The rebuilt Broughton Suspension Bridge in 1883 (public domain)

On April 12, 1831, soldiers from the 60th Rifle Corps, returning to barracks after exercises, marched across the five-year-old Broughton Suspension Bridge spanning the River Irwell in Greater Manchester (one of the first suspension bridges in the UK). As they marched, the bridge began to vibrate in time with their steps. Amusement turned to horror as the vibrations increased, leading to the collapse of an iron column and pitching soldiers into the water below.

This incident exemplifies mechanical resonance—the lesson is that soldiers must “break step” over bridges. Society and investors also need to break step to avoid disaster.

GroupThink in Society

In recent years, a troubling group think has descended upon markets and societies. Rather than celebrating diverse thoughts and challenging scientific orthodoxy, there is a growing emphasis on uniformity—contrary to the spirit of science. This trend has permeated public health, social media, and government policy. However, we are beginning to see people break step from the anti-nuclear groupthink that dominated post-Fukushima.

Nuclear Power’s Resurgence

Ironically, just months after Germany decommissioned fully functional nuclear power plants, Microsoft announced an agreement with Constellation Energy to restart Unit 1 of the Three Mile Island nuclear power plant. This marks a symbolic victory for nuclear advocates.

At least three other plants in the U.S. are being extended or restarted. Globally, the narrative is similar (excluding Germany). India plans for 20 new reactors by 2031, while China aims for 150 plants by 2035. Additionally, Ontario is planning another large reactor at Bruce and three SMRs at Darlington. Even Japan has restarted nine plants and plans to restart at least 16 total—source.

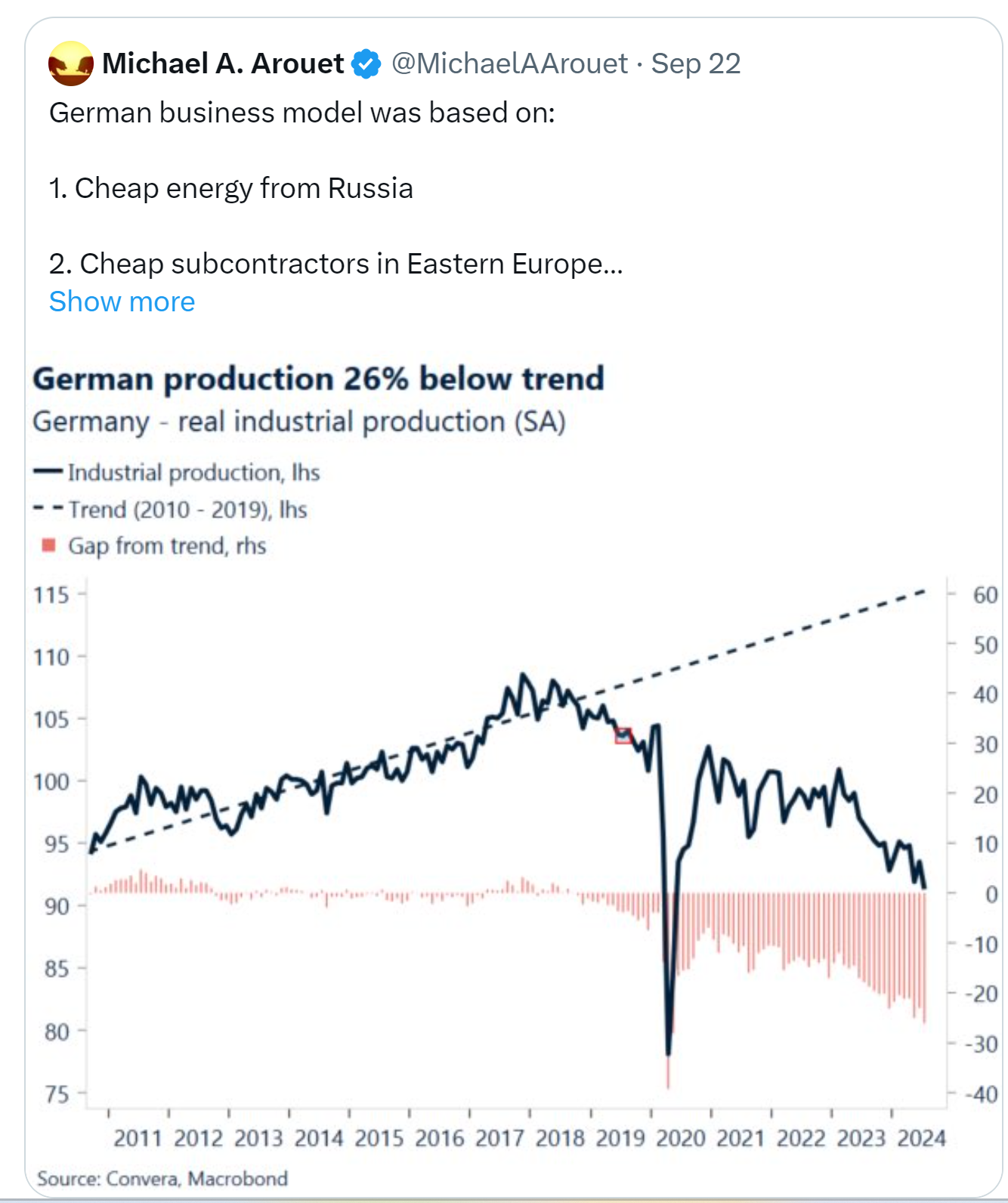

Germany represents the nadir of implementing the Green Energy revolution without nuclear. Until recently, it was seen as a model for energy transition but has faced economic challenges due in part to its anti-nuclear stance.

The Driving Force Behind Change

What pushed Microsoft to “break step”? Data centre power demand is exploding. Nuclear power provides the consistent, high-capacity energy output required by next-generation centralized AI datacenters, offering advantages in reliability and scalability that distributed, weather-dependent sources like solar and wind struggle to match on their own. Larry Ellison of Oracle has secured permits for three Small Modular Reactors (SMRs) to power a 1 Gigawatt data centre—enough for about 876,000 homes—source.

I understand that some readers may be disappointed by nuclear energy’s recovery, but COP28 called for the tripling of nuclear power by 2050 and recent changes in the banking industry make funding those projects more do-able. John Podesta, President Biden’s Senior Climate Advisor stated:

“Our collective mission is clear: nuclear energy is clean energy, and if we are to ensure a livable planet, build secure, sustainable supply chains for clean energy and bolster prosperity around the world, we need to make sure that nuclear energy does its part,” source.

I’m hopeful that a global push to nuclear will reduce CO2 emissions and reduce costs. It is conceivable this could both reduce CO2 emissions and power carbon capture technology to help us meet our climate goals. That said, let’s focus on why this breaking step matters for you as a Canadian investor.

Investment Opportunities in Nuclear Energy

Canada is the third-largest exporter of uranium globally, holding a 10% market share. The uranium mining company Cameco exemplifies changing attitudes toward nuclear energy.

source: YCharts.com © 2024 YCharts, Inc. All rights reserved

To support explosive growth in U.S. data centres, electricity demand for them will nearly triple by 2030, requiring an additional 50-60 gigawatts—enough to power approximately 40-50 million homes—source.

Amidst AI hype and tech glamour stocks, savvy investors are looking beyond semiconductors to companies building and powering data centres. I track about 25 companies benefiting from this new spending, including Canadian names like Cameco, WSP Global, Brookfield Infrastructure, Hammond Power Solutions, and Atkinsrealis Group.

Final Thoughts

The resurgence of nuclear energy signifies a critical “breaking step” in energy policy and investment opportunities. As global capacity expands and companies adapt to rising energy demands, Canadian investors can capitalize on this transformative shift in the nuclear sector by recognizing its potential within their portfolios. We’re on it!

Glen