A black line snakes its way across the yellow sands of Mauritania. Seen from above, the three-kilometer-long line inches its way over the barren landscape. Vibrations make the sand dance long before the thrum and whine of the diesel locomotives pass by, dissolving into the rhythmic clacking of the 200 iron-ore filled box-car wheels banging out the beat of the railway joints in the arid heat. The longest and heaviest train in the world doesn’t speed up or slow down quickly. When the engineer decelerates and applies the brakes the squealing and sparks created by steel on steel extends an impossibly long time.

Source: Midjourney

Economies are a bit like freight trains and Tiff Macklem, the Governor of the Bank of Canada knows all about how long it takes to slow down a run-away train. Two years ago, Macklem slammed the brakes on the Canadian economy – raising interest rates in a desperate bid to bring down inflation. He faced the same problem the conductor of the Mauritania Railway would face – inertia. Only recently has the Canadian economy finally slowed enough that Macklem could ease off the brakes and cut interest rates. The first cut in 2 years happened last week. Investors have been hoping for this for a long time. Now that we are seeing interest rate cuts, they are wondering what should we expect?

Source: Midjourney

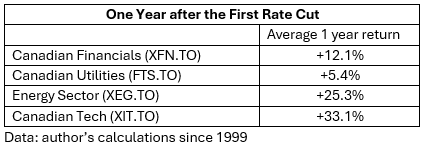

While the minimal impact of this first rate cut will take time to work its way through the economy, we can look to history for a guide to what a series of rate cuts might mean for investors. Rather than repeating the sound bites in the news, let’s look at what has happened to the Canadian Financials, Energy, Utilities and Technology after the first rate cut in the past.

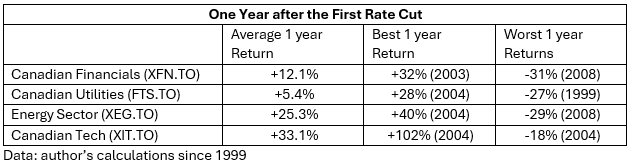

Pretty impressive returns, right? Historically, investors have fared well the year following the first cut in the overnight lending rate in Canada. Wait, not so fast. Average returns can hide wide disparities in outcomes – so I feel compelled to add a little nuance to these ‘average’ calculations. The range of outcomes following the first interest rate cut are extremely high:

My takeaway here – unless we have a bad recession, we should expect decent returns in the near term. Patience will be required; more interest rate cuts are necessary and are not guaranteed. The clear risk is that the Bank of Canada has waited too long to begin cutting rates and that a Canadian recession may be unavoidable. Against that risk is the ongoing profligate spending of our government and astonishing population growth, both of which should act to prevent a severe recession.

Risks remain, but Canadian investors should be happy that our conductor has finally let up on the brakes!

Cheers,

Glen