity supercycles emerge when three conditions are met. Cold War 2.0 creates all three—by design:

- Forced Demand: AI and reindustrialization create massive, non-negotiable demand. National security policy locks it in.

- Constrained Supply: Years of underinvestment and the strategic imperative to avoid adversarial supply chains create structural bottlenecks.

- Limited Substitution: For foundational metals and energy, there are few viable short-term substitutes.

Front Row Seats

Let’s sum up, the United States leads in Bits, creating relentless demand for atoms. China controls the supply of Atoms and is leveraging that control. Canada can help the West break China’s choke hold.

Briana and I share many of your concerns about the implications of U.S. policy and the obviously mounting global tensions. We don’t celebrate the direction the world is headed. Our job is to equip you to protect your capital and to prosper whatever the situation. So, as mortified as we are by the news flow, as investors we’re laser-focused on the opportunity-set which seems very bright.

At our October client event we talked about Front Row Seats to the AI Boom, that vision is fully intact and is now complemented by the race for the raw materials to build it.

At Evans Family Wealth, we’re on it.

Glen