Blue-Chip Stocks Once Led the Way in Retirement Portfolios

For three decades after the Second World War the safest retirement income wasn’t a government bond—it was a basket of Blue Chips christened “widows-and-orphans” stocks. From 1950-79, real equity returns in the United States averaged ≈9–10% a year while long-term government bonds lost about 1% in real terms (Dimson, Marsh & Staunton). Now the 1950’s playbook is being brought back.

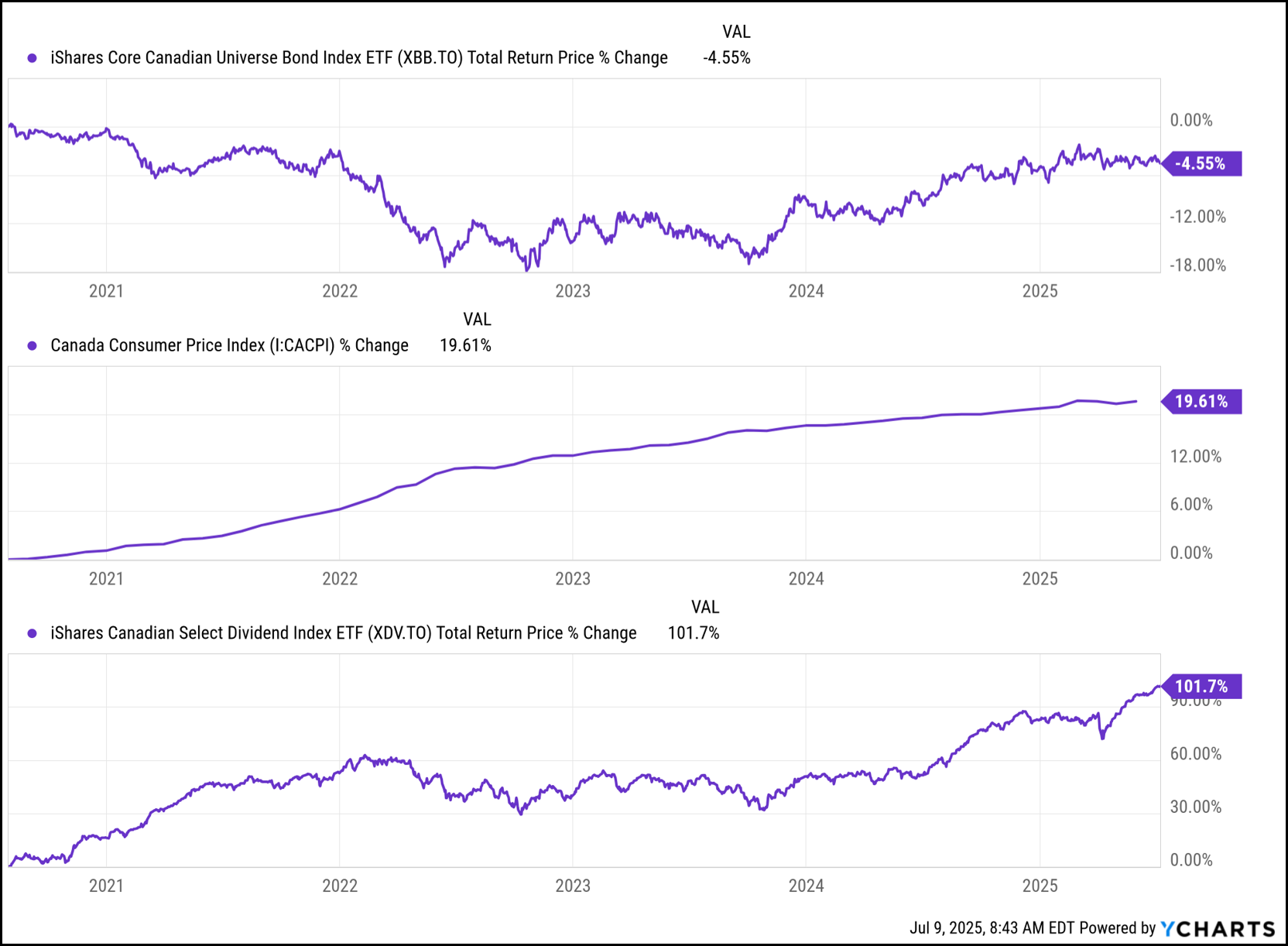

Canadian Bonds Have Lost Real Value Since 2020

Canadian investors and advisors are waking up to a sobering realization, since 2020 bonds in Canada have generated total return losses of almost 5%. Inflation has increased by 20%. The difference is a 25% loss in purchasing power for bond holders over that time. Widow and Orphan stocks over the same period? Up over 100%!

YCharts.com © 2025 YCharts, Inc. All rights reserved

Rising Debt and Interest Costs Mirror the 1950s

We find ourselves in an economic situation analogous to the 1950’s—our debt levels are high and rising. The Parliamentary Budget Officer modelling shows interest costs overtaking the health care transfers as early as 2026-27 if rates stay near today’s levels.

Governments May Turn to Financial Repression

When debt service crowds out programs, governments historically resort to financial repression—keeping interest rates below the level of inflation and letting rising prices erode the debt in real terms. That is exactly what happened from the early-1950s through the late-1970s.

Dividends Still Work: A Lesson From Elaine

Elaine—one of my earliest (and largest) clients—lived comfortably on dividends from banks, utilities and pipelines. When I once suggested “lower-risk” bonds, she smiled and said in her clipped British accent, “I don’t like bonds.” Elaine passed away almost a decade ago, but the past five years vindicate her instinct.

How to Invest for Real Income in 2025

Three take-aways for 2025+

- Supplement long bonds with high-dividend equities to restore positive real income.

- Accept some price volatility and manage it with sizing, cash buffers and hedges rather than lock in negative real yields.

- Stay tactical. If recession drives rates lower, we can add duration when bonds once again pay investors after inflation.

Real Security Comes From Real Returns

The hard truth of investing is balancing “holding fast” with updating assumptions. Today’s mix of high debt, rising interest costs and negative real bond returns suggests it’s time to revisit those assumptions—and position portfolios for real, not just nominal, security.

Watch the Video: Financial Repression 2.0

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen Evans