Understanding Today’s Two Competing Economic Narratives

Two narratives define the extremes of today’s economic forecasts. While reality will likely fall somewhere in between, understanding both ends of the spectrum provides investors with a clearer roadmap for navigating what comes next.

The Glass Half Empty Narrative: The Global Debt Spiral

There has always been a chorus of doom in investing. Today, it’s driven by those warning of a “Fourth Turning” or financial repression. These concerns often begin reasonably enough—with fears about unsustainable debt, persistent deficits, and soaring interest costs—but quickly escalate into warnings of a full-blown debt spiral.

Canada’s Debt Challenges and Rising Interest Burden

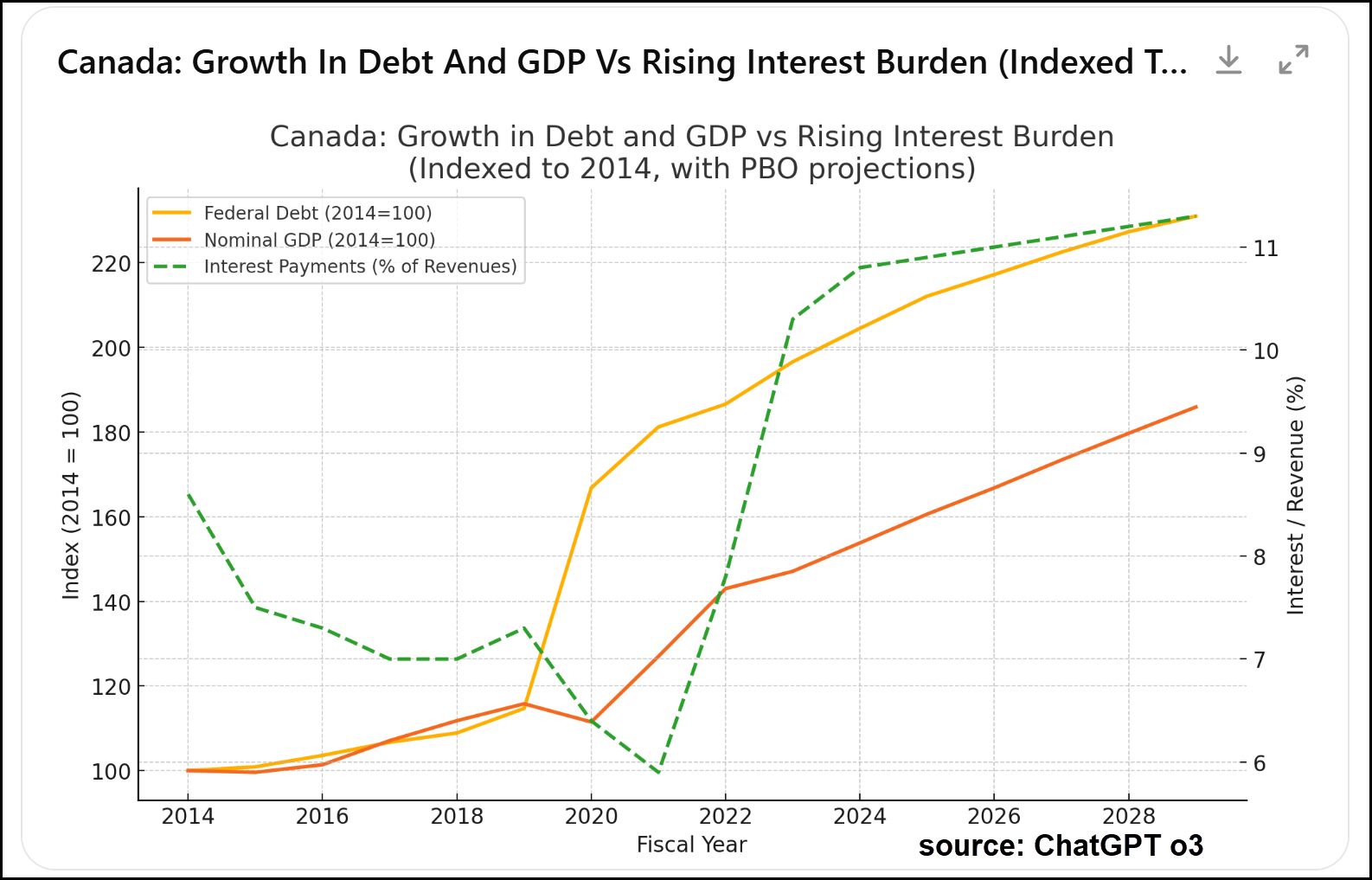

The chart below illustrates Canada’s predicament. Federal debt (yellow) has surged relative to GDP (orange), while interest payments (green dotted line) now exceed 11% of the federal budget—more than the total spent on healthcare transfers.

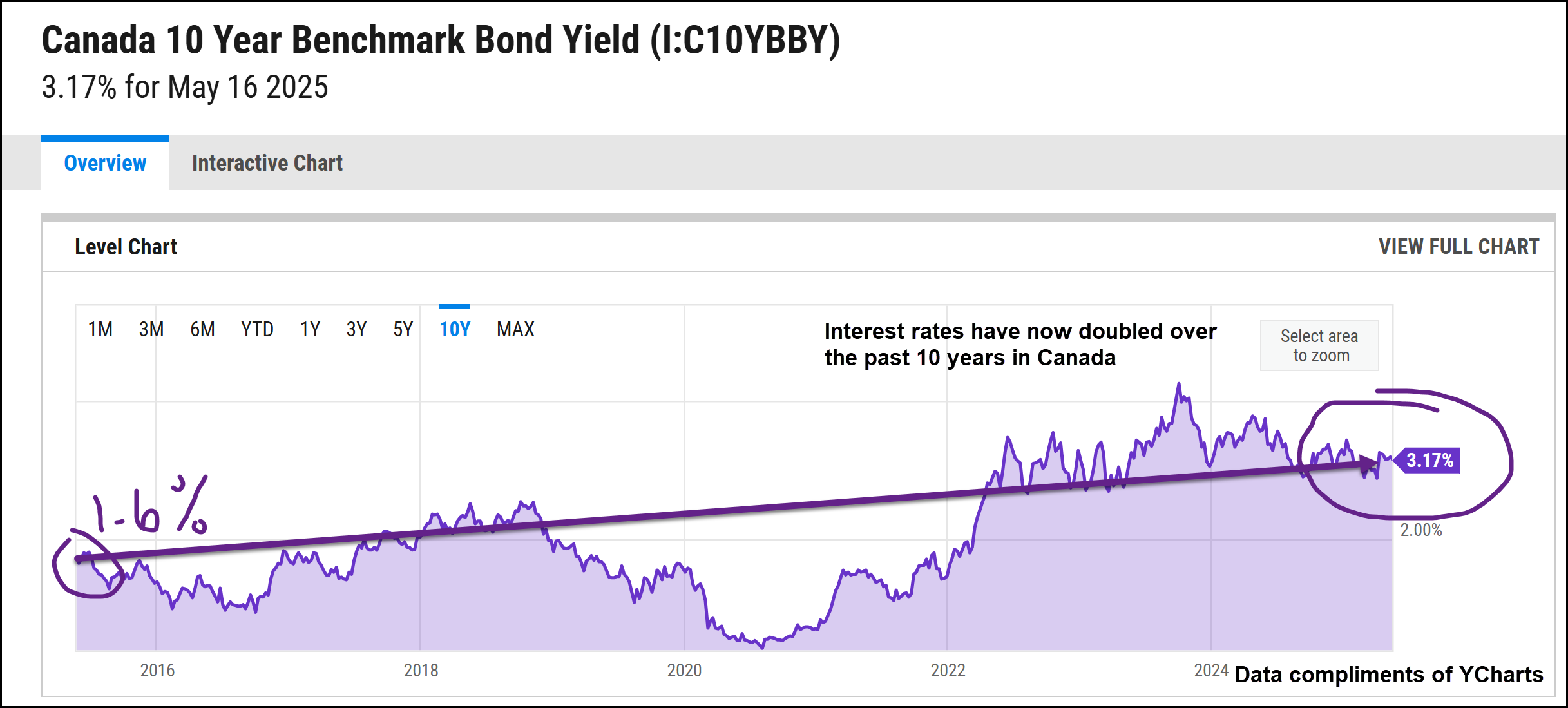

What makes this situation more alarming is the recent doubling of interest rates. We now face the challenge of servicing a much larger debt at far higher costs. Canada has been running deficits for a decade, and the current Carney government has no credible plan to reverse course. In fact, it hasn’t even tabled a budget. And this is not just a Canadian issue. Across much of the developed world, similar dynamics are playing out.

YCharts.com © 2025 YCharts, Inc. All rights reserved

Why Investors Are Turning to Gold and Hard Assets

This way lies trouble. Without a sharp increase in productivity, it’s difficult to imagine how economies will grow their way out of this bind. It’s no surprise that some investors are retreating into gold and hard assets. But while the risks are real, others are pointing to a very different path.

The Glass Half Full: Productivity, AI, and Exponential Growth

Since the Industrial Revolution, technology has been the lever that lifts productivity and lowers labor costs. That trend may soon accelerate dramatically with the rise of artificial intelligence (AI) and Robotics.

U.S. AI Dominance and the Strategic Shift in Compute Power

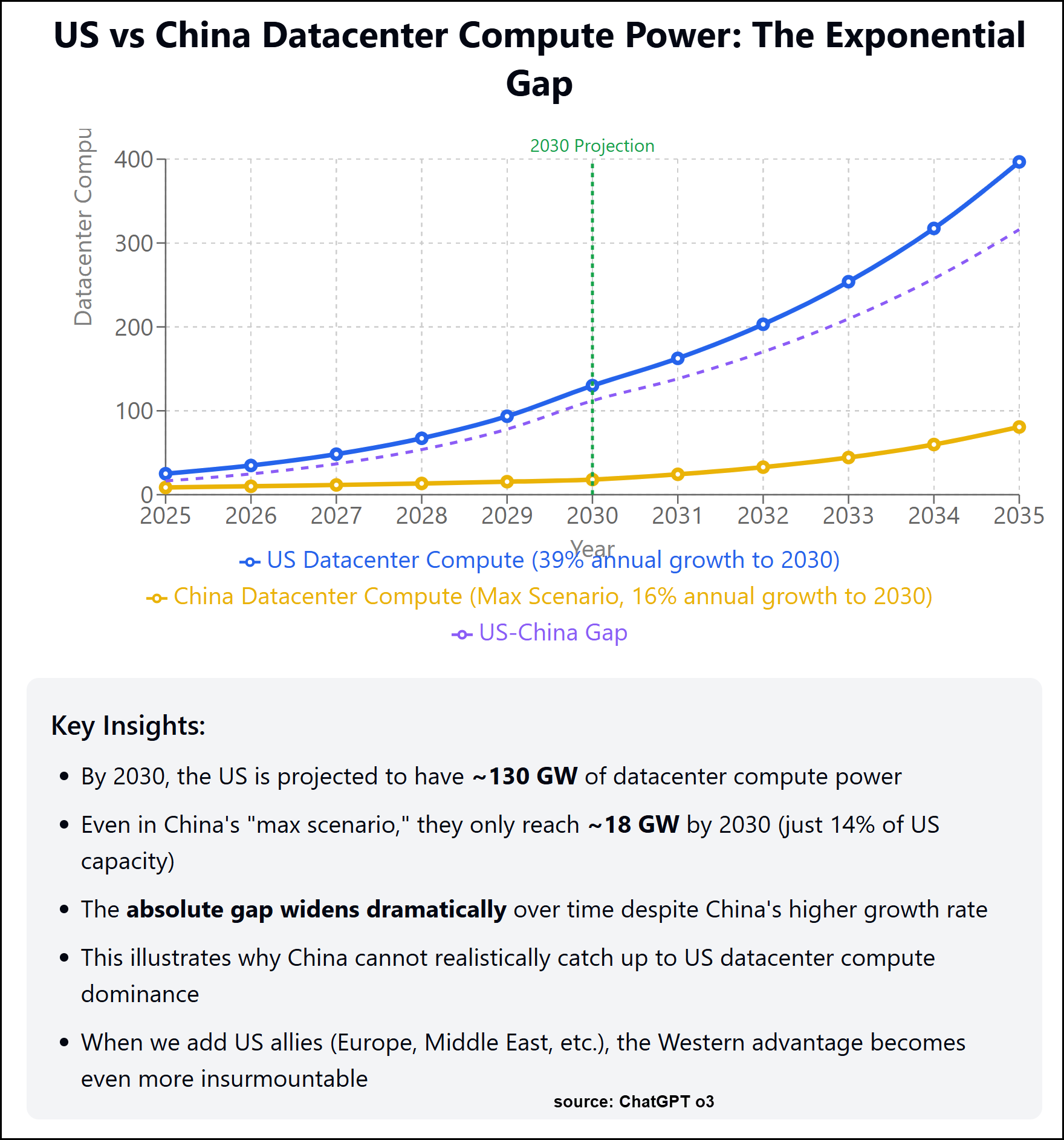

President Donald Trump’s recent trip to the Middle East marked a turning point. The U.S. has now drawn key Middle Eastern countries into its AI orbit, a significant loss for China. In the age of AI, the new factories are datacenters. Countries that control the most compute power will lead in AI development. By 2030, the Middle East is projected to host nearly 30% of China’s total compute capacity—a strategic coup for the U.S. alliance.

This is not a downward spiral. It is exponential growth—and that kind of growth may be precisely what’s needed to overcome the mounting weight of global debt.

Why Datacenters Are the New Factories of the AI Era

While China continues to make progress in chip design and AI algorithms, the U.S. advantage in infrastructure remains substantial. So far, scaling laws have held. That means the bigger the datacenter and the greater the number of GPUs, the better the resulting AI model. If this trend continues, China will struggle to close the gap. Elon Musk’s plans for a datacenter with one million GPUs in Memphis (5x larger) underscore the pace of this race.

AI and Robotics Could Drive Double-Digit GDP Growth

Former Google CEO Eric Schmidt, now a leading AI voice, recently predicted in a TED Talk that AI and robotics could drive double-digit GDP growth by eliminating labour shortages and boosting productivity. It’s a radical forecast, but not implausible

Embracing the Future: Why We Stay Optimistic About AI

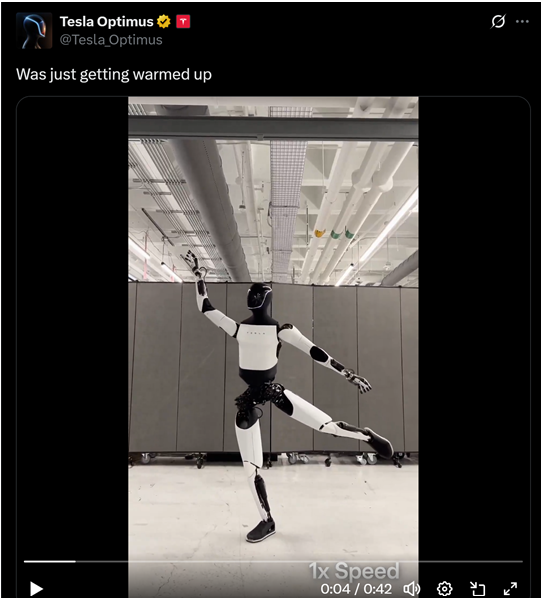

At Evans Family Wealth, we lean toward optimism. Equity investors must be, by nature, forward-looking. The arrival of bipedal robots like Tesla’s Optimus and Figure’s humanoid platforms points to a coming shift in labour economics. The cost of labour may soon fall, not because of outsourcing, but because of automation.

From Dancing Robots to Transformative Productivity

If you have a moment, watch this clip of Optimus dancing autonomously—no teleoperation, no safety harness:

https://x.com/Tesla_Optimus/status/1922456791549427867

What the Experts Are Predicting for AGI by 2030

Even without Artificial General Intelligence, the current pace of AI progress is transforming business models, productivity, and national strategy. We asked ChatGPT to summarize the current forecast for AGI. The consensus probability of reaching it by 2030 is now estimated between 35 and 45 percent.

It’s important to understand that this growth is not linear. It is exponential. That makes it difficult to model and predict, but also potentially transformative. It’s why the future feels uncertain and thrilling at the same time.

We are not selling our bank stocks or exiting core Canadian names like railroads and energy. And yes, we still own gold. But we believe financial advisors who ignore the impact of AI and robotics are missing the most important trend of our time.

Canada’s AI Disadvantage and What Investors Must Do

Here’s a reality check for Canadian investors: despite world-class talent at institutions like the University of Waterloo and the University of Toronto, and an abundance of clean electricity and natural resources, Canada is forecast to host less than 1% of U.S. datacenter capacity by 2030. It gets worse, relative to the U.S. stock market’s nearly 40% weight in technology (including Amazon and Tesla), Canada’s market has a measly 10% allocation to technology. We are bordering on irrelevance.

Canada’s Policy Missteps Amidst a Global Transformation

We’ve blown up housing affordability, mismanaged immigration, and are now doubling down by installing the federal government as a homebuilder. In the face of exponential AI transformation and mounting debt spirals, Canada is scribbling in the margins.

The Investment Takeaway: Look Beyond Canadian Borders

The implication is sobering but clear. To participate meaningfully in the coming wave of AI-driven productivity, Canadian investors will need to look beyond our borders—primarily to the United States.

As AI disintermediates labour, growth curves are likely to steepen. That is the shift we are preparing for, and the opportunity we are positioning your portfolio to capture.

Watch the Video: Investor Alert: Debt Spirals, Exponential Growth Curves and Scribbles

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen