It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so. attributed to Mark Twain

We’re a confident species – even in the face of evidence to the contrary! Consider this short list of things we knew for sure that just weren’t so:

- butter is bad for you – eat margarine instead

- eggs will give you high cholesterol

- the low fat diet is better for heart health

- Iraq had weapons of mass destruction

- Y2K was going to cause computers to crash

- COVID couldn’t have come from a lab leak

- cracking your knuckles will lead to arthritis

In my field, there is a pervasive false belief that when the stock market hits all-time highs investors should sell. I think the confusion comes from a misinterpretation of the aphorism to “buy low and sell high”. This confusion creates anxiety for investors and deprives us of the enjoyment of bull markets. I say life is too short not to enjoy the ride – especially of bull markets. Meb Faber of Cambria Investment agrees.

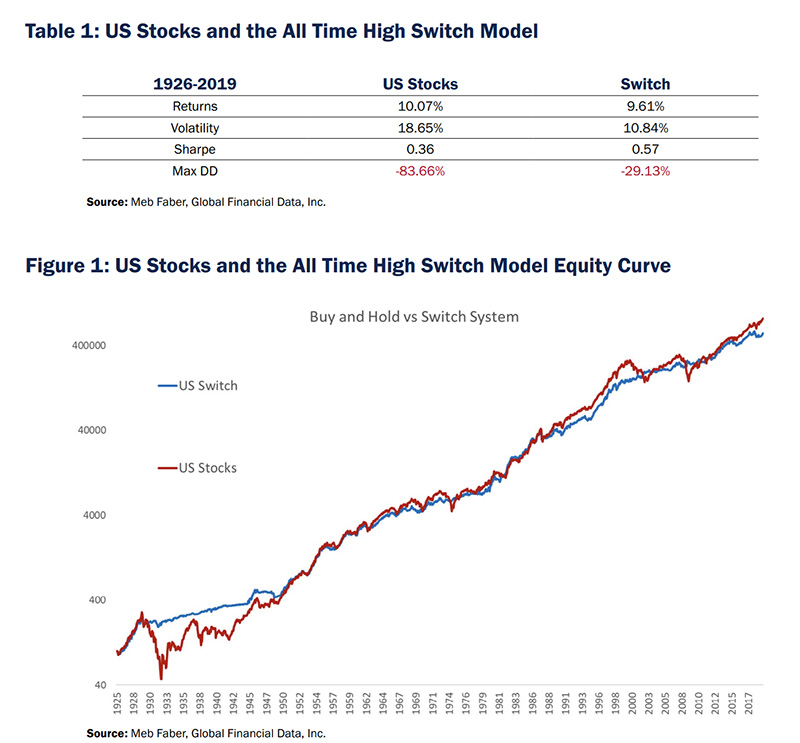

Meb recently wrote a remarkable paper illustrating that buying (or holding onto) stocks so long as they are trading within 5% of all time highs (and switching into bonds otherwise) generates almost all of the upside of the stock market since 1926 with less than 1/2 the downside! Here are the summary statistics from his paper:

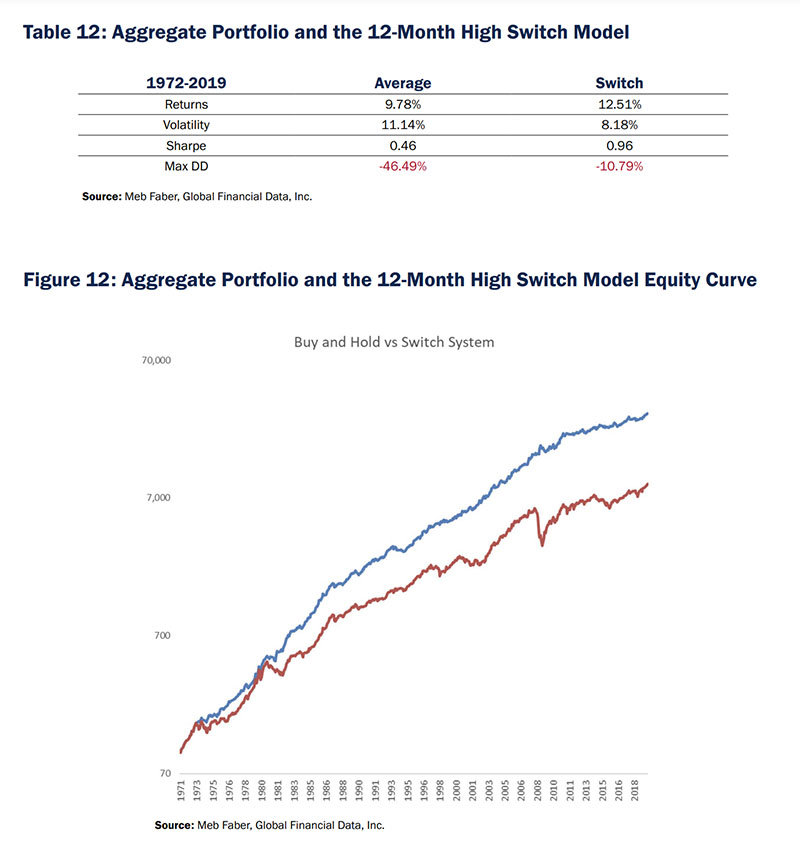

His paper goes on to document the same reality for other asset classes as well. Turns out that buying at all time highs is actually a pretty good idea! Then Faber illustrates an even more compelling idea – holding an equally weighted portfolio of these various asset classes so long as they are within 5% of their highs for the past 12 months (otherwise holding bonds).

Pretty impressive right? Faber is illustrating an idea that has been around since the 1960’s. It’s called trend following. I’m bringing it to your attention because in recent weeks we’ve seen new All-Time Highs in several important asset classes:

- Gold

- US Stocks (SPX, Nasdaq, Dow)

- German Stocks (DAX)

- French Stocks (CAC40)

- Europe and Far East (EFA)

- Bitcoin

To be clear, Meb isn’t offering a prediction that stocks will continue to rise, only that holding stocks when they are within 5% of 12 month highs is a time tested approach to both growing our portfolios and reducing the losses along the way. Like all systematic approaches to investing, trend following offers simple solutions that require relentless discipline to enact and can have long periods of underperformance. It may be simple – but it isn’t easy!

That said, new all-time highs are unambiguously bullish for investors. That’s this week’s Good News! So go ahead crack your knuckles, eat a steak (with butter on top) and enjoy the bull market.

Cheers,

Glen