A Modest Proposal to Change the World (or at Least Canada)

History often feels like a slow grind—decades of incremental change punctuated by sudden, seismic shifts. The election of Donald Trump marked one such moment, upending Canada’s traditional approach to governance. In a single, heartburn-inducing evening at Mar-a-Lago with Trudeau and team, Trump accomplished what the official opposition failed to do for years—completely shift the direction of the federal government. Watching this “about-face” unfold got me thinking: Are we living through one of those rare, transformative moments now? If so, it would be a shame to miss it.

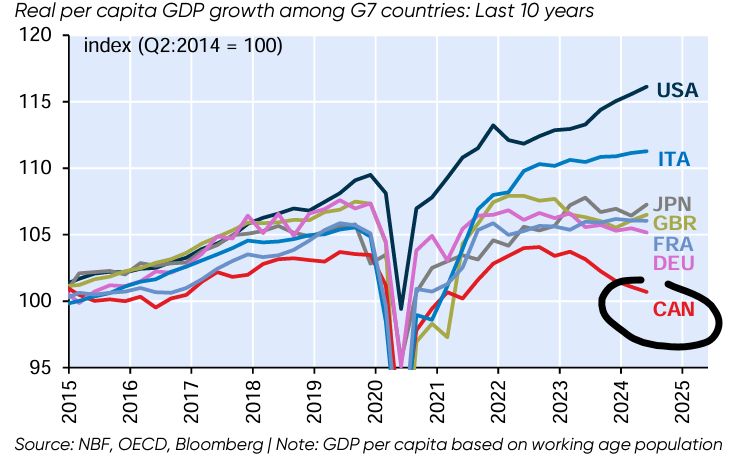

Remember Gulliver in Lilliput, tied down by countless tiny threads—that’s the way I see Canada in 2024. Forget external threats like Trump’s tariffs; Canada’s provinces have been locked in internal battles with the federal government too. Poorly managed population growth and bad policy have pushed Canada to the bottom of G7 countries for Real per capita GDP.

To break free from these Lilliputian bonds, we need bold, innovative action. Our governments still operate as they did in the 1950s, oblivious to the technological revolutions of the 21st century. Consider this: in the age of SpaceX, does NASA still need to build spacecraft? That question was answered when SpaceX had to rescue astronauts stranded by NASA and Boeing’s perpetually delayed Starliner capsule.

The X-Prize Model: A Catalyst for Change

How did SpaceX achieve what government agencies could not? Part of the answer lies in the Ansari X-Prize, which offered $10 million to the first non-governmental team to launch a reusable manned spacecraft. This competition sparked a private space revolution, with every dollar invested generating over 31 times the impact. Imagine multiplying research dollars instead of watching them disappear into administrative black holes.

Now consider this: donations to political parties in Canada are fully tax-deductible. What if we extended that privilege to donations funding X-Prize-style competitions? Picture a public platform where Canadians could vote on projects, supported by AI-driven empirical analysis to prioritize the most promising ideas. Entrepreneurs could tackle grand challenges, with the public holding equity stakes in resulting innovations.

By aligning public incentives with private ingenuity, we could bypass the grant-seeking behavior that often plagues universities and research institutions, freeing resources to pursue breakthroughs rather than bureaucratic compliance. Our challenges require new solutions.

Facing the Lilliputians

Of course, such a proposal would face fierce resistance. Regulators, universities, and entrenched research bodies would cry foul as their comfortable systems are disrupted. But transformative change often comes only when someone dares to rip up the script—much like Trump is, for better or worse.

From Policy to Portfolio

This is, after all, an investing newsletter, not a political manifesto. So, what’s the investment takeaway? Innovators like Elon Musk and companies like SpaceX exemplify how transformative technologies can deliver significant returns. While public opinion may be divided, savvy investors recognize the value of backing visionaries who challenge the status quo.

Venture capitalists have long understood that world-changing innovations often emerge from unconventional thinkers. As individual investors, we can apply this lesson by allocating modest portions of our portfolios to emerging technologies. Here’s why:

- Growth Potential: Technology sectors offer unparalleled growth opportunities.

- Diversification: Adding emerging tech investments can balance traditional portfolios.

- Long-Term Trends: Key indicators point to sustained upward trajectories in transformative tech.

Too many investors, like governments, drive with a blacked-out windshield, relying solely on the rearview mirror to guide them. This blind faith in tradition and past performance might feel safe, but it can trap them in mature, stable companies that have become walking dinosaurs—giants lumbering toward the tar pit. Progress demands looking ahead, not back, or risk missing the turns that lead to real opportunity.

Embracing the Future

History reminds us that progress often comes in bursts, breaking through periods of stagnation with transformative leaps forward. We might be living in one of those moments now. The question is whether we’ll recognize it in time to act—or whether we’ll cling to the status quo, bound by our own Lilliputian threads.

As investors, we have the opportunity to embrace the future by supporting bold ideas and visionaries who dare to reimagine what’s possible. After all, every leap forward begins with a single step into the unknown. Let’s make sure we don’t miss it.

Glen