The Power of Hindsight in Wealth Creation

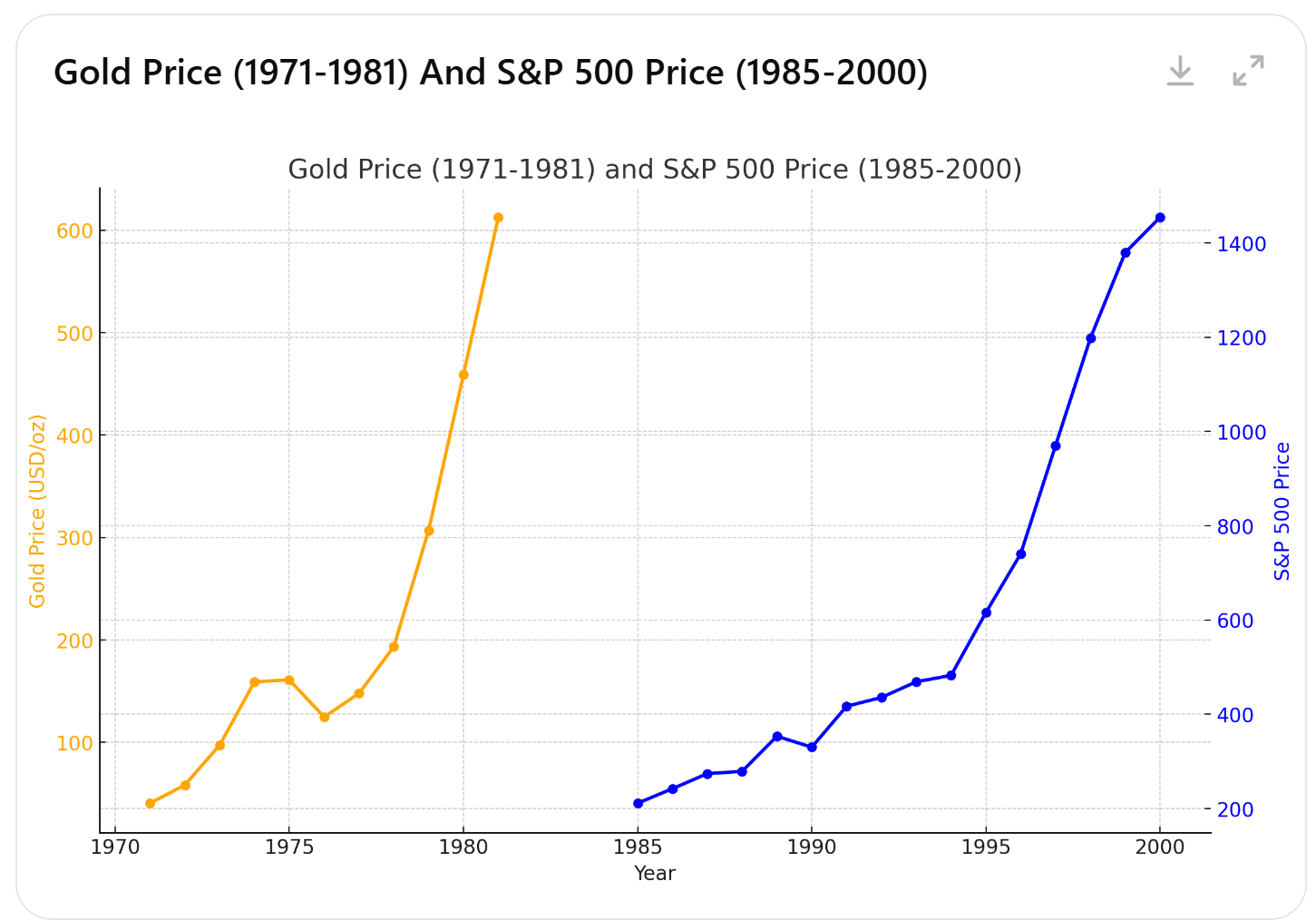

It’s easy with the benefit of hindsight, to see why gold surged 24x (an extraordinary 2329%) between 1971 and 1980, after Nixon took the U.S. dollar off the gold standard. Or why the S&P 500 climbed 7.5x, gaining 650%, from 1985 to its 2000 peak after the Plaza Accord was implemented to weaken the U.S. dollar. However, predicting these seismic shifts in real time, in the face of uncertainty, is where fortunes are made and lost.

source: ChatGPT and Yahoo finance

Bitcoin’s Potential Rise Under a Trump Re-Election

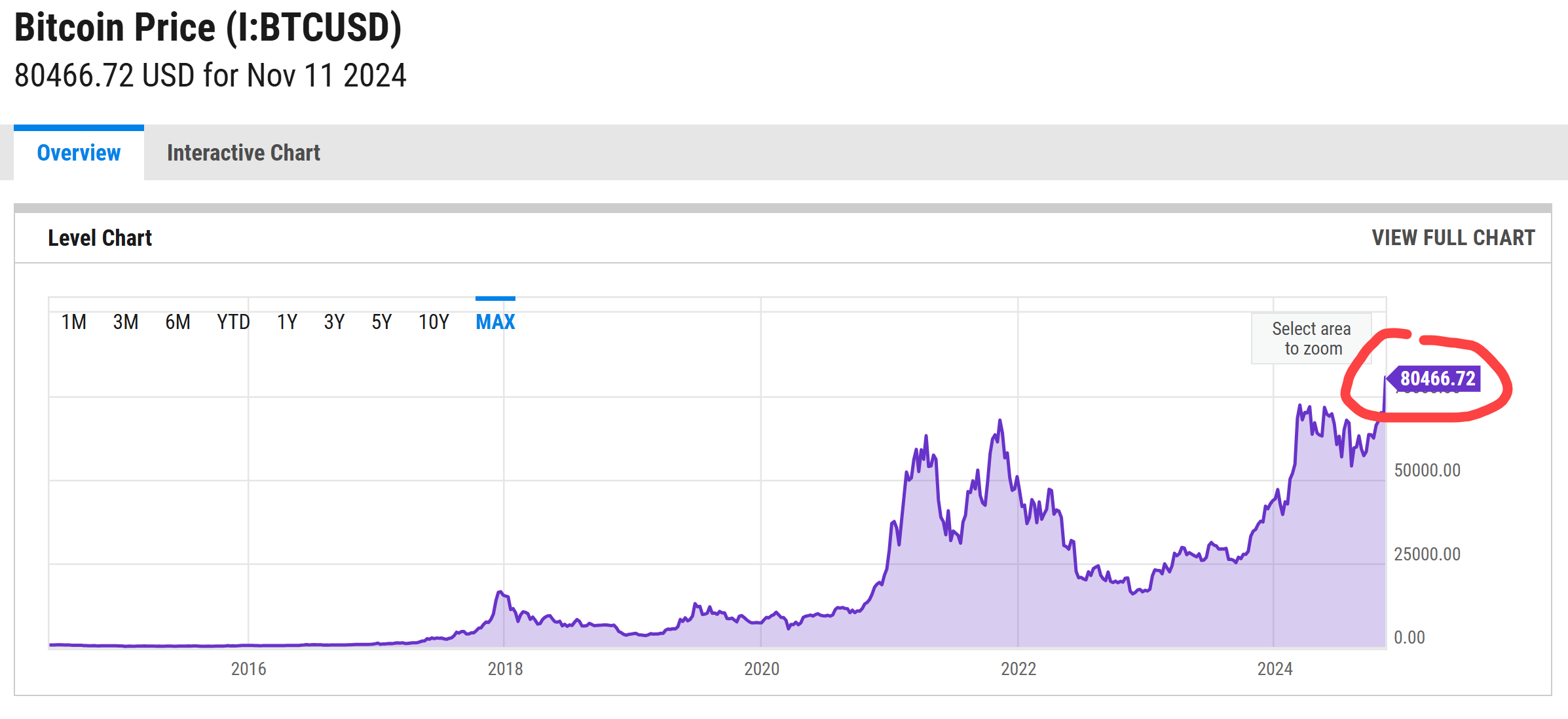

As of today, President-Elect Donald Trump’s re-election has Bitcoin enthusiasts forecasting similar outsized gains. With Trump’s favourable stance toward Bitcoin and the potential addition of Bitcoin to U.S. Treasury assets, some speculate that we’re on the brink of Bitcoin’s own dramatic rise. Could this be the next transformational moment in financial history? Here’s how this potential shift could unfold—and why missing it could be the costliest oversight of the decade.

The Regulatory Landscape and Bitcoin’s New Opportunity

This outcome was far from certain two weeks ago. Elizabeth Warren chaired the Senate Banking, Housing, and Urban Affairs Subcommittee on Economic Policy. Senator Sherrod Brown of Ohio, chair of the Senate Banking Committee, and SEC Chair Gary Gensler had kept regulatory risk high, stalling growth in the U.S. crypto industry. A Vice President Kamala Harris victory might have been the nail in the coffin. Instead, a crypto renaissance is on offer: Gensler has resigned, Brown lost re-election, and Warren will soon lose her powerful subcommittee position. The regulatory landscape is poised to shift.

Elizabeth Warren Sherrod Brown Gary Gensler

Bitcoin as a Strategic Treasury Asset

Uncertainty remains, but Bitcoin bulls are driving prices to new highs, anticipating its potential addition to U.S. Treasury reserves. This move would reshape the geopolitical game theory surrounding Bitcoin, likely lifting other crypto assets. For a highly indebted country, adding Bitcoin could function as a hedge against inflation, a store of value, and a way to offset a weakening dollar. If Bitcoin continues to appreciate, it would reduce the Treasury’s relative debt burden, strengthening the balance sheet with a high-growth asset.

YCharts.com © 2024 YCharts, Inc. All rights reserved

Global Implications: The Game Theory Behind Bitcoin Adoption

Ask yourself: What might China and Russia do if the U.S. adopts Bitcoin? Wouldn’t it be prudent for U.S. adversaries to at least match this move to avoid being priced out? Can you see how this could create a positive feedback loop, driving prices higher as each nation follows suit? Game theory dictates that this first-mover advantage could spark a global adoption race, with countries hedging against currency risk and boosting asset growth. As more nations adopt Bitcoin, demand and price would likely continue to climb, potentially positioning it as a central asset in modern reserves—and reshaping the global financial landscape.

The Timing is Still Right

There’s no need for panic. It wasn’t too late to buy gold in 1976 or stocks in 1990. If Bitcoin is indeed becoming a Treasury asset like gold, time is on our side. That said, I’ve already increased exposure to Bitcoin and select crypto-focused companies within my North American and Canadian portfolios, and I plan to add more as regulatory clarity improves. Consider whether a gradual approach to adding Bitcoin could serve as a strategic move for your own portfolio—positioning you for potential growth in what could be the next evolution of global finance.

The goal here is to use the benefit of hindsight in past geopolitical events to provide us all with a little foresight—so that 10 years from now we won’t look back and wonder how we missed the obvious opportunity!

Glen